The regulatory requirements in store for lenders – and how open banking can help

The digital transformation of financial services has led to a multitude of new ways for banks and lenders to connect to their customers. But while the pandemic caused a digital lending boom, it also led to an increasing number of loans granted to customers who can’t afford repayment. Here’s how open banking technology can help.

With the digital transformation of finance, more consumers are taking out loans even though they can't afford to pay the money back.

Regulatory support to help lenders navigate processes around risk decisioning and creditworthiness assessment is underway.

Open banking has the power to simplify and streamline the loan application process, to the benefit of both businesses and consumers.

The digital boom experienced by the world during the pandemic meant that banks and lenders found new platforms to connect with and serve their customers. Digital tools made it easier to process a large amount of loan applications online, with less manual paperwork.

But this has also led to more loans being granted to people who can’t afford them. Over the years, non-performing loans have weighed heavily on banks’ and lenders’ profitability and hampered their ability to grant new loans.

Non-performing loans expected to rise

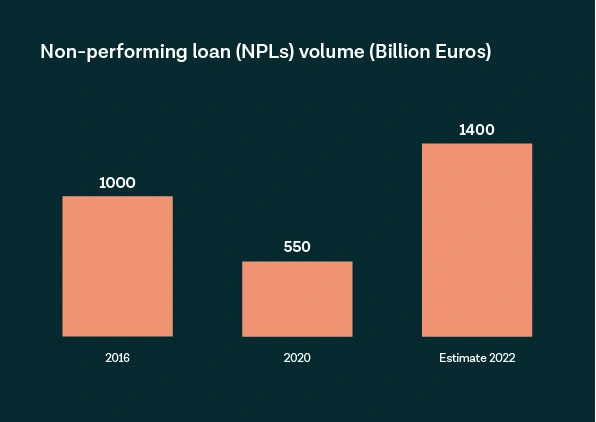

Non-performing loans, or NPLs, are loans where the borrowers are not fulfilling their financial commitments to repay in accordance with their contractual agreements. The amount of NPLs has steadily decreased from a 2016 peak of around €1 trillion. However, the ECB believes that the economic crisis caused by the coronavirus pandemic is likely to trigger a sharp increase in non-performing loans – they could even reach levels as high as €1.4 trillion by the end of 2022.

EBA regulations to turn the tide

In June 2020, the European Banking Authority (EBA) released its comprehensive approach to loan origination in response to financial stability concerns.

EBA is a specialised agency of the European Union set up to achieve a more integrated approach to banking supervision across all member states. The EBA promotes a transparent, simple, and fair financial market for consumers to ensure that EU consumers have confidence in financial systems across the EU. One of the guidelines’ main objectives is to improve lenders’ credit assessment by specifying how to assess the creditworthiness of applicants.

EBA’s guidelines and regulations may seem intimidating, but they’re actually beneficial for both lenders and consumers. According to a credit survey performed by the Swedish financial supervisory authority (Finansinspektionen), 9% of consumers with unsecured loans received at least one reminder during the first five months of the loan. This indicates that the credit assessments weren’t thorough enough to protect the consumer from taking loans they couldn’t afford to repay.

With regulatory support, borrowers can be protected from borrowing money they can’t afford to pay back, while lenders can ensure that their credit portfolio is in line with their risk appetites.

Putting regulation into practice

To combat the rise of NPLs, some countries are in the process of implementing regulatory requirements for credit assessment. In Sweden, the authorities provide general guidelines for how to calculate cost of living for consumer loans, giving lenders examples of categories they need to assess. The expenses are calculated by using a standard table based on the number of loan takers, their children, and type of housing.

Having guidelines in place is better than not having any regulation at all. However, Sweden’s guidelines hold no reference to the household's actual expenses at the time of the loan, but rather an estimate of the household's necessary expenses. Each applicant has different spending habits based on factors such as age and location, for example. A couple living in a big city centre will most likely have higher monthly expenses than a couple of similar age living in a smaller, rural town. In this case, the traditional methods for assessing the applicants’ budget are not ideal.

How open banking can power lending

Until now, providing loans meant a multitude of manual input of data – for credit givers and takers alike. When you are in a financial bind and need a loan, manually entering details and then waiting for a response can be quite stressful. So while regulation can guide lenders in how to assess applicants’ financial health, open banking can provide customers with a sleek user experience.

Open banking offers customers a better customer experience with the added knowledge that there is a more tailored check being undertaken on their financial health and ability to repay.

It can also help lenders get the most out of their creditworthiness assessments by streamlining the way to process data.

At Tink, we built a new product for identifying and assessing expenditures of the applicants in relation to affordability, which includes categories such as:

Housing costs (rent, mortgage payments, property tax)

Loan payments (mortgage payments, interest, amortisation)

Utilities (electricity, heating, water)

Transportation costs (fuel, leasing, public transport)

Insurance (vehicle, property)

This tool, Expense Check, analyses the data and delivers it to you through our API, enabling you to assess the applicant’s affordability in minutes instead of hours or even days. Expense Check is designed to give lenders access to real-time data so that you can rely on current, up-to-date information rather than traditional methods such as standard tables.

Using open banking technology to power lending benefits businesses as well as consumers, as it prevents consumers from borrowing money they can’t afford to pay back – decreasing the amount of NPLs and boosting lender profitability.

Open banking is powering the future of lending. Want to be part of the change?

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.