What is pattern recognition and what is it good for?

Managing utility bills, subscriptions and other fixed costs can be tricky, from tracking to ensuring sufficient funds are on hand as a buffer. Luckily, the capabilities of Tink’s Data Enrichment analyses historical spending patterns – and predicts upcoming costs. Here’s how Data Enrichment presents a solution with pattern recognition.

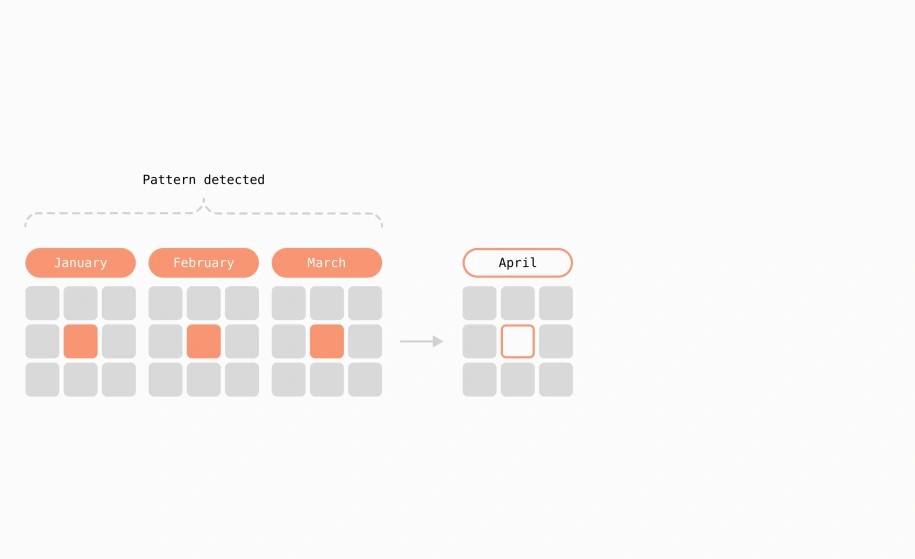

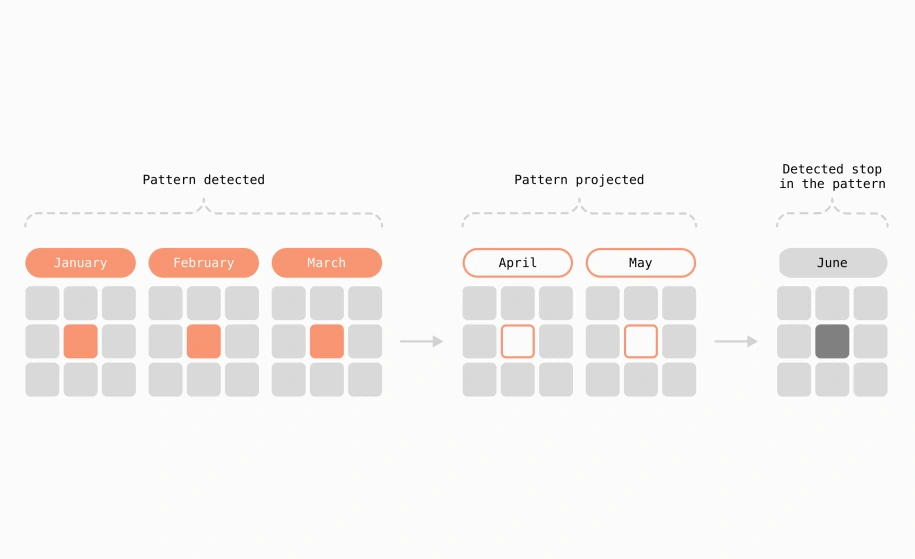

Pattern recognition is a data enrichment tool that analyses historical spending patterns and upcoming costs.

Data enrichment with Tink is based on recurring transactions and predicted recurring transactions, giving consumers insight into their spending patterns.

Using Tink Data Enrichment helps banks and financial services know their customers better, while personalising the experiences they offer.

To help their customers better understand their financial habits and future costs, banks can give them a useful overview of spending patterns and recurring expenses within their banking app. This is done by analysing recurring income, expenses and transfers, and future income, expenses and transfers. Two capabilities that are a part of Tink's Data Enrichment product, and are both based on analysing patterns - i.e. pattern recognition.

Recurring transactions allows consumers to gain a better understanding of their cash flow, by accessing an overview of their fixed costs, e.g. subscriptions, utility bills, loans and transfers. By viewing historically fixed monthly transactions and creating better insight to where their money has gone, they can better understand what they can do about it. For instance gaining insight into subscriptions they might have forgotten or aren’t actively using anymore, provides the opportunity to cancel unnecessary expenses and cut costs.

Predicted recurring transactions gives users access to an accurate overview of upcoming transactions for the next 30 days, including charges that typically go unannounced (such as recurring card payments). It gives a full view of all recurring transactions a user has such as subscriptions, gym memberships, loans, utility bills, rent, monthly savings, credit card invoices – and importantly, when these payments will be withdrawn. Since these payments can happen at different times throughout the month, people might be caught unaware and not have sufficient funds – ending up in overdraft on their account. This makes in-app interactions more valuable by also showing upcoming commitments and their impact on the balance available to spend.

How pattern recognition benefits businesses

Get to know customers

Gain deeper understanding of your customers by easily accessing more complete data on their spending behavior

Improve customer experiences

By getting to know your customers better, you can target them with more relevant offers within your digital channels.

Build engagement and drive more traffic

Offering valuable services like contracts overview, or identifying where to cut more costs based on historical spending habits, can increase engagement and traffic in your banking app, by activating more customers logging in to reap the benefits.

How pattern recognition benefits your customers

Prevent overspending

By allowing users a view over upcoming transactions – and when they will happen – they can prevent overdraft by ensuring they have sufficient funds.

Better insight to spending habits

By providing customers with a view of transactions that are recurring each month, they get more control of their spending habits and can make necessary adjustments.

Overview of contracts

Provide insight to what contracts, such as subscriptions, your customer has – so they can cancel the ones that may be unnecessary and cut monthly costs

Curious about how you can help customers stay on top of their fixed costs, prevent overspending and understand how to improve their financial wellbeing? Get in touch and we’ll tell you more about Tink’s Data Enrichment.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.