Feature update: Savings Goals elevates your money management experience

As economic conditions evolve, offering proactive ways to manage personal finances is key to supporting consumers – and building loyalty. That’s why we’ve enhanced our Savings Goals feature – part of the Tink Money Manager product – to help digital banking providers give users hyper-personalised budgeting resources.

As consumers increasingly demand financial management support from their banks, personalised budgeting tools become a must to retain loyalty.

Savings Goals, a new feature of Tink’s Money Manager product, has launched to help digital banking providers meet this need.

Pushing money management UX further, Savings Goals helps banks empower their customers to proactively achieve their financial goals.

Staying motivated to save can be challenging at the best of times, let alone when still feeling the impact of a cost-of-living crisis. While expense tracking tends to involve defined, various steps across monitoring, analysing and classifying spending habits, saving can feel like a mammoth task without a specific objective in mind.

According to Tink’s 2023 research, a third of consumers surveyed would switch banks for financial wellness support tailored to their needs.* Additional research indicated that of the participants surveyed, the personal finance management tools they were most in need of included budget management such as setting up and managing budgets to limit spending (31%), savings management like setting up and managing saving pots, and spending categorisation that, for example, categorises spending into groups (28%).**

Bearing in mind these insights, Tink constantly pushes the boundaries of what financial management solutions can do for digital banking service providers – and the people who use them. This means taking our personal finance management products like Money Manager beyond classifying budgets into categories. By adding intuitive, hyper-personalised features, consumers get tailored financial coaching in their pocket.

How the Tink Savings Goals feature benefits consumers

Reinforcing our Money Manager product, Savings Goals is a feature that helps financial service providers empower their users to practise saving proactively – and track their progress. The beauty of Savings Goals is that the customer sees their money accumulate, per goal, over time – and should their priorities change, they can transfer funds between goals accordingly.

Saving for specific purchases like cars or holidays is short term by nature and may be relatively manageable over time. Working towards long-term objectives however – such as retirement, rainy day buffers or simply putting money aside – can benefit from the option of setting up a regular, recurring transaction. So no matter if it’s saving for an annual trip or rainy day fund, Savings Goals is an adaptable, automated, user-friendly way of motivating and enabling consumers to achieve financial wellness.

A money management solution that makes things happen

Designed to help people reach their goals – and build up capital – more effectively, Savings Goals focuses on small steps for a systematic, planned approach to saving. In other words, creating the conditions for a productive habit that encourages choosing to save more rather than giving into the temptation of spending.

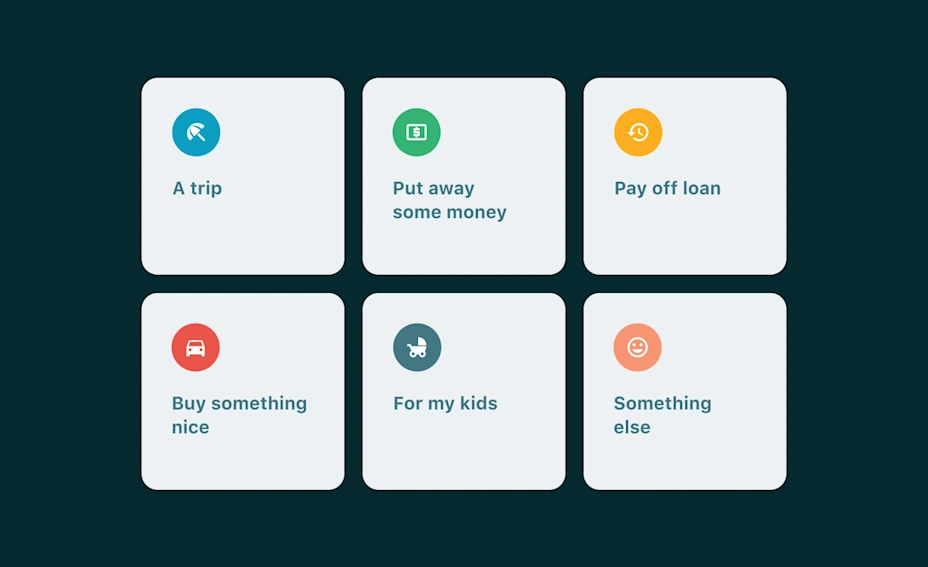

An example savings goal setup

Create a category

What’s new?

Added functionality enables Savings Goals users to set up recurring transfers. They can nominate weekly, monthly or customised transfers to top up savings (e.g. every month on the 25th) – and the amount they would like to set aside. This supports reaching goals with:

Automation – one-time setup of a goal and recurring period lets users set and forget until ready to make changes

Making meaningful progress – saving for the sake of saving can be daunting, so specific goals with automated actions like recurring top ups can help

Setting separate goals – this approach can feel more achievable than trying to save a lump sum

Easy progress tracking – seeing results continuously accumulate can aid motivation

First class UX that builds loyalty

By leveraging the potential of Savings Goals, banks and financial institutions help consumers develop the ability to set short and long term goals in the context of their overarching financial wellness – and achieve them.

In addition, investing in hyper-personalised financial management creates the opportunity to enhance customer experiences, cross sell relevant products and increase awareness of other services that support their interests.

Ready to build your consumer engagement with tools like Savings Goals? Get inspired to scale your financial services or reach out to our team who are happy to help you get started.

—

About the research

* Research was conducted by Censuswide with 2,010 general consumers in the UK (nationally representative) between 17 January 2023 to 19 January 2023. Censuswide abide by and employ members of the Market Research Society which is based on the ESOMAR principles and are members of The British Polling Council.

** Consumer research was conducted by Censuswide on behalf of Tink in May 2023, amongst 2,007 nationally representative UK adults. Banking executive research was conducted by Censuswide on behalf of Tink in May 2023 amongst 113 retail banking executives working at head offices. All executives surveyed are decision makers who are involved in the strategic direction of the business.

More in Product

2025-10-07

7 min read

Beyond instant: Building reliable Pay by Bank payments

As instant payments roll out across Europe, merchants still face challenges with reliability and settlement. Our Smart Routing and Risk Signals products provide a reliability layer for Pay by Bank, optimising payment routes and blocking likely-to-fail transactions.

Read more

2025-02-06

6 min read

Introducing User Match: Built-in name verification to make security fast and easy

Discover how the latest feature of our verification products, User Match, is improving security by verifying users' names when adding bank accounts, reducing fraud and enhancing account protection.

Read more

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.