What is multi-banking, and what is it good for?

Multi-banking is a solution made possible by open banking that lets people see all their different accounts in one place – no matter the bank. Here’s how it works, and why it’s useful for consumers and businesses alike.

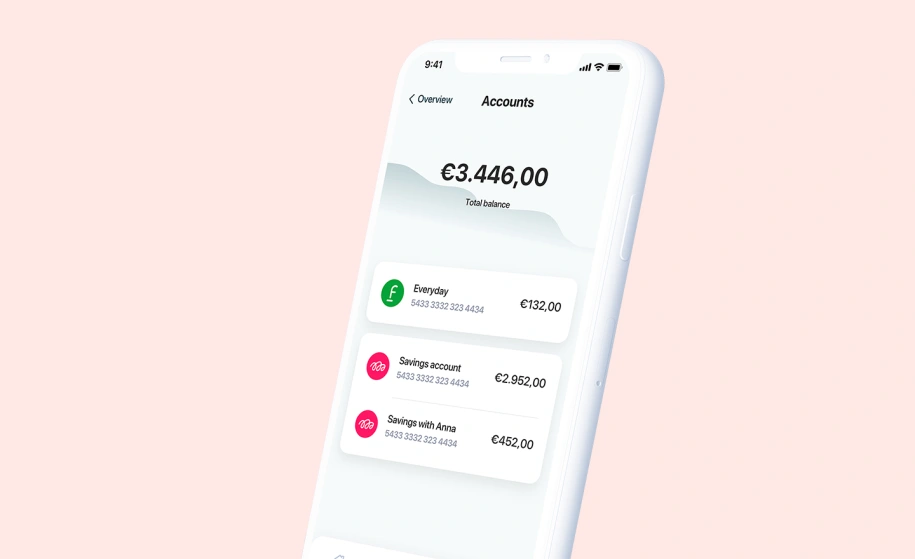

Multi-banking lets people see all their different financial accounts – often from multiple banks – in a single place.

This helps people see the full picture of their finances, so they can get a better understanding and control over their money.

Offering a multi-banking solution can help businesses engage customers, and provide better services that are based on the user’s complete financial picture.

Many people have accounts with multiple banks or financial institutions. A checking account in one bank, investments in another, and a mortgage somewhere else entirely. What multi-banking does is make it easier for people to see the full picture of all their finances, giving them one go-to place where they can view and manage all their accounts.

Multi-banking was one of the first use cases to pop up when open banking started to become a thing. And it makes sense. Once people could more easily access and share their financial information, they wanted to increase visibility for themselves.

What do people get out of multi-banking?

As simple and necessary as it may seem, the ability to see all your bank accounts in one place was not always possible. (Unless you had some spreadsheet you were manually updating, that is.) Before open banking, people with accounts in different banks would need to log in to multiple banking apps to check what was going on.

But the benefit of multi-banking goes beyond the convenience of having all your accounts in one screen. What it ultimately does is help people see the full picture, instead of just one piece of the puzzle at a time. This helps people have a greater understanding and control over their personal finances.

What do businesses get out of multi-banking?

There are different ways businesses can leverage multi-banking to get closer to their customers. But there are two main benefits that stick out: increasing engagement, and having better customer insights.

Increasing engagement is a matter of course when your app becomes the go-to place for customers to manage all their finances (instead of an individual account). By offering a more comprehensive solution – that brings more value and truly helps customers get better control – they will be drawn to your environment. And they won’t need to go anywhere else.

After drawing them in, it can also help businesses get closer to their customers by having deeper insights into their economy. This opens up the way for a bunch of other solutions, like smarter budgeting features and personalised financial coaching – that bring a lot more value because they’re based on the customer’s complete financial picture.

Multi-banking in action

Multi-banking is made possible thanks to Tink’s Transactions (which can help you aggregate personal accounts) or Business Transactions (which does the same, but for business accounts). These products let users easily and safely connect to their different bank accounts, and gives you data in a standardised format so it’s ready to use. If you want to find out more, check the product pages linked above.

More in Open banking

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.