Beyond instant: Building reliable Pay by Bank payments

As instant payments roll out across Europe, merchants still face challenges with reliability and settlement. Our Smart Routing and Risk Signals products provide a reliability layer for Pay by Bank, optimising payment routes and blocking likely-to-fail transactions. Germany’s complex banking landscape serves as the proving ground for these innovations before wider expansion.

The Instant Payments Regulation (IPR) will make instant euro payments available across Europe from late 2025 – but speed alone does not guarantee a payment will arrive.

Legacy systems, fraud checks, and merchant rail-choice complexity will continue to influence whether account-to-account (A2A) payments and online bank transfers settle successfully.

Tink’s Smart Routing and Risk Signals work together as a reliability layer for Pay by Bank, building on IPR by optimising payment routes and blocking likely-to-fail transactions.

Currently available in Germany, chosen for its complex banking landscape and regulatory environment, providing the ideal proving ground before expanding to other markets.

When “instant” isn’t enough

Picture this: your end-user checks out, the payment is initiated, they’ve moved on with their day. But on your side, the funds are still in limbo.

The order sits in the queue. Stock is reserved but not shipped. Your team is left wondering: Do we fulfil this now, or wait?

For merchants, this isn’t just a technical hiccup. It’s a chain reaction: operations slow, end-users grow impatient, and teams waste hours chasing down missing funds. Without the right safeguards, these delays can undermine the speed and simplicity that Pay by Bank is meant to deliver.

Pay by Bank has enormous potential – low fees, fast settlement, and a smooth experience for end-users. Soon, the upcoming Instant Payments Regulation (IPR) will accelerate its adoption by making instant transactions available across Europe – and with surcharging banned, they will quickly become an attractive option to pay.

But here’s the truth: availability of instant payments doesn’t necessarily equal certainty.

The Instant Payments Regulation reality check

From 9 October 2025, IPR will require all European banks connected to SEPA to offer instant euro payments. It’s a significant milestone for the industry, but it’s not a silver bullet.

Even in a post-IPR world, payments may not settle successfully. For example, factors that can influence settlement include:

Legacy systems: Some banks still rely on infrastructure that cannot process payments, including fraud checks, within the 10‑second IPR confirmation window. When this happens, the payment is rejected outright.

Risk and compliance checks: Each bank applies its own rules and processes, including treasury checks, and broader risk assessments. Depending on the merchant type, transaction amount, or end-user profile, these reviews can delay or block payments entirely.

Possible fraud: Fraud will continue to be a risk to parties involved in financial transactions, and it should remain top of mind for regulators and the industry more broadly once IPR takes its next step in October.

The right rail

Even after IPR, the PSP or PISP can decide whether to route a payment via instant (SCT Inst) or regular credit transfer (SCT) rails. SCT Inst must be confirmed within 10 seconds, which can lead to timeouts or rejections during checks. Regular SCT allows more time and can sometimes succeed where SCT Inst fails (especially for high-value or complex transactions). When PSPs have the right data and routing logic, payments can be executed on the best possible rails, ensuring a seamless experience for both end-users and merchants.

The regulation ensures instant payments are possible. It does not ensure they are predictable.

The reality: settlement depends on context

Settlement rates vary widely. They depend on the merchant, the destination account, the transaction value, and the end-user.

That’s why Tink takes a modular approach to Pay by Bank. Our core offering delivers fast, secure payment initiation. And for merchants who want to go further, we offer Smart Routing and Risk Signals: two enhancements designed to maximise settlement success.

Smart Routing: intelligent payments, optimised for success

Speed matters. But for merchants, reliability matters more.

That’s why we built Smart Routing: a way to make Pay by Bank work more predictably, no matter how complex the payment landscape.

Smart Routing acts as a reliability layer for Pay by Bank, making intelligent decisions on how each payment is sent. It looks at the bank, the scheme, the merchant profile, and settlement performance data, then selects the optimal route for the highest likelihood of settlement.

For merchants, this means no more rail‑choice guesswork. No more checking bank‑by‑bank quirks. Just a higher chance that when a payment is initiated, it will arrive.

Risk Signals: data-driven protection, built in

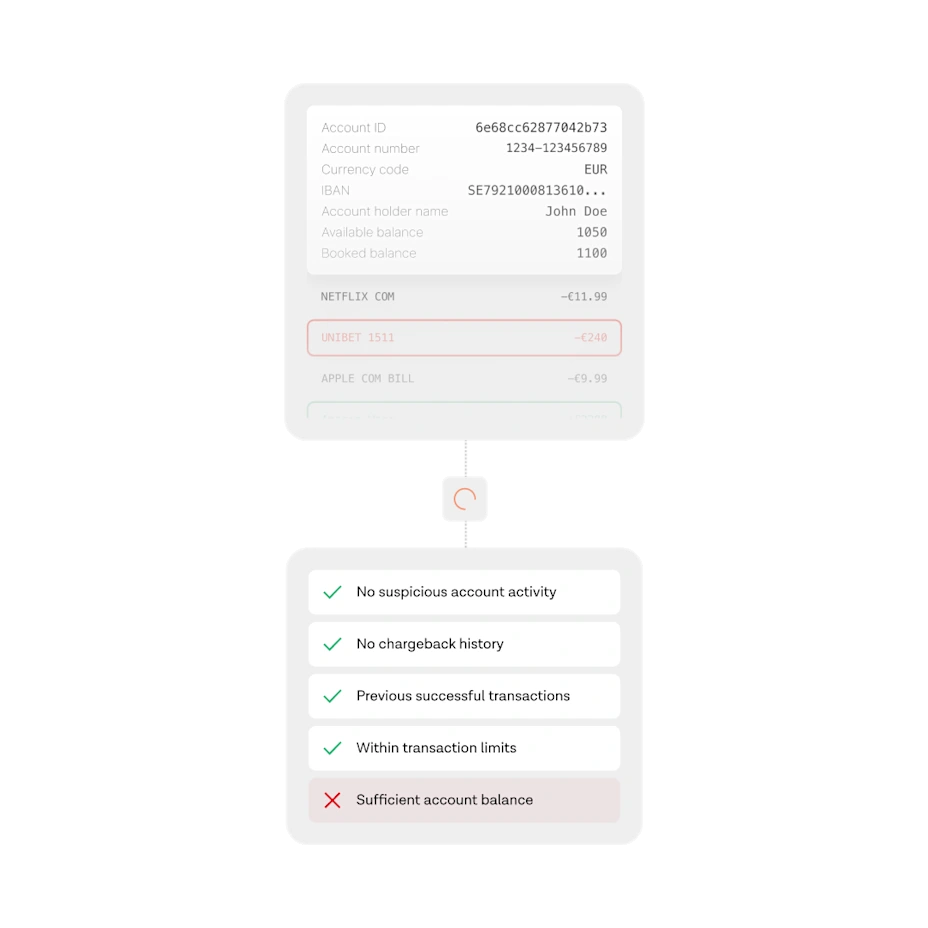

Alongside Smart Routing, Risk Signals adds another dimension to reliability. Risk Signals uses Tink’s unique breadth of account and transaction insight to spot patterns invisible to individual merchants. It can identify transactions that are likely to fail – whether due to account problems like insufficient funds, or fraud risk – and block them before they cause operational headaches.

The result:

Higher settlement rates

Fewer payment‑related losses

Greater confidence to process an order once a payment is initiated

Together, Smart Routing and Risk Signals form a powerful combination that improves Pay by Bank outcomes, all without adding friction to the user experience.

Proving reliability in Europe’s most complex markets

Germany is one of Europe’s most intricate banking landscapes. With thousands of banks, varied technical capabilities, and strong local payment habits, it’s a market that demands precision.

That complexity is exactly why we chose to launch Smart Routing and Risk Signals here first. Germany’s mix of regulatory requirements, and the ability to integrate AIS data seamlessly into a Pay by Bank flow, provide the right conditions to fine‑tune our reliability layer without adding friction for end-users.

By proving our approach in a market that reflects many of Europe’s broader challenges, we’re refining our reliability layer in a market that represents Europe in microcosm.

From promise to proof: the impact of a reliability layer

With Tink’s Smart Routing and Risk Signals, Pay by Bank can deliver:

Higher settlement rates – thanks to intelligent routing and real-time risk assessment.

Instant confirmation for most payments – with clear communication when risk is identified.

Operational simplicity – Tink handles the complexity, so merchants can focus on their business.

Modular flexibility – choose the features that fit your needs, from core PIS to advanced optimisation.

Let’s set the record straight

IPR will speed up payments. But the next chapter for Pay by Bank is about making them reliably successful. With Smart Routing and Risk Signals, Tink is providing the reliability layer enabling merchants to move from hoping payments arrive to being increasingly confident that they will.

If you want to learn more about building a reliability layer for your Pay by Bank payments, and how Tink can help, please contact us at commercial@tink.com.

More in Product

2025-02-06

6 min read

Introducing User Match: Built-in name verification to make security fast and easy

Discover how the latest feature of our verification products, User Match, is improving security by verifying users' names when adding bank accounts, reducing fraud and enhancing account protection.

Read more

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

2024-09-18

14 min read

Connecting the dots: how UX optimisations are driving success rates

We’ve previously explored small tweaks that get big results in open banking conversion rates. This deep dive drills further into how to reduce friction – and improve success rates through a fresh round of incremental changes in our UX.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.