The UK leads the way in seeing the digital shift caused by Covid as permanent

In Tink’s new report ‘open banking in a post-pandemic world’, 56% of UK financial executives say they believe the fast-tracked digital shift caused by Covid is permanent - far ahead of the European average of 41%. This shift to digital is propelling financial institutions to concentrate their efforts on the creation of digital services, on improving the customer experience and restoring profitability – with almost three-quarters of UK financial executives saying the pandemic has increased their focus on open banking.

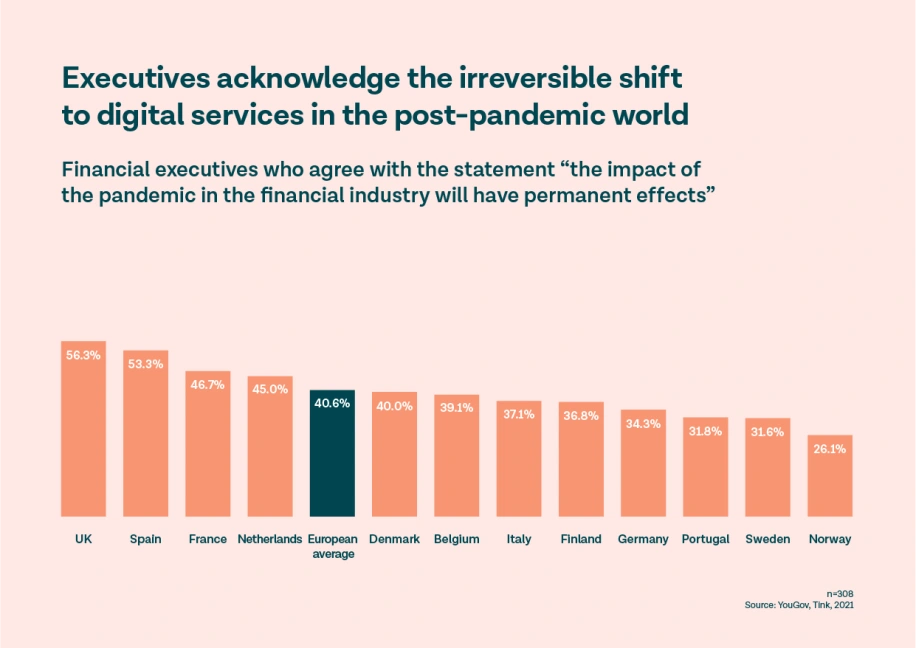

Tink’s new survey report finds that 56% of UK financial executives say they believe the digital shift caused by Covid is permanent.

This is the highest result seen across Europe, where an average of 41% of bankers see effects as permanent.

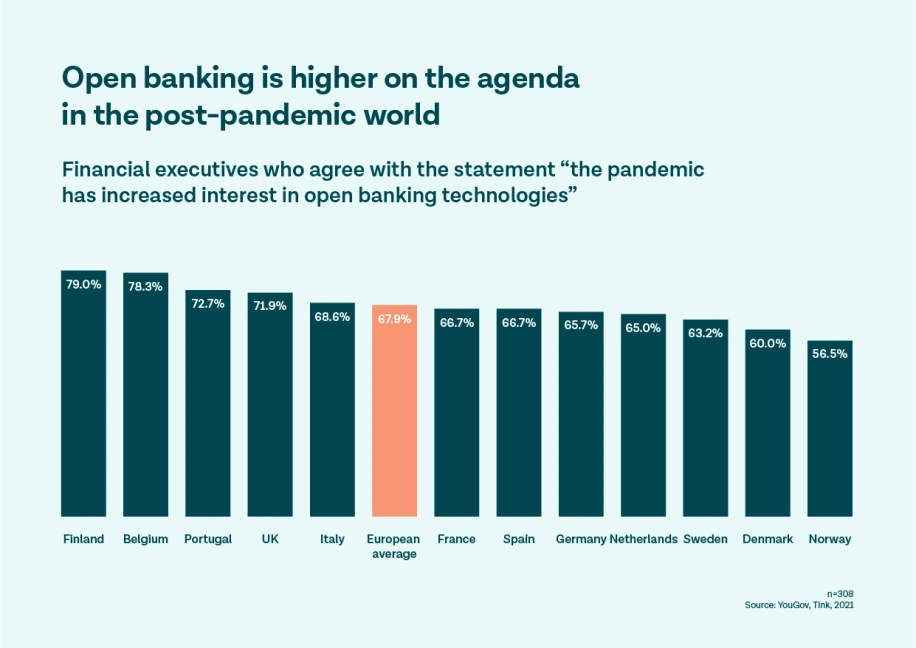

This shift is changing priorities for executives, who are looking to open banking as a potential solution – 72% of UK executives say their interest in open banking has increased as a result of the pandemic.

During the COVID-19 pandemic, financial institutions have been forced to adapt to more digital ways of serving their customers, while people across all age groups have had to become familiar with using these digital services. This has led to the digitalisation of financial services being fast-tracked. In Tink’s report ‘open banking in a post-pandemic world’, 56% of UK financial executives say they believe these effects on the financial services industry will be permanent (Vs 41% on average in Europe), acknowledging an irreversible shift. Out of all the financial executives surveyed across Europe, those in the UK are the most ardent believers that the digital financial shift will be permanent

Even in light of the digital transformation efforts that have been set in motion over the past few years, 65% of financial executives across Europe still believe that financial institutions need to increase their speed of innovation. This digitalisation shift has resulted in an increased appetite for financial institutions to leverage technology, and find solutions to new challenges as a result of Covid-19. In fact, more than two-thirds (68%) of European financial executives say their interest in open banking has increased during the pandemic – increasing to 72% of executives in the UK.

Our report also shows that the pandemic has focused the minds of financial institutions on three key business priorities. Three-quarters (75%) of executives in the UK see an increased need to enhance their digital services – to streamline onboarding and manage more customers digitally. While 88% are also focused on the customer experience – the highest of all European countries and far ahead of the European average of 70% – to differentiate themselves from competitors and boost customer engagement in an increasingly digital world. For 84% of UK financial executives, there is an increased focus on restoring profitability, through automating and streamlining business processes, against an average of 68% in Europe.

‘The UK leads the way in believing the digital shift in financial services is here to stay’, said Rafa Plantier, Head of UK and Ireland at Tink. ‘In fact, the UK is ahead of the curve on interest in open banking increasing during the pandemic, allowing financial institutions to improve digital services, level-up the customer experience and bring greater profitability to their organisations. This reflects the UK’s position as a leading hub for fintech innovation and as pioneers of the open banking movement.’

Despite the big shifts the financial services industry has witnessed during the pandemic, 44% of financial executives in the UK still see the transition to digital as a short-term blip, and expect things to return to normal. But more executives in the UK (72%) than on average in Europe (67%) believe that Covid has increased business risk. Clear signs of looming economic danger are on the horizon – with households under increasing financial distress, non-performing loans set to rise and businesses at risk of bankruptcy when governmental support runs out. This suggests that some financial institutions are at risk of sleepwalking into a future of unforeseen challenges that may have a severe impact on their customers, unless they recognise the significant and lasting impact that Covid has had on the financial industry.

‘The pandemic has forced many executives to remedy the lack of personal interaction with customers by focusing on delivering digital services, said Rafa Plantier. ‘But this has also provided a way of creating more value for the customer, while increasing insights to identify or even predict potential risks and new demands. Financial institutions have seen that open banking technology presents opportunities to increase the speed of innovation, introduce new commercial streams and revenue opportunities, while enabling operational efficiencies that will benefit their business long term – and nowhere is this more true than in the UK.

‘But there are also many executives who are expecting things to go back to normal, Rafa continues, ‘who will need a plan on how to respond and where to focus their digitalisation efforts as the transformation of financial services continues to pick up pace.’

Tink has set out to help empower the pioneers of financial services – the financial institutions that are looking at technology not as a cost, but as an opportunity to improve many of the things they do today. How they operate internally, how they deliver their products, and how they will serve their customers in a post-pandemic world.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.