Lending essentials: how enriched data solutions help lenders tackle constraints

Lenders in today's financial landscape grapple with constraints that impact both their operational efficiency and ability to offer competitive and secure services. Three major challenges lenders face are inaccurate data, outdated assessment methods, and increasingly tight regulations. Tackle these issues head on with enriched data solutions – and make room for innovation and growth.

Some of the top challenges for lenders today are having inaccurate data, fraud in lending application processes and tight regulations

Various factors influence these constraints, from outdated, manual loan origination to considerations around lending responsibly

Enriched data solutions like those in Tink’s risk decisioning arsenal can help banks and lenders build world-class UX – and their bottom lines

When assessing loan applicants, lenders traditionally lean heavily on historical financial data or market estimates of spending. Using this data presents issues as it often consists of outdated financial records and credit checks that may not accurately reflect a borrower's current financial situation. This can lead to:

Denying potentially creditworthy customers due to lack of extensive credit history

Approving high-risk lending with an increased chance of defaults if applicants receive loans they can’t really afford

In addition, lenders face the risk of increased fraud due to loan applicants resorting to drastic measures to secure loans. According to our research, 12% of UK adults have altered their information after being refused a loan.*

Approve more and risk less: real-time data to the rescue

Looking at up-to-date banking behaviour means getting instant, accurate insight into an applicant’s current financial situation. And using enriched data solutions helps lenders do just that – leading to high quality income and affordability assessment.

Another digital banking development – having applicants validate their bank account through Strong Customer Authentication (SCA) – can mitigate fraud in loan applications. Using SCA means the applicant is asked to identify themselves via two of these elements: a password or PIN, mobile phone or other device, fingerprint or facial recognition. For one of Tink’s customers, first and third-party fraud on marginal decline applicants dropped by up to 70% when people validated their details with Tink and SCA, rather than manually with pay slips.

Taking assessment methods from outdated to outstanding

Many lenders still use manual, paper-based processes for assessing borrowers’ creditworthiness. Tink’s recent data shows that 32% of lenders cite manual income verification as the most time-consuming step in their own risk decisioning process.* While an estimated 50% of consumers say they abandon financial applications if applying digitally takes more than three to five minutes.**

Using analogue, paper-based processes to assess creditworthiness is:

Time consuming for both lenders and borrowers

Costly and likely to cause inefficiency and inconsistency due to human error

A contributing factor in applicant drop-offs for customers expecting seamless, digital service

Automated, instant processes: be efficient and keep customers happy

In contrast to manual loan origination, making the leap to digital services is a win-win for all involved. Setting up open banking-powered risk decisioning solutions means being able to leverage real-time data. And that gives lenders:

A fuller picture of applicants’ financials across income and expenses, which, with consumer consent, is instantly verified from their bank account

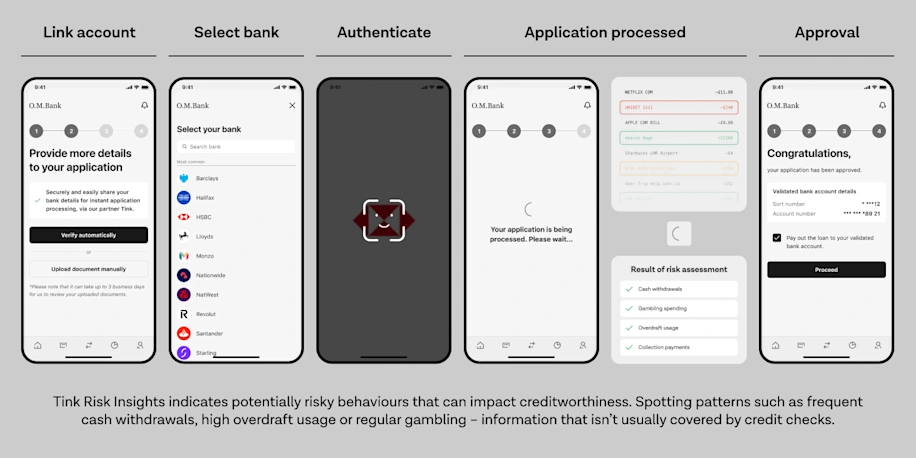

More well-rounded predictions that go beyond traditional credit reports. Tink Risk Insights indicates potentially risky behaviours that can impact creditworthiness. This could be spotting patterns such as frequent cash withdrawals, high overdraft usage or regular gambling – relevant information that isn’t usually covered by credit checks.

Meeting ever-tightening regulations

As the financial sector’s regulatory environment grows increasingly stringent, lenders need to be on the front-foot with legislation such as the FCA’s Consumer Duty in the UK and the Consumer Credit Directive 2.0 in the EU. When putting an increased focus on responsible lending – to meet regulatory standards in preventing consumer harm and financial difficulty – lenders can face challenges around:

Inaccurate affordability analysis owing to manual input and outdated financial records or credit history

Investment in the time and resources necessary to assess applicants’ individual behaviour to the standard required

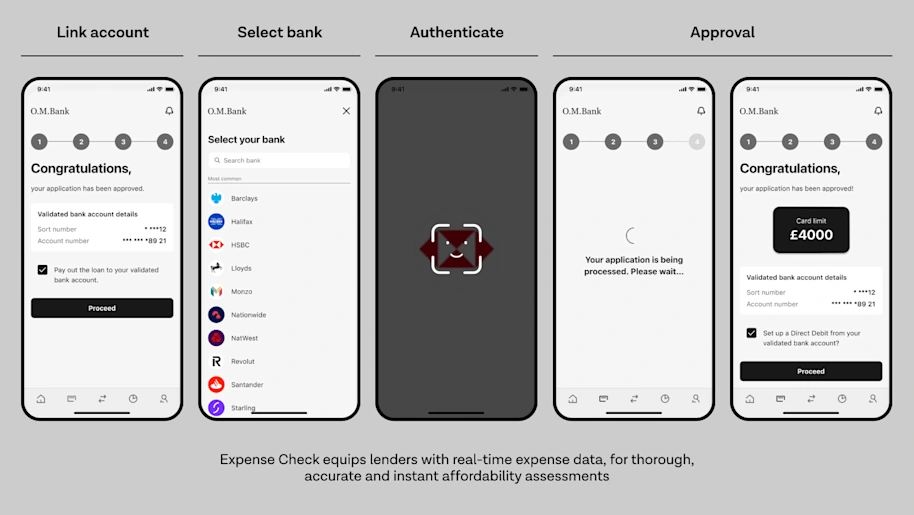

Using enriched data in lending solutions is a surefire route to staying compliant. By enriching data with tools like Tink Expense Check, lenders access detailed information beyond what traditional credit reports typically include – income, expenditure, debts, and other financial obligations. Taking this approach equips lenders with the calibre of real-time data required by regulations for thorough, accurate assessment. All while supporting inclusive assessment of borrowers more likely to be declined via traditional methods.

Ultimately, while many factors potentially inhibit lenders as they balance efficiency and innovation, there are tools at hand. And they can help lenders unlock their superpowers – digitised, personalised, customer-centric processes and reduced risk – while meeting the demands of applicants and regulators. Tink’s enriched data solutions like Income Check, Risk Insights and Expense Check empower lenders to swap constraints for growth.

Looking to enhance operational efficiency and compliance while reducing risk? Tink’s enriched data solutions offer robust answers. Get in touch to explore how our tools can address your specific challenges.

––

About the research

*Consumer research was conducted by Censuswide on behalf of Tink in September 2023, amongst 1,000 UK borrowers aged over 18 (i.e. those who currently have either a mortgage or a loan). Lender research was conducted by Censuswide on behalf of Tink in September 2023 amongst 200 executives at a High street bank, Building society, Challenger bank, Payday lender or BNPL lender who have a decision-making role in the lending process.

**The Financial Brand, 2023, https://thefinancialbrand.com/news/bank-onboarding/3-ways-credit-card-issuers-are-tackling-online-application-abandonment-162266/

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.