Introducing Risk Signals: minimising fraud risk

Today we’re launching Risk Signals, a rules-based engine that unlocks instant payment experiences while reducing risk – and already in use by Tink customers like Adyen.

Already in use by one of the world’s largest PSPs, Adyen, Risk Signals uses account, balance and transaction data to accurately assess payment risk.

By conducting real-time risk checks during the payment process, Tink offers a payment solution that enhances security, reliability and aligns with both merchants' and consumers’ expectations for instant experiences.

Tink’s uniquely positioned product feature will be rolled out across Europe. Available as of today in Germany with more markets coming soon.

When the speed and ease of a payment is of prime importance to consumers and businesses alike, having to wait up to three days for transactions to settle in some markets across Europe is far from ideal. And there’s always the chance (however slim) that the funds never arrive. Over the past half-decade, open banking has made it easier than ever to make payments and move money. It’s cost-effective, quick to implement, and securely authenticated. And now with the launch of Risk Signals, the final piece of the puzzle is solved: fraud risk.

Consumers don’t want to wait for their payment order to be confirmed, to access a service, or for their account to be funded. This leaves businesses in a bind. Offer an instant experience and absorb the risk, or hold off until the payment is settled and potentially lose the customer.

As of today, you no longer need to compromise between a fast checkout and reducing risk. Risk Signals is a rules-based risk engine that leverages account, balance, and transaction data at banks across Europe to increase settlement rates and enable instant payment experiences. We’re now excited to launch its availability, starting in Germany, after a successful beta with one of the world’s largest PSPs – Adyen.

Dirk Jan Meijers, Payment Partnerships Lead Europe at Adyen commented: "With Risk Signals, Tink is enhancing the open banking payment landscape, particularly in important markets like Germany. By leveraging the real-time risk analysis during payment processes, Adyen can offer a payment option that not only ensures security and reliability but also aligns perfectly with both merchants' and shoppers' expectations."

Tom Pope, SVP of Payments and Platforms at Tink added: “Risk Signals is an ideal fit for businesses looking to offer a secure and fast payment method especially in markets without real-time settlement – like Germany. With Tink’s Risk Signals, you no longer need to compromise between a fast checkout and reducing risk. Already in use by PSPs like Adyen, Risk Signals uses account, balance, and transaction data shared under valid consent by the payer to prevent fraud which simultaneously contributes to providing a brilliant experience for both merchants and consumers.”

Offer instant bank payments

Risk Signals consists of a suite of risk checks which Tink can customise per bank and per country.

Here are some of the ways Tink customers are benefitting from it:

Add an instant account-to-account option at checkout: Risk Signals is an ideal fit for businesses looking to offer a secure, fast, and high-converting Pay by Bank option at checkout, especially in markets without real-time settlement. Combined with Payments and our settlement accounts feature, it enables a truly instant account-to-account payment method for retail and ecommerce use cases.

Provide a faster account funding experience: Businesses that want to offer fast, frictionless onboarding and account top-ups – like investment platforms and iGaming services – can use Risk Signals to reduce user friction.

Improve an existing risk program: Risk Signals uses account, balance and transaction data shared under a valid consent by the payer to analyse a payer’s intent and ability to pay that can enhance any existing settlement risk and fraud model.

How it works

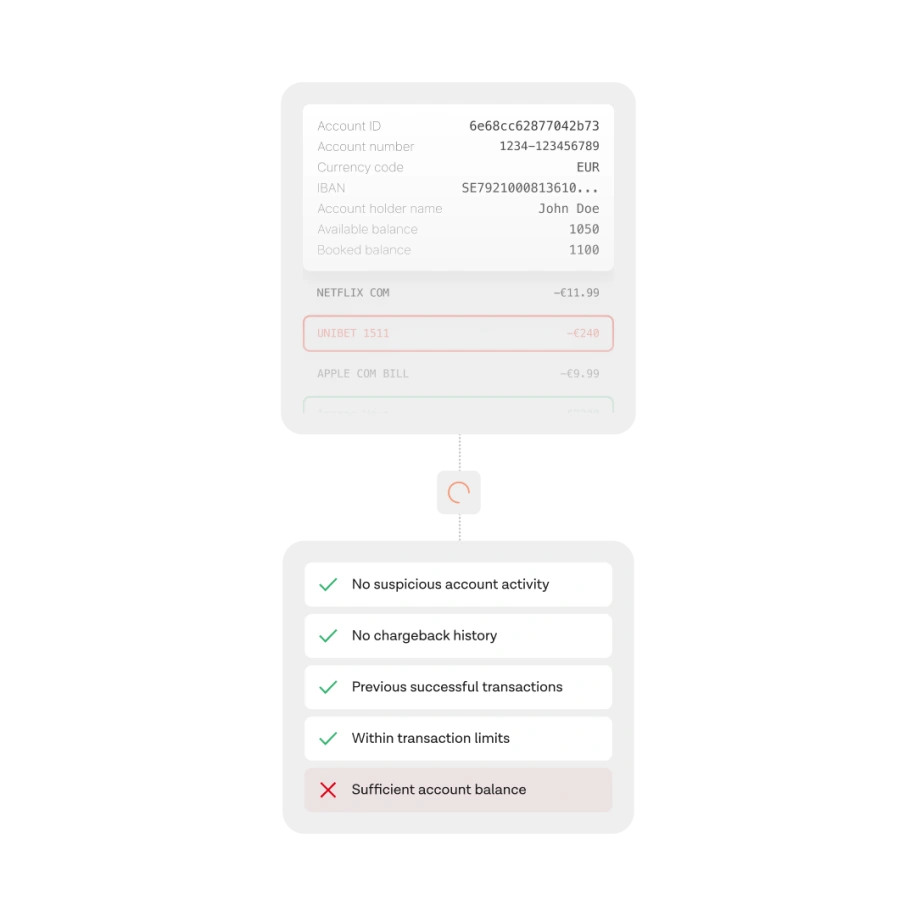

Based on Tink’s pan-European bank connectivity platform, Risk Signals uses the full breadth of account, balance, and transaction data to make more accurate risk decisions. Here’s a quick deep-dive into what’s under the hood.

Risk checks

An optimised suite of risk checks designed by Tink to reduce account-to-account fraud risk.

Live balances: Verify a user’s ability to pay with real-time balance information including overdraft, credit lines, and pre-booked orders.

Transaction history: Assess fraud risk based on recent transactions, and previous non-settled payments.

Velocity checks: Flag suspicious transaction activity.

Transactions analysed in the background

Our priority is protection against fraud risk without extra disruption for the user. Risk Signals assesses each transaction in seconds while the user progresses through the flow, adding minimal friction to the payment experience. Here’s an example of how it works in a mobile app.

Ongoing monitoring and optimisation

We leverage the Tink platform’s pan-European data sets and our deep knowledge of bank systems to help customers meet the payers’ expectation of an instant experience while also minimising fraud. Our team of analysts work behind-the-scenes in A/B testing rule changes and reduce fraud risk.

1 week

Risk Signals takes just one week to fully implement for Tink payments customers on average. There is no additional integration work needed by the customer. The product feature is simply configured for you by Tink and then activated, making it extremely easy to onboard customers.

Get started

Join Tink customers like Adyen and unlock a fast and secure account-to-account payment experience for you and your customers. Risk Signals reduces payment risks while enjoying all the inherent benefits of open banking powered payments like cost-effectiveness and an improved user experience. Available as of today in Germany with more markets coming soon.

More in Product

2025-10-07

7 min read

Beyond instant: Building reliable Pay by Bank payments

As instant payments roll out across Europe, merchants still face challenges with reliability and settlement. Our Smart Routing and Risk Signals products provide a reliability layer for Pay by Bank, optimising payment routes and blocking likely-to-fail transactions.

Read more

2025-02-06

6 min read

Introducing User Match: Built-in name verification to make security fast and easy

Discover how the latest feature of our verification products, User Match, is improving security by verifying users' names when adding bank accounts, reducing fraud and enhancing account protection.

Read more

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.