Improve risk assessment and application processes with data-driven Risk Insights

Having an in-depth understanding of customers’ risk profiles has always been a challenge. Most data sources used to evaluate applicants are outdated, costly and fall short in providing a measure close to the true risk value. With open banking and data engineering, Tink’s new Risk Insights product can finally give you a full overview of all the (often overlooked) ‘risky’ patterns.

Tink is launching a new product: Risk Insights, which simplifies risk assessments for both lenders and consumers.

Thanks to data-driven insights (made possible with open banking and machine learning), lenders can create more detailed risk profiles, or use the data to improve their risk modelling.

Consumers also benefit from a simplified application process that lets them skip the paperwork and can get them results in a matter of minutes.

Let's be honest: making accurate risk assessments can be hard. The tools most commonly used today aren't always up to scratch, and fail in detecting several risk factors. Factors that show the client's authentic risk, but can lie hidden in their transaction history.

Of course, this is like trying to find a needle in a haystack unless predictive data engineering is in hand. Having a granular set of data makes a big difference towards helping lenders improve their prediction models..

Besides, applicants want a quick answer and there are many alternatives that can get them the funds, fast. So having a seamless and instant digital application process is crucial – people aren’t exactly keen on providing a lot of paperwork and waiting days for an answer. They want to get a ‘yes’ or ‘no’ right away.

So, how can you get more applicants, lend more, onboard digitally (and quickly), improve your risk modelling and increase the Gini? That’s what Tink’s new product, Risk Insights, is here to solve.

Review applicants with a more detailed perspective

Banks and lenders have been using various tools to assess a potential customers’ risk profile.

One of the most common is credit reports. The details and score shown in a credit report are typically based on the person’s loan engagements. And the data in these reports refer to activity from six months prior (in most cases).

But of course – ideally, lenders would see applicants’ most recent activities. Say, with real-time data that shows their current finances.

The other drawback with credit reports is that it doesn’t always show the ‘true’ risk. They can’t always spot if applicants are engaging in risky behaviours, such as gambling, or if they’re having a hard time making ends meet and often end up in overdraft. Other behaviours like ATM withdrawals could be a risk factor to consider (since cash usage isn’t trackable). All of those are relevant information that aren’t really covered by credit reports.

Tink’s Risk Insights solves that, because it bases the analysis on their real-time data (so you have all the current information), while also considering statistics and patterns in the customers’ historical transactions to make more well-rounded assessments and predictions.

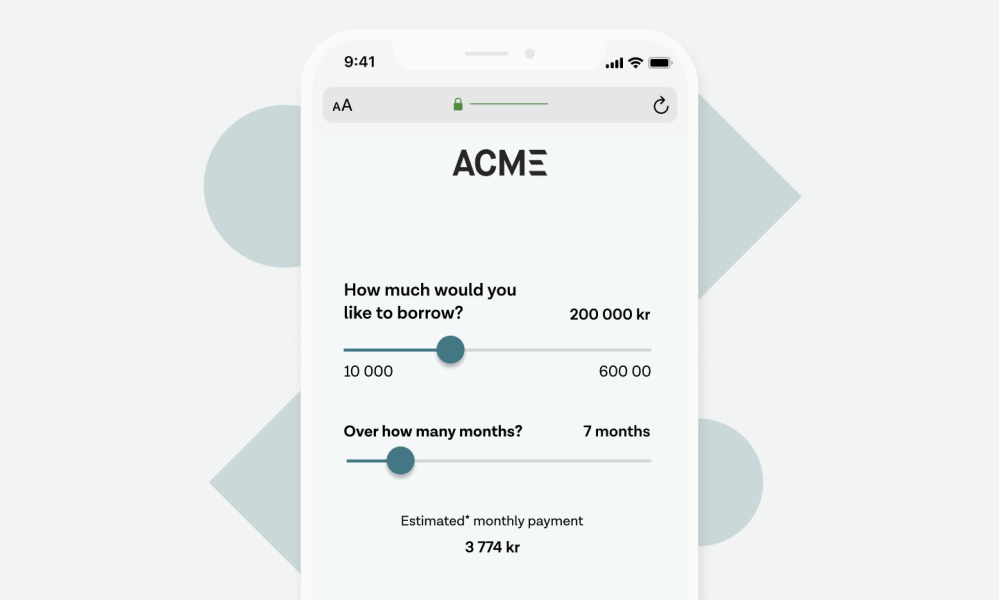

User chooses the loan amount and maturity to apply for a loan

Reduce onboarding time from days to minutes

Now let’s take a look at the process from the applicants’ perspective. What does the customer journey for a traditional low ticket consumer loan or credit card application look like?

In most cases, the application can be done online, with users needing to submit some paperwork (such as payslips, or ID documentation). The lender might then request additional information or documentation. Additionally, a credit check would be done (regardless of the loan size). And each credit inquiry could potentially decrease the applicant’s score.

All in all, we’re talking days (if not weeks) to get an application processed and approved. That’s a lot of waiting.

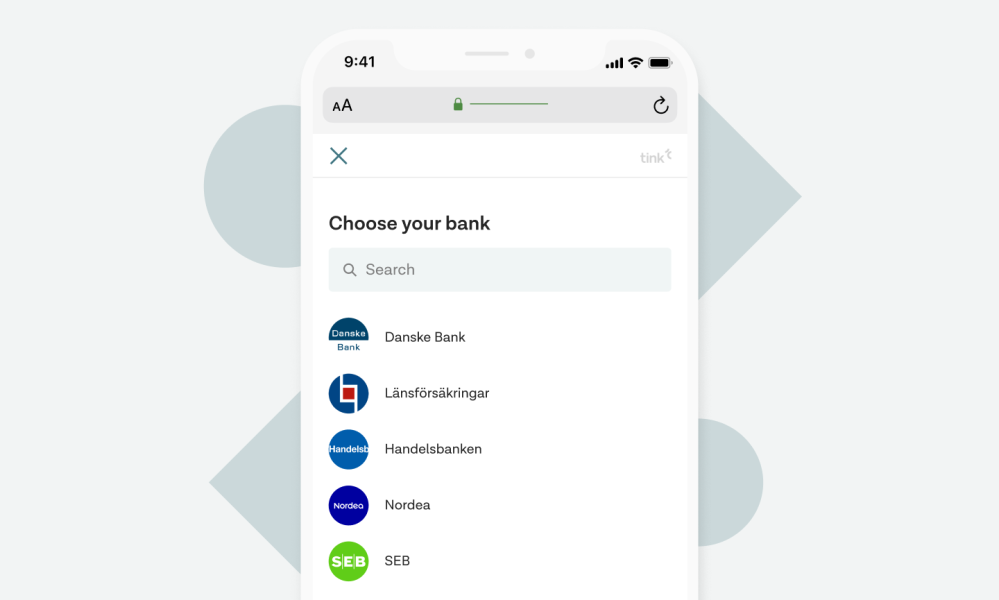

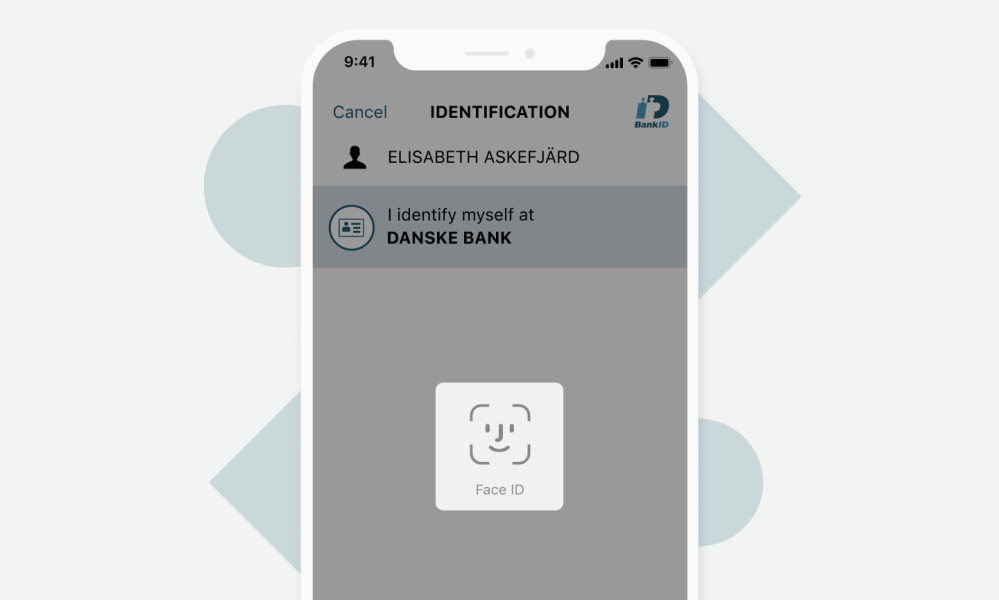

With Risk Insights, you can streamline that process – receiving the applications digitally, giving decisions instantly and without affecting the applicant’s credit score. How?, you ask...

How it works

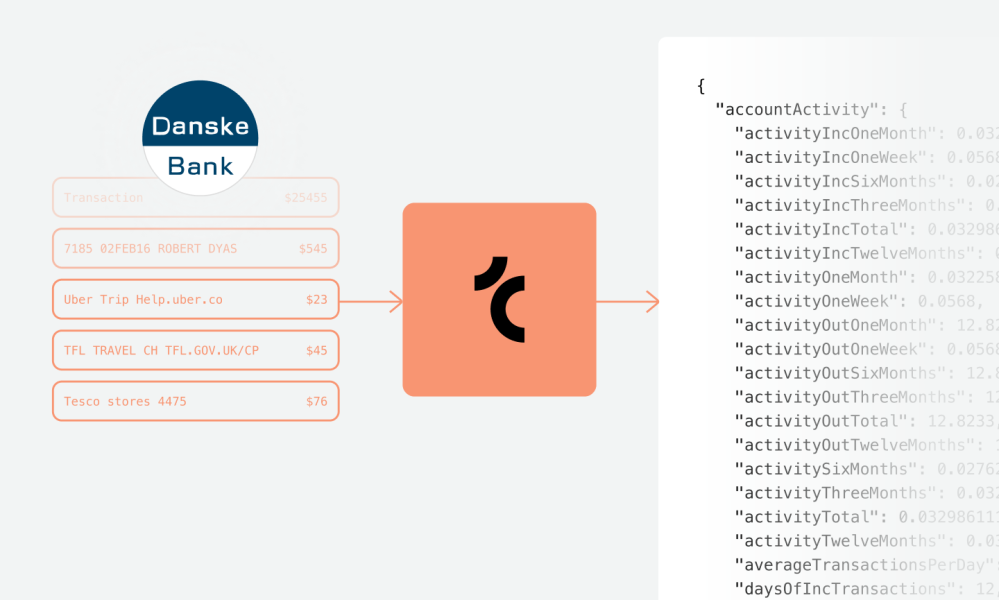

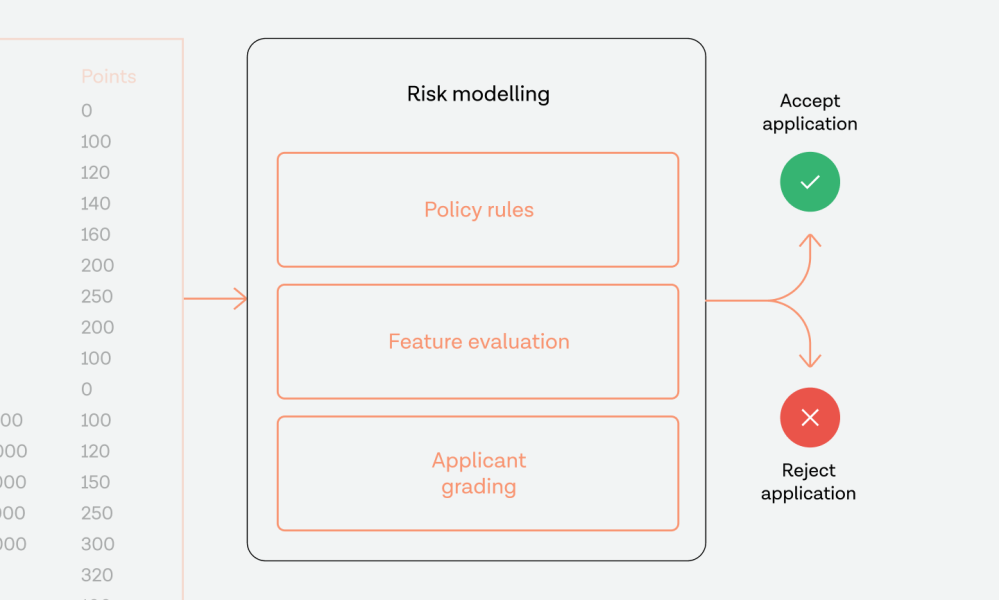

Risk Insights could be described as an ‘MRI scan’ of someone’s financial health. It uses open banking to perform in-depth risk analysis using the customer’s transaction data.

Basically, it gathers all the applicant’s transactions straight from their bank accounts (with their consent), filters and groups the relevant transactions, and produces an insightful report based on an evaluation of the historical streams.

Creditworthiness of the applicant is determined by analysing their risk appetite, spending behaviors and financial habits.

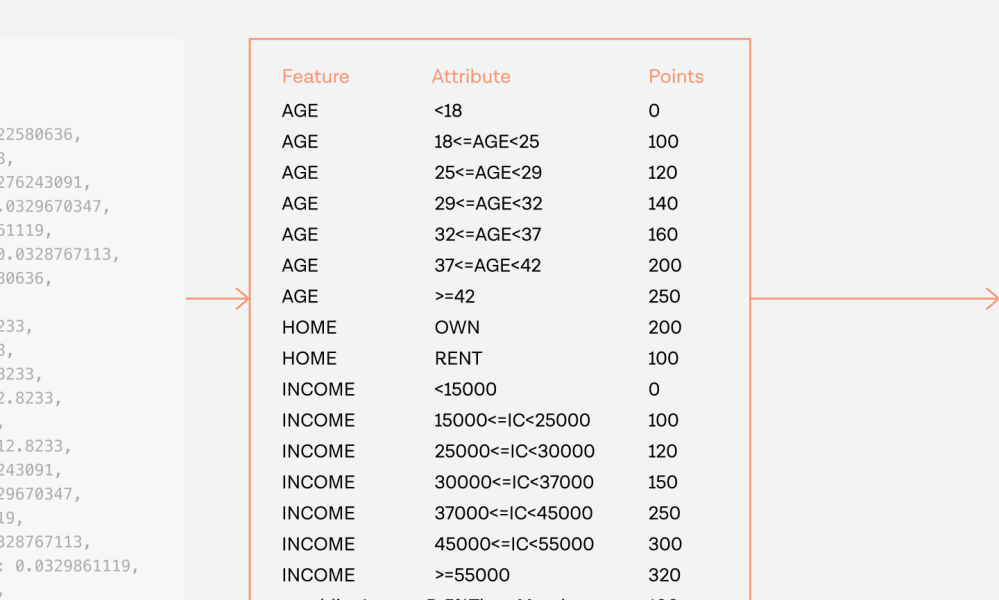

The Risk Insights product filters the relevant transactions based on machine learning analysis of millions of loan applications giving it more predictive power and giving lenders detailed information that goes beyond outdated credit reports. Alternatively, it helps lenders improve their in-house risk modelling by giving them more data, and insights based on over 300 engineered features that they can implement as they see fit.

As a result, risk metrics such as Gini and NPL ratio are improved, the customer portfolio becomes more solid with an improved business model, and the applicant gets results – and their loan – in a painless and timely manner..

Get in touch

Tink’s Risk Insights is currently available in select markets (you can check the product page for the full overview).

Whether you’re a bank aiming to have stronger loan portfolios and provide a better customer experience, or a digital lender looking to streamline credit assessment models, we’d be happy to chat about how we can help. If you have any questions or would like to get started – get in touch.

More in Product

2025-10-07

7 min read

Beyond instant: Building reliable Pay by Bank payments

As instant payments roll out across Europe, merchants still face challenges with reliability and settlement. Our Smart Routing and Risk Signals products provide a reliability layer for Pay by Bank, optimising payment routes and blocking likely-to-fail transactions.

Read more

2025-02-06

6 min read

Introducing User Match: Built-in name verification to make security fast and easy

Discover how the latest feature of our verification products, User Match, is improving security by verifying users' names when adding bank accounts, reducing fraud and enhancing account protection.

Read more

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.