Data Enrichment

Power your digital services and turn financial transactions into holistic sources of consumer information.

Overview

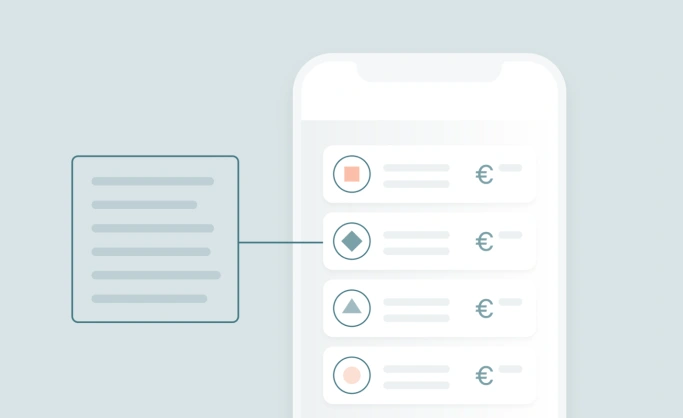

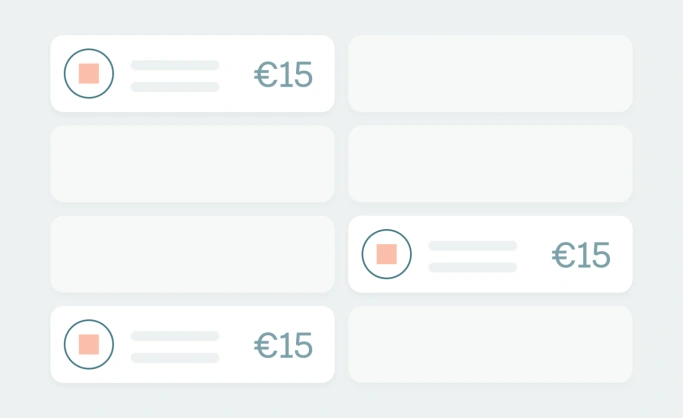

Categorised transactions

Transactions overview

Future balance overviews

Features beyond banking

Categorisation

Smart categorisation based on machine learning models, including a user feedback loop allowing for better accuracy and a personalised experience.

Recurring transactions

Find out which fixed costs your user has and provide them with a better overview of their spending habits.

Predicted recurring transactions

Forecast upcoming transactions to help users prevent overspend. Including all fixed commitments.

Plug in with a ecosystem partner

Integrate with our ecosystem partners to enhance your digital experience with extra solutions and insights.

Variable Spend

Help consumers proactively take control of their finances by categorising spending into comprehensive yet easy-to-digest insights.

How can Data Enrichment help you?

Discover how Data Enrichment can help you leverage the power of financial data and boost consumer loyalty.

Financial coaching

Help consumers understand their spending and remember past transactions with merchant mapping. Provide an overview of regular income and expenses, and predict future account balances.

Learn moreContracts and subscriptions

Identify subscriptions across accounts, and leverage an ecosystem partner allowing users to directly manage subscriptions. Transfer contracts between banks seamlessly by identifying recurring costs in the accounts.

Learn moreSustainability services

Help users understand their CO2 consumption based on transaction data and provide tips and suggestions on how they can reduce their carbon footprint.

Learn moreLoyalty and reward offers

Use Tink to identify eligible transactions for rewards/points, maximise loyalty card rewards with nudges, and offer real-time deals based on purchase behaviour.

Learn moreWhy Data Enrichment with Tink?

2 bn +

With over 2 billion transactions per month across all products, Tink is one of the largest data platforms at scale.

Plug and play

Deliver engaging experiences out of the box with Tink’s ready-to-go use cases, or one from our ecosystem partners.

11+ years

We’ve been building and refining digital-first engagement solutions for over a decade, making Tink the preferred partner.

Tink API

One integration connects you to

13,000+

Connections to all major banks across Europe

18

countries across Europe

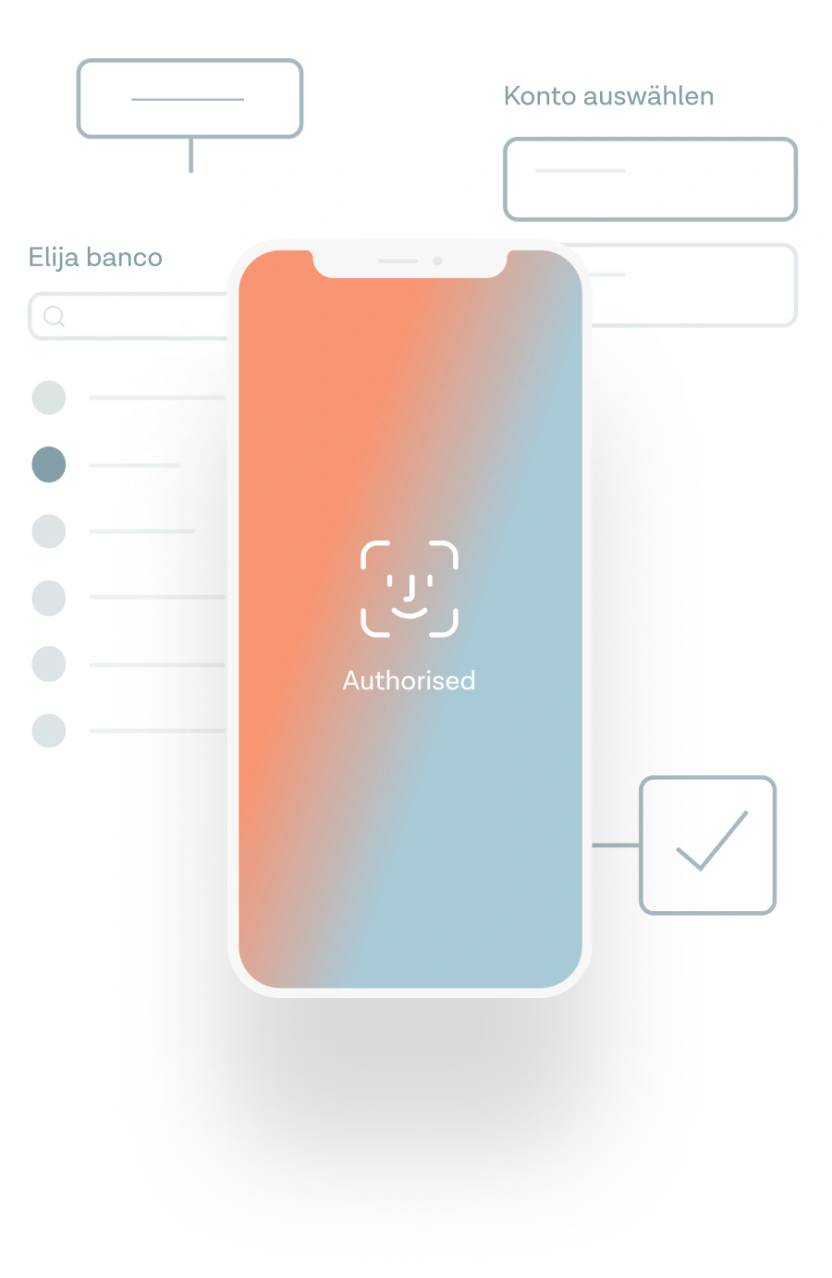

Tink Link

Fully-managed end-user authentication

Authenticate millions of end-users across Europe through a link

All translations, local nuances and compliance taken care of

Flows are constantly improved based on data and testing

Customisable colours and fonts to match your brand guidelines

Tink Link

Fully-managed end-user authentication

Authenticate millions of end-users across Europe through a link

All translations, local nuances and compliance taken care of

Flows are constantly improved based on data and testing

Customisable colours and fonts to match your brand guidelines

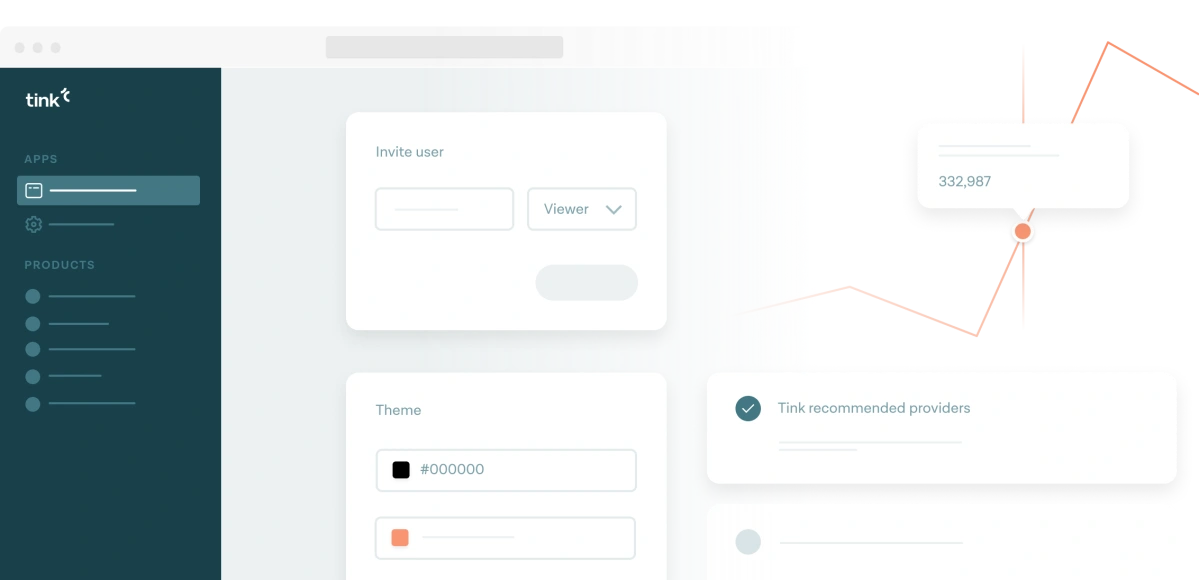

Tink Console - your open banking control panel

Easily tap into the world of open banking with the Tink Console – an intuitive developer interface that lets you access financial data and configure, customise, and manage your applications.

‘Best Developer Dashboard’

DevPortal awarded Tink as ‘Best Developer Dashboard’ for providing a great developer experience.

Setup and configuration

Configure, customise, manage, and deploy access to the financial data powering your apps.

Usage reports

Get real-time usage and performance reports without the need for a third-party solution.

Team roles

Give the right level of access to team members within your organisation.

Explore the full range of products through Tink Console, using test bank data for the complete testing experience. Dive into guides, resources and sample projects below to help you get up and running with your account.

Documentation

Easy-to-follow guides, API reference and sample projects

Introduction to Data Enrichment

Use Data Enrichment to innovate and develop digital banking experiences for your customers by extracting real value from financial data with reduced time-to-market.

Fetch a list of all categories for your locale

If you want to see the complete list of categories for a particular locale you can call the list categories endpoint. In this guide, we’ll use this to get friendly category names to present to your users.

Get all recurring transactions for an end user

Find out how to fetch all recurring transactions for a user. This is useful when you want to create a view that shows all fixed costs (like subscriptions, for example) for a user.

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.