2025-07-01

2 min read

Tink and Chip partner to power seamless account top-ups with open banking

Chip, the award-winning wealth app, is now using Tink’s open banking technology to offer users a faster, more secure way to top up their accounts.

Read more

2025-06-18

2 min read

Video – How Snoop is unlocking smarter saving with variable recurring payments

With the launch of variable recurring payments (VRP), Snoop is introducing a smarter, more flexible way for people to build their savings – and making the most of Tink's open banking solutions in the process.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2025-05-28

2 min read

Tink and Adyen partner to bring Pay by Bank to Vodafone customers in Germany

Tink and Adyen have announced a partnership with Vodafone, a leading telecoms company, to offer their customers in Germany the option to pay their prepaid tariff and outstanding postpaid balances using Pay by Bank.

Read more

2025-03-20

4 min read

Tink hits 10,000 merchant milestone for open banking payments

As the adoption of open banking payments surges, we've hit a new milestone as 10,000 merchants choose Pay by Bank – plus a new €100M daily peak for our payment initiation services

Read more

2025-02-06

6 min read

Introducing User Match: Built-in name verification to make security fast and easy

Discover how the latest feature of our verification products, User Match, is improving security by verifying users' names when adding bank accounts, reducing fraud and enhancing account protection.

Read more

2025-02-05

6 min read

Merchants invest in payment upgrades as younger generations prioritise sustainability and security for luxury purchases

The latest findings from our peak season survey suggest that younger generations are reshaping the luxury market by prioritising quality, sustainability, and secure payment experiences. With cost-of-living pressures, these discerning shoppers demand more than just premium products, pushing high-end merchants to upgrade their payment systems to stay competitive.

Read more

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

2024-12-17

7 min read

User experience: Wealthify empowers customers’ financial wellness with Pay by Bank

Tink partner Wealthify uses Pay by Bank for the optimal PFM, investment and saving experience, thanks to easy account top ups and secure account-to-account payments.

Read more

2024-12-11

6 min read

Three in four high-end merchants optimistic about peak season

New research from Tink shows that, this festive season, quality is trumping quantity as many cost and climate-conscious consumers choose to invest in higher-quality goods, even if that means purchasing fewer items overall.

Read more

2024-09-24

4 min read

Why Pay by Bank fits luxury retail like a glove

Pay by Bank offers a solution that addresses the potentially higher transaction fees and fraud risks while enhancing the customer experience for luxury retailers.

Read more

2024-09-18

14 min read

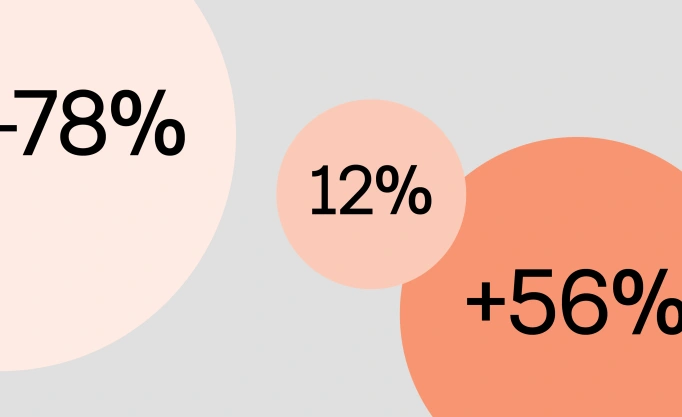

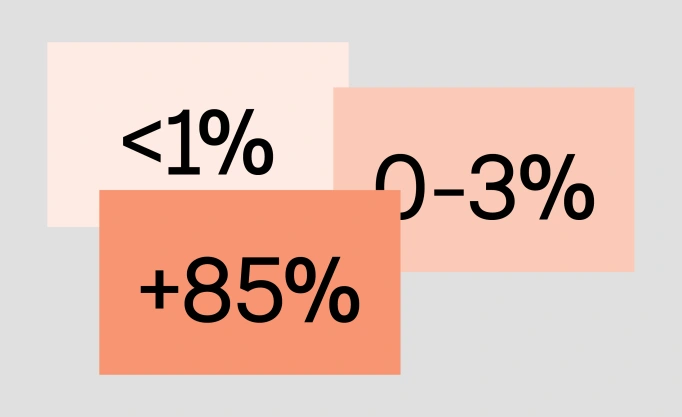

Connecting the dots: how UX optimisations are driving success rates

We’ve previously explored small tweaks that get big results in open banking conversion rates. This deep dive drills further into how to reduce friction – and improve success rates through a fresh round of incremental changes in our UX.

Read more

2024-09-04

2 min read

CTS EVENTIM adds Tink’s user-friendly Pay by Bank service to its checkout options – giving fans even more choice

Collaborating with Tink, a market-leading payment services and data enrichment platform, CTS EVENTIM has now added Pay by Bank to its checkout process.

Read more

2024-08-12

11 min read

Six ways open banking helps remittance

Learn all about remittance, and how open banking can help it happen more smoothly with six of our best tips. From reducing friction, to simplifying compliance processes, and much more.

Read more

2024-07-29

6 min read

Not just another payment method – six reasons why leading PSPs are prioritising Pay by Bank

In the second article of this series, we focus on why leading Payment Service Providers (PSPs) – like Adyen and Stripe – are introducing Pay by Bank to their checkout options (and why this is important for their merchants too).

Read more

2024-07-29

6 min read

Pay by Bank in 2024 - the current status and outlook

Sometimes called open banking payments, or account-to-account (A2A) payments, Pay by Bank is now the more common industry term in ecommerce. Tink is one of the leading providers, and here we provide an overview of one of the fast-growing payments technologies in the first of a new blog series.

Read more

2024-05-02

3 min read

TransferGo and Tink partner for international money transfers

TransferGo, the global fintech empowering a world on the move, has partnered with Tink to add Pay by Bank to its payments offering. Pay by Bank is now live for UK TransferGo customers, introducing a new way to more securely and quickly send money internationally.

Read more

2024-04-22

4 min read

Splitwise and Tink partner to make paying back friends and family easier than ever

Splitwise, a popular app for sharing bills and expenses, and Tink have partnered to bring Pay by Bank to Splitwise users. This enables millions of Splitwise users to initiate direct payments to friends and family from within the Splitwise app.

Read more

2024-04-16

4 min read

Jennifer Thunander – delivering the goods

How does Tink make sure that its technical integration is successful? That’s where delivery teams, overseen by people like Jennifer, come in. Here she tells us about her role and ensuring that Pay by Bank journeys are as smooth as possible.

Read more

2024-04-10

7 min read

Thomas Gmelch - how open banking can change the instant payment experience in Germany

We sat down with Thomas to chat about the challenges facing our customers in Germany, and how our newly launched Risk Signals product is coming to the rescue.

Read more

2024-03-20

1 min read

The ultimate guide for building the future of recurring payments

Variable Recurring Payments, powered by open banking, have huge potential for merchants and consumers in the UK. Read our VRP guide to find out how they work and why they are important.

Read more

2024-03-07

6 min read

Smart moves with smart meters: how commercial VRP could support pay-as-you-use billing models

Discover how variable recurring payments can transform smart meter billing into a more flexible user experience – and utility providers more ways to support financially vulnerable customers.

Read more

2024-03-06

3 min read

Deutsche Bahn and Tink partner for direct debit setups

Deutsche Bahn has teamed up with Tink for Account Check - enabling instant, easy and secure account onboarding. DB Connect, part of the Deutsche Bahn Group, runs some of Germany’s largest modern mobility sharing services including ‘Flinkster’, Germany’s largest car sharing network and ‘Call a Bike’, one of the biggest bike sharing systems in the country.

Read more

2024-02-20

5 min read

Billing and the cost of living: 2/3 of Brits want support from utility providers

Empower your customers through the cost of living with more options in energy billing and improved UX with variable recurring payments.

Read more

2024-01-31

6 min read

Introducing Risk Signals: minimising fraud risk

Tink has launched Risk Signals, a rules-based engine that unlocks instant payment experiences while minimising risk – and already in use by Tink customers like Adyen.

Read more

2024-01-02

8 min read

2024 – what’s on the horizon for payments and data-driven financial services?

From Pay by Bank and VRP, to risk assessments, sustainability and money management tools, 2024 looks set to be the year when data-driven financial services hit the mainstream.

Read more

2023-12-04

5 min read

Livia Kathi – how to accelerate adoption of Pay by Bank

Livia Kathi, Tink’s Product Solutions Director, is spearheading our Pay by Bank drive in the challenging realm of ecommerce. Learn more about the crucial factors of user experience, building trust, and incentives.

Read more

2023-11-16

5 min read

Investments and the cost of living: why everyday investors are being forced to cash in

Investment platforms can avoid losing people to poor user experience – let open banking tools make your payments friction free, while your customers focus on their financial wellness.

Read more

2023-11-09

7 min read

Peak retail season: the cost of living and high volume returns

Prep for Black Friday and 2023 end-of-year sales with new data from Tink, and discover the benefits of Pay by Bank for seamless refunds and returns.

Read more

2023-10-03

7 min read

Direct debit cancellations: a guide to customer success with open banking

The cost-of-living crisis is impacting direct debits, but open banking tools can enable businesses to safeguard revenue while supporting customers. Read Tink’s guide to the solutions that can help.

Read more

2023-09-14

6 min read

New streamlined authentication journey makes open banking payments even faster

Secure open banking payments are now even faster with streamlined authentication – optimise your payment journey and increase returning customers with Tink’s Pay by Bank-powered tools.

Read more

2023-09-01

3 min read

Dennis Dorfmeister & giroAPI – The importance of good frameworks and technical designs

We spoke to Tink Engineering Manager Dennis Dorfmeister, who has been appointed to the advisory board of giroAPI, an open banking initiative led by the Association of German Banks.

Read more

2023-08-29

3 min read

Orbyt turbocharges invoicing and direct debits with Tink partnership

Tink and Orbyt partner to offer instant account verification, better direct debits and Pay by Bank-powered invoicing to its customers across Europe.

Read more

2023-08-01

5 min read

Martina Sjöblom - Improving consumer protection with commercial VRPs

Tink Senior Legal Counsel, Martina Sjöblom, has been named to a new sub-working group as part of the Joint Regulatory Oversight Committee’s (JROC) push in the UK to introduce commercial, non-sweeping variable recurring payments (VRPs).

Read more

2023-07-26

4 min read

SEPAexpress teams up with Tink to scale payments across Europe

SEPAexpress and Tink are teaming up to improve payments for its customers across Europe. Using Tink’s technology, SEPAexpress is simplifying the payment process offering Pay by Bank and instant account and balance verification.

Read more

2023-06-29

5 min read

European Commission introduces PSD3/PSR to advance open banking and strengthen consumer protection

Tink’s Head of Industry & Wallets, Jan van Vonno, discusses the EU's draft legislation for financial services - PSD2's impact, open banking progress, consumer protection, and benefits of the upcoming PSD3/PSR.

Read more

2023-06-28

4 min read

Variable Recurring Payments - New UK working group drive to help accelerate and improve adoption

Tink’s Andrew Boyajian is playing a key role in a new variable recurring payments (VRPs) working group in the UK, advocating for standardisation and faster implementation of this technology in open banking.

Read more

2023-06-15

2 min read

SSP selects Tink as its pan-European partner for open banking payments

Read about how Tink has teamed up with Score & Secure Payment (SSP) to enable open banking payments across the eurozone for its 14,000+ merchants.

Read more

2023-06-13

2 min read

JROC latest - mapping out the UK’s open banking actions

After last week’s announcement of two new working groups formed by the Joint Regulatory Oversight Committee, Tink maps out the latest UK open banking timelines.

Read more

2023-06-07

4 min read

Spotlight - Tink’s fast-growing team in Poland

We spoke to members of Tink’s thriving Polish office, which has expanded from a small engineering hub to a live open banking payments market, with more than 140 staff now based in Warsaw.

Read more

2023-05-24

7 min read

How Pay by Bank is approaching its tipping point

Understand how Pay by Bank works as an account-to-account payment method and how to leverage open banking with Tink as it reaches mass adoption.

Read more

2023-03-01

3 min read

Introducing payment logs inside Tink Console

We’re releasing payment logs – a troubleshooting toolkit within Tink Console that allows you to see the current status of a payment and get more details if and when something goes wrong.

Read more

2023-02-22

4 min read

Beat the challenge of refunds with Pay by Bank

Online retailers struggling with refunds processes can reduce costs with Pay by Bank. Tink’s open banking tools help businesses optimise both their spend and UX. Read on to learn how real-time payments can help.

Read more

2023-01-18

8 min read

3 ways to accelerate Pay by Bank adoption

Pay by Bank could change the game for your business, helping you add speed and prevent fraud. Learn how open banking powered payments can turbocharge your customer experience.

Read more

2022-12-14

7 min read

How VRPs can help your customers weather the economic storm

How Variable Recurring Payments can help vulnerable consumers avoid overdraft fees and cancelled payments during the economic crisis.

Read more

2022-12-08

4 min read

How Pay by Bank can help struggling merchants as recession looms

Tink’s latest research shows that half of UK online retailers are worried about surviving the next 12 months, as recession looms. Here’s how Pay by Bank can help.

Read more

2022-12-02

4 min read

The European Payments Council’s first SEPA Payment Account Access (SPAA) rulebook – the Tink take

The European Payments Council’s first SEPA Payment Account Access (SPAA) rulebook was published this week. Tink provides a summary and view on the latest developments.

Read more

2022-11-30

9 min read

How VRP is sweeping money management into a new era

Sweeping VRPs, the me-to-me payment method that is simplifying money management for businesses and consumers.

Read more

2022-11-23

5 min read

Instant refunds and withdrawals are here

Tink’s payments upgrade adds instant refunds and withdrawals, letting businesses across Europe issue payouts that settle in less than one second.

Read more

2022-11-21

12 min read

How to achieve the best possible Pay by Bank conversion rate

When making a purchase online, consumers look for simple, safe and convenient payment experiences. In this guide, our Payments team shares its best practices for optimising Pay by Bank user journeys and ensuring the highest possible conversion rate.

Read more

2022-11-02

5 min read

Introducing Tink’s Variable Recurring Payments beta programme

Tink and NatWest have partnered up to launch a beta VRP programme in the UK to gather real use cases for merchants based on their needs.

Read more

2022-11-01

8 min read

What’s a good Pay by Bank conversion rate?

Comparing Pay by Bank conversion rates across different payment methods can be tricky since most don’t use an end-to-end metric. See Tink’s own benchmarks and how we track performance in this conversion rate deep-dive.

Read more

2022-10-28

3 min read

The European Commission’s Instant Payments proposal – the Tink take

The European Commission published its proposal on Instant Payments clearing the way for widespread adoption of open banking payments.

Read more

2022-10-27

8 min read

Investment platforms: what to look for in an open banking partner

Looking for the best open banking provider? Here is everything you need to consider before making a decision.

Read more

2022-10-21

5 min read

How to create a digital-first invoice payment experience with ease

Whilst some invoice distributors are still using time-consuming, traditional analogue flows, open banking is transforming the invoice payment experience. Learn how to easily digitalise existing analogue flows using Tink payment technology.

Read more

2022-10-14

3 min read

Tink and Zervant partner for faster invoice payments

Tink and Zervant have partnered up to enable open banking payments for invoicing for over 100,000 SMEs.

Read more

2022-10-12

2 min read

The solutions that are transforming the payments landscape

The modern customer wants a frictionless payment experience. Discover how open banking payments can help you in our ultimate solutions guide.

Read more

2022-10-05

3 min read

Tink and Adyen partner for open banking payments

The global fintech platform Adyen is partnering with Tink to power its new pay-by-bank solution and offer instant bank payments to its customers. The partnership will help accelerate the global adoption of open banking powered payments.

Read more

2022-09-22

10 min read

The truth about Variable Recurring Payments: current status, use cases, and future prospects

Many claim Variable Recurring Payments (VRPs) are changing the payments landscape. But what’s the actual status? And are there already viable use cases? We try to cut through the noise and explore the challenges and opportunities of VRPs.

Read more

2022-09-06

4 min read

SlimPay partners with Tink

SlimPay is partnering with Tink to offer seamless subscription payment experiences across Europe, powered by open banking. SlimPay merchants will be able to offer a secure, seamless way to set up a direct debit that lets users authenticate and make the initial payment through open banking.

Read more

2022-08-25

3 min read

Billogram and Tink partner to streamline invoice payments

We’re proud to announce a partnership with Billogram to further improve their customer experience by removing friction from their invoicing platform.

Read more

2022-08-24

6 min read

The top 3 trends driving open banking payments adoption today

Faster, broader coverage, and higher security: the top 3 trends driving open banking payments adoption today, according to industry leaders.

Read more

2022-08-16

2 min read

The solutions that will lead to a new world of finance

Discover the open banking solutions that are leading to a new world of finance.

Read more

2022-07-27

6 min read

3 easy ways to turn financial data into value

The democratisation of financial data is opening up new opportunities. Find out how to harness its power with open banking in our latest article.

Read more

2022-07-18

5 min read

Solidi and Tink partner to launch instant account top-ups for crypto investors

Tink is partnering with UK cryptocurrency exchange Solidi to bring instant payments settlements to crypto investors. Open banking-enabled account settlements are faster, safer, and more convenient than bank transfers.

Read more

2022-07-14

4 min read

How open data can help tackle the cost-of-living crisis

The cost of living is reaching an all-time high for many. Read on to find out how data can help consumers navigate these turbulent times – thanks to the near limitless possibilities of the open data economy.

Read more

2022-07-13

6 min read

Settlement accounts

Tink launches settlement accounts for simpler instant bank payments to speed up settlement times and reduce the risk of fraud. First launch in collaboration with UK crypto exchange, Solidi. Find out how it can help reduce friction in your business.

Read more

2022-07-05

11 min read

Lessons from taking open banking payments mainstream: an interview with Billy Telidis

We caught up with Billy Telidis, Product Manager of Payments at Tink, to talk about how open banking payments have gone from relative obscurity to a preferred payment method.

Read more

2022-06-28

11 min read

Debunking the 5 biggest myths about Pay by Bank

Curious about what's true and what's false about open banking payments like Pay by Bank? Let's cut through the noise and bust some of the most persistent myths.

Read more

2022-06-16

7 min read

Why invoices are the perfect use case for open banking payments

What makes open banking such a good match for invoice settlement, and how can this product-market fit help lead to mass adoption? We take a look at a use case to find out.

Read more

2022-06-07

2 min read

Revolut and Tink partner for European payments

The global financial super app Revolut has entered into a strategic partnership with Tink to offer its European customers seamless payment solutions powered by open banking.

Read more

2022-05-18

5 min read

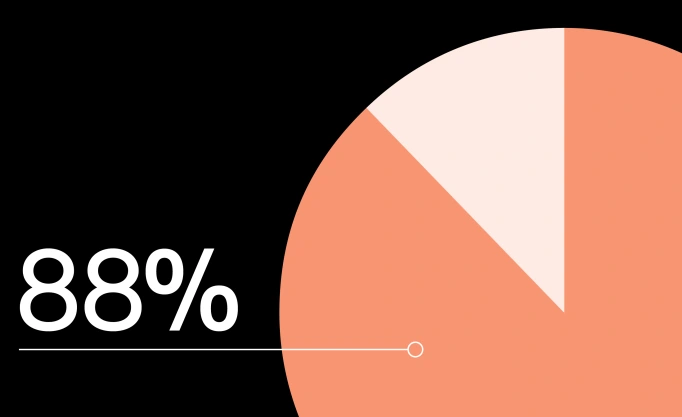

UK consumers expect fast and frictionless payment journeys

Tink’s latest UK survey shows that nearly 9 in 10 consumers (88%) are prepared to abandon a transaction if faced with friction when making a payment online, highlighting the need to ramp up payments innovation and focus on user experience

Read more

2022-05-03

4 min read

Invoice settlement: what it is, and how open banking makes it simpler

Paying bills and invoices has typically been a cumbersome process – but thankfully, open banking can make it a lot quicker and easier by allowing customers to pay directly from their bank account. Here’s how that works.

Read more

2022-03-23

8 min read

Are open banking payments taking off? How businesses and consumers are already reaping the rewards

Tom Pope, head of payments and platforms at Tink, lifts the lid on where open banking payments scale is coming from – and whether the world is ready.

Read more

2022-03-22

4 min read

Verify corporate account ownership in real time with Business Account Check

No more manual and inefficient onboarding processes: with Business Account Check, your customers can verify a business bank account with just a few clicks – for a better onboarding and a safer payout setup.

Read more

2022-03-17

6 min read

Unsure how open banking payments can help your business? We can show you where they’re booming

Tom Pope, head of payments and platforms at Tink, explains where open banking payments are gaining the most traction – and why the big opportunities are emerging now.

Read more

2022-03-16

4 min read

Beyond PIS – different ways payments can benefit from open banking

Explore the different ways to leverage open banking technology in payments – beyond A2A and PIS. Enable seamless onboarding with instant account verification, and reduce fraud and nonpayments with real-time balance check.

Read more

2022-03-15

3 min read

PostNord Strålfors and Tink partnering for payments

Find out how PostNord Strålfors – the largest distributor of invoices in the Nordics – is transforming how invoices are paid. (Spoiler alert: it has to do with their new partnership with Tink.)

Read more

2022-01-04

4 min read

Where is open banking heading? – our predictions for 2022

While we can never really know for sure what the new year will bring – it’s still quite fun to guess. (Then look back to see what you got right and where you were way off.) Here’s what Tink CEO Daniel Kjellén predicts for 2022.

Read more

2021-10-28

10 min read

SEPA Request-to-Pay: what you need to know about the new scheme

What is the SEPA Request-to-Pay scheme? What does it mean for banks, merchants and consumers – and for the future of payments in Europe? Is there anything that might be holding it back? We provide answers – and our own take on it.

Read more

2021-10-08

3 min read

eCollect partners with Tink to streamline receivables management across Europe

Find out how eCollect is simplifying and digitising invoice payments – and how their new partnership with Tink will help ensure hassle-free cash management for their customers and a seamless experience for end users.

Read more

2021-09-23

3 min read

Serrala partners with Tink to offer improved bill payments across Europe

We’re partnering with global financial automation and payments company Serrala to simplify the billing process and reduce transaction fees for billers while improving the payment experience for millions of consumers across Europe.

Read more

2021-05-05

4 min read

Tink and Tribe partner for open banking payments

We’re teaming up with Tribe for open banking technology, enabling Tribe to combine issuer and acquirer services with Tink’s open banking payments – so Tribe’s customers can access both traditional and more innovative payment solutions.

Read more

2021-04-29

10 min read

All about Variable Recurring Payments, and how they can accelerate innovation

Variable Recurring Payments is a hot topic in open banking, and many believe it could change the face of consumer payments as we know them. Here’s an overview of how it works – and why it’s such a powerful contender in the payments space.

Read more

2021-04-13

4 min read

What is SCA, and what is it good for?

SCA stands for Strong Customer Authentication, and it’s a regulatory requirement introduced in connection to PSD2. Here’s a basic summary of what a ‘strong’ authentication process can look like – and why it’s important.

Read more

2021-01-27

3 min read

What is account verification, and what is it good for?

When charging or paying out customers, businesses rely on them to provide their account details. But people can make mistakes – or try to commit fraud. Thankfully, account verification can save everyone a lot of grief.

Read more

2020-12-11

4 min read

Tink closes €85 million investment round extension to fuel growth

Co-led by new investor Eurazeo Growth and existing investor Dawn Capital, Tink has announced an €85 million investment round extension, to accelerate its growth plans and expand payment initiation across Europe.

Read more

2020-12-01

4 min read

How Avy is simplifying rental payments

Find out how Swedish startup Avy is upgrading the renting experience for property owners and tenants by putting real people at the centre of real estate – and how Tink is helping improve one of the cornerstones of their product.

Read more

2020-11-04

5 min read

Instantly verify customers’ account information with Account Check

Get to know Tink’s new product, Account Check. Here’s how it can speed up and simplify the account verification process, providing an easier onboarding and setup for direct debit and payouts.

Read more

2020-10-08

2 min read

Lydia and Tink partner for open banking

The news is out. We’re teaming up with Lydia as its open banking technology partner across Europe, to streamline the app’s bank connectivity and create new services for millions of customers.

Read more

2020-10-01

2 min read

What is payment initiation, and what is it good for?

Not sure what payment initiation is, what it looks like, or why you should care? We’re breaking it down into simple terms. Here’s how it works, and what advantages it brings to consumers and businesses alike.

Read more

2020-07-01

3 min read

Sopra Banking Software becomes Tink's channel partner

Sopra Banking Software and Tink have joined forces to bring open banking solutions – account aggregation, data enrichment, payment initiation, and personal finance management technology – to a platform serving 1,500 financial institutions worldwide.

Read more

2020-06-03

2 min read

PayPal and Tink expand partnership across Europe

PayPal is making a second strategic investment in Tink, and together, their commercial agreement is extending across all countries in the EEA to continue the expansion of open banking technology.

Read more

2020-04-14

3 min read

Kivra and Tink partner up to provide a more user-friendly way to pay bills and invoices

Find out how Swedish company Kivra is providing a more user-friendly and friction-free payment solution – to simplify things for their customers, and their business.

Read more