How Money Manager helps you boost customer loyalty

Personal finance management is one of the most powerful tools available to banks. Why? It sets your customers up for better financial control, while personalising their user journeys and nudging them to keep coming back. Tink’s Money Manager has all you need to engage your customers – straight out of the box. Here’s how its features look in practice, and how they benefit your business.

Personal finance management is a powerful tool for banking and finance apps to engage customers and build loyalty.

Tink’s Money Manager product has all you need to help every customer understand, manage and improve their own financial health.

Explore how personal finance management tailors the customer journey and get inspired to enhance your own.

In a post-pandemic world, digital services must transcend generic recommendations to succeed long term. More than a nice touch, personally tailored journeys are what today’s customers expect. People are used to getting smart tips based on their interests and situation, from their streaming services to shopping online. In addition, engaging consumers takes on new meaning against the backdrop of a cost-of-living crisis. The perfect storm of rising inflation and interest rates, soaring energy prices and stock market volatility makes having a sound grasp of your economic outlook essential. And for the financial industry, personal finance management becomes the ultimate support system for helping vulnerable consumers stay afloat.

The Money Manager experience from your customer’s POV

It’s always crucial to connect with your customers at key touchpoints in your app, and even more so when coaching them to achieve better control of their finances. Money Manager is intuitively designed to slot into everyday moments in your users’ lives – from methodically planned expenses to that ‘Why not?’ last-minute extravagance.

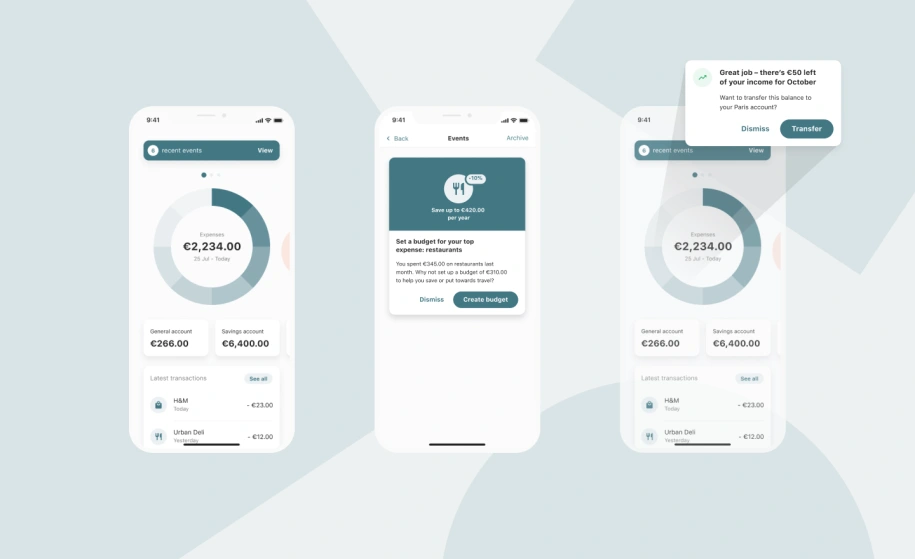

Financial overview. Money Manager’s main dashboard shows your users a comprehensive overview of their income and expenses at a glance, across all the bank accounts they’ve linked to your app. A natural way of helping users be proactive, you can display data points like how much they’ve spent and where – as well as categorising transactions automatically – to save them time.

Insights. In the current economic climate, financial control is more important than ever. But many consumers need a little nudge in order to gain better financial control. Using Money Manager’s Insights function, sending timely hints across several different features couldn’t be easier. For example, your user has more income left than usual for this month – would they like to transfer it to their savings account? Or perhaps set up a budget for a top expense category?

Savings goals. Discipline is the name of the game when saving, which is a timely opportunity to help users get on top. Designed to keep your customers on track, Savings goals helps to map out and reach targets efficiently. Link goals to existing accounts, move funds between them and use handy tags or descriptions.

Left to spend. Imagine that you know your customers periodically open their app to check how their overall finances are going. Implementing Money Manager’s cost prediction feature, Left 2 spend, shows users how much they have left of their disposable income and gives them an overview of their monthly expenses.

Recurring and future transactions. Make it easy for your customers to gain an overview of their fixed costs, and predict future purchases such as gym membership fees or subscriptions to services. This helps them determine whether they’ll have a sufficient savings buffer.

Budgeting. Inspire your users to set, manage and personalise budgets for themselves. Money Manager’s Budgets feature can support users to gain greater financial control. Help them get ahead of the curve by making a travel, restaurant or gift buying budget across all accounts and categories, in your app. You can also provide automated budget recommendations, based on the users' top category spending. Allowing for a more engaging and even easier-to-use budget feature.

Plug in with our partners. When building with Money Manager, you can plug into a network of innovative partners. For carbon footprint conscious customers, for example, why not offer insight into their CO2 emissions per transaction? By partnering with one of our third-party sustainability services, your customer gets what they need to compensate for their purchases. A personally tailored experience for them, and the opportunity to tap into a key emotion – and foster loyalty – for you.

The benefit of tailored customer journeys for your business

Equipping customers with a 360-degree financial outlook puts them in greater control of their income and expenses. In other words, your app can be their financial one-stop shop, viewing all their accounts in one place. This also allows you to understand your customers’ habits and needs at a deeper level – enabling you to find opportunities to provide real-time tips, relevant offers and increase your share of wallet.

Adding smart tools from personalised insights, categorised transactions, budget goal setting, transaction prediction, savings and more turns your banking app into a financial coach. Money Manager’s engaging features create habits that feel productive to your users, such as checking in more often to stay on top economically – all while igniting their curiosity for exploring more of your app’s services.

Money Manager currently helps brands like An Post get closer to their customers with financial management tools and personalisation. Interested in learning more about how Money Manager can help your business? Get in touch.

More in Product

2025-10-07

7 min read

Beyond instant: Building reliable Pay by Bank payments

As instant payments roll out across Europe, merchants still face challenges with reliability and settlement. Our Smart Routing and Risk Signals products provide a reliability layer for Pay by Bank, optimising payment routes and blocking likely-to-fail transactions.

Read more

2025-02-06

6 min read

Introducing User Match: Built-in name verification to make security fast and easy

Discover how the latest feature of our verification products, User Match, is improving security by verifying users' names when adding bank accounts, reducing fraud and enhancing account protection.

Read more

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.