The truth about Variable Recurring Payments: current status, use cases, and future prospects

We’ve previously covered how VRPs work and their oft-touted potential to transform the payments industry. Here we attempt to cut through the noise and give an honest assessment of the current status, where Tink is at in its journey, and how businesses should be thinking about VRPs – if at all.

VRPs have the potential to reshape online payments as an alternative to direct debit and card payments.

The roll-out of VRPs in the UK is well underway, with some banks further ahead than others.

We go to the bottom of what VRPs is doing for the payments landscape, and what they mean for banks and consumers.

Depending on who you ask, variable recurring payments are viewed as either the most promising payments innovation in recent memory or bringing about the end of open banking. So what’s the truth?

At Tink, we’re optimistic about the long-term potential of VRPs and we’re investing heavily in this space: we’re currently working on a beta launch together with a leading UK bank, with more partners to follow. Recent industry developments have been promising – HSBC announced its own sweeping offering in August and NatWest made its first successful non-sweeping VRP in May – but given that the roll-out is still underway, there’s some way to go before VRPs for commercial use cases become viable at scale. There’s also a case to be made that VRPs don’t go far enough, but more on that below.

What are Variable Recurring Payments?

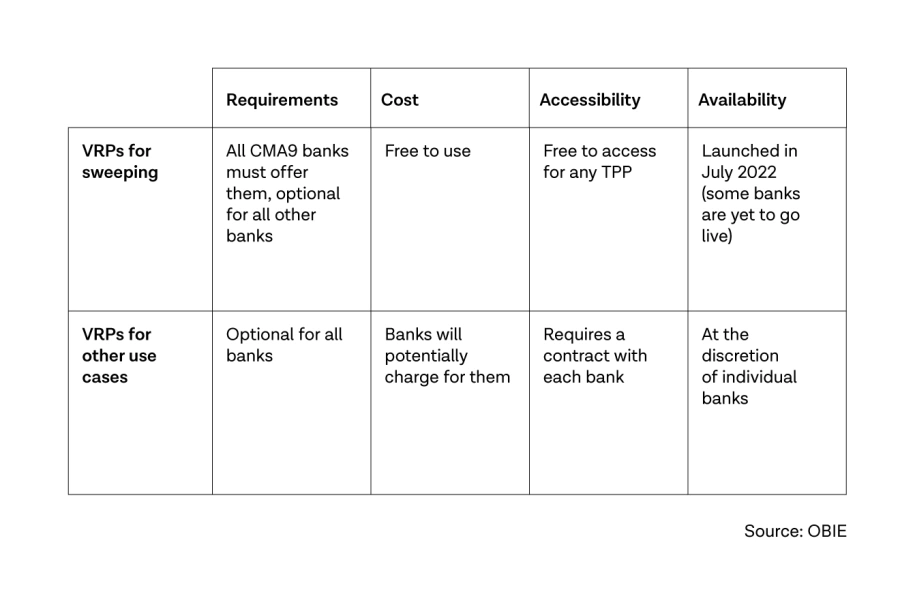

For a full in-depth look at how VRPs work, check out this post. In short, VRPs break down into two types, sweeping and non-sweeping or commercial VRPs. Both are an additional type of transaction enabled by Open Banking APIs that the UK’s nine largest banks (the ‘CMA9’) have been ordered to offer.

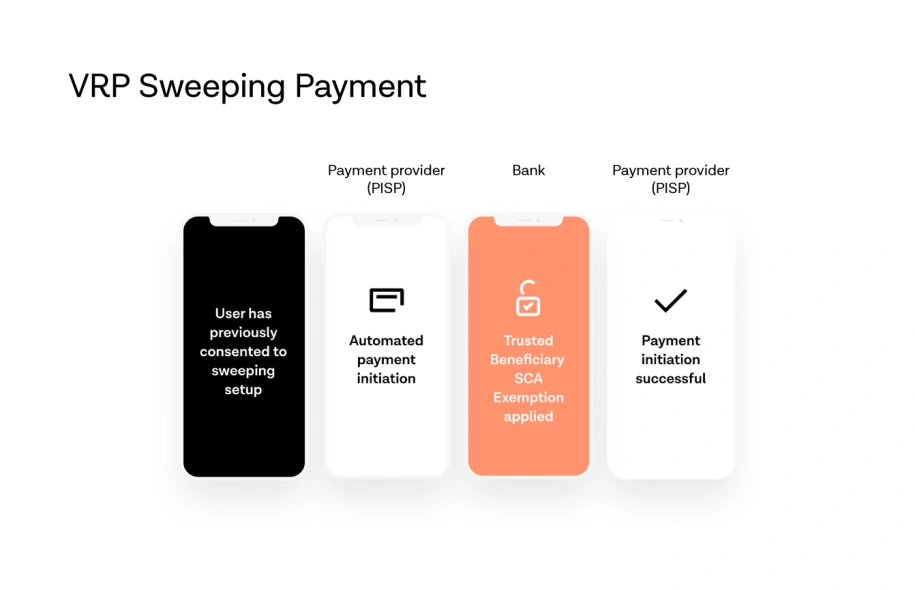

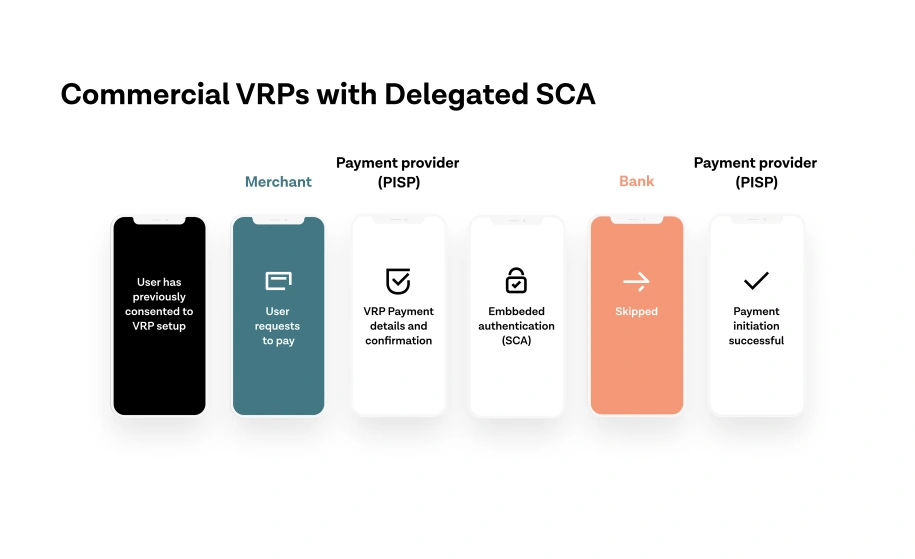

A VRP enables a customer to give permission to a third-party provider (TPP) – such as Tink – to make a series of payments from their bank account at variable amounts and intervals with only one strong customer authentication (SCA) step when setting it up. Previously, it was only possible for TPPs to initiate a single, one-off payment with the consumer needing to complete an SCA step for each subsequent payment – or a series of recurring transactions with the same amount and frequency (known as Standing Orders).

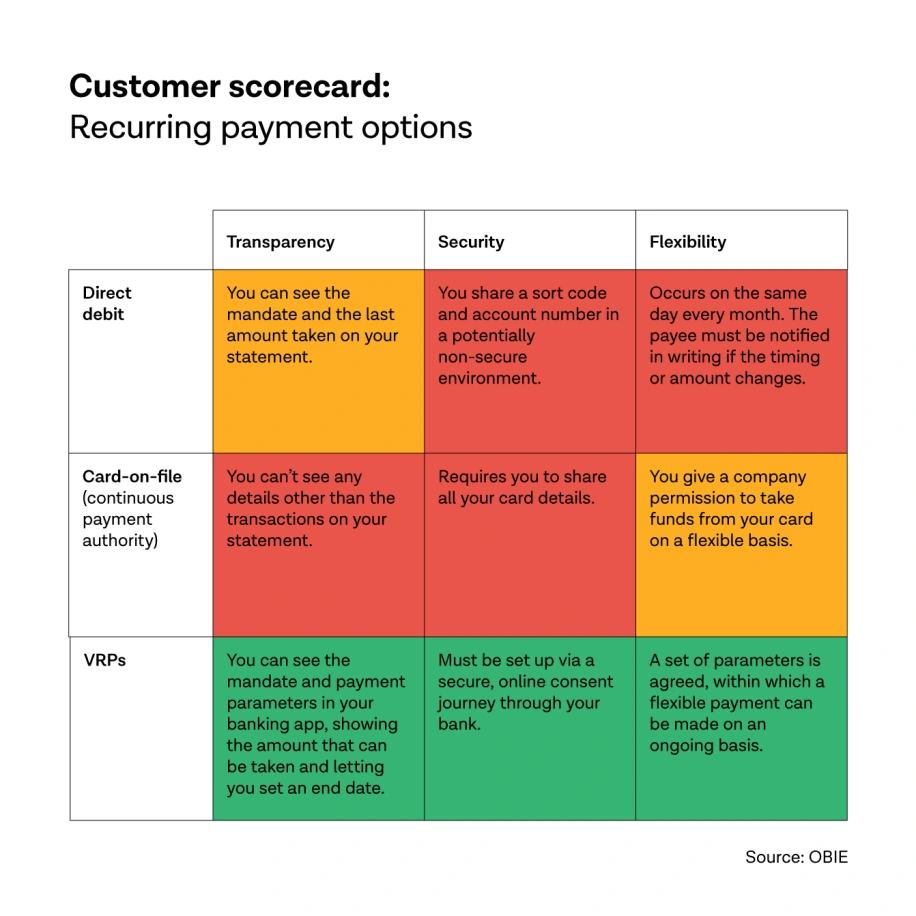

In practice, VRPs will work in a similar way to direct debits and card-on-file payments in that businesses will be able to easily collect payments from their customers on a recurring basis without them having to take any additional action.

What is sweeping?

Also referred to as ‘me-to-me’ payments, VRPs for sweeping enables the transferring of money between two accounts under the same name. In other words, consumers and businesses can automatically sweep money between their accounts at the same bank or different ones without performing any subsequent SCAs – as long as the money is sent from a CMA9 bank.

In 2021, the UK Competition and Markets Authority (CMA) mandated that the UK’s nine largest banks should enable sweeping using VRP APIs. This requirement means that TPPs like Tink are able to offer recurring me-to-me payments for a number of use cases.

What are the key use cases for sweeping?

Sweeping gives consumers a simpler and faster way to move their money between accounts, enabling them to more easily manage their finances and make their money work harder through rules and automation.

The two main use cases are:

Overdraft protections: One of the motivations behind the CMA’s decision to mandate sweeping was to help consumers avoid high interest rates when their account goes into overdraft. Sweeping means consumers and businesses can allow TPPs to automatically move money between accounts to avoid potential overdraft fees.

Intelligent savings: Personal finance apps already enable consumers to maximise their income from savings and investments. The actual money transfers are typically made using direct debits, though, which are slow, don’t provide the payer with any control over the transaction, and can be costly for the service provider. Sweeping will let consumers move money instantly while giving them more control. The same use case could apply to businesses too. There’s over £100 billion pounds currently lying in UK business current accounts earning little interest – automated sweeping lets businesses put their money to work more easily too.

What are commercial VRPs?

Currently, only VRPs for sweeping are required for banks. The industry expectation is that all CMA9 banks will use the same set of APIs to enable commercial or ‘me-to-business’ VRPs, where the payment destination is not restricted to an account under the same name.

Sometimes referred to as premium or non-sweeping VRPs, commercial VRPs would expand the scope of potential use cases – improving upon some of the most common types of recurring payments used today. This is ultimately why there’s so much noise around VRPs at the moment: when it’s fully implemented, VRPs will offer a more flexible and likely more cost-effective alternative to direct debit and card payments – potentially transforming the payments landscape.

Key use cases could include:

Bill payments: As a faster, cheaper alternative to the UK’s Bacs Direct Debit scheme for merchants, with greater flexibility and transparency for consumers.

Bank-on-file payments: Similar to Amazon’s one-click payments and Uber’s seamless checkout experience, which are both enabled by card-on-file payments. VRPs could offer the ability for merchants to set up account- or bank-on-file payments for services where users make repeat purchases, offering a similar frictionless experience at a lower price point.

Subscription payments: As an alternative to Bacs Direct Debit and card-on-file payments for digital subscriptions.

B2B invoicing: VRPs could make the paying of repeat invoices much faster with less manual work, and even open up new types of B2B payments like supplier-initiated payments.

Customer scorecard: recurring payment options

Where we are today

Back in July 2021, the UK’s competition regulator announced that the CMA9 would be required to enable VRPs for sweeping. The initial deadline was January 2022, which was then delayed by six months to July, and even now most banks are yet to roll it out.

That said, with key banks like NatWest and HSBC having already launched VRPs for sweeping, there is definite momentum. Tink is collaborating closely with select major banks on this and we’re excited about what we’ll soon be able to offer our customers.

In terms of commercial VRPs, there are currently no guarantees about when it might become a viable option for merchants. NatWest is the only bank to have publicly announced a pilot, having made its first successful non-sweeping VRP back in May. Clearly more banks will need to participate if VRPs are to gain meaningful adoption and challenge direct debit and cards.

At Tink, we’re backing that commercial VRPs will become a competitive payment option in due course. We’re at the forefront of working with major banks and industry bodies and aim to be first-to-market with a comprehensive UK offering. But we have to be realistic – it will take months if not years of collaboration with banks before commercial VRPs will be unlocked at scale.

Commercial VRPs remain optional for banks to implement and most of the bigger UK banks are still exploring if and how they’ll offer this at scale. VRPs will also come with additional costs compared to one-time open banking payments – a cost that has not yet been set industry-wide. And for VRPs to succeed in transforming the retail landscape, banks need to continue improving their online authentication journeys. Even if UK banks eventually get behind VRPs, it won’t necessarily result in an all-conquering payment method unless banks are incentivised to improve their user experiences accordingly.

How should businesses be approaching VRPs now?

It’s worth pointing out that the roll-out of VRPs is still underway and bank coverage remains limited as of now. But there are opportunities to gain a first-mover advantage and Tink is investing heavily in VRPs as well as the near-identical European initiative for the SEPA zone, dynamic recurring payments (DRPs). We’re working with a leading UK bank on a beta launch of commercial VRPs for bill payments – more news to follow on this soon – which will set the foundations for a full-scale launch of our commercial VRP solution. If you’re interested in learning more or potentially participating, then get in touch.

We’re optimistic that if their full potential is realised, VRPs could bring about a new era in online payments where open banking technologies take centre stage. Change in the payments industry doesn’t happen overnight though. It would be naive to think of VRPs as open banking’s silver bullet in driving mainstream adoption. It remains to be seen how many banks will fully adopt VRPs, how much they’ll cost (and who pays), and whether banks will be incentivised to improve their authentication flows in parallel – a necessary step if VRPs are to win share-of-wallet at checkout.

VRPs are a step in the right direction, but the industry shouldn’t content itself with where we are now. We at Tink believe in a bolder future for account-to-account payments – one that goes beyond VRPs to deliver a truly winning user experience. So stay tuned for future updates.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.