Instant bank payments for any checkout

Offer real-time payments and refunds, reduce fraud and chargebacks.

Some industries we serve:

Retail

Travel

Marketplaces

SaaS

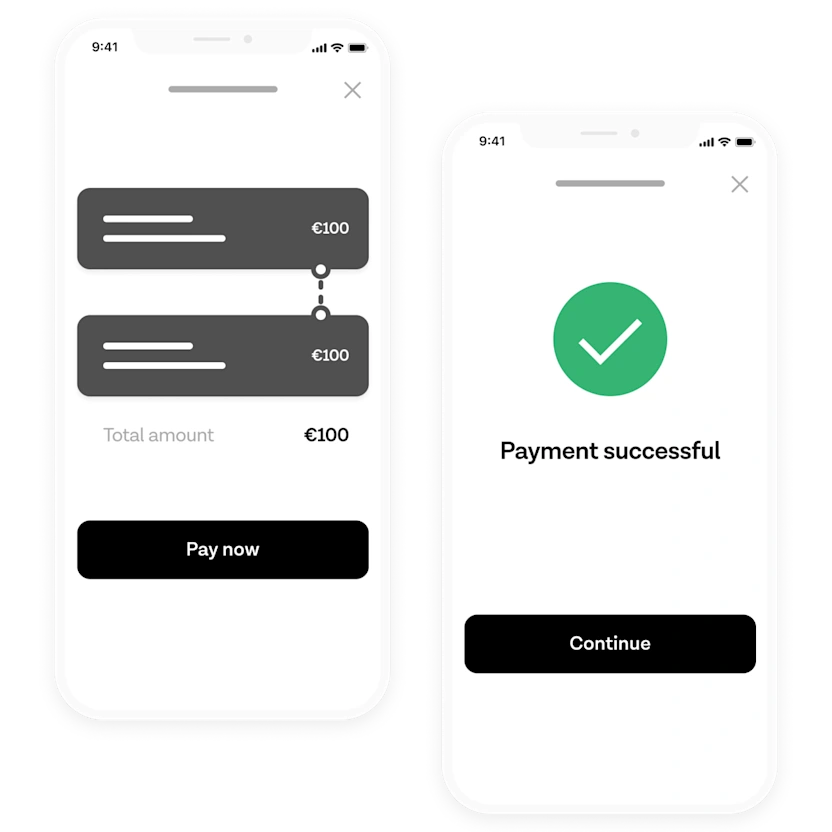

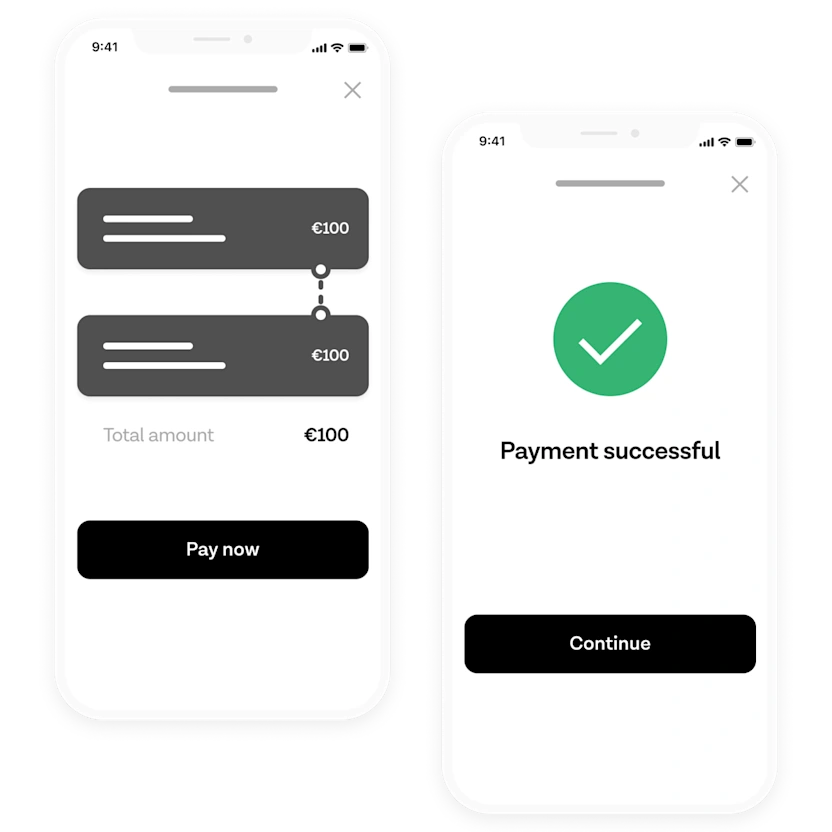

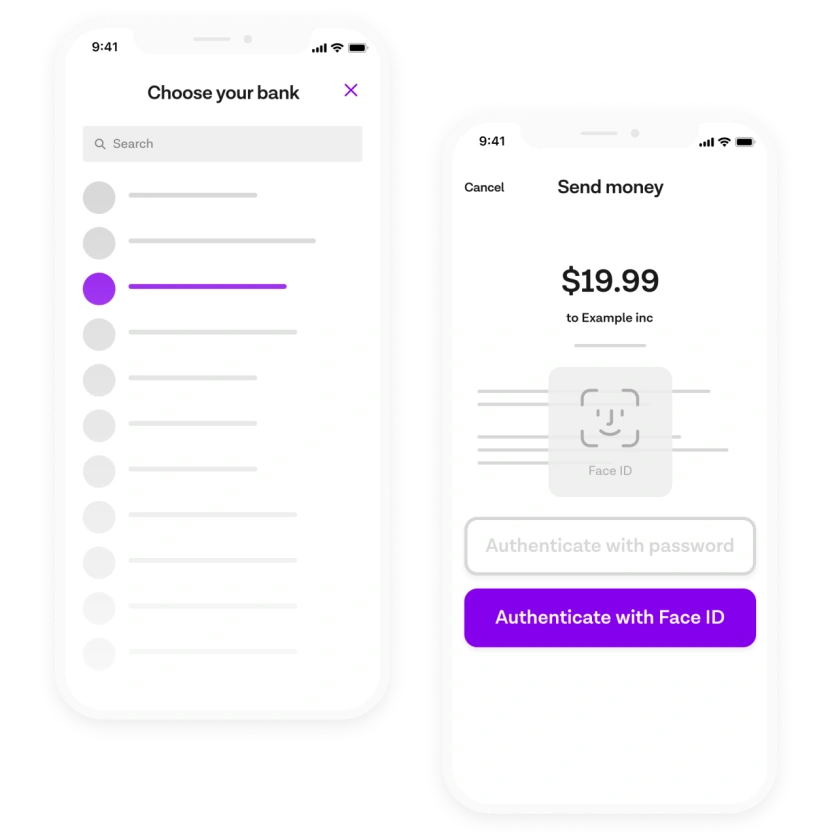

Offer the ultimate checkout experience

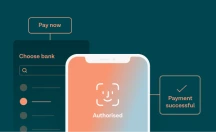

Convert more shoppers with instant bank payments in a fully white-label checkout flow, customised to your brand. Tink customers have cut their payment journey down to as little as 25 seconds – with no clunky redirects, no lengthy forms, and no unnecessary friction.

Pay in a few clicks via fingerprint or Face ID

Real-time payment confirmation and settlement

Fully customisable to your brand

Offer the ultimate checkout experience

Convert more shoppers with instant bank payments in a fully white-label checkout flow, customised to your brand. Tink customers have cut their payment journey down to as little as 25 seconds – with no clunky redirects, no lengthy forms, and no unnecessary friction.

Pay in a few clicks via fingerprint or Face ID

Real-time payment confirmation and settlement

Fully customisable to your brand

Eliminate fraud, reduce costs

Open banking means no intermediaries, no chargebacks, and no unnecessary fees. Plus every transaction is authenticated directly with the bank. Tink customers save up to 80% on payment- and fraud-related costs versus other online payment methods.

No interchange fees

Reduced fraud, zero chargebacks

Fixed fee per transaction

Eliminate fraud, reduce costs

Open banking means no intermediaries, no chargebacks, and no unnecessary fees. Plus every transaction is authenticated directly with the bank. Tink customers save up to 80% on payment- and fraud-related costs versus other online payment methods.

No interchange fees

Reduced fraud, zero chargebacks

Fixed fee per transaction

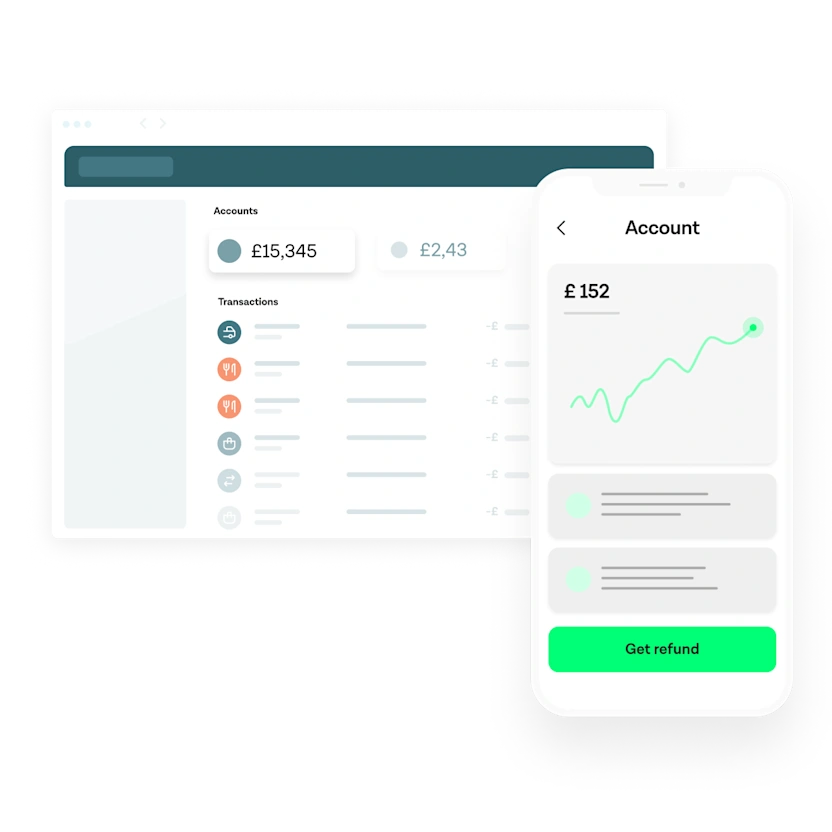

Delight customers with instant refunds

Increase customer loyalty and conversion by giving shoppers their money back in seconds. You can automate refunds and payouts via API or issue them from inside the Tink Console, where you can also track payments, manage multiple settlement accounts, download reports, and automate reconciliation.

Learn about settlement accounts

Delight customers with instant refunds

Increase customer loyalty and conversion by giving shoppers their money back in seconds. You can automate refunds and payouts via API or issue them from inside the Tink Console, where you can also track payments, manage multiple settlement accounts, download reports, and automate reconciliation.

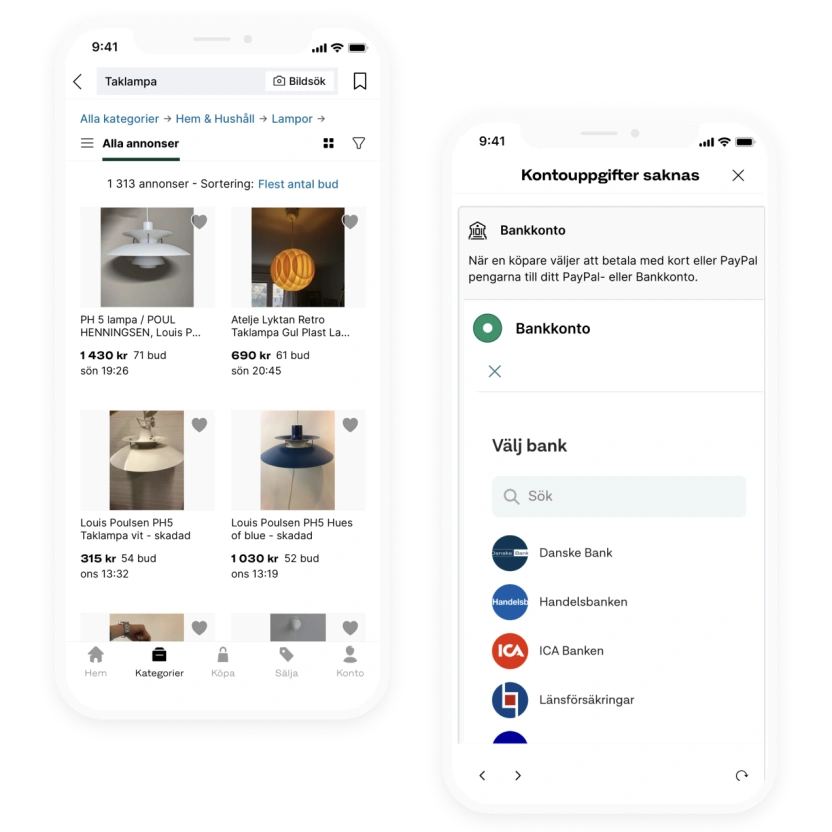

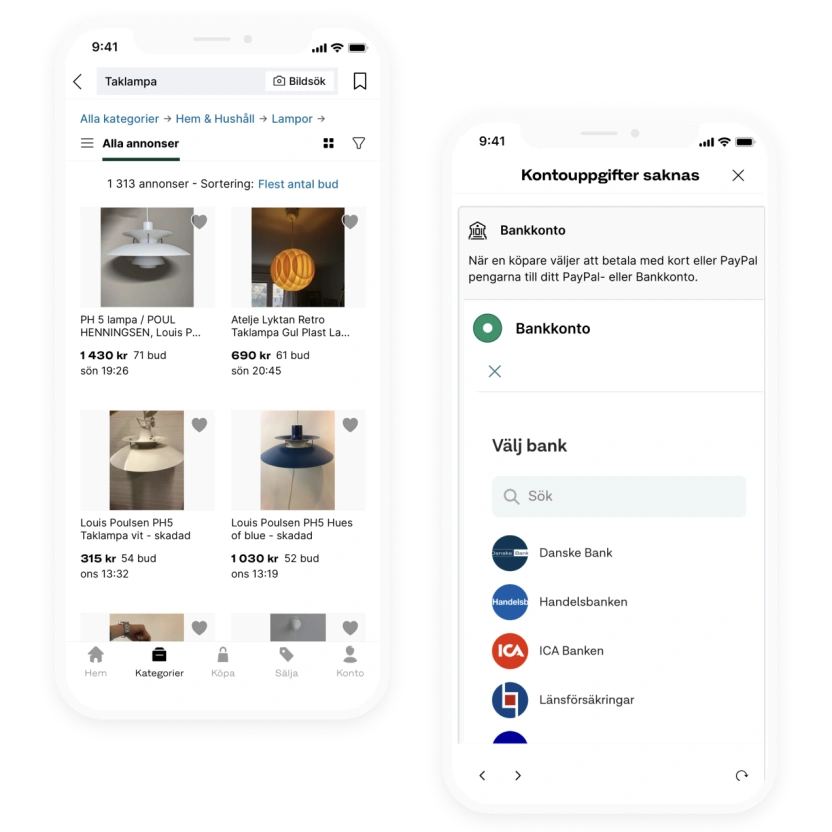

Learn about settlement accountsTradera uses Tink to remove friction for buyers and sellers

Challenge

Tradera, one of the largest second-hand marketplaces in the Nordics, wanted to enable faster payouts in the app instead of requiring users to manually enter their details.

Solution

Tradera chose Tink to deliver a seamless onboarding and payout experience, letting users connect their accounts instantly and reducing payout errors by 50%.

Account Check

Payments

Tradera uses Tink to remove friction for buyers and sellers

Challenge

Tradera, one of the largest second-hand marketplaces in the Nordics, wanted to enable faster payouts in the app instead of requiring users to manually enter their details.

Solution

Tradera chose Tink to deliver a seamless onboarding and payout experience, letting users connect their accounts instantly and reducing payout errors by 50%.

Account Check

Payments

For industry leaders

“At Tradera, we always aim to make the user experience as simple and friction-free as possible for our customers. For that reason, our partnership with Tink was a perfect fit for us.”

Stefan Öberg

CEO at Tradera

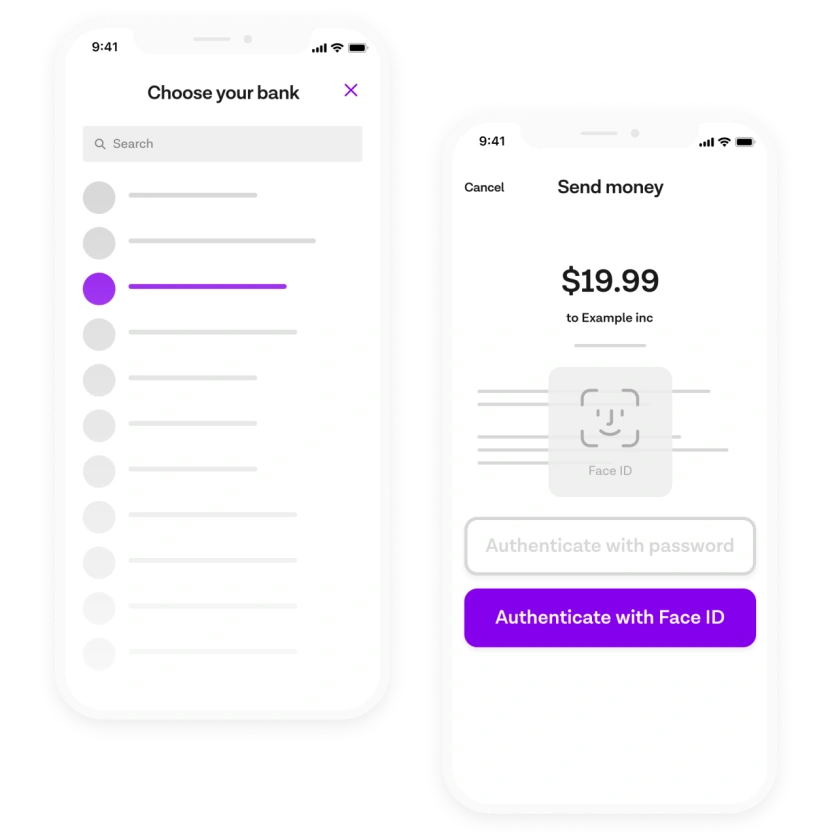

One fast, secure payment method for all of Europe

Accept payments from anyone with a bank account, enabling shoppers to pay in real-time using the institution they trust the most: their bank.

Boost checkout conversion

Let shoppers pay and authenticate via fingerprint or Face ID in a few clicks. Our flows are designed to offer the fastest SCA experience.

Reduced fraud, zero chargebacks

Open banking means no chargebacks and bank-grade security on every payment, making fraud a thing of the past.

Protect your revenue

Using open banking means no card or interchange fees, saving up to 80% on payment-related costs.

Simplify operations

Cut out extra work and launch in new markets faster with aggregated settlement, automated refunds and reconciliation, and integrated reporting.

Why execs see this as a top open banking use case

We surveyed 380 financial executives across Europe.

Read the report1 in 3

see e-commerce payments as a top payments use case for open banking

7 in 10

view speed and security as the most important benefits of open banking payments

75%

have already invested in open banking or plan to in the next 12 months

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.