New priorities for bankers – and how open banking can help

How have banking priorities changed as a result of the pandemic? Our survey reveals the three focus areas that are top of mind for financial executives: enhancing digital services, customer experience and profitability. As luck will have it, there is one thing that can help address it all. (Spoiler alert: it’s open banking.)

Financial executives across Europe recognise the pandemic has increased focus on three key areas: enhancing digital services, customer experience and profitability.

Interest in open banking has also increased as a result, as it can help institutions deliver on each of these priorities by enabling data-driven services.

Get more insights and discover what else our survey uncovered in our full report.

As well as revealing these top three priorities for bankers, our research report on open banking in the post-pandemic world also reveals that two-thirds of financial executives say their interest in open banking has increased as a result of the ‘unprecedented times’ we’re still adjusting to.

How are these things connected?

Well, it seems financial institutions recognise that open banking provides a solution to many of the challenges presented by the pandemic. Let’s take a closer look at the most pressing priorities, and what open banking can do to accelerate these efforts.

Prio 1: continue the shift to digital services

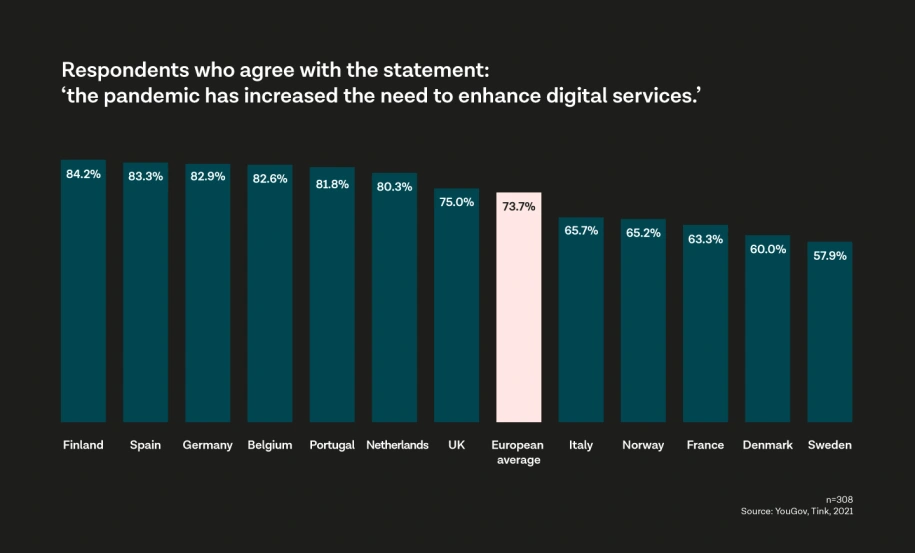

With the world rapidly shifting to a remote, digital-first way of living seemingly overnight, it’s no surprise the need to improve the digital offering took a big spike. 74% of executives across Europe recognised the need to enhance digital services.

Enhancements can range from streamlining onboarding for digital customers, to scaling to support a rapid rise in traffic volumes, or adapting to better serve all types of customers remotely.

Although many primary banking services have been digitally accessible for many years, shortcomings in design and functionality may have become more apparent now that most (if not all) customers have gone fully digital at once. Services have needed to adapt to all types of users – whether they are tech savvy or not.

How open banking can help

Simply put, leveraging open banking connectivity platforms can shorten the time to market for digital services. That’s because these platforms give access to tools and capabilities that are easily scalable across lines of business, customer segments, and even geographies.

More importantly, they also let financial institutions easily tap into different data-driven services, radically accelerating development of digital services.

Prio 2: differentiate on customer experience

Improving the customer experience (CX) is often linked to the need for enhancing digital services. Attention to CX is not just a way to grow customer satisfaction with digital services, it’s also a way to differentiate from competitors, increase engagement, and streamline operations by transitioning to zero-touch services.

This came out as the second biggest priority, with 70% of financial executives agreeing that the pandemic has increased focus on the customer experience.

Delivering a compelling customer experience can be a delicate balancing act between building simple and intuitive interfaces versus offering a rich set of functions. Finding the right mix for your customers might require continuous iterating.

How open banking can help

By giving access to financial data, open banking can greatly aid in creating personalised customer experiences. With account information services, institutions can get a lot more insights in each customer’s needs and situation to deliver experiences tailored to them.

This is key, because a good experience doesn’t stop at speedy, ease-to-use digital services (which open banking can also help achieve, by streamlining previously cumbersome processes like account verification). Today’s customers have also come to expect highly relevant and timely nudges that basically anticipate their needs.

Prio 3: restore profitability

It’s no surprise to see this one ranked as another big priority – with 68% of executives recognising an increased focus on profitability as a result of the pandemic.

Many of the investments made in 2020 have been targeted at business continuity, keeping operational costs low, and supporting customers in need. As financial institutions undergo significant transformation, the costs incurred to deal with the pandemic suggest that the technology overhead has gone up for a lot of financial institutions.

For the time being, banks are saving expenses where possible and heavily cutting down branch networks. (Kearney predicts that 25% of all bank branches will close across Europe in the next three years.)

How open banking can help

Open banking can help automate several processes, making them a lot more cost-efficient. This is true for a lot of processes that require manual input from the customer: from identity and due diligence processes, to affordability and risk assessments – anything that requires customers to send in documents to be verified.

Since these documents need to be manually handled and assessed, it can be a massive productivity drain (some banks share that 50% of customers don’t provide the right information in their first submission).

Open banking simplifies this by retrieving the required information from the customer’s bank – which radically increases operational efficiency.

Since the data can be fetched in real time and in a machine-readable format, financial institutions can also onboard quicker and with lower risk, reducing the cost of customer acquisition.

The detailed view

Want to learn more about how financial executives across Europe are reacting to the pandemic? We have a lot more findings to share.

Among other topics – such as why so many executives foresee a permanent impact – we also take a closer look at what might explain the different results across countries (as seen in the graphs above).

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.