How Lumify cut their loan application time by half with open banking

Until now, providing loans meant a multitude of manual input of data – for credit givers and takers alike. With the help of open banking, Lumify has cut application processing time by more than half – with a 40% increase in success rate. Here’s how.

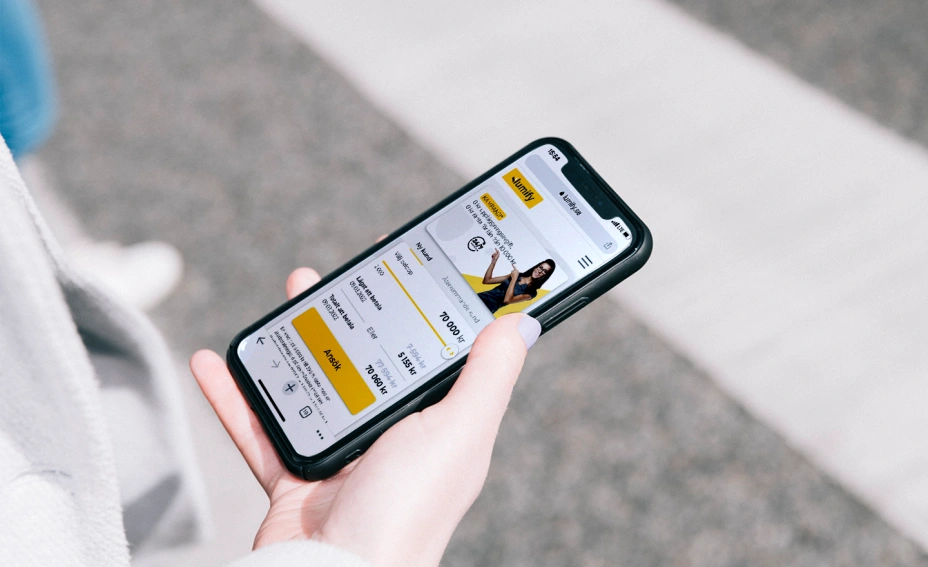

Lumify is a Swedish online-lending platform providing fast and seamless loans to borrowers in Sweden.

Their aim is to provide fast and simple loans for financial emergencies, but the manual application process led to drop-offs.

After integrating Tink’s open banking technology, Lumify has cut their application processing time by half and increased their success rate by 40%.

Providing seamless, fast-tracked loans to borrowers comes with its own set of challenges: keeping track of compliance, adjusting to different risk profiles, handling applications, and more. That’s why Lumify decided to choose Tink as a technology partner in open banking – to streamline the lending process and significantly cut application processing time.

Fast loans for financial emergencies

Luma Finans is a Consumer Credit Institute licensed by the Swedish Financial Supervisory Authority. It’s part of Sun Finance Group and operates in Sweden with two brands, Lumify and Credifi, with the same objective: easy and fast financing for people who need to borrow money for financial emergencies.

Before implementing open banking into their application flow, Lumify had some issues with drop-offs as applicants needed to input all their information manually. Because of this, applying for a loan took longer than 20 minutes. When you’re in a financial bind and need a quick and simple loan, manually entering details and then waiting for a response can be quite stressful.

With the help of Tink’s open banking technology, Lumify managed to cut their application-process time by more than half. This quick and seamless application process increased their success rate by 40% – meaning nearly twice as many are now applying for loans with Lumify.

Seamless loan applications with real-time data

After the integration of Tink’s Transactions, Lumify’s application process takes less than 10 minutes. When the application is approved, the funds are transferred to the client's bank account within half an hour. Lumify performs a risk assessment using real-time financial data, fetched straight from the customer’s bank account. Thanks to Tink’s Early Redirect Function, the engine works in the background while the customer is busy with the application form.

The applicant can also receive better offers by authenticating their bank account using Tink. With open banking, Lumify has not only cut application time by half, but also improved their customer experience to such an extent that more people have chosen them as their preferred online lender.

Choosing the right technology partner

Tink gives companies access to financial data from more than 3,400 banks in 18 European countries. With data engineering, fintechs like Luma Finans get up-to-date, cleaned, and standardised transactional data so they can extract real value and gain insights while ensuring protection against account fraud.

Integrating with Tink is as simple as adding a link in your product flow. Curious about what open banking could do for your business? Get in touch.

More in Use cases

2025-06-18

2 min read

Video – How Snoop is unlocking smarter saving with variable recurring payments

With the launch of variable recurring payments (VRP), Snoop is introducing a smarter, more flexible way for people to build their savings – and making the most of Tink's open banking solutions in the process.

Read more

2024-12-17

7 min read

User experience: Wealthify empowers customers’ financial wellness with Pay by Bank

Tink partner Wealthify uses Pay by Bank for the optimal PFM, investment and saving experience, thanks to easy account top ups and secure account-to-account payments.

Read more

2024-08-12

11 min read

Six ways open banking helps remittance

Learn all about remittance, and how open banking can help it happen more smoothly with six of our best tips. From reducing friction, to simplifying compliance processes, and much more.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.