Building a more inclusive and diverse fintech industry

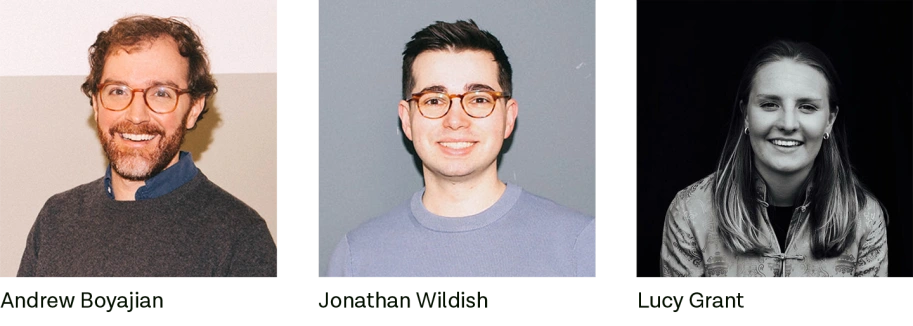

We spoke to Tink’s rising stars who are championing inclusion and diversity in fintech. Andrew, Jonathan and Lucy were included in the Innovate Finance Pride in Fintech 2023 Powerlist and we are proud of them for driving a more inclusive, democratic, and transparent financial services sector for all.

We spoke to Tink’s rising stars Andrew, Jonathan and Lucy who are championing inclusion and diversity in fintech.

While there has been progress in the fintech industry to create a more inclusive and diverse workplace, there is still much more that could be done.

All three Tinkers were included on the Innovate Finance Pride in Fintech 2023 Powerlist and are closely involved with improving inclusion, raising awareness of the multiplicity of contributors with valuable insight and opinions in the industry, and inspiring others to consider entering the fintech arena.

While there has been progress in the fintech industry to create a more inclusive and diverse workplace, there is still much more that could be done. Read on to hear from Tinkers who are closely involved with improving inclusion. Andrew, Lucy and Jonathan talk about their personal experiences in the industry, while also providing advice for members of the LGBTQIA+ community looking to enter the fintech arena.

Jonathan Wildish, Product Solutions Lead

Jonathan joined Tink after many years at our parent company Visa and he is helping to integrate some of the best D&I practices from his time there. He previously worked for Visa in San Francisco and has been part of the Pride Employee Resource Group for many years, co-leading the European sub-group when he moved to London.

“During my early years in fintech, even in an inclusive city like San Francisco, I was nervous to break people’s assumptions and risk feeling left out of the conversation. Getting to know colleagues became a minefield – questions like “do you have a girlfriend?” and “what are you up to this weekend?” were hard to answer truthfully. It was only through meeting other LGBTQIA+ colleagues and seeing LGBTQIA+ individuals in leadership that I felt empowered to be open at work. Once this happened I was on a mission to make sure everyone around me feels belonging at work.

“I am most proud of the events hosted and the content published by our Visa LGBTQIA+ employee resource group. In one event, we had the honour of hearing from a mother who supported their child through their transition. Right after the event, some audience members came up to the mother saying their child had come out as transgender and they felt lost. With the right knowledge and tools I feel there is a proud LGBTQIA+ ally in most people, however, often they do not feel safe asking questions. During my time as co-lead we published material describing the ‘alphabet’ of the LGBTQIA+ community and an email pronoun campaign designed to create understanding amongst the entire employee base. In every event and campaign, an ally or LGBTQIA+ colleague shares their story on how they are navigating these exact topics both at home and at work.

“Ensuring every LGBTQIA+ individual feels safe and belonging at work has been my focus. I am extremely proud of the work we have done to educate colleagues and managers, as everyone has a role to play in driving greater LGBTQIA+ inclusion in the workplace."

What's your advice for members of the LGBTQIA+ community?

“My advice is to join your employee resource group or start one yourself. The mentorship and leadership experience I have gained through being a member and a leader of an employee resource group has deepened my fintech career in many ways. When facing a crossroad in my career or a difficult situation, I know I can turn to other resource group members and executive sponsors for advice and support.”

Lucy Grant, Business Development & Strategy

Lucy is a Business Development & Strategy Lead. Prior to joining Tink she worked in consulting at Bain & Company, mainly in the Financial Services sector.

“In my career to-date, I’ve tried to seek out different ways to explore and drive a more inclusive financial system. This is an even more critical and a personal mission, knowing that the LGBTQIA+ community has lower trust in the financial services system, irrespective of age or income.

“At Tink this means expanding the ways in which people can pay. I am thinking about how new payment methods like Pay by Bank can change the way consumers pay. As part of Visa, we’ve got the scale now to make a meaningful difference across the world - this is super exciting for me as part of driving change in the financial services system.

“While at Tink, I co-founded and led our Women at Tink network, which we kicked off first in the UK, and then rolled out to other offices across Europe, including Sweden and Poland. Witnessing Tink's period of intensive growth since I joined a year ago, I recognised the importance of building a supportive structure for our expanding team, and it became evident that we could improve our sense of community.

“We wanted to keep it easy to start and open to everyone, creating a feedback loop from these initial conversations into the People and Leadership teams, as well as the wider organisation to say we know this is something we want to be better at. We looked to address the tangible things that we can change quickly (e.g. more flexible working arrangements, social events and activities to help bond as a community) and what we should be focusing on in the long-term (improving the diversity in our talent pipeline across all levels of the organisation)."

What's your advice for members of the LGBTQIA+ community?

“My biggest learning (and in turn advice!) is how important it is to bring your whole self to the office, and how this empowers you to do your best work. So I’d make sure you seek out places and environments to work in that allow you to do this - be that doing your extra due diligence on the culture of an organisation, or joining an internal or external affinity group.

“I have also learnt how willing folks in the fintech space are to share their time and advice - if there are people working on things that you admire, don’t be afraid to reach out and show an interest or ask for a coffee.”

Andrew Boyajian, VP of Product for Payments & CX

Andrew studied marketing and Spanish in university, but ended up focusing on payments at his job and has not looked back. Prior to Tink, Andrew led product commercialisation of emerging payments and fintechs for Wholesale Payments at J.P. Morgan in the US. Andrew spent five years as Head of Banking, North America for Wise and also served as Director of International and Payments for Kickstarter.

“The aspect about payments that I love is that it's localised, both in tech and behaviour, by the immediate culture and consumer attitudes toward money.

“Throughout my career, I’ve been attracted to companies that are using technology for good or to better experiences. At Kickstarter we used our tech to share artistic value and create inclusion in the creative process. At Wise, we looked at how to use our platform to ensure the value of remittances makes it to where it is needed most. And at JP Morgan, we worked at finding how alternative payments can reach people in more convenient or accessible ways.

“Now at Tink, we are exploring how open banking can increase consumer choice, reshaping banking and making it more accessible, inclusive, understandable and useful – to anyone, anywhere.

“At both Tink and JP Morgan (Wholesale Payments), I have supported the creation and participation in D&I/DEI groups. While at JPM, I contributed to one of their mentorship programs, with a focus on an LGBTQIA+ fintech.

“The Pride Powerlist is important not only to inspire young people starting their careers to be themselves – but also to help raise awareness within all career levels already in finance and technology that there are a multiplicity of contributors with valuable insight and opinions.”

What's your advice for members of the LGBTQIA+ community?

“Finance might conjure up images of pinstripes and oak board rooms (and those still exist) but it’s come a long way and realises the value of diversity in employees and products – and there is still a lot of work to be done in fintech for the betterment of the LBGTQIA+ community.

“Your viewpoints are absolutely critical to creating the best possible user experiences and technologies, which can in turn create better financial inclusion and financial literacy. This is one of the biggest impacts we can make, especially to LGBTQIA+ communities which can still see high percentages of being underbanked and working in cash-based economies. We can continue to challenge historic norms like including non-binary options in onboarding processes or the recent examples of chosen names on payment cards.”

“As you start in your career in fintech stay curious and inquisitive – ask ‘why’ and push your thinking when it comes to ‘how’ to include your own voice and perspective. By driving culture and promoting that diversity across the industry, we are working to make sure our environment is an inclusive one.

"Stay true to who you are and your values and look for how you can positively impact your company, whether that’s internal culture and policies or external product features to encourage inclusion.”

More in Interviews

2024-04-10

7 min read

Thomas Gmelch - how open banking can change the instant payment experience in Germany

We sat down with Thomas to chat about the challenges facing our customers in Germany, and how our newly launched Risk Signals product is coming to the rescue.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.