Open banking

Follow the latest developments in the open banking movement, as we dive into emerging trends and opportunities brought by this shift. Find out how regulations like PSD2 and new open banking technologies are reshaping the financial industry – as well as consumer expectations – with insights gathered by Tink’s research and leadership teams.

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

2024-10-08

6 min read

Lending essentials: how enriched data solutions help lenders tackle constraints

Enhancing your affordability assessment with Tink’s data-enriched solutions helps you put an end to inaccurate data, prevent fraud in loan origination and stay compliant – read on to explore the benefits.

Read more

2024-09-24

4 min read

Why Pay by Bank fits luxury retail like a glove

Pay by Bank offers a solution that addresses the potentially higher transaction fees and fraud risks while enhancing the customer experience for luxury retailers.

Read more

2024-09-04

2 min read

CTS EVENTIM adds Tink’s user-friendly Pay by Bank service to its checkout options – giving fans even more choice

Collaborating with Tink, a market-leading payment services and data enrichment platform, CTS EVENTIM has now added Pay by Bank to its checkout process.

Read more

2024-09-03

5 min read

Customer interview – Nordea on consumer engagement

We spoke to Nordea Product Manager Sami Mikkonen about enhancing their mobile app using open banking technology, focusing on improving consumer engagement and financial management.

Read more

2024-08-20

7 min read

UK bank customers could be almost £24.5 billion better off per year – through the power of digital financial management tools

Tink’s new research is telling for banks, revealing that consumers now demand more digital financial management tools to support their personal finance goals.

Read more

2024-07-29

6 min read

Not just another payment method – six reasons why leading PSPs are prioritising Pay by Bank

In the second article of this series, we focus on why leading Payment Service Providers (PSPs) – like Adyen and Stripe – are introducing Pay by Bank to their checkout options (and why this is important for their merchants too).

Read more

2024-07-29

6 min read

Pay by Bank in 2024 - the current status and outlook

Sometimes called open banking payments, or account-to-account (A2A) payments, Pay by Bank is now the more common industry term in ecommerce. Tink is one of the leading providers, and here we provide an overview of one of the fast-growing payments technologies in the first of a new blog series.

Read more

2024-07-22

1 min read

Commercialising open finance – a VCA report

Tink worked with Visa Consulting and Analytics on a new white paper which details the state of play, direction of travel, and best open finance practices from around the world.

Read more

2024-04-10

7 min read

Thomas Gmelch - how open banking can change the instant payment experience in Germany

We sat down with Thomas to chat about the challenges facing our customers in Germany, and how our newly launched Risk Signals product is coming to the rescue.

Read more

2024-04-08

6 min read

How the Instant Payments Regulation will change the EU payments landscape

We explore the details of the Instant Payments Regulation, as well as its benefits for consumers and PSPs – such as increased convenience, more innovation in the market, and reduced costs.

Read more

2024-03-07

6 min read

Smart moves with smart meters: how commercial VRP could support pay-as-you-use billing models

Discover how variable recurring payments can transform smart meter billing into a more flexible user experience – and utility providers more ways to support financially vulnerable customers.

Read more

2024-03-05

5 min read

Serving younger borrowers: the impact of inaccessible lending

Streamline risk decisioning as a lender to lower operating costs using data-driven, digital loan origination, affordability assessment and income verification.

Read more

2024-02-21

10 min read

The full SPAA treatment – Tink signs up for new EU scheme

Tink has become one of the first participants of the European Payments Council’s SPAA scheme. We explain why SPAA was needed and how it could be the catalyst to transform account-to-account payments in the European Union.

Read more

2024-02-20

5 min read

Billing and the cost of living: 2/3 of Brits want support from utility providers

Empower your customers through the cost of living with more options in energy billing and improved UX with variable recurring payments.

Read more

2024-01-26

7 min read

How the EU digital identity wallet could change the way we pay

eIDAS 2.0 and the EU Digital Identity Wallet are coming and they have the potential to revolutionise the digital payments landscape, making transactions more secure than ever before. Find out what this means for payments, and for consumers and businesses alike.

Read more

2024-01-16

4 min read

Level up your lending – and meet the challenges of fraud

Prevent fraud in loan applications with data enrichment tools from Tink – while enhancing your affordability assessment, building better UX and future proofing consumer loans for the digital age.

Read more

2024-01-02

8 min read

2024 – what’s on the horizon for payments and data-driven financial services?

From Pay by Bank and VRP, to risk assessments, sustainability and money management tools, 2024 looks set to be the year when data-driven financial services hit the mainstream.

Read more

2023-12-21

5 min read

Three key 2024 milestones in EU payments regulation

Looking ahead to next year’s financial regulation in the European Union, there are three important developments set to shape the future of payment initiation services – Instant Payment Regulation, EU Digital Identity Wallet, and the SPAA scheme.

Read more

2023-12-04

1 min read

Discussing sustainable banking with ecolytiq

In our latest webinar, we’re joined by David Lais, Co-Founder & Managing Director of ecolytiq to discuss how we have partnered to create a seamless way for banks to seize the opportunity and offer combined financial and sustainability coaching – and what we can expect for the future.

Read more

2023-11-17

8 min read

Savings Banks Group takes the stage with Tink at Nordic Banking Forum 2023

Open banking tools like Tink Money Manager and Tink Data Enrichment help its partners, like Savings Banks Group, offer streamlined user experiences that coach consumers towards financial wellness.

Read more

2023-10-23

8 min read

What you need to know on rescoping Account Information Services for a future open finance framework

Following the European Commission's PSD3, PSR, and FIDA proposals, here we examine some key considerations surrounding the potential transition of account information services (AIS) from PSD3 to FIDA.

Read more

2023-10-03

7 min read

Direct debit cancellations: a guide to customer success with open banking

The cost-of-living crisis is impacting direct debits, but open banking tools can enable businesses to safeguard revenue while supporting customers. Read Tink’s guide to the solutions that can help.

Read more

2023-09-12

3 min read

Scaling your services: how to offer your customers financial coaching

Help your customers manage the cost of living with open banking technology like Tink Data Enrichment, and offer them personalised financial coaching.

Read more

2023-09-05

12 min read

How to reduce fraud in loan applications with enhanced risk decisioning

Beat the challenge of fraud in lending with actionable tools, from risk decisioning to authentication solutions with Tink – while getting closer to inclusive loan origination.

Read more

2023-08-30

8 min read

Open finance – Assessing FIDA and its implications

We take a closer look at the European Commission’s FIDA proposal, in particular the pivotal role of Article 4, its implications for data rights, innovation, and the balance between accessibility and affordability for vulnerable consumers.

Read more

2023-08-01

5 min read

Martina Sjöblom - Improving consumer protection with commercial VRPs

Tink Senior Legal Counsel, Martina Sjöblom, has been named to a new sub-working group as part of the Joint Regulatory Oversight Committee’s (JROC) push in the UK to introduce commercial, non-sweeping variable recurring payments (VRPs).

Read more

2023-07-19

7 min read

Financial wellness coaching – how to personalise your digital banking services

Take personalised digital banking into the future with Tink’s Data Enrichment and Money Manager products, based on real-time data and bleeding edge open banking technology.

Read more

2023-07-17

5 min read

Why digital banking services need partners outside banking

Learn why banks need tech partners and ecosystem providers to engage customers, increase loyalty and meet consumer sustainability expectations.

Read more

2023-06-29

5 min read

European Commission introduces PSD3/PSR to advance open banking and strengthen consumer protection

Tink’s Head of Industry & Wallets, Jan van Vonno, discusses the EU's draft legislation for financial services - PSD2's impact, open banking progress, consumer protection, and benefits of the upcoming PSD3/PSR.

Read more

2023-06-28

4 min read

Variable Recurring Payments - New UK working group drive to help accelerate and improve adoption

Tink’s Andrew Boyajian is playing a key role in a new variable recurring payments (VRPs) working group in the UK, advocating for standardisation and faster implementation of this technology in open banking.

Read more

2023-06-13

2 min read

JROC latest - mapping out the UK’s open banking actions

After last week’s announcement of two new working groups formed by the Joint Regulatory Oversight Committee, Tink maps out the latest UK open banking timelines.

Read more

2023-05-25

1 min read

The next era of invoice payments

In this webinar, PostNord Strålfors – the Nordics’ largest distributor of invoices – speaks with Tink to discuss how invoice payments are becoming digitalised.

Read more

2023-05-24

7 min read

How Pay by Bank is approaching its tipping point

Understand how Pay by Bank works as an account-to-account payment method and how to leverage open banking with Tink as it reaches mass adoption.

Read more

2023-04-21

5 min read

BNPP Fortis: safeguarding customer trust with budget management tools

An interview with BNP Paribas Fortis' Director of Channels and Customer Experience, Emilie Jacqueroux, on how the bank supports financial wellbeing by providing money management tools to adapt to the cost-of-living crisis.

Read more

2023-04-20

4 min read

Nearly one in four Brits in need of tailored financial support

Tink's latest research shows that almost one in four Brits are in need of tailored financial support. Learn how open banking can help UK banks support financially vulnerable consumers during the cost-of-living crisis.

Read more

2023-04-14

5 min read

How to turn data into personalised customer experiences with categorisation

Data categorisation helps banks clean and categorise transaction data to build better digital banking services, personalise customer experiences and encourage financial wellness. Here’s how to use Tink’s Data Enrichment.

Read more

2023-03-20

6 min read

How banks can offer tailored support to different consumer groups

Different consumers need differing levels of support. Learn how banks can support UK consumers through the cost-of-living crisis by using tailored financial coaching, data-driven tools and money management solutions.

Read more

2023-03-01

5 min read

Under the hood of Early Redirect – turbocharging income verification

How does Income Check make it possible for lenders to verify income in seconds? We went behind the scenes of the Tink tech team to find out how Early Redirect is powering the open banking lending engine. Marcus Elwin, Associate Product Manager, has the details.

Read more

2023-02-23

5 min read

The lenders’ guide to getting started with open banking

Risk decisioning and creditworthiness assessment technology are the tools lenders need to take loan origination into the future. Learn how Tink can help with this guide to optimising affordability assessment.

Read more

2023-02-22

4 min read

Beat the challenge of refunds with Pay by Bank

Online retailers struggling with refunds processes can reduce costs with Pay by Bank. Tink’s open banking tools help businesses optimise both their spend and UX. Read on to learn how real-time payments can help.

Read more

2023-02-14

4 min read

What is pattern recognition and what is it good for?

What is pattern recognition in data enrichment? Learn how Tink Data Enrichment analyses recurring transactions and predicted recurring transactions to help consumers to understand their spending – and banks to improve their services.

Read more

2023-02-09

6 min read

Half of Brits fear budget shortfall – here’s how banks can help

Tink’s latest research shows that a staggering 25 million Brits fear their income soon won’t cover essential costs, meaning banks have the opportunity to support them with tailored banking solutions.

Read more

2023-01-18

8 min read

3 ways to accelerate Pay by Bank adoption

Pay by Bank could change the game for your business, helping you add speed and prevent fraud. Learn how open banking powered payments can turbocharge your customer experience.

Read more

2022-12-16

6 min read

The challenges in underwriting and how open banking can help

Digital loan origination processes powered by open banking are often faster, safer and provide a better customer experience than traditional methods – here’s why.

Read more

2022-12-15

4 min read

Why open banking is important for consumers to manage their finances

Give customers actionable ways to stay on top of their finances with Tink’s open banking tools. From personal finance management to inclusive loan origination, make banking and lending processes work for everyone.

Read more

2022-12-14

7 min read

How VRPs can help your customers weather the economic storm

How Variable Recurring Payments can help vulnerable consumers avoid overdraft fees and cancelled payments during the economic crisis.

Read more

2022-12-13

4 min read

How to unlock growth through consumer engagement

Consumer engagement is a crucial component when delivering products and services. Discover the strategies that can help power growth for your business.

Read more

2022-12-08

4 min read

How Pay by Bank can help struggling merchants as recession looms

Tink’s latest research shows that half of UK online retailers are worried about surviving the next 12 months, as recession looms. Here’s how Pay by Bank can help.

Read more

2022-12-06

3 min read

Closing the data gap for affordability assessment

Quality affordability assessment and creditworthiness are key to the future of lending. Learn how Tink’s open banking platform closes the data gap for lenders and encourages responsible lending.

Read more

2022-11-30

9 min read

How VRP is sweeping money management into a new era

Sweeping VRPs, the me-to-me payment method that is simplifying money management for businesses and consumers.

Read more

2022-11-21

12 min read

How to achieve the best possible Pay by Bank conversion rate

When making a purchase online, consumers look for simple, safe and convenient payment experiences. In this guide, our Payments team shares its best practices for optimising Pay by Bank user journeys and ensuring the highest possible conversion rate.

Read more

2022-11-17

2 min read

Open banking solutions to meet digital-savvy customer expectations

The modern customer expects more from their service provider than ever before. Discover how open banking can help you satisfy their needs in our ultimate solutions guide.

Read more

2022-11-04

2 min read

How open banking is reducing risk and powering more inclusive lending

Lenders can approve more loans while taking less risk with the help of open banking. Learn more about risk decisioning in our ultimate solutions guide.

Read more

2022-11-02

5 min read

Introducing Tink’s Variable Recurring Payments beta programme

Tink and NatWest have partnered up to launch a beta VRP programme in the UK to gather real use cases for merchants based on their needs.

Read more

2022-11-01

8 min read

What’s a good Pay by Bank conversion rate?

Comparing Pay by Bank conversion rates across different payment methods can be tricky since most don’t use an end-to-end metric. See Tink’s own benchmarks and how we track performance in this conversion rate deep-dive.

Read more

2022-10-31

7 min read

Consumer lending in times of uncertainty

Discover what lies ahead for lending in these uncertain times – and how you can adapt to today’s needs.

Read more

2022-10-28

3 min read

The European Commission’s Instant Payments proposal – the Tink take

The European Commission published its proposal on Instant Payments clearing the way for widespread adoption of open banking payments.

Read more

2022-10-27

8 min read

Investment platforms: what to look for in an open banking partner

Looking for the best open banking provider? Here is everything you need to consider before making a decision.

Read more

2022-10-24

1 min read

Unlocking a new era of credit

In this webinar, Christophe Joyau, Tink SVP Banking and Lending, and David Öhlund, CEO Scandinavia GF Money, discuss how open banking is transforming the lending landscape.

Read more

2022-10-21

5 min read

How to create a digital-first invoice payment experience with ease

Whilst some invoice distributors are still using time-consuming, traditional analogue flows, open banking is transforming the invoice payment experience. Learn how to easily digitalise existing analogue flows using Tink payment technology.

Read more

2022-10-14

3 min read

Tink and Zervant partner for faster invoice payments

Tink and Zervant have partnered up to enable open banking payments for invoicing for over 100,000 SMEs.

Read more

2022-10-12

2 min read

The solutions that are transforming the payments landscape

The modern customer wants a frictionless payment experience. Discover how open banking payments can help you in our ultimate solutions guide.

Read more

2022-10-06

5 min read

How telco and utility companies are using open banking to navigate economic uncertainty

Open banking is helping telco and utility companies navigate these uncertain times by focusing on quicker onboarding, faster payments and better affordability checks. Learn how open banking can help you.

Read more

2022-09-29

5 min read

The key to unlocking fairer and more responsible lending

In our latest report, we explore how open banking can pave the way for faster, safer, and more responsible lending practices – and what lenders can do to prepare for this new era of credit.

Read more

2022-09-22

10 min read

The truth about Variable Recurring Payments: current status, use cases, and future prospects

Many claim Variable Recurring Payments (VRPs) are changing the payments landscape. But what’s the actual status? And are there already viable use cases? We try to cut through the noise and explore the challenges and opportunities of VRPs.

Read more

2022-09-07

2 min read

Affordability solutions that are leading the way in lending

Affordability and lending. Discover how open banking can help you get a more accurate picture of a potential borrower’s creditworthiness in our ultimate solutions guide.

Read more

2022-08-24

6 min read

The top 3 trends driving open banking payments adoption today

Faster, broader coverage, and higher security: the top 3 trends driving open banking payments adoption today, according to industry leaders.

Read more

2022-08-18

10 min read

The key to picking an open banking payments partner: bank coverage

The key to picking the right partner for open banking payments is connectivity. Bank on better coverage to help you scale in the best possible way.

Read more

2022-08-16

2 min read

The solutions that will lead to a new world of finance

Discover the open banking solutions that are leading to a new world of finance.

Read more

2022-08-11

2 min read

Get ready for better digital affordability assessments

How open banking can help simplify and improve digital affordability assessments.

Read more

2022-08-04

5 min read

Charlotte Hogg @ Money2020 – five quotes on the future of open banking

What lies ahead for the future of open banking? Five Money 20/20 quotes from Visa Europe CEO, Charlotte Hogg

Read more

2022-07-27

6 min read

3 easy ways to turn financial data into value

The democratisation of financial data is opening up new opportunities. Find out how to harness its power with open banking in our latest article.

Read more

2022-07-21

5 min read

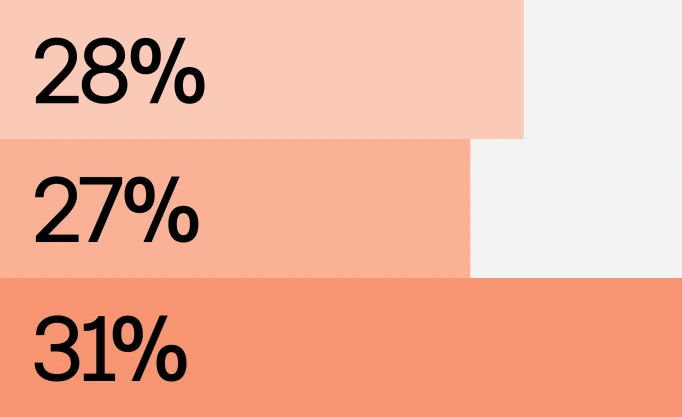

28% of self-employed struggle to access financial services

Self-employed workers are being left out of financial services. Here’s how open banking can help.

Read more

2022-07-14

4 min read

How open data can help tackle the cost-of-living crisis

The cost of living is reaching an all-time high for many. Read on to find out how data can help consumers navigate these turbulent times – thanks to the near limitless possibilities of the open data economy.

Read more

2022-07-05

11 min read

Lessons from taking open banking payments mainstream: an interview with Billy Telidis

We caught up with Billy Telidis, Product Manager of Payments at Tink, to talk about how open banking payments have gone from relative obscurity to a preferred payment method.

Read more

2022-06-28

11 min read

Debunking the 5 biggest myths about Pay by Bank

Curious about what's true and what's false about open banking payments like Pay by Bank? Let's cut through the noise and bust some of the most persistent myths.

Read more

2022-06-22

7 min read

What’s the difference between A2A payments and PIS? In short: open banking

A2A payments are said to be faster, safer, cheaper than other payment methods. The term PIS, or payment initiation services, often gets thrown around in the same context. So how do they differ? In short: through open banking.

Read more

2022-06-02

6 min read

The regulatory requirements in store for lenders – and how open banking can help

In the wake of the pandemic and the digital transformation of finance, consumers are borrowing money they can’t afford to pay back. But open banking holds the key to safely assess applicants’ creditworthiness.

Read more

2022-05-31

4 min read

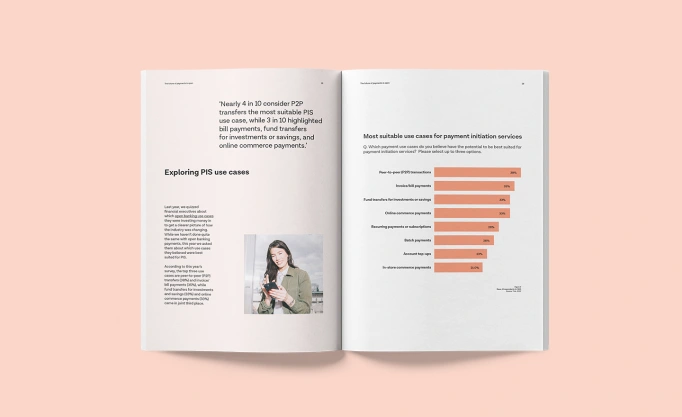

A new generation of payments is taking shape – powered by open banking

Tink survey reveals financial executives in Europe consider security, speed, and low cost as top benefits of payment initiation services – but that barriers to full-scale adoption remain.

Read more

2022-05-24

5 min read

How banks can add value for their customers with recurring transactions

With so many subscription services popping up, consumers are losing control of their recurring costs. Find out how banks can leverage open banking – and Tink’s data enrichment capabilities – to help them better manage their finances.

Read more

2022-05-18

5 min read

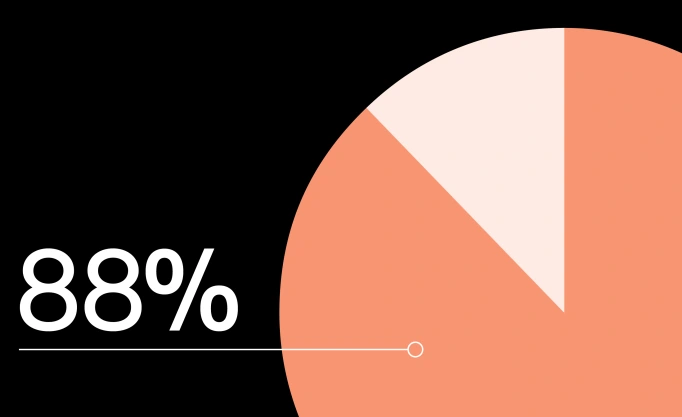

UK consumers expect fast and frictionless payment journeys

Tink’s latest UK survey shows that nearly 9 in 10 consumers (88%) are prepared to abandon a transaction if faced with friction when making a payment online, highlighting the need to ramp up payments innovation and focus on user experience

Read more

2022-05-17

6 min read

Build vs buy – a lender’s guide to the pros of partnership

In today’s digital world, it’s all about data – and the seamless user experiences it can power. Learn about the importance of real-time data, optimal UX, and more in this guide to building vs buying.

Read more

2022-05-11

4 min read

Get to know the tech behind better risk assessments

Open banking can help make better informed risk decisions – but access to data is just a part of the puzzle. Find out why quality account aggregation and data enrichment are the foundations of a standout risk assessment process.

Read more

2022-05-10

4 min read

The evolution of the revolution – from open banking to open data economies

It’s time to move on from just talking about open banking. Tink's latest report shows that data is on the agenda – open banking is evolving into open finance, which in turn is readying the market for the creation of open data economies.

Read more

2022-05-03

4 min read

Invoice settlement: what it is, and how open banking makes it simpler

Paying bills and invoices has typically been a cumbersome process – but thankfully, open banking can make it a lot quicker and easier by allowing customers to pay directly from their bank account. Here’s how that works.

Read more

2022-04-28

4 min read

How open banking risk assessments can impact consumers’ lives

It’s no secret that traditional credit checks don’t always work for everyone – but open banking can boost financial inclusion, giving more people access to credit, and fairer results thanks to better risk assessments. Here’s how.

Read more

2022-04-20

4 min read

A simple way to improve risk decisioning

Having a more holistic picture of someone’s financial situation can make all the difference when it comes to making well-grounded risk decisions. Luckily, open banking makes it a lot easier to build strong risk profiles. Here’s how.

Read more

2022-03-31

7 min read

Young people in the UK call for banks to help them go green

Tink research finds that 18-34 year olds in the UK want more information on their carbon footprint, and place high expectations on banks to help them track and improve it. With open banking, financial institutions can meet this demand.

Read more

2022-03-24

17 min read

Lender's guide to improving risk assessments with open banking

We dive into the world of risk assessments, exploring challenges lenders face with current decisioning methods, and how the process can become more convenient, reliable and complete thanks to open banking and the smart use of data.

Read more

2022-03-23

8 min read

Are open banking payments taking off? How businesses and consumers are already reaping the rewards

Tom Pope, head of payments and platforms at Tink, lifts the lid on where open banking payments scale is coming from – and whether the world is ready.

Read more

2022-03-17

6 min read

Unsure how open banking payments can help your business? We can show you where they’re booming

Tom Pope, head of payments and platforms at Tink, explains where open banking payments are gaining the most traction – and why the big opportunities are emerging now.

Read more

2022-03-16

4 min read

Beyond PIS – different ways payments can benefit from open banking

Explore the different ways to leverage open banking technology in payments – beyond A2A and PIS. Enable seamless onboarding with instant account verification, and reduce fraud and nonpayments with real-time balance check.

Read more

2022-02-16

6 min read

3 ways open banking can promote sustainability

There are many ways in which open banking can help promote sustainability, for businesses as well as consumers. Find out how to create better digital experiences, increase efficiency, and save the planet – all at the same time.

Read more

2022-01-20

6 min read

Making way for open finance: insights from the EU Commission

We had a chat with Mattias Levin, Deputy Head of Unit at the EU Commission, about the pandemic boom of digital finance, the future of open banking, and using policy to aid post-pandemic economic recovery.

Read more

2022-01-04

4 min read

Where is open banking heading? – our predictions for 2022

While we can never really know for sure what the new year will bring – it’s still quite fun to guess. (Then look back to see what you got right and where you were way off.) Here’s what Tink CEO Daniel Kjellén predicts for 2022.

Read more

2021-12-16

4 min read

3 tips to keeping a competitive edge as new entrants move into financial services

Open banking is ramping up competition in the financial services space, as new market entrants start capitalising on the opportunities. How can financial incumbents make sure they remain on top of the game? Here’s what we suggest.

Read more

2021-11-23

2 min read

Open banking investments and use cases

How has the pandemic impacted open banking budgets? How much did financial executives invest in their open banking objectives? And which opportunities do they have in sight? We surveyed bankers across Europe to find out.

Read more

2021-11-17

3 min read

Open banking investments: are billions in revenue at stake?

Open banking brings an opportunity to improve the value propositions in payments, retail banking, wealth management, insurance, investments and other segments of finance. But how much could this opportunity be worth, exactly?

Read more

2021-10-28

10 min read

SEPA Request-to-Pay: what you need to know about the new scheme

What is the SEPA Request-to-Pay scheme? What does it mean for banks, merchants and consumers – and for the future of payments in Europe? Is there anything that might be holding it back? We provide answers – and our own take on it.

Read more

2021-10-26

5 min read

3 ways accountancy services can take advantage of open banking

Is open banking a threat to the accounting industry? We don’t see it that way. In fact, we think accounting software providers have a lot to gain by leveraging new open banking capabilities. We take a look at some of the key benefits.

Read more

2021-10-14

5 min read

Emerging open banking strategies

To expose, or consume open banking APIs? That is the question. Discover the four paths financial institutions can take when it comes to their open banking strategy, and our view on what is currently the best route to explore.

Read more

2021-10-12

8 min read

Open banking use cases beyond financial services

Open banking isn’t just changing the game for financial services. Find out how different industries, from retail to telcos, can take advantage of the free flow of financial information to improve customer experiences – and business results.

Read more

2021-09-21

3 min read

Bankers embrace the open banking revolution – but expect a long journey ahead

Financial executives in Europe see open banking as a revolution, and are embracing it more than ever. But many expect it will take several years to get there. While transformation takes time – there could be a way to accelerate it.

Read more

2021-09-14

5 min read

Why is the UK so good at open banking?

The UK’s open banking journey has been a bit different compared to other countries in Europe, and this has given them an edge – leading to a more mature environment. Here’s our take on what has contributed to their success.

Read more

2021-09-01

6 min read

New priorities for bankers – and how open banking can help

Banking priorities have changed as a result of the pandemic. Discover the three focus areas that are top of mind for financial executives – and how open banking can help institutions tackle all three by leveraging financial data.

Read more

2021-08-19

5 min read

Why connecting to open banking APIs is not as simple as it seems

Connecting to an open banking API seems pretty straightforward. But making the connection is just the first step in a complex process. Here are some aspects businesses often overlook when deciding to build the connections in-house.

Read more

2021-07-13

5 min read

The UK leads the way in seeing the digital shift caused by Covid as permanent

Tink’s new survey report finds that a majority of financial executives in the UK foresee a permanent impact from the pandemic – unlike their European peers. We take a closer look at the UK stats, and how they compare to the EU-wide results.

Read more

2021-07-07

4 min read

How open banking simplifies income verification

Income verification used to mean having to dig up bank statements, share income tax statements or payslips – and then wait days or even weeks to have it all verified. Now, thanks to open banking it can take seconds. Here’s how.

Read more

2021-07-01

4 min read

Investing in the customer: interview with Poste Italiane

We interviewed Guido Crozzoli CIO of Poste Italiane to see how they are using open banking APIs and PSD2 to improve their service offerings to create an improved customer experience.

Read more

2021-06-17

1 min read

Open banking in the post-pandemic world

Tink’s Research Director Jan van Vonno dives into the findings from our 2021 report, sharing economic statistics and survey results to shed light on emerging risks, changing priorities, and the role of open banking in the years ahead.

Read more

2021-06-16

5 min read

What is a payment account according to PSD2?

What is considered a payment account under PSD2 and what isn’t? Seems like a simple question, right? But, as with most topics in the finance industry, the answer is almost always ‘well, it depends…

Read more

2021-06-15

4 min read

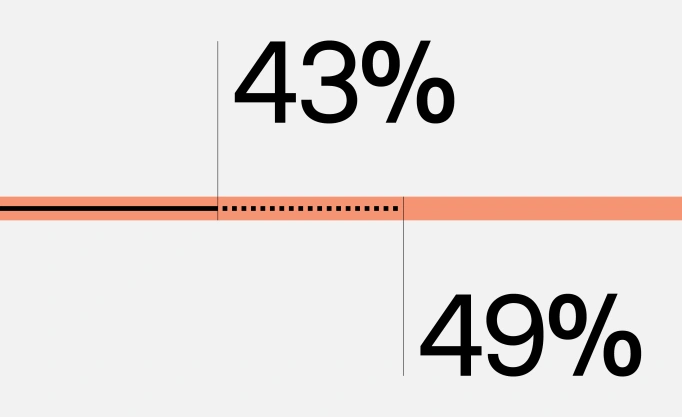

Banking executives see an irreversible digital shift caused by Covid

In our new report ‘open banking in a post-pandemic world’ 41% of Europe’s financial executives believe the digital shift caused by Covid is permanent – with over two thirds saying the pandemic has increased their focus on open banking.

Read more

2021-06-01

6 min read

3 ways lenders can take advantage of open banking

Find out how the lending industry can benefit from open banking, and how they can leverage new tech capabilities to improve the user experience, reduce costs, increase operational efficiency and optimise results.

Read more

2021-05-12

7 min read

Open banking glossary: the ABCs of PSD2

Many of the acronyms used in open banking were introduced in connection with PSD2, and they can be a little confusing. This means it’s important to explain them, otherwise, people might have a hard time following you.

Read more

2021-04-29

10 min read

All about Variable Recurring Payments, and how they can accelerate innovation

Variable Recurring Payments is a hot topic in open banking, and many believe it could change the face of consumer payments as we know them. Here’s an overview of how it works – and why it’s such a powerful contender in the payments space.

Read more

2021-04-13

4 min read

What is SCA, and what is it good for?

SCA stands for Strong Customer Authentication, and it’s a regulatory requirement introduced in connection to PSD2. Here’s a basic summary of what a ‘strong’ authentication process can look like – and why it’s important.

Read more

2021-04-01

6 min read

How open banking is a game changer for sustainability

Open banking is becoming a crucial tool in the fight to reduce carbon footprint. By plugging open banking tech into digital services, individuals and businesses can track and change their behaviour in a meaningful way. Here’s how.

Read more

2021-03-03

1 min read

Guide to improving the digital banking experience

How can banks transform the digital banking experience and build long, lasting (and more profitable) relationships with customers? We lay out how banks can leverage open banking to create more valuable, personalised services.

Read more

2021-03-02

7 min read

What the EBA putting its foot down on PSD2 API obstacles really means

The latest EBA Opinion calls for the removal of obstacles that obstruct TPP’s access to accounts for open banking services. Here’s our take on the most important bits of the Opinion, and what it means for banks and TPPs alike.

Read more

2021-02-24

7 min read

Bringing new energy into financial services: interview with Enel X

We interviewed Matteo Concas, Head of Global Digital Banking Solutions at Enel X. Here’s why one of the largest energy companies in Europe is looking to financial services – and open banking – to bring more value to their customers.

Read more

2021-01-27

3 min read

What is account verification, and what is it good for?

When charging or paying out customers, businesses rely on them to provide their account details. But people can make mistakes – or try to commit fraud. Thankfully, account verification can save everyone a lot of grief.

Read more

2021-01-06

6 min read

Why the entrant vs incumbent story never added up

Gone are the days when banks and fintechs battled for the financial services crown, as collaboration proves king. Tink’s Rafa Plantier takes a look at how banks and fintechs have worked out they’re better together.

Read more

2020-12-22

3 min read

3 steps to taking advantage of open banking

With new possibilities brought on by open banking, banks need to overcome internal challenges to beat the race to deliver the best possible customer experience. Here are three key steps to taking advantage of this opportunity.

Read more

2020-12-16

1 min read

Taking advantage of open banking

Watch this recorded session of our latest webinar, where Tink’s Research Director Jan van Vonno will look at the different forces impacting open banking progress and shine a spotlight on where the internal alignment may reflect why some financial institutions are able to move faster than others.

Read more

2020-12-11

1 min read

Taking advantage of open banking

Our Research Director takes a look at the different forces impacting open banking progress and explores how organisations’ internal alignment may explain why some financial institutions are able to move faster than others.

Read more

2020-12-02

4 min read

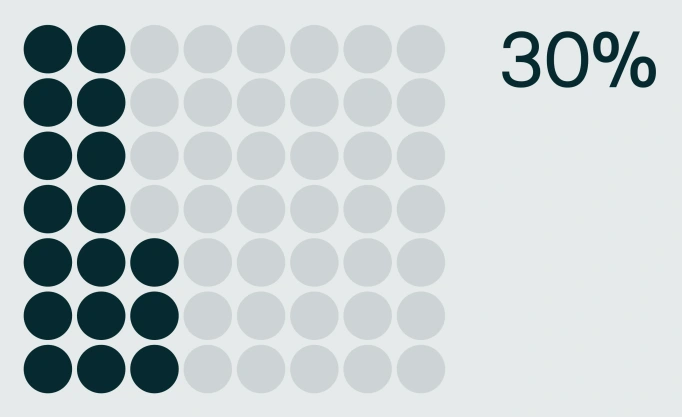

Are banks internally aligned on open banking?

A whopping 70% of C-level executives see the opportunities of open banking, while just 45% of product owners agree. Tink’s latest research report dives into the task banks face aligning their organisations to make the most of open banking.

Read more

2020-11-12

3 min read

Discover the leading open banking use cases – per country

When it comes to the top open banking opportunities, not all countries see eye-to-eye. Here are the open banking use cases being prioritised in five different markets – and the differences between them.

Read more

2020-10-30

2 min read

What are open banking APIs, and what are they good for?

Not sure what open banking APIs are, and getting tired of hearing about them all the time? We’re looking past the technicalities and explaining the term in plain English.

Read more

2020-10-21

3 min read

What is multi-banking, and what is it good for?

Multi-banking makes it easier for people to see the full picture of all their finances by gathering all their accounts in one view. Here’s why that can make a big difference for consumers and businesses.

Read more

2020-10-15

4 min read

What is open banking, and what is it good for?

We’re always on about how great open banking is, and how it’s ramping up innovation and competition in the financial services industry. But what is it, exactly? And why does it matter? Here’s a (very simple) rundown.

Read more

2020-10-07

3 min read

3 tips for staying ahead of the curve in the open banking shift

To stay ahead of the curve and master the open banking transformation, bankers need to start looking beyond compliance, and be smart about where to invest.

Read more

2020-10-01

2 min read

What is payment initiation, and what is it good for?

Not sure what payment initiation is, what it looks like, or why you should care? We’re breaking it down into simple terms. Here’s how it works, and what advantages it brings to consumers and businesses alike.

Read more

2020-09-25

5 min read

Insights from Michael Anseeuw: a first mover in open banking

We interviewed Michael Anseeuw, Head of Retail Banking and long-time open banking evangelist at BNP Paribas Fortis. Here’s what he had to share about the challenges of being an early adopter, and his vision for a customer-centric approach.

Read more

2020-09-23

1 min read

What’s driving open banking investments?

Watch our webinar, where Tink’s Research Director runs through our 2020 survey results, taking a closer look at the use cases financial institutions are investing in and the immediate opportunities they have in sight.

Read more

2020-09-16

4 min read

5 open banking use cases European bankers are most investing in

Our newly released survey report takes a closer look at open banking use cases, and which opportunities financial executives across Europe are most anticipating. Get to know more about the top five picks.

Read more

2020-09-15

7 min read

Where are we a year on from PSD2?

From an expanding ecosystem, to improvements in APIs, and increased investment – open banking has come a long way since the PSD2 deadline in 2019. Here’s how we see the progress that’s been made, and where work still needs to be done.

Read more

2020-08-19

3 min read

What is data enrichment, and what is it good for?

Data is great, but it can often be made better. That’s what data enrichment is all about. Here’s what data enrichment can do for financial data in very simple terms. And why it can make all the difference.

Read more

2020-08-11

7 min read

3 ways open banking can boost financial inclusion

Rafael Plantier, Tink’s UK & Ireland Country Manager looks at how open banking technology can open the digital doors to financial services for many more people, while helping businesses operate more efficiently.

Read more

2020-07-29

4 min read

What is account aggregation, and what is it good for?

We get down to the basics of account aggregation. Find out more about what it means, and how it can be used to increase transparency for both consumers and businesses.

Read more

2020-07-23

5 min read

How open banking investment is hotting up — in your country

Tink’s series of local open banking reports lift the lid on the biggest open banking spenders in Europe, looking at who is expecting speedy returns on their investments, where innovation has boomed and whose spend has increased the most.

Read more

2020-07-15

5 min read

What is PFM, and what is it good for?

PFM is great. But what is it exactly? We get down to the basics and explain the term, what it means, and what it has to offer for consumers and businesses alike.

Read more

2020-07-14

4 min read

How open banking tech lets anyone scale-up across Europe

The barriers of operating across borders are coming down. Open banking is allowing any company, big or small, to take the same model and apply it to any country - slashing time-to-market, and creating vast opportunities for everyone.

Read more

2020-06-25

6 min read

PSD2 APIs: what the EBA Opinion on obstacles really means

The EBA has resolved some of the biggest questions in relation to PSD2 APIs, after documenting its opinion on the practices of banks and the obstacles caused. This is Tink’s summary of the most significant implications.

Read more

2020-06-16

3 min read

Open banking: from compliance challenge to commercial opportunity

The financial services industry is on the verge of a monumental shift towards data-driven solutions. By going beyond compliance businesses can unlock new market opportunities and improve customer experiences at lower costs.

Read more

2020-05-27

3 min read

The open banking investment boom across Europe

Open banking has taken the financial services industry by storm, with executives taking advantage of a new industry paradigm. But how is open banking investment shaping up across the continent? Here’s a spoiler - it’s massive, and growing.

Read more

2020-05-27

1 min read

The investments and returns of open banking

Watch the recording of our webinar to find out more about the results from our 2020 survey. Research Director Jan van Vonno explores how much financial institutions are investing in open banking, and how they’re looking to profit from it.

Read more

2020-05-20

3 min read

Why European banks are investing in open banking

We ventured once again into the minds of European bankers and found that financial institutions are making significant investments towards their open banking initiatives. But what’s driving them? Or what’s standing in the way?

Read more

2020-05-14

6 min read

4 ways to reap the rewards of open banking

It’s time for the industry to catch up with the first movers of open banking, but the end goal is not to meet regulation. It’s about increasing sales and productivity, and reducing risk - to get a return on your open banking investment.

Read more

2020-05-12

5 min read

Taking open banking up a notch in the DACH region

Our new Regional Director for DACH has his sights set on making the financial actors in the region the stars of the open banking show - by helping them create the slick digital experiences people are beginning to expect.

Read more

2020-04-23

4 min read

The growing positivity towards open banking in Europe

The first report based on our survey of 290 senior executives and decision makers in the financial industry across Europe is out. Find out what the results reveal about how bankers are tackling the open banking opportunity.

Read more

2020-04-20

1 min read

Open banking attitudes & fintech partnerships

Watch our webinar to learn more about how businesses are looking to create value from open banking – and how you can do the same. Tink’s Research Director presents the results from our 2020 survey of financial executives.

Read more

2020-04-09

5 min read

Why open banking relies on trust – and the 4 keys to building it

Open banking is changing the way people interact with their finances, as more providers launch value added services that have a real impact on people’s lives. But to get people to adopt new services – especially when they require sharing personal data – you need a solid foundation of trust. Here’s why trust matters, and the four pillars that are needed to keep it in place.

Read more

2020-04-08

7 min read

4 ways actionable insights will benefit your business

Find out how you can engage more customers, build trust, boost sales and increase share of wallet by providing actionable insights in your PFM experience.

Read more

2020-02-13

5 min read

Building a successful bank and fintech partnership: the CGD story

Bank and fintech partnerships are booming as the shift in the financial industry is taking everyone in the same direction. But just like with any other relationship, a happily ever after is not always a given. We’ve previously shared tips from our own experience in building successful partnerships, but we were curious to get the bankers’ perspective. So we reached out to our partners at CGD for their take on it.

Read more

2020-01-24

5 min read

The power of one: personalisation for the masses

Instead of focusing on the September deadline, the real test will be how you innovate to meet consumer demands in an era of increasingly personalised experiences.

Read more

2020-01-14

4 min read

3 strategies for getting the most out of your data

Data is becoming increasingly central to innovation, but it can be challenging to know how to leverage it successfully. What strategies can help you gain an edge? We heard out a data guru’s 3 tips on using data to create value – while putting the customer first.

Read more

2019-12-31

1 min read

Lessons with Leda: Why bank and fintech partnerships need to go deeper

Leda Glyptis is a leading voice in banking from both the startup and the incumbent side. Way back at Money2020 in Amsterdam, we sat down with her to talk about this opportunity that is open banking and the big opportunities that it presents.

Read more

2019-12-18

2 min read

What Tink’s 2019 journey reveals about this year in open banking

At the beginning of 2019, we set our sights on making the most of the opportunity that open banking is offering – a huge industry shift that is bringing about a new generation of financial services to market. Before we wrap up another year, we’re looking back at our own journey in 2019 and how it reflects this industry-wide transformation.

Read more

2019-12-03

6 min read

The ‘big UK opportunity’ – as seen by our new country lead

Rafael Plantier, our new UK & Ireland Country Manager, arrives at Tink with a motto: open banking is good only once people get to enjoy the fruits of their data. To make this a reality, our London-based recruit wants to seize the open banking opportunity — and give innovators in the UK the right tools for building data-driven services.

Read more

2019-11-19

8 min read

Two months after the final PSD2 deadline: where are we with the APIs?

With the September PDS2 deadline now visible in our rearview mirror, what is the status of the bank APIs in Europe two months later? Well, we still face big challenges as an industry to make sure the technical environments improve. But what we’ve seen is an encouraging shift in terms of collaboration and cooperation with some of Europe’s biggest banks.

Read more

2019-10-30

4 min read

How financial data is powering a new generation of ideas

Financial data has until recently been an untapped powerhouse of insight into a customer’s mind and heart. But now this data is in the hands of consumers instead of being locked away in their banks’ vaults – opening up space for innovation and enabling a range of new ideas that can make a big impact in people’s lives.

Read more

2019-10-17

7 min read

How we’re helping to make PSD2 successful from the inside out

Since before PSD2 became law, we have been working at a European level to advocate for the changes that are now becoming core to the open banking movement. And it’s because we see a future in which the banking and financial services industry takes a major leap into the future. Here’s the role we’ve played – and why it matters.

Read more

2019-10-15

6 min read

5 tips for launching a bank and fintech partnership

After reaching a commercial agreement, the bank and fintech are feeling pretty comfortable together. A commitment has been made and everyone’s clear about where the relationship is headed. The next step – making the collaboration fruitful – is not always straightforward. Here are five tips we’ve refined for when it’s time to get a product to market.

Read more

2019-10-08

5 min read

3 things that make or break a bank and fintech partnership

Our blossoming bank and fintech relationship has reached the ‘let’s make it official’ phase. But even though we both want to end up in the same place, charting a path there can be complicated. First, we have to make sure we can get past our fundamental differences to see a happy future together – preferably in the form of a commercial agreement.

Read more

2019-10-01

4 min read

Go inside the secret world of bank and fintech partnerships

Forming a bank and fintech partnership is a lot like dating. You meet, hit it off and decide you want to be together. But first you have to manage the challenges of bridging two totally different worlds. This is the full story of how we figured out that banks and fintechs can see the future in the same way (cue: heart emoji).

Read more

2019-09-26

5 min read

The opportunity of a century in banking is here

The financial industry has been standing at the precipice of this major shift. Some banks have taken the leap – innovative thinkers and leaders embracing the data revolution and using it to deliver amazing services. For those who’ve waited, now is your time – to take a leap, redefine how consumers manage their money and seize a once-in-a-lifetime opportunity to change banking for the better.

Read more

2019-09-25

3 min read

Tink survey: UK bankers see other incumbents as biggest threat

The results from Tink’s new UK survey report show that British bankers have a split opinion on the open banking movement, and unlike most other bankers across Europe, dealing with the new regulations is not a major concern for them. For respondents in the UK, ‘other incumbent banks’ came up as the single biggest threat brought by the open access to data.

Read more

2019-09-19

3 min read

Tink survey: German bankers’ unique take on open banking

Tink’s new report finds that financial executives in Germany are more likely to perceive the open banking movement as a threat rather than an opportunity, and indicates that they are not looking to explore new opportunities beyond the scope of PSD2 regulations for now. But they still understand the industry is in transformation (just like the German market), and are looking to partner with fintechs to tackle the journey ahead.

Read more

2019-09-10

8 min read

5 ways customer’s banking expectations are changing

From the demise of cash and physical bank branches, to the rise of digital banks and automation, technology is irreversibly changing the way we manage our money – and what we expect from the services that do.

Read more

2019-08-29

12 min read

Chris Skinner: the three major mindset changes banks have to go through

Tink speaks to independent blogger and author Chris Skinner, about his positive view on the future of banking and what banks need to do - to change their business model and truly digitalise.

Read more

2019-08-27

6 min read

3 ways big tech are about to disrupt financial services in Europe

Europe has so far been largely protected from the big tech march into financial services. Penetrating each market has been a challenge due to differences in language, tech adoption and regulations. But open banking is unifying the financial landscape across the continent, making it easier for tech giants to get a foot in. Now the big questions are: what will happen when they do? And what do we need to do to safeguard customer loyalty?

Read more

2019-08-21

5 min read

Zero PSD2 APIs are compliant with just weeks left before the deadline

In our final analysis of PDS2 APIs, we’ve found that none are compliant with the PSD2 requirements and obligations – the same result we reported from our last evaluation in June. And with less than a month before the final deadline, it is the millions of banking customers across Europe who will suffer the consequences.

Read more

2019-08-14

8 min read

Behind the scenes: the blood, sweat and laughs shared on our way to the PSD2 deadline

It has felt in recent months as if the entire industry is mobilised to meet next month’s final PSD2 deadline. But forgotten in all the talk of SCA requirements, fallbacks and EBA clarifications is the monumental human effort that is being made deep in the offices of third parties and banks to create and align on an entirely new way of working.

Read more

2019-08-07

12 min read

A one-way path that might kill the customer experience in a post-PSD2 world

Ultimately, everyone involved in this march to September – banks and third parties alike – is in the business of meeting the needs of customers. And yet, they could be forgotten if the majority of banks’ PSD2 APIs continue to offer just one authentication flow – the dreaded web redirect. It’s a method that kills innovation, destroys the customer experience, and could threaten the success of this open banking movement in which we’ve all invested so heavily.

Read more

2019-07-30

4 min read

How partnering for tech allows ABN AMRO to be more productive

In our recent open banking report – Inside the minds of Europe’s bankers – we quizzed nearly 270 financial executives across Europe, and sat down with some of the leading minds in the field to get to the bottom of the biggest challenges, threats and opportunities of open banking.

Read more

2019-07-17

8 min read

Why every European bank needs to provide a safety net for their PSD2 APIs

We raised the alarm bells earlier this month that the banks’ production APIs are far from ready – a reality that could threaten the services that millions of consumers enjoy. If they remain poor, then the success of PSD2 could hinge on a safety net that’s built into the regulation. But with no clarity around what this safety net should look like or how it will be applied, there is a real risk it won’t provide the security it was intended to.

Read more

2019-07-10

3 min read

Top 3 tips for bankers embarking on the open banking journey

We’ve seen our fair share of banking partners succeed in their efforts to build digital services that customers love, partner with fintechs to get the right tech, and becoming data-driven organisations. Taking all of those lessons, we’ve distilled them down into the three things you can do as a banker that will best equip you for the journey ahead.

Read more

2019-07-04

5 min read

Could the poor readiness of bank APIs put the success of PSD2 in jeopardy?

A Tink analysis finds that none of the tested bank APIs released by the penultimate 14th June deadline meet the quality requirements laid out by PSD2 regulators – potentially creating a “cliff edge” scenario in September that compromises the financial services for millions of consumers.

Read more

2019-07-03

2 min read

The Tink buyer’s guide to ‘open banking platforms’

The open banking movement is picking up steam – and we’re seeing an uptick in companies launching “open banking platforms”. But without defining what this really means, it’s impossible to make a like-for-like comparison. So we’re stripping away the term – and giving you a checklist with the criteria that really matters when evaluating a tech partner.

Read more

2019-06-19

6 min read

4 key takeaways from Europe’s biggest financial event Money20/20

Over three days in early June, the best and brightest decision makers in the industry met at Money20/20 to discuss the biggest transformation in decades. We had substantive conversations about the future of open banking in the pink booth – and took the stage to share our vision.

Read more

2019-06-18

5 min read

The open banking battles banks are fighting on every front

This is the final piece in a three-part series: Inside the minds of Europe’s bankers. We conducted an open banking survey, querying nearly 270 European financial executives on how they see the movement, the regulations and the future. This is the last of the three major conclusions we’ve made after analysing the data.

Read more

2019-06-14

16 min read

The sobering September preview: banks’ PSD2 APIs far from ready

Today is the deadline for all banks to have their production APIs ready, and the first day for all third parties to officially start integrating with them. But having spent the last three months rigorously testing more than 100 bank APIs in their sandbox environments, we can conclude this: the APIs available up to now are far from ready, lacking the quality and maturity they need – offering a sobering preview of the condition of the production APIs due out today.

Read more

2019-06-11

5 min read

What’s behind one of the biggest attitude shifts in banking history?

This is the second piece in a three-part series: Inside the minds of Europe’s bankers. We conducted an open banking survey, querying nearly 270 European financial executives on how they see the movement, the regulations and the future. This is the second of the three major conclusions we’ve made after analysing the data.

Read more

2019-06-03

5 min read

Why executives say regulation is the biggest threat to banking

This is the first piece in a three-part series: Inside the minds of Europe’s bankers. We conducted a survey on the subject of open banking, querying nearly 270 European financial executives on how they see the movement, the regulations and the future. This is the first of the three major conclusions we’ve made after analysing the data.

Read more

2019-05-31

7 min read

Tink Thinks: EBA says banks need to increase the quality of their PDS2 APIs

This is the second piece in our ongoing series called Tink Thinks: Inside the EBA, where we explain and comment on the business of the European Banking Authority’s (EBA) PSD2 API Working group, which is helping to ease the implementation process ahead of the September deadline.

By Tomas Prochazka and Ralf Ohlhausen

Read more

2019-04-23

4 min read

Christian Clausen: advice from a veteran banker

Meet Tink’s new senior adviser and investor: Christian Clausen. He’s a veteran of the old guard of banking – a former CEO of Nordea and chairman of the European Banking Federation. He’s sharing his expertise and unique insight gained from years working with Europe’s biggest banks. And we’ve joined forces to help bankers seize the immense opportunity up for grabs as the industry shifts – and open the digital doors to their customers.

Read more

2019-04-16

4 min read

To win the open banking race, wow your customers

As other industries fuel a change in customer expectations, the banking biz has some catching up to do. And the only way to win in this new era of customer engagement – where their data is up for grabs – is to focus, relentlessly, on the people behind the accounts.

Read more

2019-04-09

4 min read

Bank 2.0: the software company

The open banking movement is forcing the industry to innovate on an unprecedented scale. The smart banks are meeting this challenge by rethinking their singular focus on products – and behaving more like software companies to attract and hold onto their customers.

Read more

2019-04-02

2 min read

Why 2019 is the year of open banking

Now that banks can start to look beyond the huge task of being regulation ready, everyone’s attention is turning to what’s next. Which is how to get the most out of the open banking opportunity. But if banks want to stay ahead of the emerging competition, the time to act is now.

Read more

2019-03-21

5 min read

What a missed PSD2 deadline says about the challenge of implementation

One of the two biggest PSD2 deadlines just whizzed by on 14 March without much fanfare – and more importantly – without the compliance of 41% of the European banks we surveyed in 10 markets. Many will point fingers at those who failed to comply. But what it really highlights is that despite deep pockets and plenty of resources, the demands that PSD2 places on banks are monumental.

Read more

2019-03-19

4 min read

Tink Thinks: EBA's clarifications on PSD2 APIs – and what they mean

This is the first piece in our ongoing series called Tink Thinks, where we explain and comment on the business of the European Banking Authority’s (EBA) PSD2 API working group, which is helping to ease the implementation process ahead of the September deadline.

Read more

2019-03-08

6 min read

Why automated finances aren’t a death knell for banks

Automated financial services bringing about the demise of banks is being talked about as if it’s a done deal.

Read more

2019-03-03

8 min read

How to build customer trust and loyalty through better PFM experiences

Winning the customer of the future will require a level of personalisation and insight that doesn’t currently exist in banking. But it’s coming – and we’re building the platform that will deliver it. Our PFM solutions use machine learning to offer tailored, actionable advice that guides customers to the financial future they envision – and creates long-term relationships.

Read more

2019-02-15

3 min read

The 3 factors that increase user retention in financial apps

We recently wrote about the high abandonment rates that banks are battling during the onboarding process – and how to kill the friction so that more users complete the process. But improving onboarding doesn’t necessarily mean your user retention will be high. We’re sharing the top three factors that will help you attract users – and keep them coming back.

Read more

2019-02-08

3 min read

A potential PSD3 template from Down Under

Australia is known for many things, including its natural wonders, and (potentially daunting) wildlife. In the fintech world, it will also soon be known for its own version of open banking. One that is inspired by Europe, but with an Aussie twist.

Read more

2019-01-31

2 min read

Banking is getting personal – or at least it should be

When it comes to open banking, behavioural finance expert Galina Andreeva is a staunch supporter. But she cautions that the opportunities it presents come with their own risks – and to offer the best service, banks need to understand their customers better than ever before.

Read more

2019-01-14

2 min read

Open banking lessons: 3 choices to make and how to partner the right way

Leda Glyptis can empathise with the banks. She’s a recovering banker herself. At a time when the incumbents are choosing to embrace this era of open banking – albeit slowly – the chief of staff at challenger consultancy 11:FS lays out the three choices they can make in order to make money and move their business forward.

Read more

2018-11-07

1 min read

Open banking offers opportunities for everyone

We sat down with payments and PSD2 expert from the Bank of Ireland, Julie Connor, to discuss the opportunities of open banking and the strengths of standardisation.

Read more

2018-10-31

5 min read

The world is watching

The financial services industry in Europe is at a crossroad. Regulators have decided to open the floodgates to competition by introducing the concept of open banking. Although Europe is progressive when it comes to regulations, implementation can be complex. Now the world is watching to see how new regulations affect the financial industry in Europe.

Read more

2018-10-08

1 min read

The future is access to all data

Much like Tink, the trustee for the UK’s Open Banking Implementation Entity (OBIE) has big visions for the future of data-driven banking. He says it’s only a matter of time until the full scope of customer data is available for fintechs to use to build innovative new products.

Read more

2018-08-31

1 min read

A fintech consolidation is coming

Hugo Bongers, head of ABN AMRO's Digital Impact Fund, says he is excited by the plethora of new companies working on big ideas. But in a chat with us at the Money20/20 conference in June, he said that ultimately people want one central place or platform where all services will be combined.

Read more

2018-08-21

1 min read

How Tink customers use data to provide better financial services

From blue-chip banks to fintech unicorns, our customers are using Tink services to better respond to this era of open banking – in which the power is shifting from banks to consumers, and giving consumers the power to choose.

Read more

2018-08-20

6 min read

Data is unlocking customer value – for the smart banks

Open banking was designed to open the retail banking market by giving everyone access to the data they needed to deliver banking services. Initially viewed as a massive boon for fintechs, and a worrying threat for banks, the mindset of the latter is shifting.

Read more

2018-07-18

6 min read

The democratisation of data and what it means for financial services

Every financial transaction generates data, which means that every business in the financial services sector has a hugely valuable resource right under their nose. Until recently, very few businesses and banks were actually able to make use of this data. Even those who held the right expertise were often held back by the cumbersome legacy systems which remain prevalent in the banking sector. Now, things are changing.

Read more

2018-07-03

4 min read

How using better data will help you win more customers and earn more revenue

We’re big fans of open APIs – they bring much-needed transparency to the banking industry and are a catalyst for better services. And while PSD2 will usher in an era of open APIs, it does so in a whisper – offering only payment data and thus an incomplete picture of a customer’s full financial life. The future is open APIs that make all data available – and create a foundation for anyone to build services that result in better financial choices for us all.

Read more

2018-06-14

4 min read

The big lessons from Money20/20

Tink conversed, connected and listened at this year’s Amsterdam conference. And here’s what we learned about the major leaps the banking industry is taking in this era of open banking.

Read more

2018-02-02

5 min read

The top three myths associated with PSD2

With the introduction of PSD2 (the second Payment Services Directive), we are now entering a new era of open banking. At the customer’s request, EU member states will be forced to open up their customer data and payments infrastructure to third-party providers.

Read more

2018-01-22

7 min read

Technology – not legislation – is leading the open banking revolution

Until now, banks have occupied a privileged space. They have operated in a market that has handed them a monopoly over their customers’ data and discouraged competition and innovation. This is about to change as we are entering the era of open banking.

Read more

2017-12-21

5 min read

Open banking: whose data is it anyway?

Instead of resisting, banks should embrace the opportunity to embrace the spirit of PSD2. First mover advantage is huge.

Read more

2017-12-13

5 min read

Say 'goodbye' to the service formerly known as banking

Anyone who thinks that a mobile banking app is simply a place where people interact with their own bank should think again. Banking is becoming a concierge service, providing consumers with an overview of all their finances, regardless of who they ‘bank’ with in the traditional sense.

Read more