Tink news

Get the latest news and find out what's going on in the world of Tink.

2025-12-10

4 min read

SMEs count the cost of Brits’ ‘Fear of Messing Up’ (FOMU) at checkout

Our latest research reveals that many UK consumers feel anxious about making mistakes when paying by manual bank transfer. This lack of confidence is driving abandoned transactions and undermining trust in the small businesses they buy from – while simple human errors continue to cause failed payments.

Read more

2025-12-03

2 min read

Fidelity introduces Tink’s Pay by Bank for account top-ups

Tink and Fidelity International have partnered to enable account top-ups via Pay by Bank for Fidelity’s Personal Investing customers and advised clients on the Fidelity Adviser Solutions platform.

Read more

2025-10-30

2 min read

Coinbase and Tink partner to launch Pay by Bank crypto payments in Germany

Coinbase and Tink have partnered to launch Pay by Bank in Germany, enabling secure, fast crypto purchases directly from users’ bank accounts and expanding access to the cryptoeconomy with a seamless, mobile-first experience.

Read more

2025-10-20

2 min read

Splitwise expands Pay by Bank across France, Germany, and Austria with Tink

Splitwise is expanding its partnership with Tink to bring seamless Pay by Bank payments to users in France, Germany, and Austria, following a year of rapid growth of our partnership in the UK. This move enables millions more people to settle shared expenses instantly and securely within the Splitwise app, thanks to our open banking technology.

Read more

2025-09-18

2 min read

Vipps MobilePay selects Tink to power Pay by Bank for P2P in Finland

We are delighted to announce a new partnership under which Vipps MobilePay will use Tink’s Pay by Bank to power peer‑to‑peer (P2P) payments in Finland.

Read more

2025-09-03

6 min read

Brits’ ‘fear of fraud’ cost UK SMEs £6.15bn in the last financial year

The latest research and economic analysis from Tink shows that UK SMEs relying on outdated manual bank transfers as a primary method of payment lost out on an estimated £6.15 billion in sales last year.

Read more

2025-07-01

2 min read

Tink and Chip partner to power seamless account top-ups with open banking

Chip, the award-winning wealth app, is now using Tink’s open banking technology to offer users a faster, more secure way to top up their accounts.

Read more

2025-05-28

2 min read

Tink and Adyen partner to bring Pay by Bank to Vodafone customers in Germany

Tink and Adyen have announced a partnership with Vodafone, a leading telecoms company, to offer their customers in Germany the option to pay their prepaid tariff and outstanding postpaid balances using Pay by Bank.

Read more

2025-03-20

4 min read

Tink hits 10,000 merchant milestone for open banking payments

As the adoption of open banking payments surges, we've hit a new milestone as 10,000 merchants choose Pay by Bank – plus a new €100M daily peak for our payment initiation services

Read more

2025-02-12

1 min read

Video: Francois Tornier on his time at Tink & Visa, and the future of A2A payments

Meet Francois Tornier, our VP Open Banking, in this video to find out more about his journey with Tink and Visa, expanding account-to-account payments, and the challenges of navigating a complex ecosystem.

Read more

2025-02-05

6 min read

Merchants invest in payment upgrades as younger generations prioritise sustainability and security for luxury purchases

The latest findings from our peak season survey suggest that younger generations are reshaping the luxury market by prioritising quality, sustainability, and secure payment experiences. With cost-of-living pressures, these discerning shoppers demand more than just premium products, pushing high-end merchants to upgrade their payment systems to stay competitive.

Read more

2024-12-11

6 min read

Three in four high-end merchants optimistic about peak season

New research from Tink shows that, this festive season, quality is trumping quantity as many cost and climate-conscious consumers choose to invest in higher-quality goods, even if that means purchasing fewer items overall.

Read more

2024-10-14

4 min read

How Northmill’s loan book performance is reaching new heights with Tink

As consumers choose lenders and financial services for hyper-personalised, intuitive and convenient UX, Northmill partners with Tink for an optimal customer experience – and boosts its loan book performance to boot.

Read more

2024-10-01

4 min read

Meet Merchant Information: providing bank customers with elevated transaction visibility

Tink has today launched Merchant Information, a solution of our Consumer Engagement offering which provides consumers with more detailed information about their transactions.

Read more

2024-09-04

2 min read

CTS EVENTIM adds Tink’s user-friendly Pay by Bank service to its checkout options – giving fans even more choice

Collaborating with Tink, a market-leading payment services and data enrichment platform, CTS EVENTIM has now added Pay by Bank to its checkout process.

Read more

2024-08-20

7 min read

UK bank customers could be almost £24.5 billion better off per year – through the power of digital financial management tools

Tink’s new research is telling for banks, revealing that consumers now demand more digital financial management tools to support their personal finance goals.

Read more

2024-07-24

3 min read

Tink supports DKB with optimising construction loan processes

Top 20 German bank, Deutsche Kreditbank AG (DKB), teams up with Tink to give construction loan seekers a digital, frictionless application process, based on real-time data.

Read more

2024-06-20

6 min read

Engaging Gen Z: Tink’s new data on the biggest challenge for bankers in 2024

Tink’s new data identifies Gen Z as key for the banking industry, highlighting the importance of ensuring digitised, personalised features – read more and access the complete research here.

Read more

2024-06-19

7 min read

Borrowers and the cost of living: setting the scene for responsible lending in Sweden

Prioritise investing in data-driven lending models with Tink to make more informed credit decisions, enabling credit access to those who can afford it, while protecting struggling borrowers from getting into financial distress.

Read more

2024-05-09

5 min read

David van Damme – unlocking the potential of digital lending in Central Europe

Our new Banking & Lending director for the Netherlands and DACH region, David van Damme, shares his insights on these innovative markets, why they’re different and how digitalisation is changing the lending landscape.

Read more

2024-05-02

3 min read

TransferGo and Tink partner for international money transfers

TransferGo, the global fintech empowering a world on the move, has partnered with Tink to add Pay by Bank to its payments offering. Pay by Bank is now live for UK TransferGo customers, introducing a new way to more securely and quickly send money internationally.

Read more

2024-04-22

4 min read

Splitwise and Tink partner to make paying back friends and family easier than ever

Splitwise, a popular app for sharing bills and expenses, and Tink have partnered to bring Pay by Bank to Splitwise users. This enables millions of Splitwise users to initiate direct payments to friends and family from within the Splitwise app.

Read more

2024-04-16

4 min read

Jennifer Thunander – delivering the goods

How does Tink make sure that its technical integration is successful? That’s where delivery teams, overseen by people like Jennifer, come in. Here she tells us about her role and ensuring that Pay by Bank journeys are as smooth as possible.

Read more

2024-03-06

3 min read

Deutsche Bahn and Tink partner for direct debit setups

Deutsche Bahn has teamed up with Tink for Account Check - enabling instant, easy and secure account onboarding. DB Connect, part of the Deutsche Bahn Group, runs some of Germany’s largest modern mobility sharing services including ‘Flinkster’, Germany’s largest car sharing network and ‘Call a Bike’, one of the biggest bike sharing systems in the country.

Read more

2024-02-27

4 min read

Meet Jack Spiers – Tink’s new UK&I Banking & Lending Director

We spoke to Jack about working with some of the largest financial institutions in the world, optimising our banking relationships together with Visa, and what excites him about the future in our industry.

Read more

2024-02-12

10 min read

Building a more inclusive and diverse fintech industry

Hear from Tinkers who are closely involved with improving inclusion in the fintech industry and educating allies. While talking about their personal experiences, they also provide advice for members of the LGBTQIA+ community looking to enter the fintech arena.

Read more

2024-01-31

6 min read

Introducing Risk Signals: minimising fraud risk

Tink has launched Risk Signals, a rules-based engine that unlocks instant payment experiences while minimising risk – and already in use by Tink customers like Adyen.

Read more

2023-12-21

5 min read

Three key 2024 milestones in EU payments regulation

Looking ahead to next year’s financial regulation in the European Union, there are three important developments set to shape the future of payment initiation services – Instant Payment Regulation, EU Digital Identity Wallet, and the SPAA scheme.

Read more

2023-12-04

5 min read

Livia Kathi – how to accelerate adoption of Pay by Bank

Livia Kathi, Tink’s Product Solutions Director, is spearheading our Pay by Bank drive in the challenging realm of ecommerce. Learn more about the crucial factors of user experience, building trust, and incentives.

Read more

2023-11-16

5 min read

Investments and the cost of living: why everyday investors are being forced to cash in

Investment platforms can avoid losing people to poor user experience – let open banking tools make your payments friction free, while your customers focus on their financial wellness.

Read more

2023-11-09

7 min read

Peak retail season: the cost of living and high volume returns

Prep for Black Friday and 2023 end-of-year sales with new data from Tink, and discover the benefits of Pay by Bank for seamless refunds and returns.

Read more

2023-11-02

4 min read

Sofia Sundström – Our obsession with quality in connectivity

Overseeing our ever-growing network of connections to banks is Sofia Sundström – we spoke to her to find out more about what sets Tink apart in this area, and why it’s so important to be a 'data nerd'.

Read more

2023-10-25

7 min read

A closer look at UK lending in the cost-of-living crisis

New research shows that one-in-four UK borrowers are using credit to cover essential spending, while 16% take out a loan to make ends meet. For lenders, there is increasing worry around fraud and a desire to improve risk decisioning models.

Read more

2023-09-21

3 min read

Meet Christophe Joyau, Tink’s Senior Vice President of Banking & Lending

Christophe Joyau has played a crucial role in our transition from serving individual customers to business customers and building a B2B SaaS function – he told us about it and what it’s like working with Visa.

Read more

2023-09-01

3 min read

Dennis Dorfmeister & giroAPI – The importance of good frameworks and technical designs

We spoke to Tink Engineering Manager Dennis Dorfmeister, who has been appointed to the advisory board of giroAPI, an open banking initiative led by the Association of German Banks.

Read more

2023-08-29

3 min read

Orbyt turbocharges invoicing and direct debits with Tink partnership

Tink and Orbyt partner to offer instant account verification, better direct debits and Pay by Bank-powered invoicing to its customers across Europe.

Read more

2023-08-08

4 min read

An Post releases free money management services with extended Tink partnership

An Post now offers free money management services to all by deepening its partnership with Tink. Just 16 months after joining forces, the An Post Money smart budgeting tool is available to everyone in Ireland, expanding access to the service beyond An Post Money customers.

Read more

2023-07-27

6 min read

Banks step up financial management support as Brits seek help to navigate the cost-of-living crisis

New findings reveal an opportunity for banks to enhance consumer support by continuing to develop, and raise awareness of, data-driven financial services.

Read more

2023-07-26

4 min read

SEPAexpress teams up with Tink to scale payments across Europe

SEPAexpress and Tink are teaming up to improve payments for its customers across Europe. Using Tink’s technology, SEPAexpress is simplifying the payment process offering Pay by Bank and instant account and balance verification.

Read more

2023-06-21

5 min read

Customer demand for banking tools to track sustainability outstripping supply

New research from Tink shows that an estimated 40% of Brits would like to track their environmental impact through a service provided by their bank – but only 24% of banks currently offer the tools to do this.

Read more

2023-06-15

2 min read

SSP selects Tink as its pan-European partner for open banking payments

Read about how Tink has teamed up with Score & Secure Payment (SSP) to enable open banking payments across the eurozone for its 14,000+ merchants.

Read more

2023-06-07

4 min read

Spotlight - Tink’s fast-growing team in Poland

We spoke to members of Tink’s thriving Polish office, which has expanded from a small engineering hub to a live open banking payments market, with more than 140 staff now based in Warsaw.

Read more

2023-06-01

4 min read

Tink will embed ecolytiq’s solution into its platform to scale sustainability-based services

Tink and climate engagement solution, ecolytiq, are joining forces to embed ecolytiq’s sustainability services into the Tink platform.

Read more

2023-05-10

3 min read

Goodlord teams up with Tink to streamline letting applications

Goodlord chooses Tink Income Check to streamline its letting process, using open banking and real-time data to improve verification and minimise fraud.

Read more

2023-04-26

3 min read

Younited partners with Tink to enable instant lending solutions

Younited and Tink have partnered to streamline credit decisions using open banking. Younited’s data-driven approach to loan origination provides fast, accurate and inclusive lending, simplifying affordability assessments for a smoother experience.

Read more

2023-03-21

3 min read

Tink named a leader by Forrester

Forrester report ranks Tink a leader in open banking intermediaries: “…a robust, performant solution that can scale.” – read the independent 2023 report here.

Read more

2023-03-21

2 min read

ConTe.it Prestiti partners with Tink for seamless loan origination

Tink and ConTe.it Prestiti team up to power an instant lending application process with open banking, using the Tink Income Check product.

Read more

2023-03-13

4 min read

Multitude Bank partners with Tink for responsible lending processes

Discover how Tink's partnership with Multitude Bank is transforming digital banking across Europe. Streamlining loan origination, improving credit assessments, and promoting responsible lending across 19 countries worldwide.

Read more

2023-03-06

4 min read

Tink tops the Juniper Research Competitor Leaderboard in open banking

Tink tops the 2023 Juniper Research Competitor Leaderboard in open banking – read the independently evaluated report here.

Read more

2022-12-02

4 min read

The European Payments Council’s first SEPA Payment Account Access (SPAA) rulebook – the Tink take

The European Payments Council’s first SEPA Payment Account Access (SPAA) rulebook was published this week. Tink provides a summary and view on the latest developments.

Read more

2022-11-02

5 min read

Introducing Tink’s Variable Recurring Payments beta programme

Tink and NatWest have partnered up to launch a beta VRP programme in the UK to gather real use cases for merchants based on their needs.

Read more

2022-10-26

3 min read

Sambla partners with Tink for a more inclusive lending process

Tink and Sambla partner up to offer better, more inclusive affordability analysis for all types of loan applicants.

Read more

2022-10-14

3 min read

Tink and Zervant partner for faster invoice payments

Tink and Zervant have partnered up to enable open banking payments for invoicing for over 100,000 SMEs.

Read more

2022-10-05

3 min read

Tink and Adyen partner for open banking payments

The global fintech platform Adyen is partnering with Tink to power its new pay-by-bank solution and offer instant bank payments to its customers. The partnership will help accelerate the global adoption of open banking powered payments.

Read more

2022-09-06

4 min read

SlimPay partners with Tink

SlimPay is partnering with Tink to offer seamless subscription payment experiences across Europe, powered by open banking. SlimPay merchants will be able to offer a secure, seamless way to set up a direct debit that lets users authenticate and make the initial payment through open banking.

Read more

2022-08-25

3 min read

Billogram and Tink partner to streamline invoice payments

We’re proud to announce a partnership with Billogram to further improve their customer experience by removing friction from their invoicing platform.

Read more

2022-07-18

5 min read

Solidi and Tink partner to launch instant account top-ups for crypto investors

Tink is partnering with UK cryptocurrency exchange Solidi to bring instant payments settlements to crypto investors. Open banking-enabled account settlements are faster, safer, and more convenient than bank transfers.

Read more

2022-06-07

2 min read

Revolut and Tink partner for European payments

The global financial super app Revolut has entered into a strategic partnership with Tink to offer its European customers seamless payment solutions powered by open banking.

Read more

2022-03-15

3 min read

PostNord Strålfors and Tink partnering for payments

Find out how PostNord Strålfors – the largest distributor of invoices in the Nordics – is transforming how invoices are paid. (Spoiler alert: it has to do with their new partnership with Tink.)

Read more

2022-03-15

6 min read

Behind the scenes of an award-winning open banking partnership

Tink partner NatWest was awarded the Celent Model Bank 2022 Award for its Digital Spending feature. We talked to partnership insiders to get their views on the collaboration, and what it takes to build a successful partnership.

Read more

2022-03-01

3 min read

An Post and Tink team up to simplify money management for Irish customers

An Post, Irish postal service provider, is partnering with Tink to give its customers the power to better manage their money. Using Tink’s open banking technology, An Post’s Money Manager app helps users improve their finances.

Read more

2022-02-09

3 min read

Youtility and Tink partnering to simplify subscriptions and sustainability

Youtility and Tink are teaming up to help retail banks in the UK offer subscription and money management tools – with savings and sustainability in mind. Here’s more about the partnership, and how it’s addressing important consumer needs.

Read more

2022-01-19

3 min read

NatWest, Cogo and Tink: a three-way partnership to boost sustainability

NatWest enlisted the help of both Tink and Cogo to offer a carbon tracking feature for their climate-conscious customers. Here’s how it works – and why Tink and Cogo joined forces to bring other similar solutions to market.

Read more

2021-10-08

3 min read

eCollect partners with Tink to streamline receivables management across Europe

Find out how eCollect is simplifying and digitising invoice payments – and how their new partnership with Tink will help ensure hassle-free cash management for their customers and a seamless experience for end users.

Read more

2021-06-24

3 min read

Tink is joining Visa

We are thrilled to announce Visa is acquiring Tink. This is the beginning of a new chapter in open banking, and we couldn’t be more excited about what this means for our employees, our customers and the future of financial services.

Read more

2021-06-17

3 min read

Tink and Novalnet enter European partnership for real-time merchant payments

We’re partnering with German payments provider Novalnet to take real-time, open banking powered payments across Europe, starting with Germany and the UK, enabling merchants to receive transactions almost instantly.

Read more

2021-05-26

3 min read

Tink and Wealthify partner for open banking payments

Tink and Wealthify are partnering for open banking payments to transform how Wealthify investors transfer money into their accounts, providing a seamless, faster and more cost-effective payment experience.

Read more

2021-05-18

3 min read

Tink acquires leading German open banking tech provider FinTecSystems

Tink has acquired FinTecSystems – a leading German open banking tech provider, powering over 150 banks and fintechs. The acquisition will offer customers in the DACH region the most complete solution when partnering for open banking.

Read more

2021-05-11

2 min read

Tink and American Express launch open banking partnership

Tink and American Express are partnering to improve the onboarding process for prospective card members in Europe, by using open banking technology to instantly verify identity, income and account information.

Read more

2021-05-07

2 min read

Lydia expands across Europe with Tink – launching in Portugal

Lydia is expanding its open banking partnership with Tink to Portugal, enabling its users to gather their accounts in one place, make contactless payments and online purchases, and transfer money to friends.

Read more

2021-05-05

4 min read

Tink and Tribe partner for open banking payments

We’re teaming up with Tribe for open banking technology, enabling Tribe to combine issuer and acquirer services with Tink’s open banking payments – so Tribe’s customers can access both traditional and more innovative payment solutions.

Read more

2021-04-28

4 min read

Why Tink picks Poland for its biggest ever engineering expansion

Tink’s Warsaw engineering hub is booming, and we’re hiring 60 new engineers to more than double the hub in 2021 – to help lay the foundations that the future of Europe’s financial services will be built upon.

Read more

2021-04-27

7 min read

Inspiration from some of the (10,000+) developers on the Tink platform

We hit a new milestone: over 10,000 developers on the Tink platform. That’s plenty of people using Tink technology to create innovative apps and products – here are just some examples.

Read more

2021-03-18

3 min read

Tink named a Leader by independent research firm in open banking vendor evaluation

Forrester has named Tink as a Leader in The Forrester New Wave™: Open Banking Intermediaries, Q1 2021 report, where our clients cited Tink’s ‘outstanding’ and ‘relentless’ focus on the customer – which we believe cements Tink’s position as Europe’s leading open banking platform.

Read more

2021-01-14

2 min read

How Italian banking giant BNL is taking multi banking to the masses

BNL has added multi-banking to its mobile app, giving customers a 360-degree view of their finances in one place. The partnership will drive innovation for BNL, using Tink tech to take new services to its 2.5 million customers in Italy.

Read more

2020-12-11

4 min read

Tink closes €85 million investment round extension to fuel growth

Co-led by new investor Eurazeo Growth and existing investor Dawn Capital, Tink has announced an €85 million investment round extension, to accelerate its growth plans and expand payment initiation across Europe.

Read more

2020-11-04

2 min read

Tink and Eurobits Technologies become one

Tink and Eurobits Technologies’ union is official. The acquisition is complete and Eurobits Technologies is becoming part of Tink. As a result, Tink’s new and existing customers can benefit from broader connectivity across Europe.

Read more

2020-10-22

5 min read

Introducing ‘Startup stories’ – and reminiscing on Tink’s own journey

The life of a fledgling startup is rarely glamorous – but it is exhilarating. To celebrate entrepreneurship, we’ll share a few startup stories over the coming months – starting with Tink’s own, as described by an OG Tinker.

Read more

2020-10-13

4 min read

Saying goodbye to Tink’s Swedish consumer app

This goodbye is as bittersweet as any, but the time has come to officially announce that we are closing down Tink’s Swedish consumer-facing personal finance app. Here’s why, and what we will be focusing on instead.

Read more

2020-10-08

2 min read

Lydia and Tink partner for open banking

The news is out. We’re teaming up with Lydia as its open banking technology partner across Europe, to streamline the app’s bank connectivity and create new services for millions of customers.

Read more

2020-09-24

2 min read

Enel X picks Tink as its open banking partner

We’re partnering with Enel X Financial Services to take digital money management to millions of its customers. Through engaging tools and personalised advice, its customers can make smarter financial decisions.

Read more

2020-09-21

2 min read

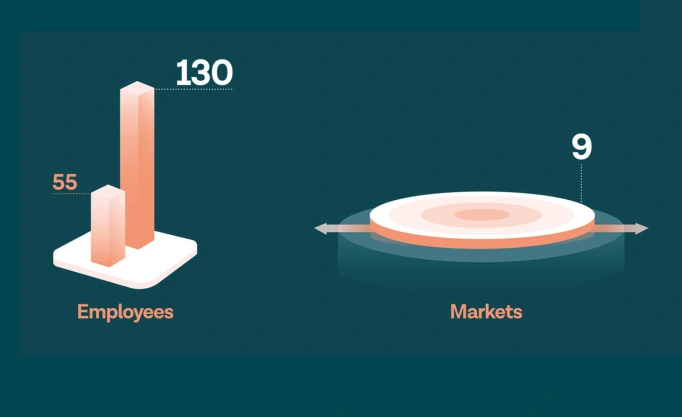

Tink acquires OpenWrks’ aggregation platform

We’re teaming up with OpenWrks, a leading UK provider of open banking applications, in a deal that sees us acquire its aggregation platform – strengthening our connectivity and coverage significantly in a key market for Tink.

Read more

2020-07-16

3 min read

Tink acquires Instantor

We’re ecstatic to announce Tink is teaming up with Instantor, a leading European provider of credit decision solutions. Built on open banking technology, Instantor’s products and services strengthen our market position across Europe.

Read more

2020-07-01

3 min read

Sopra Banking Software becomes Tink's channel partner

Sopra Banking Software and Tink have joined forces to bring open banking solutions – account aggregation, data enrichment, payment initiation, and personal finance management technology – to a platform serving 1,500 financial institutions worldwide.

Read more

2020-06-03

2 min read

PayPal and Tink expand partnership across Europe

PayPal is making a second strategic investment in Tink, and together, their commercial agreement is extending across all countries in the EEA to continue the expansion of open banking technology.

Read more

2020-05-14

3 min read

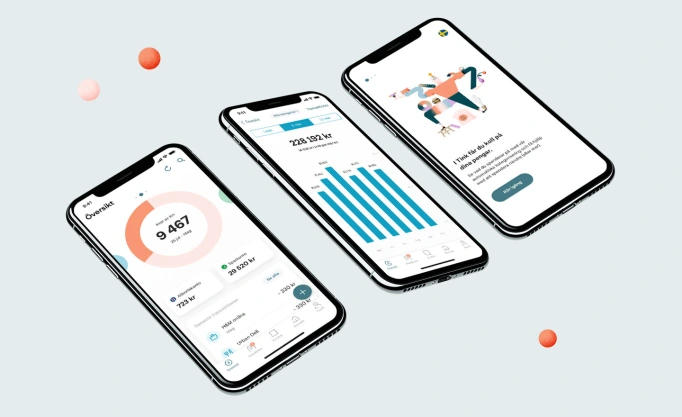

How Nordea is improving its digital banking experience

Nordea is partnering with Tink to transform their mobile banking app, and improve how their customers manage their money using open banking technology.

Read more

2020-05-12

5 min read

Taking open banking up a notch in the DACH region

Our new Regional Director for DACH has his sights set on making the financial actors in the region the stars of the open banking show - by helping them create the slick digital experiences people are beginning to expect.

Read more

2020-04-14

3 min read

Kivra and Tink partner up to provide a more user-friendly way to pay bills and invoices

Find out how Swedish company Kivra is providing a more user-friendly and friction-free payment solution – to simplify things for their customers, and their business.

Read more

2020-03-27

2 min read

Tink acquires Eurobits Technologies

We’re beyond excited to announce that Tink is joining forces with Eurobits Technologies. The acquisition of Eurobits Technologies is a big step for us in our continued expansion across Europe, and a complement to our organic growth strategy to enhance our platform, increase connectivity and expand our product offering.

Read more

2020-01-23

2 min read

Tink becomes BNP Paribas’ preferred tech partner in Europe

BNP Paribas, the world’s eighth-largest bank, has selected Tink to be its preferred European partner for data aggregation and enrichment, payment initiation and personal finance management (PFM) technology – bringing our banking infrastructure and data services to the bank that serves 18 million customers in the region.

Read more

2019-12-17

7 min read

Why our new Spanish country manager is betting on Tink

Beatriz Gimenez has made a career out of digital disruption, and she’s now joined Tink’s expansion journey – heading up our new Madrid office. We interviewed her to get to know more about her unique experience, the Spanish market, her thoughts on the future of banking – and why she decided to bet on Tink.

Read more

2019-12-03

6 min read

The ‘big UK opportunity’ – as seen by our new country lead

Rafael Plantier, our new UK & Ireland Country Manager, arrives at Tink with a motto: open banking is good only once people get to enjoy the fruits of their data. To make this a reality, our London-based recruit wants to seize the open banking opportunity — and give innovators in the UK the right tools for building data-driven services.

Read more

2019-11-27

8 min read

3 key takeaways from Europe's biggest tech fest Slush

Over a couple of intense days, we rubbed shoulders with Europe’s tech establishment at the Slush tech conference in Helsinki. We met other innovators, took on the stage for fireside chats – and kept our ears on the ground to hear what was abuzz in the fintech circles, and what other industry experts had to say. Here are our key takeaways.

Read more

2019-10-24

1 min read

Embracing the hygge lifestyle in our new Danish office

We’re hopping over the strait and expanding the Tink presence to our Nordic neighbours in Copenhagen.

Read more

2019-10-09

3 min read

Joining the customer-obsessed and optimistic Finnish fintech scene

As we open offices across Europe, Finland is one place that sticks out from the crowd. With a more optimistic view than most countries and a tech-forward culture, most players in the Finnish financial industry understand the importance of putting the customer’s needs first. And so we’re planting our pink Tink flag here in Helsinki.

Read more

2019-08-30

3 min read

Using aggregation to make data-driven decisions about customers

When payment provider Mash wanted to upgrade its onboarding process and use data to give customers a better deal, they enlisted the help of account aggregation.

Read more

2019-08-15

3 min read

How NatWest is using Tink to engage more customers

In our first UK partnership, we’re helping NatWest use open banking tech to transform its mobile banking app, and improve how customers manage their money.

Read more

2019-07-02

2 min read

Beyond borders: helping French partners take open banking across Europe

With over 50 banks – some of which are the biggest in the world – France’s financial market has a wide reach in Europe and beyond. But the tech that enables businesses to launch new open banking services has largely been local. Until now.

Read more

2019-05-15

2 min read

How SDC is powering multi-banking across the Nordics

SDC and Tink have joined forces to give 120 Nordic banks access to account aggregation and payment initiation services, allowing its banks to make money management smarter and easier for 2.5 million customers.

Read more

2019-05-15

3 min read

How our new Warsaw tech hub is laying the open banking rails across Europe

When your mission is to create the infrastructure on which the whole of Europe can build open banking services, finding enough tech talent is a challenge. It’s why we opened our new tech hub in Warsaw, Poland to put extra fuel in the tank.

Read more

2019-03-27

4 min read

Part three: How Tink launched in the UK in record time

This is the last piece of our three-part Project Win UK series. In parts one and two, we lifted the lid on our challenge to go live in the UK, and showed how we integrated with the banks and built our categorisation model. This time, we show how all hands on deck meant we could go further and deliver more to complete our mission to go live in the UK – and “win” it.

Read more

2019-03-21

4 min read

Part two: How Tink launched in the UK in record time

Here comes the second piece of our three-part Project Win UK series. In part one, we showed how our engineers smashed expectations to launch Tink in the UK in four weeks. Now we dive deeper to walk you through the first two weeks of the project, showing how we built connections with the banks and trained our categorisation model – at lightning speed.

Read more

2019-03-14

3 min read

How Tink launched in the UK, and did it in record time

This is the first piece in a three-part Project Win UK series, where we take you behind the scenes and show you how we enter a new market, how we think about technology – and how we challenge ourselves to do it better, faster, stronger.

Read more

2018-12-21

5 min read

Tink’s meteoric 2018 growth – and why it matters

A year of sprinting and scaling has put 2018 in the books as Tink’s best year yet. We’re sharing our journey – proud of what we’ve achieved in three major areas, and excited for even bigger growth in 2019.

Read more