How to unlock growth through consumer engagement

Digital transformation is happening at lightning speed. And consumer expectations are rising in equal measure. For businesses and financial institutions, ramped-up customer engagement strategies are crucial to meeting these expectations.

Consumers are becoming more demanding when it comes to digital services. They expect more from their banking provider.

Consumer engagement is a great way to power growth. By going beyond basic financial overviews and delivering value-adding services, you can increase your conversion and cross-sell opportunities.

Tink offers out-of-the-box engagement solutions, such as Money Manager, as well as hyper-usable data solutions like Data Enrichment.

How customer engagement can power growth.

Banking is becoming more mobile-first, but for financial institutions to unlock growth through mobile solutions, there is an evolving need to build strong digital banking experiences that capture and engage consumers.

Some players in the ecosystem have already begun ramping up their digital offering and therefore started to see traction. By better attracting consumers to their mobile solutions and getting them to spend more time there or log on more often, they eventually increase their chances to cross/up-sell more products and services.

However for many financial institutions, there is still work to be done in the consumer engagement space, a survey made by McKinsey shows that consumer willingness to use mobile banking services exceed the actual use. Meaning there is a need and expectation from consumers to be provided with more compelling digital banking experiences.

Successful strategies to attract and engage customers.

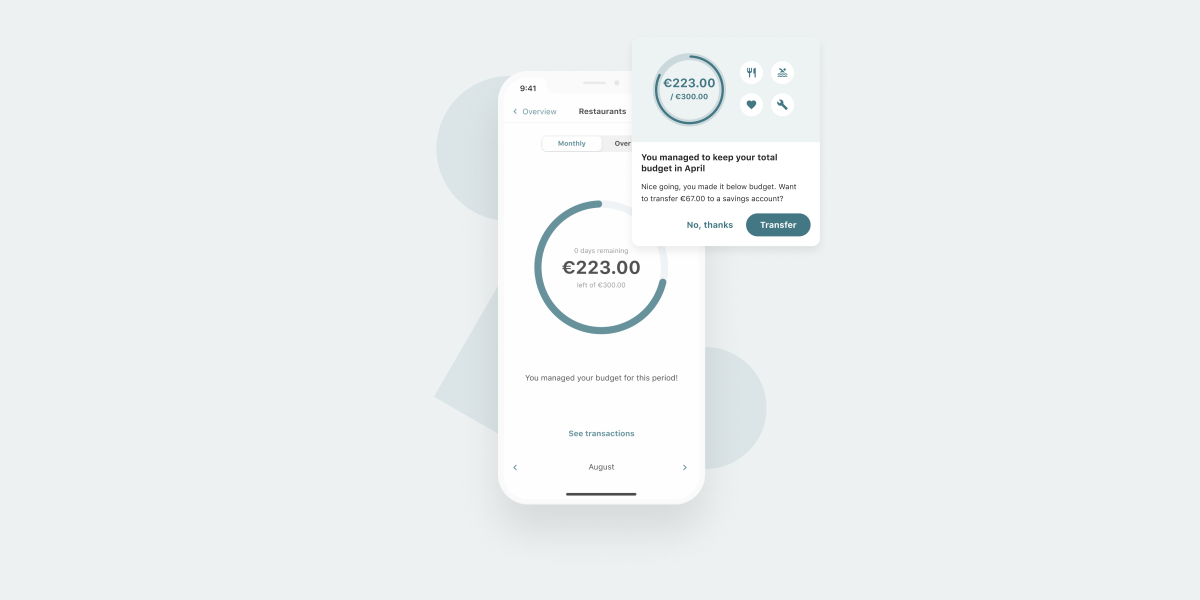

One strategy to get consumers to spend those extra minutes in their banking apps and increase engagement, is to offer more advanced features. For example, giving consumers insights on spending patterns, identifying saving opportunities and allowing them to create helpful budgets. Banks with the largest share of mobile users who are active with PFM see 37 percent higher monthly log-ins and 175 percent higher mobile sales per user. In conclusion, the key is to provide a PFM solution that activates consumers through personalised and advanced features, that impact their financial lives and spending.

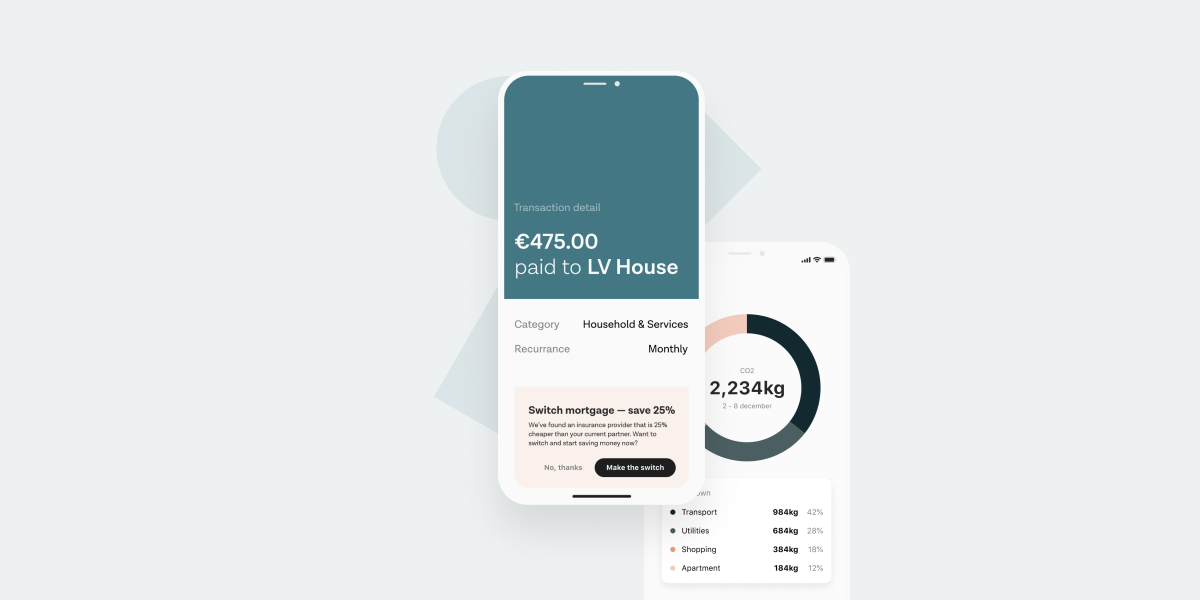

Another strategy proven to be successful is to explore and offer services beyond banking. Some financial institutions have already started to meet customer expectations beyond finance in their banking apps. Such as providing services like carbon footprint trackers, subscription management tools, loyalty/cashback services and other features that become sources of engagement and revenue.

By delivering features beyond banking, consumers are presented with even more reasons to return for more than a basic financial overview. Having multiple reasons to log in helps to increase an app's purpose, its engagement and also conversion to other services.

How to implement winning engagement strategies.

Engaging consumers through data-driven, value added features is a path to growth. Tink’s solutions include products that are built to accelerate engagement by getting to know your customer on a deeper, data-driven level. By doing so you can better meet their mobile banking needs and expectations, both within and beyond the financial scope.

Up to date PFM tools providing account overview and insights on spending…

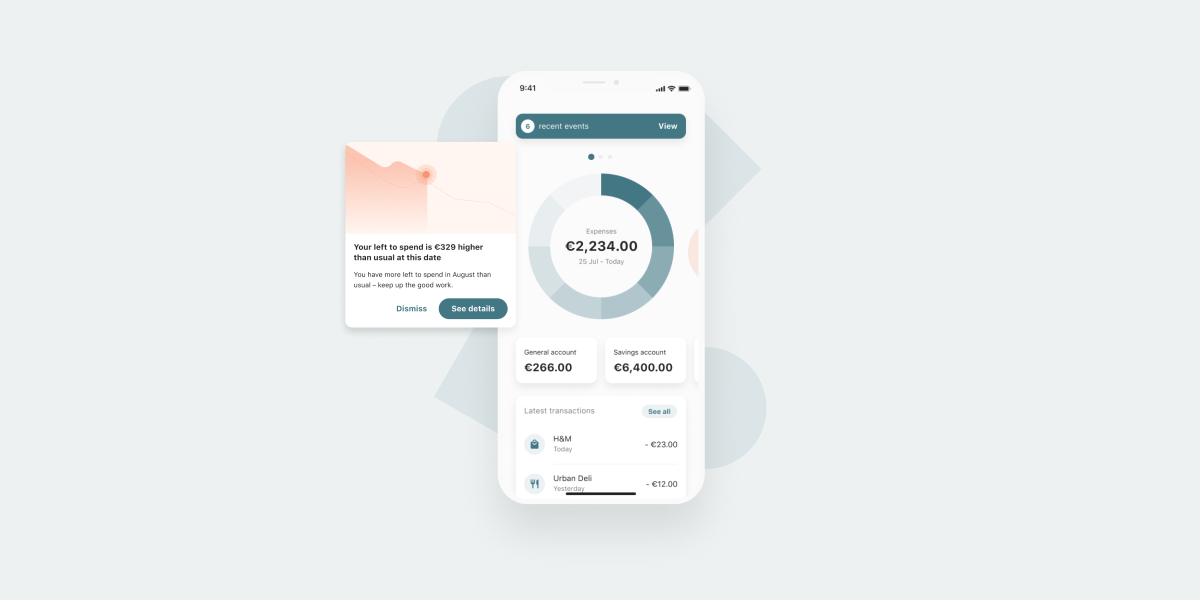

Regardless of where you are in your journey, Tink technology can help. Engage and coach by implementing a pre-built solid PFM foundation using Money Manager, containing out-of-the-box advanced features with a quick time to market. Provide your customers with a consolidated view of their financials and engage them with features such as personalised insights, budgeting and saving tools. This will enable you to deliver the right offers at the right time, that meet their needs and increase conversion in your app.

If you're not in need of the entire PFM toolbox, add more value to your financial transactions by receiving processed and enriched transaction data. This enables you to power your banking app and build more engaging features on top of your data. Our soon-to-be-launched Data Enrichment product provides the capabilities needed to scale, while also allowing easy plug-ins with other ecosystem providers to engage your customers through features beyond the financial scope.

Interested in learning more about our consumer engagement offering? Get in touch!

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.