Use cases

Find out how companies of all shapes and sizes are using Tink’s open banking solutions to power new ideas and deliver better experiences.

2025-06-18

2 min read

Video – How Snoop is unlocking smarter saving with variable recurring payments

With the launch of variable recurring payments (VRP), Snoop is introducing a smarter, more flexible way for people to build their savings – and making the most of Tink's open banking solutions in the process.

Read more

2024-12-17

7 min read

User experience: Wealthify empowers customers’ financial wellness with Pay by Bank

Tink partner Wealthify uses Pay by Bank for the optimal PFM, investment and saving experience, thanks to easy account top ups and secure account-to-account payments.

Read more

2024-08-12

11 min read

Six ways open banking helps remittance

Learn all about remittance, and how open banking can help it happen more smoothly with six of our best tips. From reducing friction, to simplifying compliance processes, and much more.

Read more

2022-06-30

4 min read

How Again is using transaction data to drive change

Using open banking to drive sustainable change: Swedish climate fintech Again is partnering with Tink to end greenwashing. Their app leverages transaction data to accelerate the climate transition by offering valuable user data to sustainable brands.

Read more

2022-06-16

7 min read

Why invoices are the perfect use case for open banking payments

What makes open banking such a good match for invoice settlement, and how can this product-market fit help lead to mass adoption? We take a look at a use case to find out.

Read more

2022-04-01

3 min read

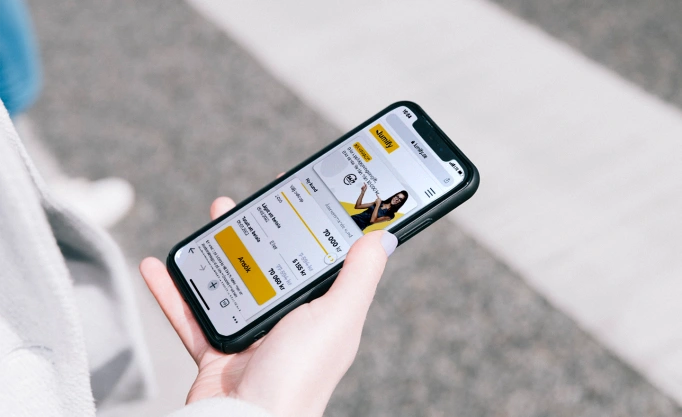

How Lumify cut their loan application time by half with open banking

Lumify partners with Tink to improve customer experience. With the help of open banking, Lumify has cut loan application processing time by more than half – with a 40% increase in success rate. Here’s how.

Read more

2022-01-27

3 min read

Mobify partners with Tink to create more value for its users

Payment and invoicing platform Mobify wanted to expand their offering and give Finnish consumers an even more comprehensive – and personalised – finance management experience. Here’s how they’re partnering with Tink to do it.

Read more

2022-01-25

4 min read

HomeQ: making renting seamless with instant income verification

Find out how Swedish rental marketplace HomeQ is simplifying life for tenants and landlords alike – and how they’re leveraging open banking to provide a seamless application process thanks to instant income verification.

Read more

2022-01-19

3 min read

NatWest, Cogo and Tink: a three-way partnership to boost sustainability

NatWest enlisted the help of both Tink and Cogo to offer a carbon tracking feature for their climate-conscious customers. Here’s how it works – and why Tink and Cogo joined forces to bring other similar solutions to market.

Read more

2021-12-02

3 min read

How ecolytiq is supercharging their sustainable banking solution with Tink

Once again, open banking data is being used to save the world and help people reduce their environmental impact. Find out how ecolytiq is supercharging their sustainability solution for banks and fintechs by partnering with Tink.

Read more

2021-10-19

3 min read

How Gimi is promoting financial education for children with open banking

Find out how Swedish startup Gimi is teaching kids about basic personal finance concepts while empowering them to better handle their finances – and how open banking comes into the mix as a fundamental piece of the puzzle.

Read more

2021-09-23

3 min read

Serrala partners with Tink to offer improved bill payments across Europe

We’re partnering with global financial automation and payments company Serrala to simplify the billing process and reduce transaction fees for billers while improving the payment experience for millions of consumers across Europe.

Read more

2021-09-16

3 min read

Lemonway and Tink partner to offer smarter digital payments for marketplaces

Lemonway, a French payments service provider, launched their Pay By Bank with Tink, a new service that allows their merchants to offer users an easy, secure, and convenient digital payment method.

Read more

2021-09-09

4 min read

How Gokind is combating greenwashing with open banking

Discover how Swedish startup Gokind is cleverly combining users’ financial data with sustainability information from brands to help consumers understand the real impact of their purchases and make more ethical choices.

Read more

2021-09-08

3 min read

Placons – a personal financial butler

Personal finance management (PFM) app placons wanted to rethink what a bank actually could do for its users. Here’s how they’re using Tink’s Money Manager to help their users lead a more financially sustainable lifestyle.

Read more

2021-08-25

4 min read

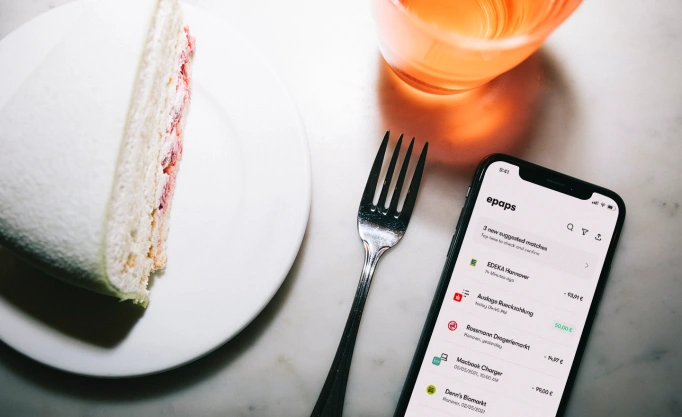

How epap is using transactional data for sustainable finances

epap is on a mission to reinvent the paper receipt with a digital and more sustainable way to keep track of receipts – all in one app. By partnering with Tink, epap can offer their users an easier and more efficient digital receipt experience.

Read more

2021-05-19

6 min read

How Sigmastocks optimised their onboarding in less than 4 weeks

Find out how Sigmastocks is simplifying investments, and how open banking is helping them streamline their account verification to speed up customer onboarding.

Read more

2021-03-25

5 min read

How MiTrust is reusing consumers’ verified online data to optimise onboarding

Find out how MiTrust is streamlining user verification and onboarding by letting consumers share their personal data from trusted sources – and why they’re partnering with Tink to strengthen their offering.

Read more

2021-02-25

3 min read

How Northmill is using Tink to streamline banking

Northmill is on a mission to build personalised banking services that improve people’s finances. By plugging Tink’s open banking technology into its app, Northmill will deliver a seamless and relevant customer experience.

Read more

2021-01-22

5 min read

How papernest is removing the pain of paperwork using open banking

papernest built a platform that makes subscription management effortless – and it already has more than 600,000 users across Europe. Here’s how it's using open banking to deliver a seamless user experience.

Read more

2021-01-20

3 min read

AccountsIQ partners with Tink to streamline financial reporting

AccountsIQ is on a mission to bring smart accounting to small and medium-sized businesses. So it’s teamed up with Tink for open banking technology, to streamline bank account connectivity and improve the user experience.

Read more

2020-12-18

5 min read

Dyme partners with Tink to scale subscription management across Europe

Subscription management app Dyme is teaming up with Tink to launch its money saving service across Europe. By plugging account aggregation technology into its app, Dyme is helping users view, switch and cancel their subscriptions in seconds.

Read more

2020-12-08

7 min read

Greenly: Reducing carbon footprint one bank account at a time

Greenly is the force behind 2.5 million French people measuring their carbon footprint – and improving it. Now with Tink, Greenly is set on taking its app across Europe, and putting banks at the centre of its plans to help shift behaviour.

Read more

2020-12-01

4 min read

How Avy is simplifying rental payments

Find out how Swedish startup Avy is upgrading the renting experience for property owners and tenants by putting real people at the centre of real estate – and how Tink is helping improve one of the cornerstones of their product.

Read more

2020-11-25

4 min read

How Tjommi is putting price match refunds on autopilot

Norwegian company Tjommi is leveraging open banking to create fairer shopping experiences. Here’s how they’re increasing transparency to price match guarantees and helping people take advantage of refund policies – without any hassle.

Read more

2020-10-20

4 min read

How Anyfin is leveraging tech to create financial well-being

Too many people pay unnecessarily high interest on their installments, credit cards or private loans. Anyfin wanted to fix that, and make it easy for people to manage their economy. Here’s how they’re leveraging tech to do it.

Read more

2020-09-17

6 min read

Driftio: unlocking the value of sharing financial data

Driftio makes it simple to build a personal financial balance sheet, and share data swiftly and securely. Users can then get value from their data through greater insight, personalised advice or better deals. Here’s how it works.

Read more

2020-08-25

3 min read

How sprovid is helping furloughed tenants get discounts on rent

It all started with a hackathon challenge, and ended with an app that uses open banking to help those financially impacted by the coronavirus. Here’s how sprovid is helping Norwegian tenants on temporary leave get discounts on their rent.

Read more

2020-07-02

5 min read

How Alpcot is making investments fairer and simpler with open banking

When people invest money in mutual funds or pension accounts, the broker receives up to 50% in commission through the fund fee. Alpcot doesn’t think this is fair – and they’re leveraging open banking to change that.

Read more

2020-06-09

6 min read

Investments made equal

From bus driver to billionaire, Opti delivers the same market-leading investment opportunities for everyone. By using Tink’s technology to help deliver a slick user experience, Opti is keeping complexity firmly in the background.

Read more

2020-05-25

3 min read

Tradera and Tink partner to simplify onboarding and payouts

Find out how Tradera, the leading online commerce marketplace in Sweden, is using Tink’s account verification solution to provide an even simpler and more user-friendly onboarding and payout experience.

Read more

2020-04-28

5 min read

How Datia self-built with Tink to make investments transparent

Datia’s mission is to connect people with investment opportunities that are good for the world, and just a few days after launch, hundreds of users are already realising they had little idea what their money is really supporting.

Read more

2020-04-03

3 min read

How Goloyal is creating more customer value in the retail space

Goloyal is leveraging open banking technology and financial data to give unique consumer insights for retail, shopping centres and loyalty programs.

Read more

2020-02-22

2 min read

Banking just got a whole lot easier with BNP Paribas Fortis

Last week BNP Paribas Fortis enabled their app users holding accounts at other banks to get a full financial overview in the Easy Banking App. This means that users can now view their account balance and real-time transactions from Belfius, ING and KBC without having to jump between different interfaces ultimately making their lives easier.

Read more

2020-01-16

2 min read

Zmarta’s quest to give people the best mortgage in minutes

Zmarta makes it quick and simple for people to get the best mortgage rate in Sweden. Using our single API to collect account data, Zmarta can understand people’s financials in an instant – and give them a better deal.

Read more

2019-11-28

2 min read

How ABN AMRO turned its PFM app bank-agnostic

ABN AMRO and Tink joined forces to make the bank’s popular personal finance management app, Grip, more open and relevant with multi-banking, so users can add accounts from other banks inside the app – and Grip can reach more customers.

Read more

2019-10-09

3 min read

Moank: on a mission to transform lending

When looking at the fast-growing lending market in Sweden, Moank could see an opportunity to give more customers a fairer lending decision by mixing industry-leading tech with a personal touch. How are they doing this? By partnering with Tink to build a more inclusive credit scoring process, and encouraging employers to get involved.

Read more

2019-10-02

4 min read

How CGD built a cutting-edge PFM app in 6 months

Portugal’s biggest bank, Caixa Geral de Depósitos (CGD), wanted to transform how it interacted with its customers. So it asked Tink to help build a first-class mobile experience that would also leverage open banking tech. Six months later, CGD launched a brand-new PFM app to give millions of consumers unprecedented insight into their economy.

Read more

2019-09-04

4 min read

How Njorda is bringing investment management to the masses

To level the playing field between small savers and investment professionals, Swedish fintech Njorda has created an app that lowers the knowledge threshold needed to make smart investments – helping users compare risk, reduce fees and maximise their returns.

Read more

2019-08-19

1 min read

How ABN AMRO built the most popular Dutch PFM app

By launching personal finance app Grip, ABN AMRO addressed two of their customers’ most pressing requests: understanding where their money went, and getting the tools to better manage their spending.

Read more

2019-08-08

1 min read

How SBAB got 50,000 Swedes to challenge their mortgage

With the launch of The Mortgage Match, SBAB has overcome a major hurdle: making it easy for people to make comparisons in the most complex financial product of their life.

Read more

2019-06-25

4 min read

How Sweden’s leading grocer is helping customers better manage their money

When retail giant ICA wanted to improve the functionality of its life-management app ICA Spara, it partnered with Tink to offer customers access to their data from 50% more banks and cards – and their full financial overview in one place.

Read more

2019-04-03

2 min read

Avanza eliminates onboarding friction with aggregation

With a high application drop-off rate, Swedish savings and investment bank Avanza turned to our aggregation technology, to automate their onboarding process and help customers set up a new account in minutes, not weeks.

Read more