All about Variable Recurring Payments, and how they can accelerate innovation

Variable Recurring Payments enable consumers to securely authorise third parties to initiate payments from their bank account on an ongoing basis, and are a hot topic in open banking right now. Here’s a basic summary of how they work – and why they might one day challenge for dominance in online payments.

Variable Recurring Payments (VRPs) lets consumers authorise third parties to initiate payments from their bank account on an ongoing basis.

This is a hot topic, and is seen by many as the next big frontier for open banking.

We go through what VRP flows could look like – and how it has the potential to upend online payments by offering a more secure, convenient and cost-effective alternative.

Variable Recurring Payments (VRPs) are seen by many as the next big frontier for open banking and could, depending on how they’re implemented, change the face of consumer payments as we know it. It’s in this context that the Open Banking Implementation Entity (OBIE), the body responsible for implementing open banking in the UK, completed its consultation phase on VRP and sweeping back in February. But before we get ahead of ourselves, let’s start from the beginning.

The European Union’s revised payment services directive (PSD2), which was transposed into national law by Member States in 2018, opened the way for platforms like Tink, operating as a Payment Initiation Service Provider (PISP), to initiate payments from a customer’s bank account on their behalf.

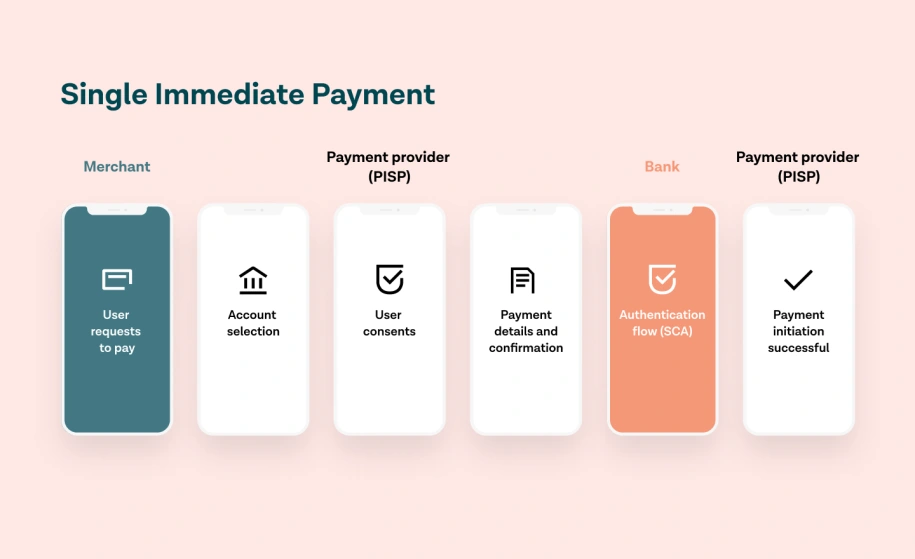

Payment initiation became, in effect, an entirely new payment flow that operates separately from the traditional intermediaries like card schemes and acquirers, with money moving directly from account A to account B. The most common open banking payments being initiated today are known in the industry as Single Immediate Payments (SIPs) because they’re just that: single, one-off payments that are scheduled to occur immediately.

Single Immediate Payment: This flow shows how an end user can authorise their bank to make a one-off payment to a specific payee, such as a merchant.

While it’s still relatively early days for payment initiation, consumer adoption is increasing and volumes are growing across Europe. In the UK alone, the number of consumers using open banking solutions reached 3 million as of January 2021.

Open banking payments are gaining traction, but industry observers see VRPs as key to its long term success. Why? Well, today, the payer has to authenticate and confirm every open banking payment made according to the requirements of Strong Customer Authentication (SCA), whether they’re topping up an account, transferring funds or paying an invoice.

But VRPs introduce the concept of long-lived or ongoing consent, potentially with big implications for the payments industry.

VRPs are similar to recurring payments made using direct debit or cards in that they allow authorised payment providers to connect to consumer bank accounts and debit funds on the consumer’s behalf, with even greater control and transparency for the consumer. An ongoing consent is agreed between the consumer and a third party, the PISP, based on limits and rules.

This ultimately enables a more frictionless buying experience. There are the two main applications of VRPs, based on whether the SCA requirements are exempted or delegated, so let’s look at each of them in turn:

Sweeping:

Also known as ‘me-to-me’ payments, sweeping is enabled by VRPs. It refers to the transfer of money between two accounts held under the same name, such as moving money from your current account to your savings account, or automatically topping up your spending account when the balance is low.

These types of transfers would be exempt from SCA altogether, and could both protect consumers from excessive overdraft fees and enable better personal finance management through rules and automation.

VRP Sweeping payment: In this flow, the payment provider can initiate an ongoing payment on the user's behalf without them being present for each transaction (due to an SCA exemption). Previously, the user needed to give explicit consent to set up a sweeping payment by authenticating with their bank.

Commercial VRPs:

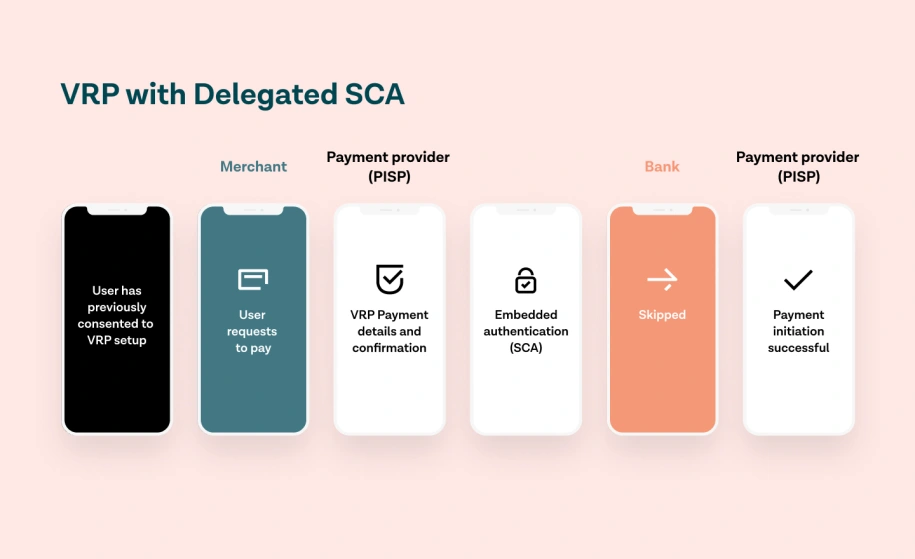

This is where the element of long-lived consent comes into play. Similar to a direct debit or card-on-file payment, VRPs enable the transfer of money from a consumer’s account to a third-party account but, crucially, with much improved security for the consumer.

In these types of payments, the SCA requirements could be delegated to third parties. This means that PISPs, working together with merchants, could enforce SCA on behalf of the user’s bank, making for a more seamless, embedded payment experience. One such use case might be using VRPs to pay for online purchases directly from your bank account, instead of using a card on file.

VRP with Delegated SCA: In this flow, the payment provider can initiate a series of payments on the user's behalf, taking over responsibility for SCA for each payment. To enable this, the user must give explicit consent by authenticating with their bank, which takes place in a separate flow.

How VRPs could disrupt payments

The reason why VRPs are generating so much buzz in the industry is that they have the potential to offer a more secure and cost-effective alternative to direct debit and card payments, which together make up the lion’s share of online payments today.

In theory, they could be faster and less prone to error too, while also reducing customer churn.

The potential to improve the digital buying experience is huge, either through seamless ecommerce payments comparable to Amazon’s one-click payments or Uber’s checkout, or entirely new B2B payment types such as supplier-initiated payments.

To take the question of security first, with VRPs there’s no need for businesses to collect or store confidential cardholder data on file, since no credit or debit card is required to make the purchase. This potentially reduces the impact of data breaches, as there’s less sensitive data stored for fraudsters to steal. What’s more, cancelling a VRP mandate will be much easier for the consumer than cancelling a recurring payment mandate tied to a card on file, meaning there’s less risk of the dreaded ‘set and forget’ scenario. Businesses, meanwhile, won’t be burdened by compliance requirements, like PCI DSS, due to not having to store sensitive card data.

In terms of cost, VRPs will entail significantly lower transaction fees for businesses versus card payments. This is because they bypass the card networks and traditional payment intermediaries.

VRPs can lead to fewer payment errors and higher conversion rates, too. Mistakes due to manual form entry – like mistyping card numbers – do happen. Relying on debit and credit cards for recurring payments can also lead to customer churn when the card inevitably expires, is lost, or is stolen.

Taken together, the potential benefits of VRPs could unlock a whole new wave of innovation in open banking. And because SCA is at the core of all open banking payments, VRPs are guaranteed to be based on strong security protocols and the consumer’s explicit consent. Which ultimately means less fraud, less payment risk, and safer commerce for consumers and businesses.

How sweeping simplifies personal finance

Sweeping enables the automatic transferring of money between accounts held under the same name.

While this sounds fairly straightforward, it has the potential to upend the world of savings and investments, because it lets consumers design and create their own personal finance setup and routines, setting up rules to maximise interest rates or help reach savings goals sooner.

Sweeping has major implications for budgeting and overdrafts, too. Consumers will be able to set rules for overdraft protection, such as automatically topping up their current account if it’s balance is low to avoid unnecessary fees.

Ultimately, sweeping promises to enable healthier financial habits and make an individual’s money work harder.

What VRPs mean for banks

On the surface, VRPs may appear to threaten certain aspects of banks’ business models – like eating into overdraft revenues since consumers will be able to ‘sweep’ money between accounts to avoid fees. It could also eat into issuing banks’ share of interchange fees to cover handling costs and fraud risk for card payments.

But of course, VRPs also represent a major opportunity for banks. The ability to set up money flows via sweeping, for example, increases liquidity and strengthens the bank account’s role as the lynchpin of the consumer’s economic life. This has the added effect of reducing the threat of third-party wallets displacing bank accounts in the future.

With VRPs potentially being used for merchant payments, consumers’ bank accounts will once again be at the center of the payments ecosystem, winning share-of-wallet from cards and other increasingly popular alternatives like mobile wallets.

Innovation beyond regulation

While VRPs may as yet be relatively unknown outside the world of open banking, they could fundamentally change consumer payments in the years to come. That said, as of today most of the discussion on VRPs is confined to the UK, with the EU lagging behind due to the lack of any regulatory mandate for banks to offer this outside their own customer interface. In this sense, the launch of the OBIE’s consultation process signifies how the UK has taken the lead on open banking.

If banks and the wider industry were to move beyond what’s stipulated in regulation, however, and focus on creating new, innovative financial products and services powered by open banking, then there’s a huge opportunity here. An opportunity to design entirely new digital payment experiences from the ground up, using modern authentication technology and fundamentally faster payment rails.

In a recent podcast, Tink’s Director of Research, Jan van Vonno, argued that VRPs even have the potential to ‘challenge the current model for mobile payments, dominated by the likes of Apple Pay and Google Pay, and could one day replace some direct debit use cases.’

In sum, VRPs could accelerate the move away from legacy payment systems and add several key use cases to payment initiation, benefiting consumers and businesses alike. There’s a long way to go before we’re likely to see it being implemented, but Tink is very much excited to be part of the journey.

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.