The key to unlocking fairer and more responsible lending

Today's macroeconomic climate requires more stringent affordability assessments than traditional lending models are generally capable of. In our latest survey report, ‘Lending unlocked: a new era of credit’, we explore how open banking can help the lending industry unlock fairer, more inclusive lending processes to help lenders get a better, more up-to-date understanding of customers, and support consumers and businesses in these troubled times.

In our latest report, we explore how open banking can pave the way for faster, safer, and more responsible lending practices.

We asked Europe’s leading financial executives how the pandemic affected their business, especially with regards to their lending origination processes.

During times of financial strain it’s important to protect vulnerable consumers from taking out loans they cannot afford.

With rising inflation, exorbitant energy prices, and climbing interest rates, many European countries are experiencing a cost-of-living crisis. Consumers are feeling increasingly pressured to use credit to cover essential costs, but many may struggle to afford the repayments. In these times of financial strain, responsible lending practices are of the utmost importance for both lenders and borrowers. Which is why accurately assessing applicants’ creditworthiness has never been more essential.

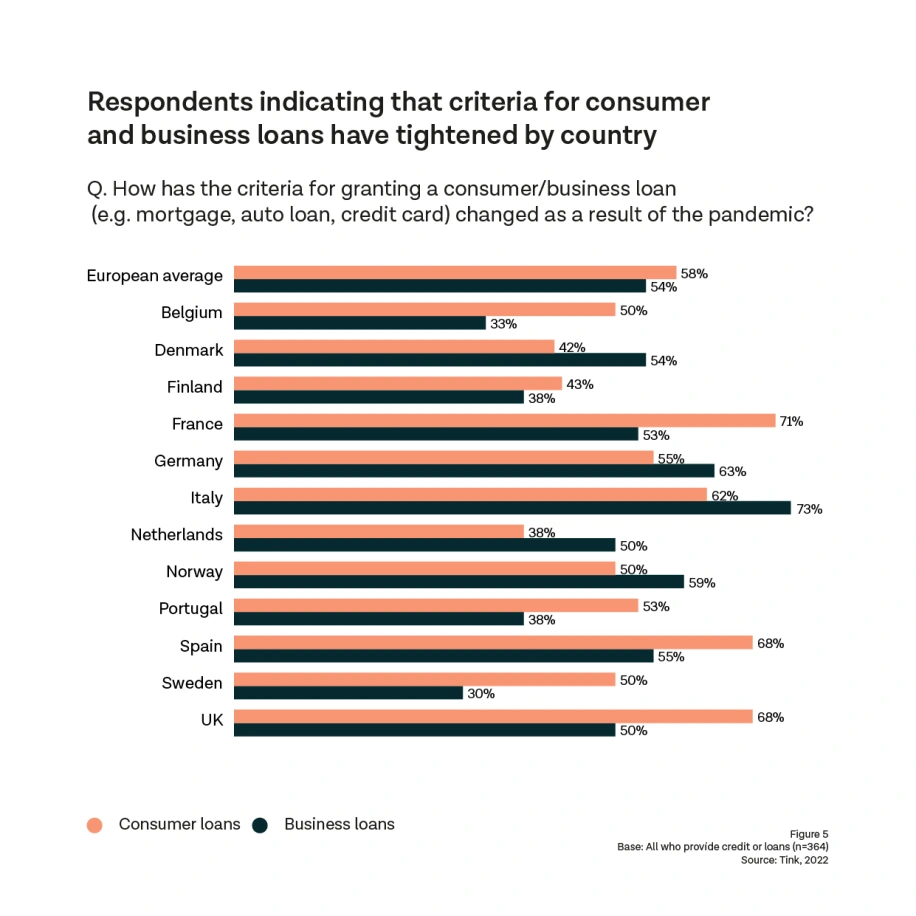

Our research shows that as an effect of the pandemic, lenders are tightening their criteria for granting both business and consumer loans. However, forcefully restricting lines of credit will have a further negative impact on an already turbulent economy. While it’s vital to protect vulnerable consumers from taking out loans they can’t afford, it’s of equal importance that those who can afford them are given a fair assessment. This means using the best tools available to prevent anyone from digging themselves deeper into financial trouble, either by borrowing more than they can afford or being forced to turn to less mainstream – and less regulated – forms of credit.

Lending powered by open banking

At Tink, we’re convinced that open banking can help level the playing field and improve financial health for consumers. Lending is a prime example of this, as open banking data allows financial institutions to meet their responsibilities in protecting vulnerable consumers while helping them gain greater control over their finances.

But as it is now, it’s hard for lenders to accurately assess applicants’ income and expenses, given the manual work required to collect and review paperwork such as payslips and identity documents. A traditional loan origination process takes many man-hours and still can’t satisfactorily represent the loan applicant’s financial situation.

But with open banking, lenders can gain access to not only the applicant’s income, but also their expenses and other bank account activity – all in a matter of minutes. Compared to traditional loan origination, open banking powered lending is:

Faster. As open banking enables instant affordability assessments, there’s no need to manual send in or process physical documents.

Safer. The account and income verification process triggers at least one SCA (strong customer authentication) meaning it’s virtually impossible for someone to assume another’s identity or to have someone apply for loans using their name.

More accurate. The wealth of information available through open banking powered processes means that it’s easier for lenders to accurately assess an applicant’s creditworthiness and calculate their risk of default.

A more inclusive lending landscape

In these troubled financial times, the financial industry will have to work together to protect vulnerable consumers as well as our own business interests. With open banking, we now have the tools to assess affordability based on consumers’ actual incomings and outgoings. This means that those who are traditionally locked out of receiving credit, such as young people or expats without sufficient credit history, can now prove their creditworthiness in a fairer and representative way.

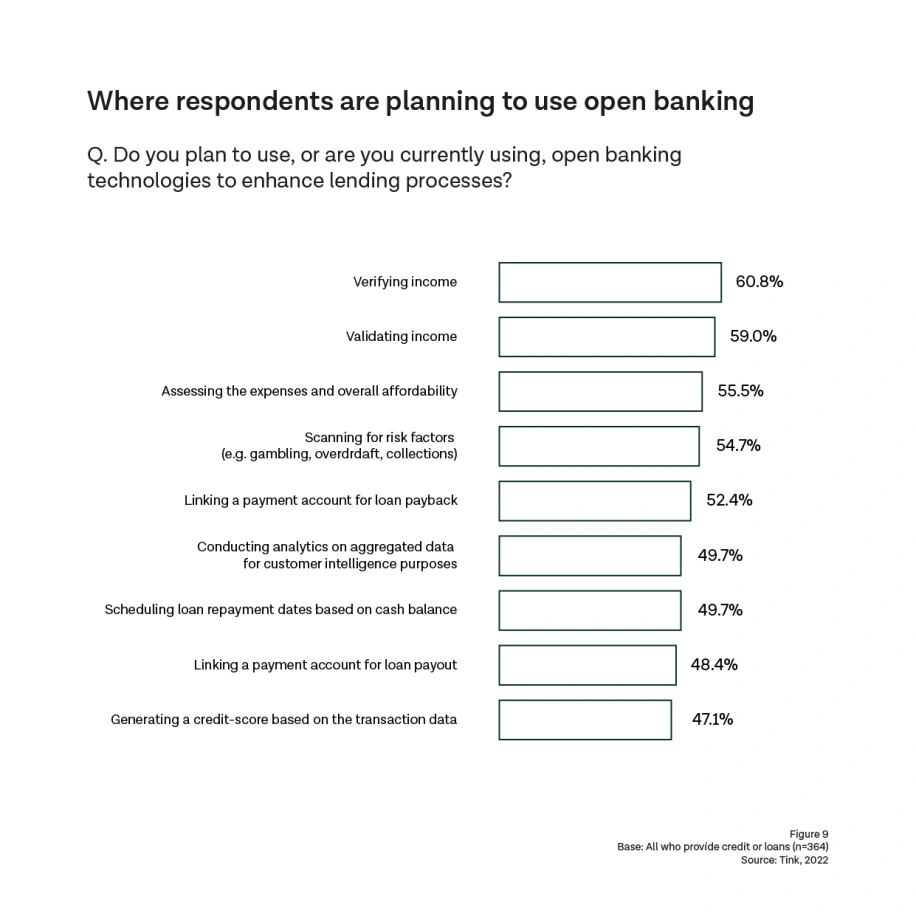

And lenders are starting to realise this: our research shows that more than half of the respondents are planning to use open banking to deal with the difficulties that often arise during creditworthiness assessments, such as income and account verification, assessing affordability, and calculating risk.

In these turbulent times, the financial industry needs to use every tool at its disposal to protect vulnerable consumers and businesses from long-term financial distress. As open banking has the potential to unlock fairer, safer, and more cost-efficient lending, we hope to see more lenders incorporate its many solutions into their loan origination processes.

Read the full report for more insights into how open banking is transforming the lending landscape.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.