Level up your lending – and meet the challenges of fraud

As lending evolves for the digital age – as well as the current regulatory and economic landscape – so do challenges like fraud. When looking at how to reap the benefits of data-enriched financial solutions, the time is now. Why? Applicants want seamless experiences, and lenders need future-proofed approaches to affordability assessment.

Digitalisation, regulations and economic conditions are evolving lending overall, as well as fraud-related issues in loan applications

Consumers want seamless loan origination processes while lenders need inclusive, adaptive affordability assessment

Data-enriched financial services using open banking technology could be the key for lenders looking to offer real-time, quality customer experiences.

Innovation in finance and its increasing importance

The digital transformation of financial services has led to a multitude of new ways for banks and lenders to connect with their customers. Consumers have access to many services with a tap of their phone – and this expectation extends to when they want to access borrowing. For this reason, businesses offering financial services have focused their operations on providing smoother applications.

How fraud looks in the loan application landscape

Delivering convenient services has, however, led to another challenge – fraud. As user experience has developed over time to digitise loan origination, so have opportunities to edit payslips and bank statements without being detected. Research from Tink partner Goodlord, a RentTech platform, has shown that more than half of all fraudulent tenancy applications involve fake or doctored pay slips.

Correctly evaluating earnings is essential for affordability assessment

It goes without saying that when analysing applicant affordability, it’s essential to understand their earnings. According to our new research, over half (53%) of UK lenders surveyed said that documents showing proof of income were most important when making decisions.

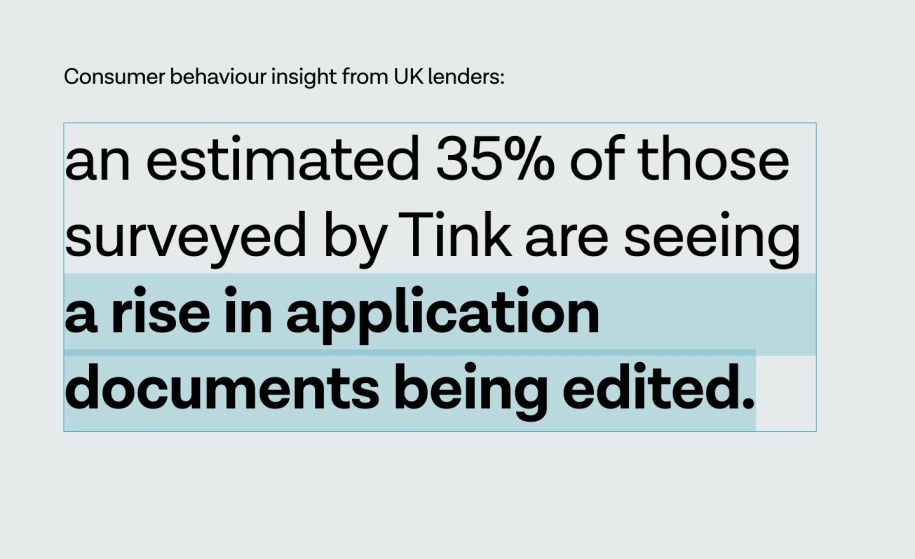

Fraud continues to pose challenges for lenders

The cost-of-living crisis is having a significant impact on borrowers and lenders alike. With UK interest rates at their highest for 15 years (5.25%) as the Bank of England tries to bring down inflation – currently 3.9% according to the latest Office for National Statistics data – higher loan repayments and increased borrowing are impacting UK consumers’ ability to make ends meet each month.

As financial pressures mount, some struggling consumers are going to great lengths to secure the borrowing they need, with over one in ten (12%) UK borrowers surveyed by Tink saying that when a loan application was denied, they have reapplied with a different lender and altered their credit information so they can access the loan they need.

With Tink’s income classification models, users are able to prove their income through secure, up-to-date data in their bank account spanning up to 12 months, while Strong Customer Authentication (SCA) adds an additional layer of security in proving the applicant's identity, reducing risk.

Keen to get insight you can act on with the latest data? Our new white paper, Lending, levelled up, shows you how to reap the benefits of enriched data for affordability assessment. The time to act is now – to both better support consumers and future proof your business.

—

About the research

Consumer research in the UK was conducted by Censuswide on behalf of Tink in September 2023, amongst 1,000 borrowers aged over 18 (i.e. those who currently have either a mortgage or a loan).

Lender research in the UK was conducted by Censuswide on behalf of Tink in September 2023 amongst 200 executives at a High street bank, Building society, Challenger bank, Payday lender or BNPL lender who have a decision-making role in the lending process.

Case studies, comparisons, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Inc. neither makes any warranty or representation as to the completeness or accuracy of the information within this document, nor assumes any liability or responsibility that may result from reliance on such information. The Information contained herein is not intended as investment or legal advice, and readers are encouraged to seek the advice of a competent professional where such advice is required.

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.