An Post: A personal financial coach - for everyone

An Post, Ireland's state-owned postal service, is passionate about fostering improved saving habits. Find out how they empowered customers to manage money effectively with Tink, and make it available to all.

Money Manager

An Post: A personal financial coach - for everyone

An Post, Ireland's state-owned postal service, is passionate about fostering improved saving habits. Find out how they empowered customers to manage money effectively with Tink, and make it available to all.

Money Manager

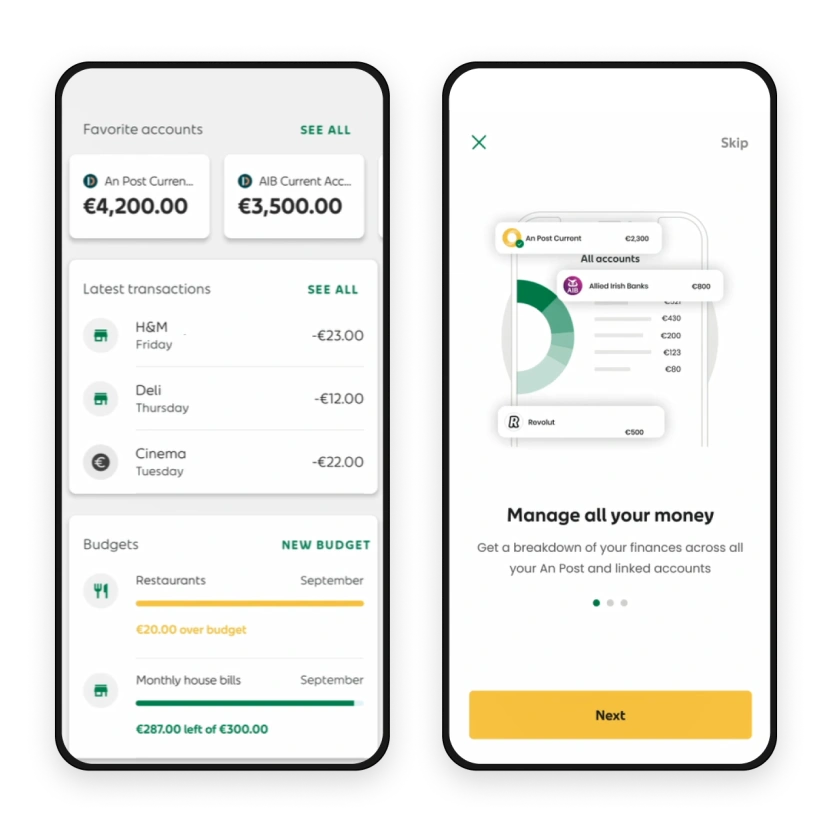

Money Manager app for free - for everyone.

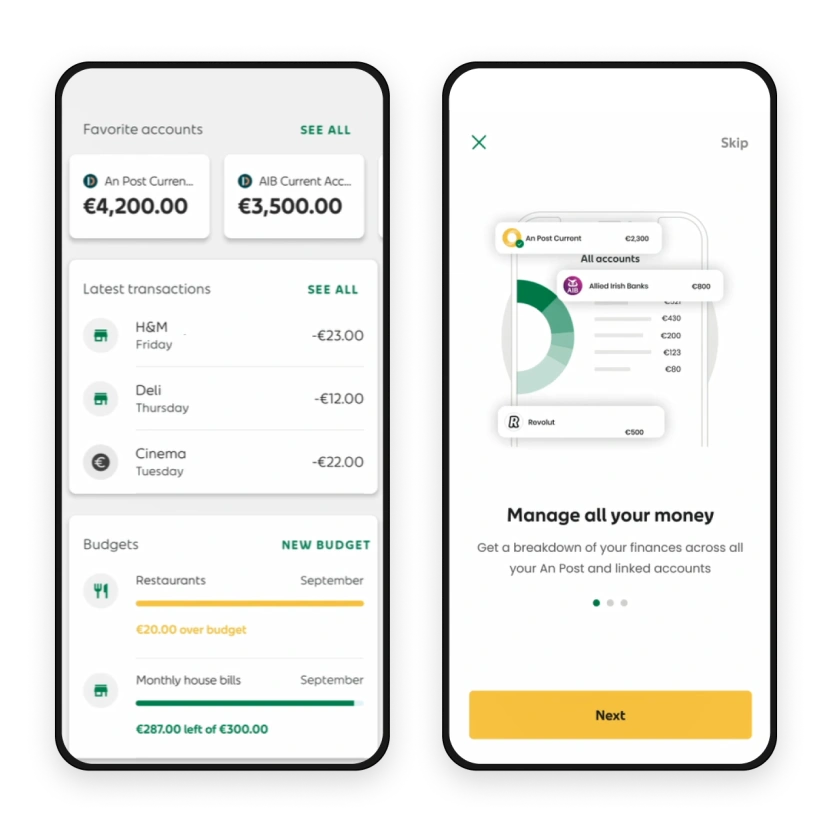

Allow users a holistic financial view, with all their accounts in one place.

Financial coaching tools working across a users entire financial situation. Not on just one account.

Helped tens of thousands of consumers to stay in control of their spending.

Empowering consumers with more financial control

With the rising cost of living, it is increasingly crucial for financial providers to better support their customers in keeping track of their finances, both in the short term and over time. An Post wanted to help put more financial power and control into the hands of the consumers, by making it possible for them to better understand their spending behaviour, manage their savings, and set budgets to stay on track with their financial goals. An Post wanted to do this by providing a clear, holistic financial overview and valuable financial tools to help consumers gain better control of their money - especially when economic times are tougher for many.

Empowering consumers with more financial control

With the rising cost of living, it is increasingly crucial for financial providers to better support their customers in keeping track of their finances, both in the short term and over time. An Post wanted to help put more financial power and control into the hands of the consumers, by making it possible for them to better understand their spending behaviour, manage their savings, and set budgets to stay on track with their financial goals. An Post wanted to do this by providing a clear, holistic financial overview and valuable financial tools to help consumers gain better control of their money - especially when economic times are tougher for many.

Tink’s Money Manager <3 An Post

Through Tink's Money Manager and open banking technology, An Post's digital banking app allows users to securely link all their accounts and credit cards into one place. Gaining a complete overview of all their different accounts in real-time. Not only benefitting current An Post customers, as their Money Manager smart budgeting tool is available for free, to everyone in Ireland, even those banking with other providers.

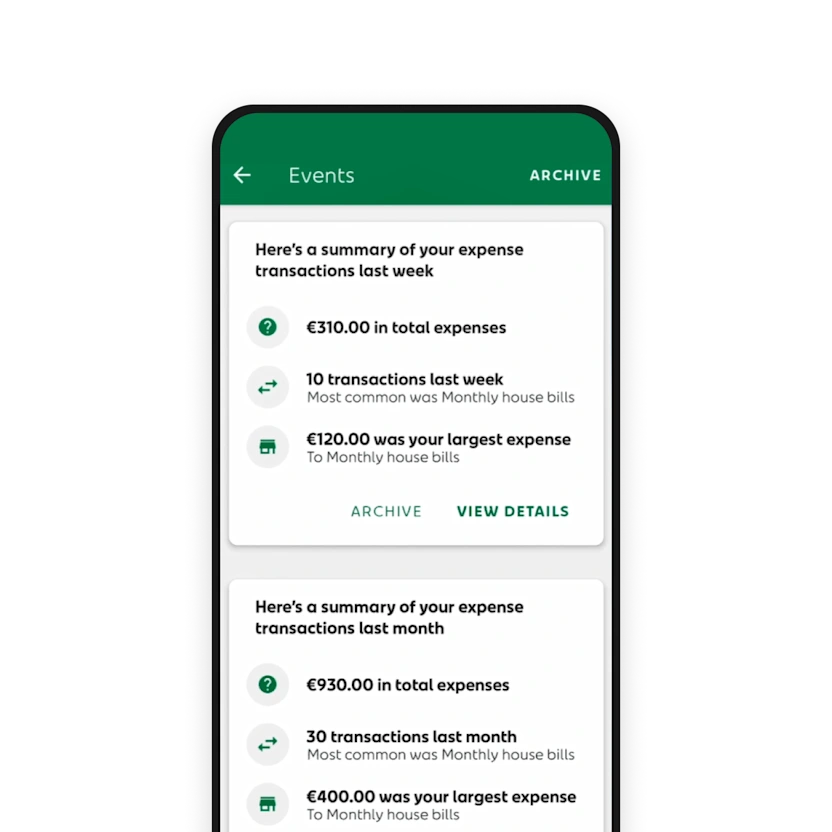

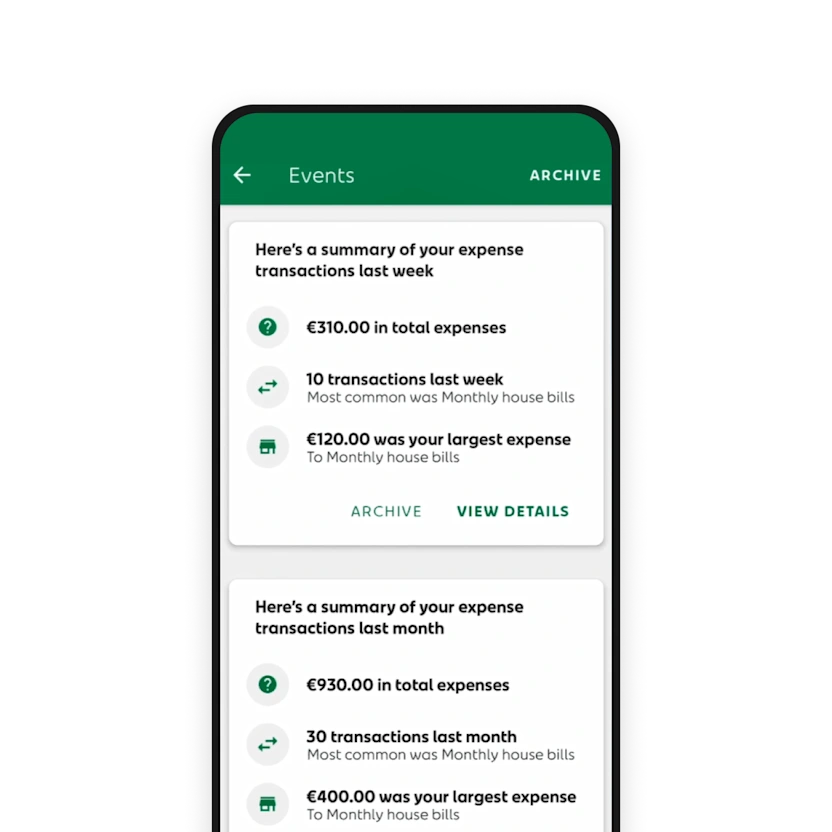

Users can track their spending by viewing their income and expenses sorted in different categories, create budgets helping them spend less and save more, and get insights into their financial behaviour.

Tink’s Money Manager <3 An Post

Through Tink's Money Manager and open banking technology, An Post's digital banking app allows users to securely link all their accounts and credit cards into one place. Gaining a complete overview of all their different accounts in real-time. Not only benefitting current An Post customers, as their Money Manager smart budgeting tool is available for free, to everyone in Ireland, even those banking with other providers.

Users can track their spending by viewing their income and expenses sorted in different categories, create budgets helping them spend less and save more, and get insights into their financial behaviour.

Fully digital financial coaching

Now An Post gives users a deeper understanding of their financial behaviour, a better digital banking experience to manage everyday banking needs, and the ability to build better financial habits.

With a digital experience that is completely personalised and facilitates budgeting and savings tools, it allows users to stay on top of their spending and reach their goals, both in the short term and long term, to help stay one step ahead of their finances.

Fully digital financial coaching

Now An Post gives users a deeper understanding of their financial behaviour, a better digital banking experience to manage everyday banking needs, and the ability to build better financial habits.

With a digital experience that is completely personalised and facilitates budgeting and savings tools, it allows users to stay on top of their spending and reach their goals, both in the short term and long term, to help stay one step ahead of their finances.

For industry leaders

“Enabling people living in Ireland to replace financial worry with financial confidence is a key goal for An Post Money. We are thrilled to have partnered with Tink to enable not only An Post Money customers but everyone living in Ireland to have the ability to manage their money better, stay in control of their expenses and start building financial confidence.”

Bruce Richardson

Product Management Consultant at An Post

– Jack Spiers, Senior Manager at TinkCollaborating with the team at An Post is a true privilege for us at Tink. We firmly believe that great things happen when like-minded organisations join forces. With our combined expertise and shared vision, we are excited to deliver innovative solutions that simplify everyday banking and empower our customers. This collaboration represents a powerful partnership that will shape the future of financial services, putting the needs of our customers at the forefront of everything we do.”

– Jack Spiers, Senior Manager at TinkCollaborating with the team at An Post is a true privilege for us at Tink. We firmly believe that great things happen when like-minded organisations join forces. With our combined expertise and shared vision, we are excited to deliver innovative solutions that simplify everyday banking and empower our customers. This collaboration represents a powerful partnership that will shape the future of financial services, putting the needs of our customers at the forefront of everything we do.”

Start building with Tink

Create a free account to give it a go, or contact our team to learn more about our premium solutions.

Get in touch