How you can extract the real value from financial data using Transactions

Financial data can be used to power a range of innovative services and personalised customer experiences. But merely having access to financial data isn’t enough. To put it to work and start reaping the rewards, the data needs to be refined. Luckily, Tink’s Transactions product takes care of all of it.

Financial data can be used to power a range of innovative services and personalised customer experiences.

When it comes to leveraging financial data, connectivity is not enough. The data should also be refined so it can actually be used.

Tink’s Transactions product, which can be easily integrated through one link, provides access and high-quality coverage, while also cleaning up and categorising the data.

Here’s how Transactions works, and what you can do with it.

While it might still sound like a buzzword to some, being ‘data-driven’ has become key to success in the digital age. Businesses that can leverage customer data to optimise their offering have been disrupting entire industries and changing consumer expectations – think Amazon, Google, Spotify, Netflix.

While today’s tech giants have been putting data at the centre of their business model for decades, the financial sector has taken longer to look to data as a way to fuel product innovation. But that’s changing, and fast.

Regulations like Europe’sPSD2 are opening up the floodgates by letting everyone tap into financial data (with consumer consent). And while having reliable access to financial data is fundamental for any business looking to leverage it – connectivity by itself is not enough.x

To extract the real value from data, and actually be able to use it to bring value to customers (and your business), you need a combination of high-quality coverage, data standardisation, and a good developer experience.

That’s whereTransactions comes in.

Accessing real-time transaction data

With Tink’s Transactions product, you can access real-time transaction data from thousands of financial institutions across Europe with a variety of connection options. What’s more – the data is cleaned and standardised, so you can easily use it to power better digital experiences.

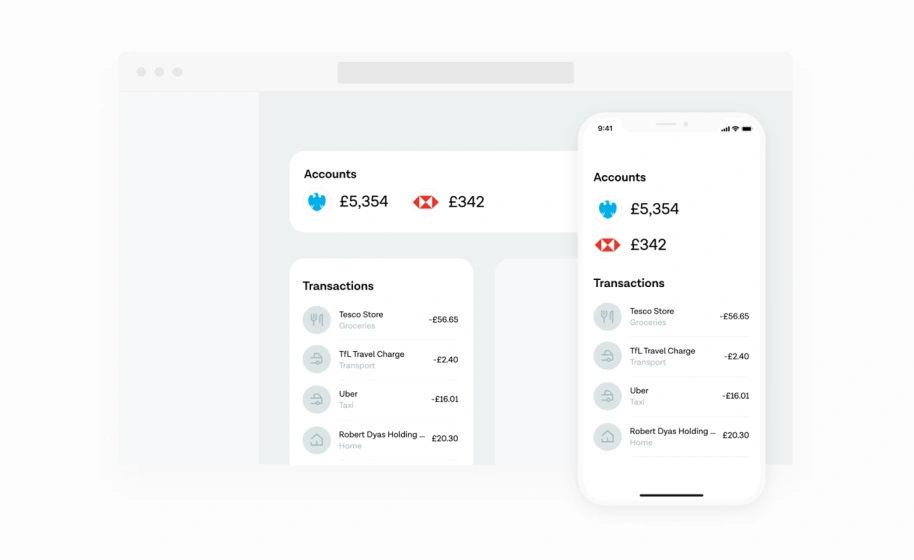

Using Transactions makes accessing users’ financial data as smooth as it gets. It lets you gather all a user’s account information – including credentials, balances, and transaction data from multiple bank accounts – in a single view.

That’s high-quality coverage taken care of. But as we mentioned before, it’s not quite enough. So Transactions also adds value to the data by making it easier to understand – and to use.

Going beyond connectivity with value-added data

So here’s why connectivity by itself isn’t enough: raw data is often messy, and hard to understand. And if you can’t understand it, you can’t really use it.

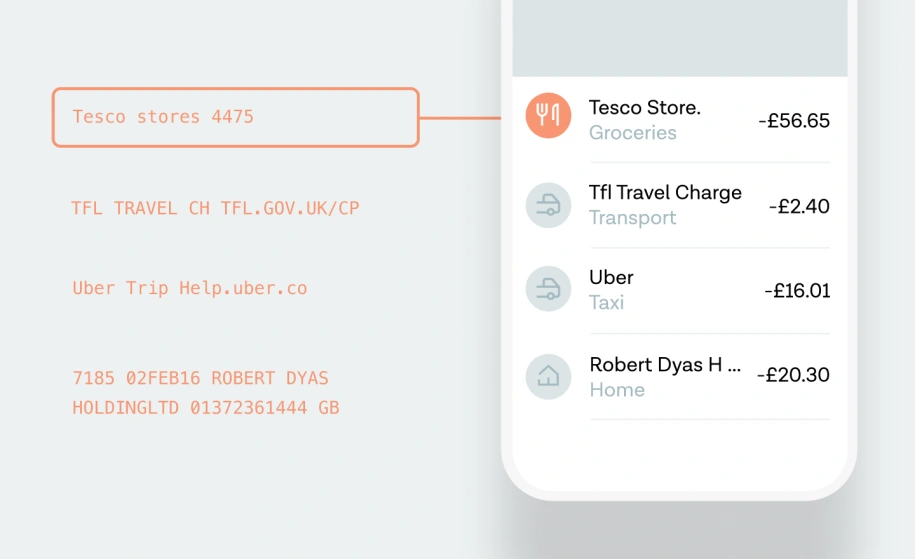

Raw transaction data often contains duplicate entries, long complicated strings of texts and a whole lot of numbers with very little context – which can turn a valuable amount of data into something that’s essentially useless.

Transactions solves that, because Tink cleans and refines the financial data in the background. So instead of a messy jumble, you get standardised data that can immediately be put to use.

As part of the standardisation process, Tink can detect new and changed transactions, and clean up the description, giving more context and a richer understanding of transactions. And because it follows a unified format, the data is immediately useful, giving valuable insights you can use to improve your product or service.

Continuous or one-time access

Access to Transactions can also vary depending on what is needed. Continuous access allows use by budgeting, finance and accounting applications, where users can add multiple bank feeds that refresh on an ongoing basis. One time access allows a simplified flow when refreshing data feeds is not required, for example in an onboarding flow when transaction validation is needed only once. This option also allows product teams to self-manage their integration and access to Transactions.

A good developer experience

Transactions is delivered through a front-end SDK called Tink Link, which makes your (integration to Tink easy, with as little as one line of code, and the user experience seamless.

By implementing Transactions into your product flows, the end-user will be asked to connect their account(s) and authenticate to their bank. Once consent is given, Tink fetches the accounts’ data and then refines the data in real-time so it’s instantly ready to use.

Tink manages all of the connections and authentication – and the complexity that comes with it. This lets you focus on building great products instead of worrying about infrastructure maintenance.

When it comes to building great products, Transactions can be used in many different ways, to solve different pain points throughout the customer journey. Here’s an example from one of our customers.

Start building right away

Transactions is an end-to-end solution with an integration that’s as simple as adding a link in your product flow.

Check out ourdocumentation to learn more about Transactions. Or if you want to try it out for yourself,sign up for a free account to start building with the Tink Platform.

More in Product

2024-07-17

2 min read

Banking on engagement

This Tink white paper introduces new consumer and retail banking executive research from key European markets, setting the scene for banks to take the next step with Personal Finance Management (PFM).

Read more

2024-05-30

5 min read

Meet Variable Spend: our latest feature for intelligent expense tracking

Expense tracking can be detailed as well as intuitive – say hello to Variable Spend, a new feature of Tink Data Enrichment designed to help banks offer their customers more insight.

Read more

2024-05-28

12 min read

Risk decisioning essentials: our latest categorisation model updates to help you get ahead

Confident decisions, top quality reports and going to market faster are just some of the benefits Tink’s new categorisation model has for lenders – deep dive into the world of generative AI, multilingual models, and more with this guide.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.