A new generation of payments is taking shape – powered by open banking

In our latest report, ‘The future of payments is open’, we asked financial executives across Europe their thoughts on open banking powered payments – and the drivers needed for full-scale adoption. It’s clear that while open banking is changing the payment landscape, there’s still work to be done before this new ecosystem can reach its full potential.

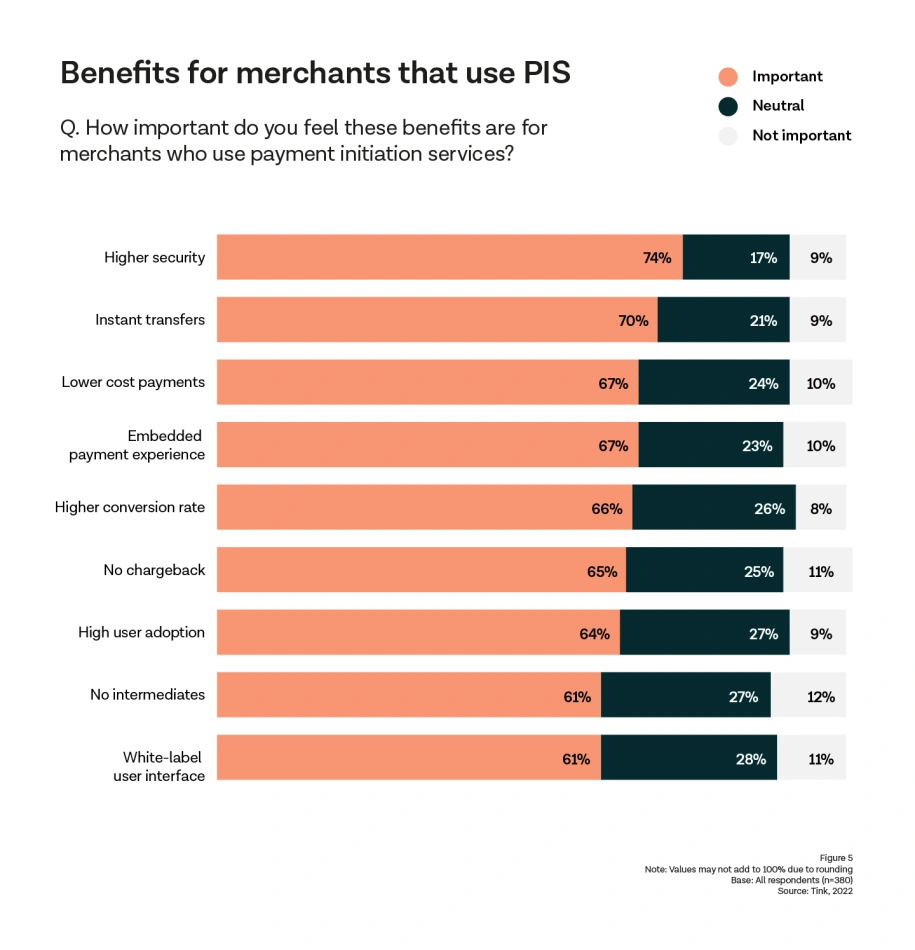

Our survey reveals financial executives in Europe consider security, speed, and low cost as top benefits of payment initiation services.

Barriers to full-scale adoption still remain, however: payments infrastructure and low user awareness are considered key challenges.

Partnering with the right fintech is a great first step to realising open banking powered payments’ true potential.

For the fourth year in a row, we asked YouGov to conduct a survey on financial executives across 12 European countries, to learn their opinion of open banking and how it’s transforming the financial industry. For our latest report, ‘The future of payments is open’, we asked them about the benefits and challenges of open banking powered payments – more specifically, of PIS (payment initiation services).

Higher security and fraud prevention key benefits of PIS

Understandably, fraud is a significant issue for many financial institutions. After all – as payments move online, fraudsters move with them. PIS has increased payment security and fraud prevention qualities, something that our survey respondents see as a key benefit. Nearly three quarters of respondents (74%) said the high security of PIS is a great advantage from a merchant perspective. So, open banking powered payments such as PIS – which have SCA processes (strong customer authentication) implemented into the payment journey – are considered a secure alternative to other payment methods.

PIS speed and low costs highly ranked by financial executives

While the surveyed financial executives ranked higher security and fraud prevention as the key benefit, speedy payments such as instant transfers (70%) and low cost payments (67%) were also ranked high. Instant transfer is considered an advantage over other payment methods as traditional methods operate on legacy payment rails that can take days to settle, leaving merchants waiting to see the money in their accounts.

Finding the user tolerance sweet spot

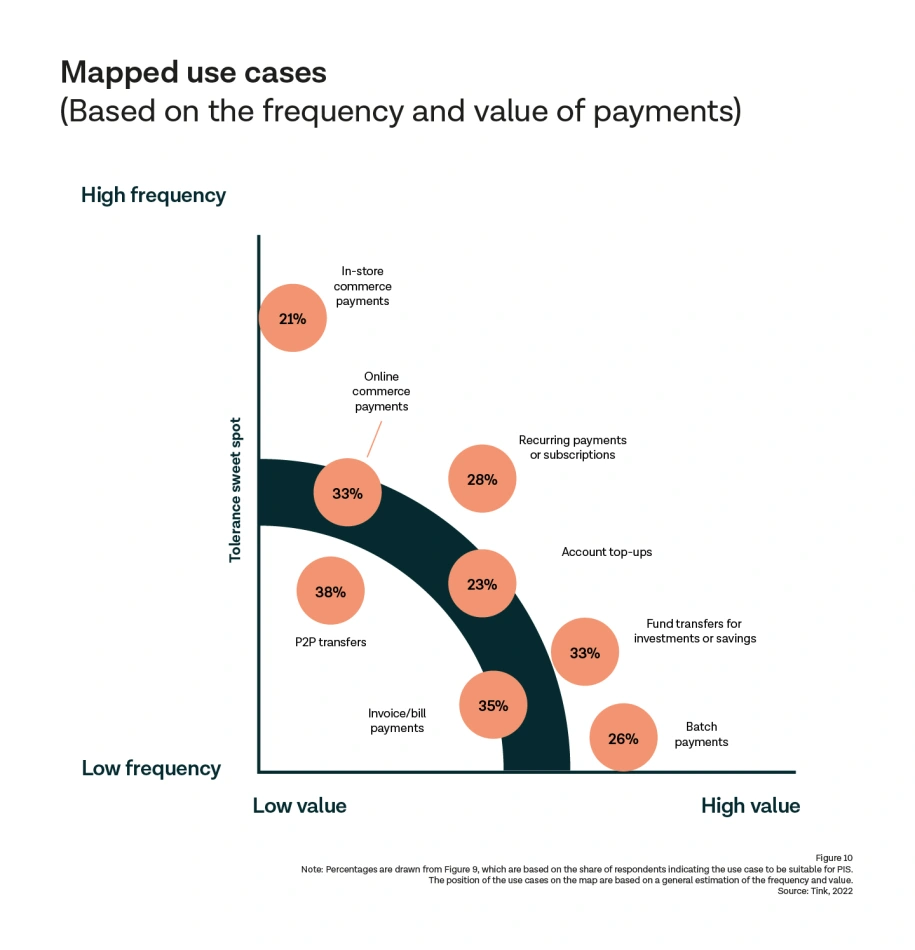

When asked which specific use cases executives believe are best suited to open banking payment initiation services, the answers reveal a focus on processes that are often inconvenient, frustrating, and time consuming for the user.

Ranking of use cases PIS are best suited to:

Peer-to-peer (P2P) transfers

Invoice/bill payments

Fund transfers for investments and savings

Online commerce payments

This asked the question: using this information, could we identify the ‘sweet spot’ for PIS user tolerance? For example, user tolerance may be low when queuing up at the kiosk to buy an apple or a bottle of water. Customers would want to choose the payment method that they know would always work. Similarly, when completing a high-value purchase the user tolerance may be low, as the perceived risk of something going wrong does not weigh up against the easy alternative of using a familiar solution.

Using factors such as transaction frequency and value, we identified a user tolerance sweet spot (pictured below). Interestingly, the top use cases of PIS fall within the area where customers would be more willing to use an unfamiliar payment method.

Choosing the right partner key to overcoming barriers

Our research made it clear that while the surveyed financial executives felt there were many things to gain from implementing open banking powered payments such as PIS, barriers to full-scale adoption remain. Survey respondents were concerned about lacking user awareness and highlighted that the payment infrastructure isn’t ready for instant transfers, with few instant payment rails. But as the European Commission has proposed to mandate the adoption of instant payment rails, that particular issue may soon be resolved.

The survey illustrates that open banking payments are well suited for meeting the market demand for fast, secure, consistent, and seamless payment journeys. But it also shows that the industry recognises the need for a solid foundation of trust and reliability to be built to let this new ecosystem reach its full potential. Solving these challenges will require increased focus and investment in the months to come – and choosing the right partner for this journey is key.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more