Latest posts

2025-02-05

6 min read

The latest findings from our peak season survey suggest that younger generations are reshaping the luxury market by prioritising quality, sustainability, and secure payment experiences. With cost-of-living pressures, these discerning shoppers demand more than just premium products, pushing high-end merchants to upgrade their payment systems to stay competitive.

2025-07-01

2 min read

Tink and Chip partner to power seamless account top-ups with open banking

Chip, the award-winning wealth app, is now using Tink’s open banking technology to offer users a faster, more secure way to top up their accounts.

Read more

2025-06-18

2 min read

Video – How Snoop is unlocking smarter saving with variable recurring payments

With the launch of variable recurring payments (VRP), Snoop is introducing a smarter, more flexible way for people to build their savings – and making the most of Tink's open banking solutions in the process.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

Guides

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

2024-03-20

1 min read

The ultimate guide for building the future of recurring payments

Variable Recurring Payments, powered by open banking, have huge potential for merchants and consumers in the UK. Read our VRP guide to find out how they work and why they are important.

Read more

2023-11-21

2 min read

The ultimate Pay by Bank UX guide

At Tink, we’re excited about Pay by Bank. Our new, in-depth UX guide tells you how to make the most of this innovative payment solution.

Read more

2023-09-05

12 min read

How to reduce fraud in loan applications with enhanced risk decisioning

Beat the challenge of fraud in lending with actionable tools, from risk decisioning to authentication solutions with Tink – while getting closer to inclusive loan origination.

Read more

2023-03-02

11 min read

Small tweaks, big results: accelerating open banking conversion rates

It’s common for friction to appear for users in open banking flows, causing lower completion rates than we would like. See how Tink is working on improving clients’ conversion rates through incremental changes to our products.

Read more

2022-08-16

2 min read

The solutions that will lead to a new world of finance

Discover the open banking solutions that are leading to a new world of finance.

Read more

2022-03-24

17 min read

Lender's guide to improving risk assessments with open banking

We dive into the world of risk assessments, exploring challenges lenders face with current decisioning methods, and how the process can become more convenient, reliable and complete thanks to open banking and the smart use of data.

Read more

2021-08-19

5 min read

Why connecting to open banking APIs is not as simple as it seems

Connecting to an open banking API seems pretty straightforward. But making the connection is just the first step in a complex process. Here are some aspects businesses often overlook when deciding to build the connections in-house.

Read more

2021-07-07

4 min read

How open banking simplifies income verification

Income verification used to mean having to dig up bank statements, share income tax statements or payslips – and then wait days or even weeks to have it all verified. Now, thanks to open banking it can take seconds. Here’s how.

Read more

2021-03-03

1 min read

Guide to improving the digital banking experience

How can banks transform the digital banking experience and build long, lasting (and more profitable) relationships with customers? We lay out how banks can leverage open banking to create more valuable, personalised services.

Read more

2021-11-25

1 min read

Guide to account verification solutions

Learn all about the most common account verification methods used today, why they don’t always meet today’s digital customers’ expectations – and how you can use open banking to provide a faster, safer, and simpler solution.

Read more

Webinars

2024-01-18

1 min read

How to create a winning Pay by Bank user experience

In this webinar our Tink team of Jaia Lloyd, Varun Atrey and Kevin Ward discuss how Pay by Bank (account to account payments) can vastly improve your user journey and demo how it works.

Read more

2023-12-04

1 min read

Discussing sustainable banking with ecolytiq

In our latest webinar, we’re joined by David Lais, Co-Founder & Managing Director of ecolytiq to discuss how we have partnered to create a seamless way for banks to seize the opportunity and offer combined financial and sustainability coaching – and what we can expect for the future.

Read more

2023-05-25

1 min read

The next era of invoice payments

In this webinar, PostNord Strålfors – the Nordics’ largest distributor of invoices – speaks with Tink to discuss how invoice payments are becoming digitalised.

Read more

2022-10-24

1 min read

Unlocking a new era of credit

In this webinar, Christophe Joyau, Tink SVP Banking and Lending, and David Öhlund, CEO Scandinavia GF Money, discuss how open banking is transforming the lending landscape.

Read more

2021-06-17

1 min read

Open banking in the post-pandemic world

Tink’s Research Director Jan van Vonno dives into the findings from our 2021 report, sharing economic statistics and survey results to shed light on emerging risks, changing priorities, and the role of open banking in the years ahead.

Read more

2020-05-27

1 min read

The investments and returns of open banking

Watch the recording of our webinar to find out more about the results from our 2020 survey. Research Director Jan van Vonno explores how much financial institutions are investing in open banking, and how they’re looking to profit from it.

Read more

2020-04-20

1 min read

Open banking attitudes & fintech partnerships

Watch our webinar to learn more about how businesses are looking to create value from open banking – and how you can do the same. Tink’s Research Director presents the results from our 2020 survey of financial executives.

Read more

2020-09-23

1 min read

What’s driving open banking investments?

Watch our webinar, where Tink’s Research Director runs through our 2020 survey results, taking a closer look at the use cases financial institutions are investing in and the immediate opportunities they have in sight.

Read more

2020-06-21

1 min read

Get up and running with Tink

Want to get a glimpse into Tink’s tech? Find out just how quick and easy it is to test, build and launch new experiences

Read more

2021-02-25

1 min read

Start verifying accounts in less than 12 minutes

Learn how you can set up Tink’s Account Check to confirm the owner of a bank account by fetching real-time data from banks. This video walkthrough takes you through the entire setup process – and it’s all done in 12 minutes.

Read more

2020-12-11

1 min read

Taking advantage of open banking

Our Research Director takes a look at the different forces impacting open banking progress and explores how organisations’ internal alignment may explain why some financial institutions are able to move faster than others.

Read more

Previous reports

Aligning on open banking objectives

Are financial institutions across Europe getting the most out of their open banking implementation efforts? Our survey report uncovers some of the common challenges organisations face when it comes to internal alignment.

Read the report

The growing positivity towards open banking

How do financial executives across Europe perceive the open banking opportunity in 2020? Our survey finds an increase in optimism, and high interest in forming fintech partnerships to accelerate the path towards value creation.

Read the report

The investments and returns of open banking

Get the full findings and dive into the EU-wide results on the investments and returns of open banking.

Read the report

Open banking use cases and opportunities

Financial institutions are investing big in open banking, but what are the use cases they’re most interested in? We surveyed 290 European bankers to find out what immediate opportunities they have in sight.

Read the report

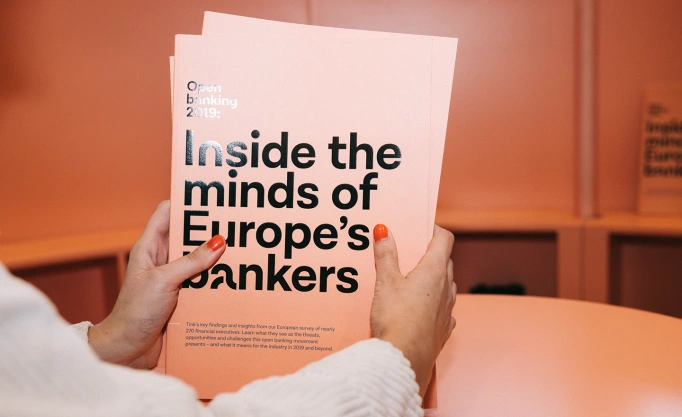

Inside the minds of Europe's bankers

Discover what financial executives across 17 Europe countries see as the biggest threats, challenges and opportunities of open banking – and what they see as necessary steps to adapt and succeed.

Read the report