The full SPAA treatment – Tink signs up for new EU scheme

As a founding member of the SEPA Payment Account Access Multi-Stakeholder Group (SPAA MSG) back in 2019, Tink has now entered the official register to become one of the first participants of the European Payments Council’s (EPC) newly launched scheme. We explain why SPAA was needed and how it could be the catalyst to transform account-to-account (A2A) payments in the European Union (EU) in the future.

Tink has joined the SEPA Payment Account Access (SPAA) scheme, which aims to transform account-to-account (A2A) payments in the EU by providing standardised rules and incentives for banks to invest in APIs and real-time payments infrastructure.

SPAA offers a modular approach, allowing participants to combine various services to create innovative payment solutions, such as dynamic recurring payments and payments to multiple counterparties, enhancing user experiences and reducing costs for merchants.

SPAA, along with other forthcoming regulations like Instant Payments Regulation, could drive increased digital adoption, payments innovation, and competition across the EU, benefiting both businesses and consumers.

Five years in the making, the launch of the new SPAA Rulebook and Scheme Default Fees in November 2023 represented a watershed movement for A2A payments in the EU, setting a standard for an industry-led approach to build upon the twin opportunities of open banking and instant payments. Although the new Rulebook has not yet generated many column inches outside of the dedicated payments press, it could potentially reshape how people pay each other across the region over the coming years.

What is SPAA and why is it important?

SPAA aims to solve a conundrum that became evident as the dust began to settle on the full implications of the revised Payment Services Directive (PSD2): to unlock the opportunities of open data access – which the PSD2 architects were keen to enable – while ensuring that banks are sufficiently incentivised to invest in maintaining application programming interfaces (APIs) and (real-time) payments infrastructure. After all, it was the banks who were set to incur the costs for these new rules and requirements. Without a sustainable commercial model, it could discourage further investment and innovation. This problem is not unique to the EU.

In the UK, The Future of Payments Review, which was published around the same time as the new SPAA rulebook last year, also wrestled with this issue, highlighting that the current regulations do not provide a suitable economic incentive for banks to maintain their APIs. It concluded that this could lead to a “reluctance to invest in consumer protections” and “ongoing challenge to maintain regulatory performance standards”.

SPAA may offer a solution to this contradiction. On the one hand, it is a simple messaging scheme that provides a set of rules and standards for facilitating the exchange of different types of payments-related data (including credit card data) between asset brokers (like Tink) and asset holders (like banks). But it also provides the conditions for allowing asset holders to offer chargeable premium API services, which can be used to provide value add to complement existing consumer data access rights under PSD2, or can be offered as separate standalone services.

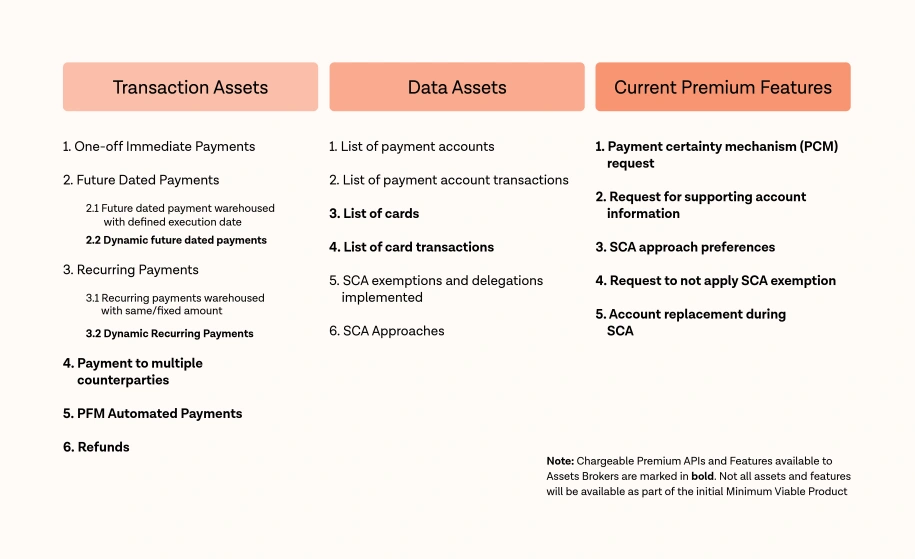

Think of SPAA as like a smorgasbord of transaction and data assets (see image below) that will be made available to scheme members that join. Participants can then simply pick and choose from a selection of available services, combining them to create all manner of unique solutions and possibilities. This modular approach allows payment firms such as Tink to support our merchant customers with innovative and tailored payment solutions that best meet their specific needs and customer journeys.

SPAA’s smorgasbord of Transaction and Data Assets, and Premium Features

For example through SPAA, an asset broker could combine a future dated payment with a premium feature such as a payment certainty mechanism. This could reassure an online merchant to immediately release the goods or service, such as a pre-order of a newly launched product where having the items on ‘Day 1’ is essential to the customer experience, in the knowledge of guaranteed payment.

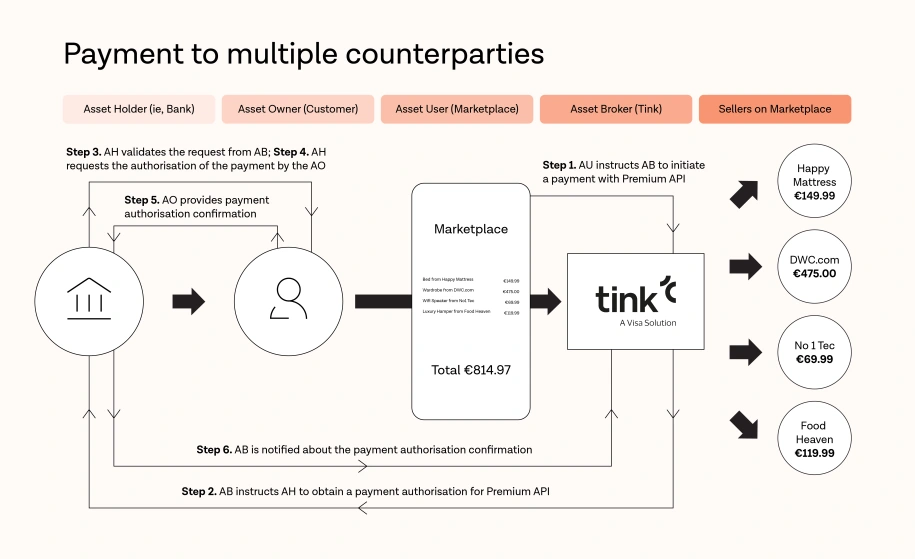

For merchants trading on the growing array of digital marketplaces, a potential pain point occurs when a customer wants to purchase a range of goods or services from different sellers. Depending on the type of marketplace, the merchant must either rely on their Payment Service Provider (PSP) accepting payment for the whole transaction, and then later allocating funds as appropriate, or the customer must make separate transactions for each seller. With SPAA’s payment to multiple counterparties, it could be possible for consumers to pay with a single payment that can be immediately divided among the different sellers, potentially reducing costs and delays in receiving the payment.

Another such chargeable premium API is Dynamic Recurring Payments (DRP), which in the UK is known as Variable Recurring Payments (VRP). DRP is like a more flexible direct debit payment, allowing billers to create a payment mandate within certain parameters, such as frequency and amount, which is ideal for scenarios where amounts can change from month to month.

Perhaps the biggest advantage of SPAA, however, is it is more than the sum of its parts. It allows businesses to tailor the way they receive payments to match the user scenario. This is particularly useful for merchants that want to experiment with offering new types of services. For example, an online specialist grocery store may want to expand from providing a simple storefront for one-off purchases, to trial a bespoke subscription service providing a regular delivery of the best seasonal produce. It may also want to allow its customers to set the parameters of the delivery box to reflect variances in price and availability during the year. Rather than use existing payment methods that may not be suitable, with SPAA you can tailor the user experience to better support the type of purchase.

Andrew Boyajian, Tink’s VP of Payments and Customer Experience, said: “Having played a key role in shaping SPAA to this point, it’s brilliant to be among the first participants to join the scheme.

“From the very first industry discussions five years ago to create SPAA, Tink has been convinced that a sustainable and commercial model benefitting all parties was key to realising compelling and competitive A2A payment solutions. But this is just the start. We encourage banks and other third-party providers to join us in SPAA and help bring about a new era in A2A, delivering choice and innovation to European payments.”

Path to Success

Merchants and businesses are already beginning to see the potential for SPAA. Atze Faas, payments advisor at EuroCommerce, the EU’s largest retail and wholesale trade federation, told Tink that they estimated between 8-15% of the combined number of A2A, card and cash transactions could shift to SPAA by 2033.

Faas said: “Obviously, these numbers will only materialise if the merchants receive attractive business conditions. There needs to be compelling consumer propositions, but also the total cost of ownership will have to be very competitive for merchants.”

However, he noted: “We’d rather pay something for standardised, performing APIs that work than have free PSD2-compliance APIs that are not standardised and at times don’t work.”

SPAA will also likely benefit from the EU’s forthcoming Instant Payments Regulation (IPR). The new regulation will mean that any PSP, such as a bank, which provides standard credit transfers in euro, will also be required to offer and accept instant payments in euro. In addition, they will be unable to charge a fee for instant payments above what they charge for standard credit transfers.

Meanwhile, instant payments continue to grow across the EU, reaching 17% of SEPA credit transfers in Q3 2023 according to the EPC. The aim of the IPR is to accelerate this adoption, by ensuring full reachability across all EU bank accounts, while removing its price premium, to encourage instant payments as the default choice for A2A payments. It could also incentivise the adoption of SPAA by banks, as it can allow them to generate a return on their investment in instant payments.

Importantly, combined with SPAA, instant payments can expand way beyond a simple replacement for existing SEPA credit transfers.

SPAA can bring increased choice and payments innovation across the EU, improving existing payment flows, support emerging new use cases, and offering improved overall customer experiences that can drive further digital adoption.

Based on European Central Bank (ECB) data, the average EU citizen makes 325 non-cash payments each year. However, there is significant unevenness across the region in terms of usage. Germany, the EU’s largest economy by GDP, is slightly above the average at 332 transactions per capita, but is significantly behind Sweden (617).

To put this in perspective, if Germany were to reach the levels of non-cash usage that Sweden currently has, this would mean an additional 24 billion non-cash payments in the economy. A2A payments are already the most preferred payment choice in Germany, accounting for just under two-thirds of all non-cash payments. Therefore, SPAA could be a catalyst to help realise Germany’s full payments potential, improving existing A2A user experiences, increasing competition and driving further digital adoption.

---

As ever, should you wish to speak to one of our team about the latest industry developments, then please don’t hesitate to reach out.

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.