Accelerate consumer

engagement

One platform - endless possibilities. Transform transactional data into innovative and engaging tools. Develop your app to fit the needs of everyone.

Some industries we serve:

Retail Banks

Neo-banks

Lenders

Financially coach consumers through enriched data and intelligent tools

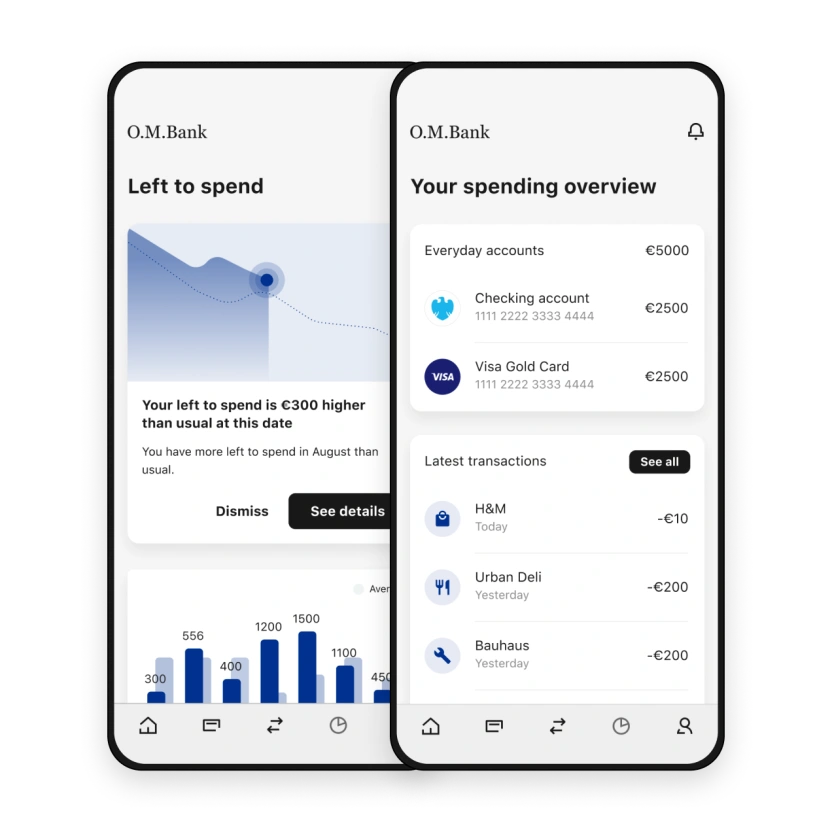

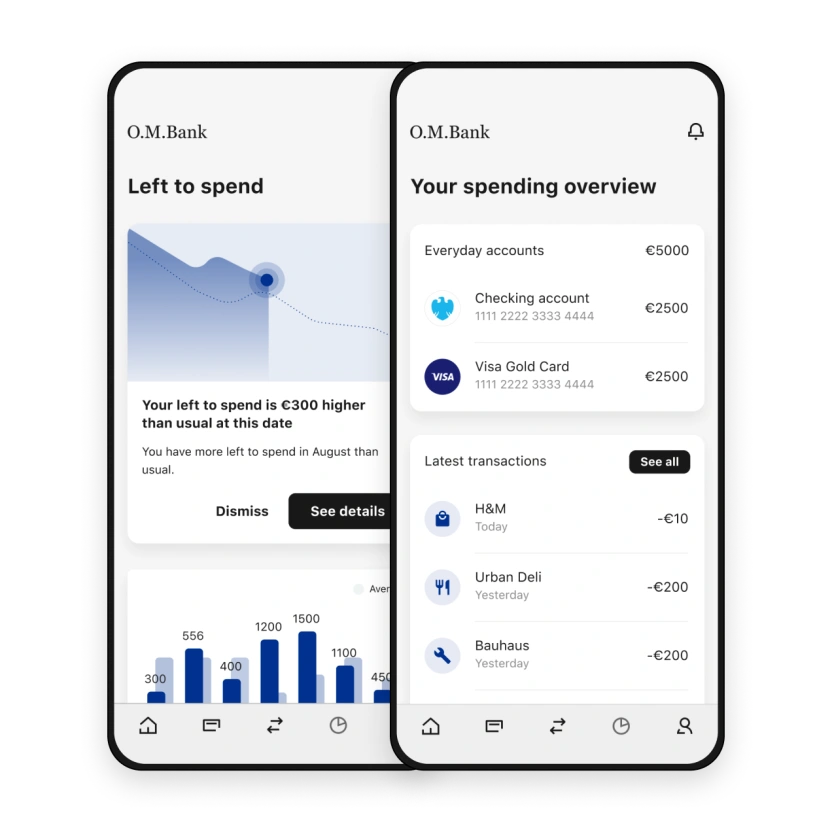

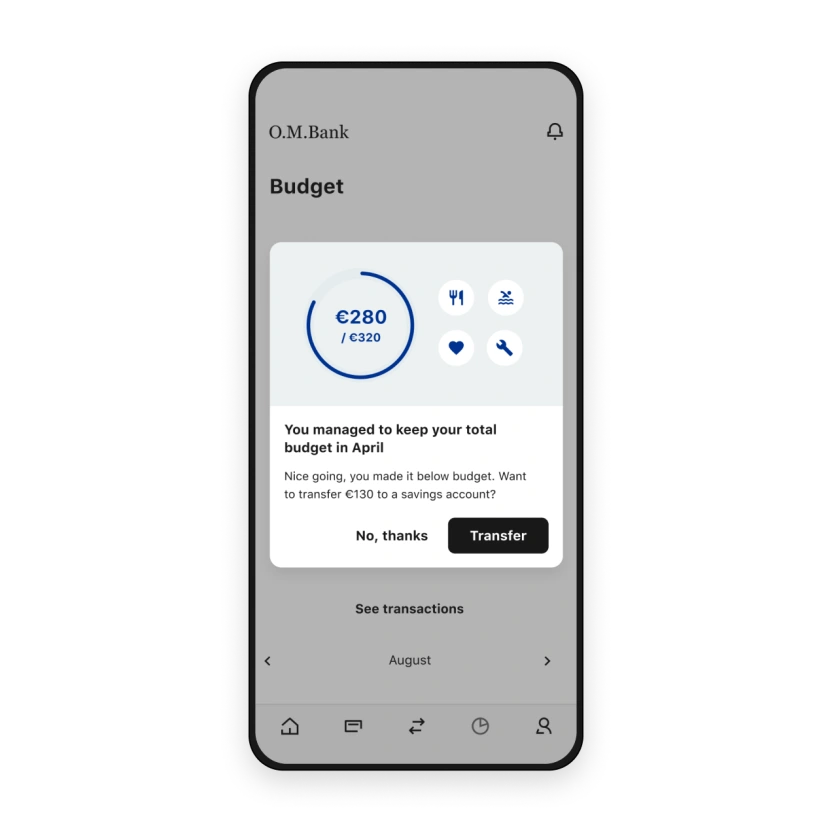

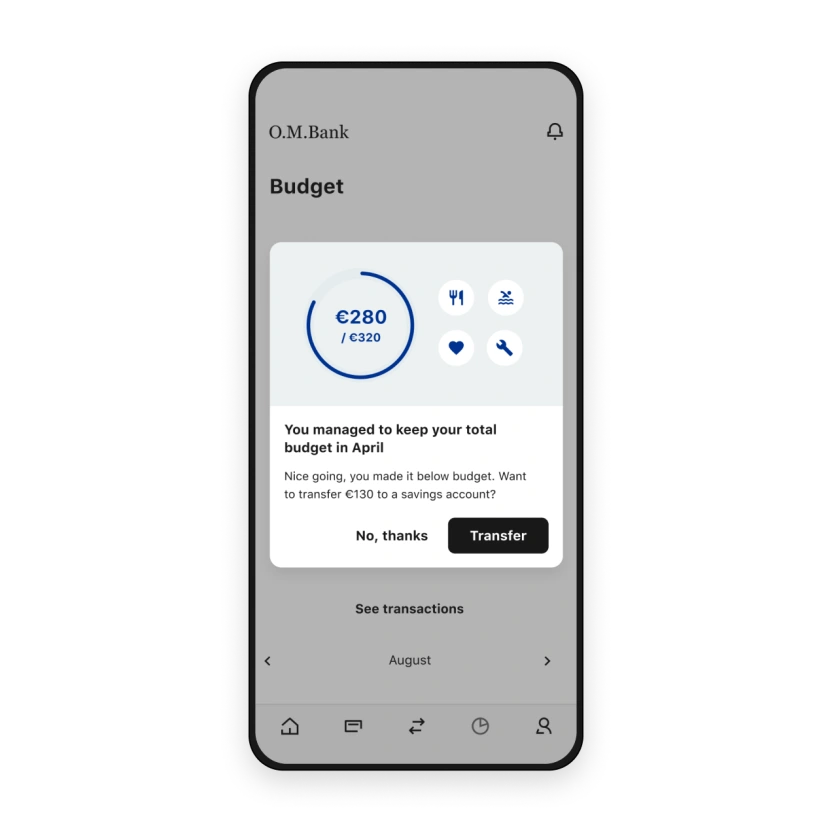

Make the most out of your transactions data with Tink’s enrichment and digital financial tools. Provide your customers with a categorised view of their finances, and coach them to optimise their finances with out-of-the-box tools and insights across all their accounts. Make the user experience proactive by allowing them to track and optimise their expected future cash flows and to budget on their spend where they most need it.

Financially coach consumers through enriched data and intelligent tools

Make the most out of your transactions data with Tink’s enrichment and digital financial tools. Provide your customers with a categorised view of their finances, and coach them to optimise their finances with out-of-the-box tools and insights across all their accounts. Make the user experience proactive by allowing them to track and optimise their expected future cash flows and to budget on their spend where they most need it.

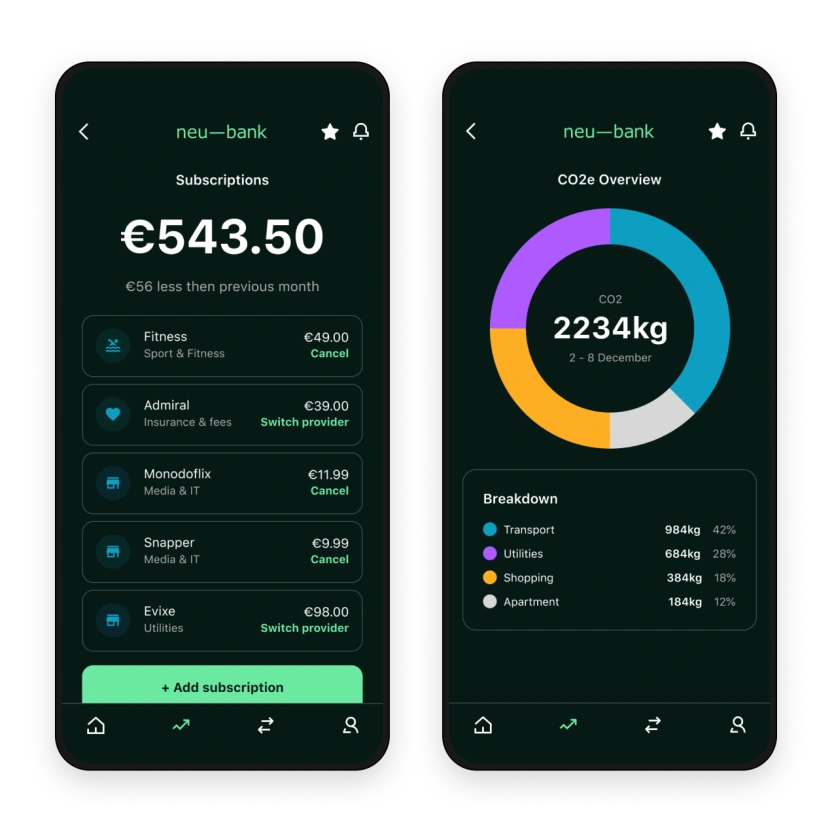

View and manage recurring spend

Increase consumer engagement by offering overviews of all regularly ingoing and outgoing expenses in one simple interface, or identifying where your users can cut more costs based on their historical spending habits. Allowing you to get to know your users spending patterns better, while offering them better control of recurring spend.

Learn more about Data Enrichment

View and manage recurring spend

Increase consumer engagement by offering overviews of all regularly ingoing and outgoing expenses in one simple interface, or identifying where your users can cut more costs based on their historical spending habits. Allowing you to get to know your users spending patterns better, while offering them better control of recurring spend.

Learn more about Data EnrichmentPersonalise the digital banking experience

Drive more consumer engagement with personalised nudges and insights from financial coaching features. Push instant triggers and notifications that provide relevant insights at the right time, and keep users returning to your channel for more support.

Personalise the digital banking experience

Drive more consumer engagement with personalised nudges and insights from financial coaching features. Push instant triggers and notifications that provide relevant insights at the right time, and keep users returning to your channel for more support.

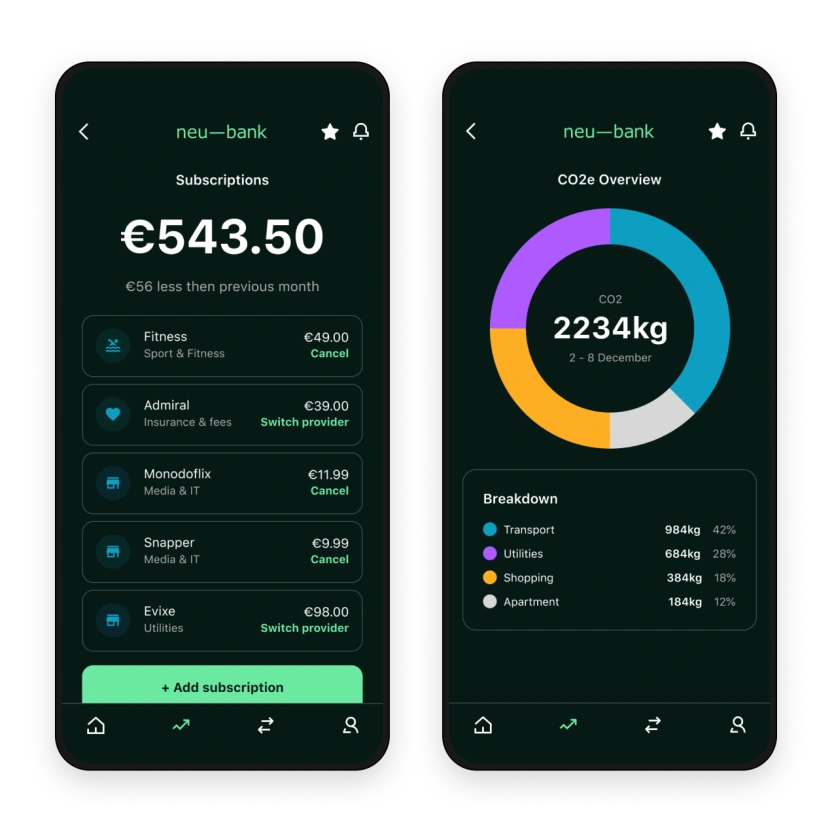

Innovate with ecosystem partners

Enrich your digital banking experience by adding more value. From financial coaching to other areas, such as sustainability coaching and subscription management. By powering your services with solutions from our ecosystem partners, you can delight and engage customers in unexpected ways, such as by helping them to understand their CO2 consumption based on their transactions. All of these features are available through one API with the Tink platform.

Read more about the benefits of additional services

Innovate with ecosystem partners

Enrich your digital banking experience by adding more value. From financial coaching to other areas, such as sustainability coaching and subscription management. By powering your services with solutions from our ecosystem partners, you can delight and engage customers in unexpected ways, such as by helping them to understand their CO2 consumption based on their transactions. All of these features are available through one API with the Tink platform.

Read more about the benefits of additional servicesIncrease consumer engagement through digital banking

Consumer expectations for digital banking are rapidly increasing and moving towards customised solutions. Let us help you expand your digital offering with data-driven experiences and meet consumer needs with the right tools in your app.

Create better understanding

.. of your consumer base, both within and beyond the financial scope

Increase engagement

Unlock Insightful interactions with your customers by providing them with tools to better understand their finances

Accelerate innovation

Easily build new features, or plug in with third-party providers to add more value to financial transactions in the digital banking app

Fast time to market

Tink does all the heavy lifting, so you can power use cases for your consumers

Personalised financial services with open banking

We surveyed approximately 2,000 UK consumers about their financial circumstances – and how they think financial service providers should be stepping up to help them.

Learn more about the benefits of tailoring financial services to support consumers here1/3

… over a third of UK consumers surveyed would switch banks if it provided them with tailored financial support.

47%

… still rely on manual tools to track their spending, meaning there is a lack of proper digital tools that support in obtaining an up-to-date view of their finances.

37%

… feel that they lack control of their finances and want more support from their banks.

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.