Introducing User Match: Built-in name verification to make security fast and easy

As impersonation fraud and unauthorised logins continue to plague platforms, verifying a user's name when adding a bank account can make a world of difference when it comes to security and account protection. That’s where User Match comes in – a new add-on feature for Tink’s verification products that helps reduce fraud.

User Match is a new feature of Tink’s verification products that helps reduce fraud by verifying a user's name when adding a bank account

The feature provides real-time match results based on the similarity of the user's name and the name on their bank account, helping to automate decision-making and reduce risk

User Match can be used across various sectors, including financial services, wallets, and e-commerce, to prevent fraud and enhance security

As the rapid rise of tech innovation has seen online scams and fraud increasing globally, verifying customers - and protecting their online accounts - has become more important than ever for online platforms. And while the introduction of Strong Customer Authentication (SCA) across Europe is showing promise, there is still more to be done to offer account protection at scale.

Tink’s new feature, User Match, looks to help soothe verification headaches. With a proprietary algorithm developed and maintained specifically for bank account data, User Match offers a technical solution to verifying users, by matching their data with the name on their bank account – a step which could help protect from a variety of scams and fraud by confirming that users are who they say they are. The feature is designed to enable automation, providing a match result as part of a JSON account report to give match levels that can be used for automated decision-making.

Global fraud is a growing problem

Scams and online fraud continue to be a problem for consumers and businesses everywhere with global losses of $485bn reported by Nasdaq Verifin in 2024. The ability to verify a customer’s name is a powerful first step to reducing risk, and there are a range of applications where adding this verification step can help businesses, banks and platforms prevent fraud. Let’s take a look at a few examples:

User Match for financial services

Imagine a bad actor wants to open an investment account under a false name so they can launder the proceeds of crime. But during the online account set-up flow User Match returns a ‘No Match’ result and the case is referred to the investment platform's anti-money laundering (AML) team. The case is reviewed, and their application is declined, helping to protect the platform from risk.

User Match for wallets

Harry uses a wallet app to receive money earned from his weekend labouring job. A fraudster gains access to Harry’s wallet account and tries to connect it to their own bank account to withdraw Harry’s funds. However, during the ‘connect account’ step, User Match flags that the name on the new bank account does not match the name on the wallet, and the wallet stops the new bank account from being added, protecting Harry from falling victim to fraud.

User Match for ecommerce

An online travel booking platform was having problems with fraudulent user accounts which used stolen credentials. They decided to include User Match in the account set-up journey. This meant they could verify their users’ legal name on their bank account and create a ‘verified’ flag for user profiles. The booking process could then use the pre-verified name, making booking fast and easy for the user, and giving platform merchants more security in the process, with the confidence that the customer is who they say they are.

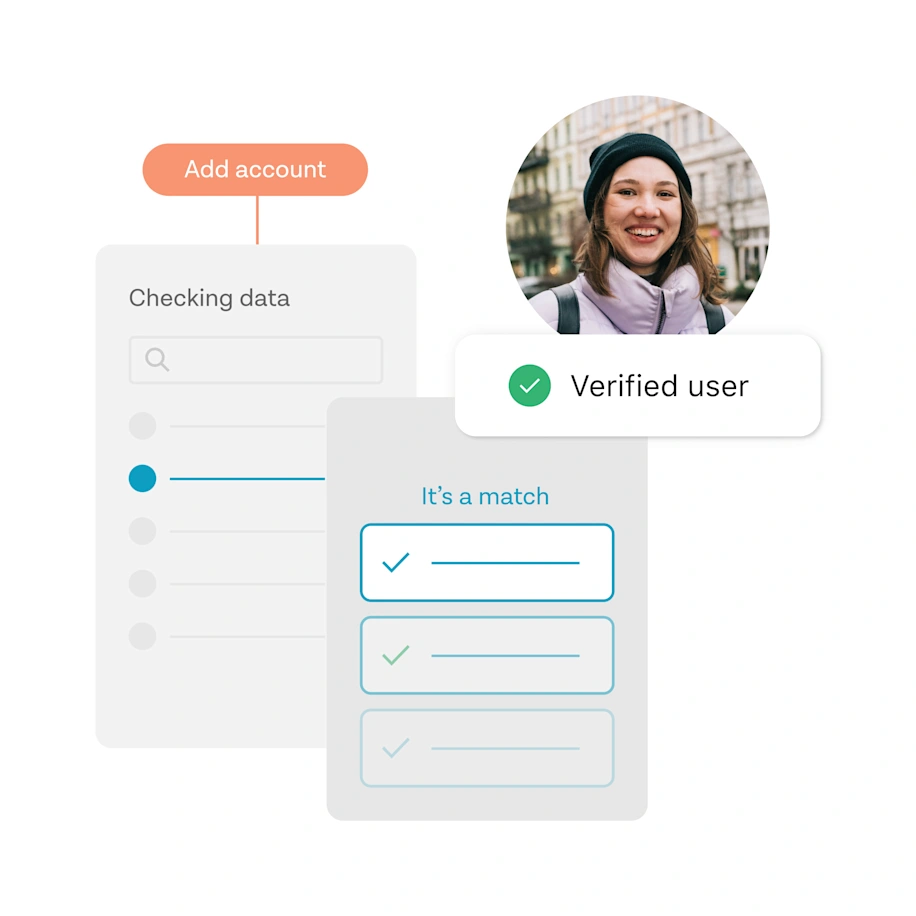

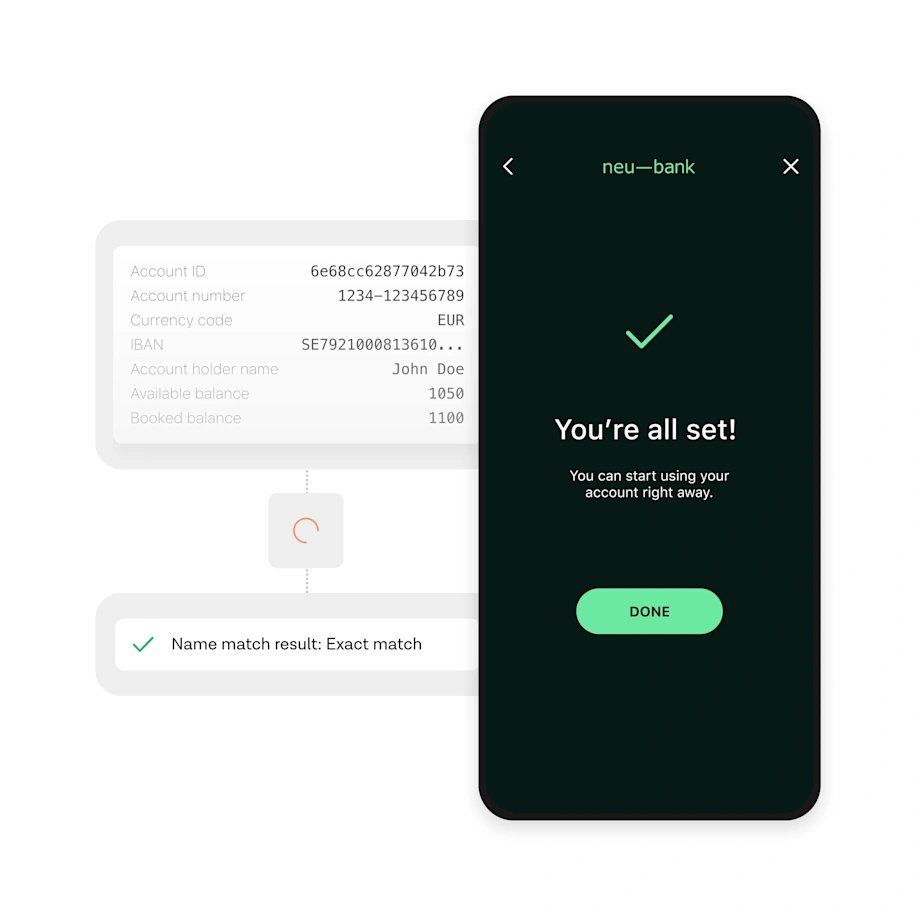

How it works

Based on the username input, User Match provides a result that represents the strength of the match: 'Exact match', 'Close Match', 'Possible Match' and 'No Match'. This result is returned in real-time in the Account Check report with no impact to the user journey. Merchants can choose how to use or act on the information provided to fulfil their own risk procedures.

User Match has been designed for a wide variety of bank data formats, languages, characters and name types, meaning it can be used for accurately matching to accounts across Europe, with flexibility to automate next steps according to your own risk appetite and processes.

The steps:

Your user's name is shared with Tink through a securely initialised session before the Account Check flow begins. Account Check retrieves the holder names from the connected bank and runs the User Match algorithm, comparing the names to determine a match result based on similarity.

User Match results are included in your Account Check JSON report via the API.

Ian Morrin, Head of Payments at Tink, said:"By introducing User Match we are providing platforms and merchants with a scalable, reliable and managed tool to help automate customer verification steps in their user journeys. User Match leverages Tink’s extensive expertise with bank data from across Europe, reducing development work for our customers’ product teams and adding significant value to helping reduce risk and fraud for businesses.

"As User Match can also be used to verify a users’ legal name, it can bring added security to a variety of online accounts including social media accounts, travel accounts, and iGaming – expanding the use case for Account Check beyond bank payments. User Match can add an extra security step to account set-up and lost-password flows for many online environments, such as marketplaces."

User Match is now available as an add-on to Account Check and will be rolling out to markets across Europe and beyond. It will be available in further Tink products very soon so talk to us to find out more.

More in Product

2025-10-07

7 min read

Beyond instant: Building reliable Pay by Bank payments

As instant payments roll out across Europe, merchants still face challenges with reliability and settlement. Our Smart Routing and Risk Signals products provide a reliability layer for Pay by Bank, optimising payment routes and blocking likely-to-fail transactions.

Read more

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

2024-09-18

14 min read

Connecting the dots: how UX optimisations are driving success rates

We’ve previously explored small tweaks that get big results in open banking conversion rates. This deep dive drills further into how to reduce friction – and improve success rates through a fresh round of incremental changes in our UX.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.