The case for “Pay by Bank” as a global term

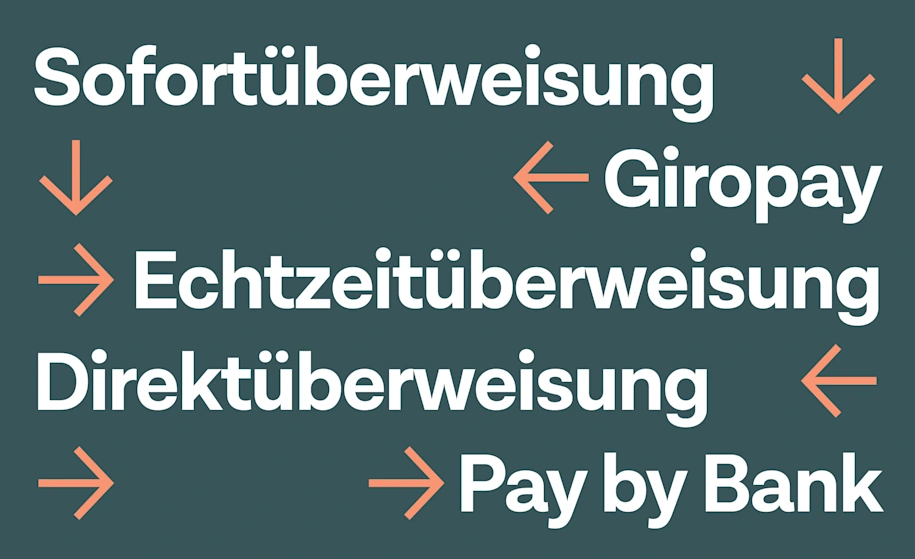

How many ways are there to describe paying directly from your bank account? In Germany alone, there are at least half a dozen. And that’s part of the problem.

Adopting "Pay by Bank" as a standard term for open banking-powered account-to-account payments can reduce confusion, build trust, and boost adoption across the industry

Clear naming conventions are essential for regulatory compliance and consumer confidence, especially as open banking continues to scale

Pay by Bank is gaining international traction and offers a brand-agnostic, scalable solution that aligns with modern open banking innovations

By Thomas Gmelch, Head of Commercial, Central Europe

Digital payments have come a long way. In just the past five years, we’ve seen open banking move from concept to reality, with APIs, regulations, and new technologies reshaping the landscape. But as the infrastructure evolves, the language around it hasn’t kept pace.

Today, one of the most promising payment experiences – where users pay directly from their bank account – goes by too many names. Sometimes it’s a branded name, like Sofortüberweisung or giropay. Other times it’s a generic term, like Echtzeitüberweisung or Direktüberweisung. And now, increasingly, it’s being referred to as Pay by Bank.

Here I make the case for why that last one, Pay by Bank,should become the standard. Because naming matters. And in a fast-moving ecosystem, a clear, universal term doesn’t just reduce confusion. It builds trust, boosts adoption, and helps the entire industry grow.

It’s not just about language – it’s about trust

Universal naming conventions help set clear expectations, build consumer confidence, and reduce friction at checkout. When people know what a payment method means, they’re more likely to use it.

From a regulatory perspective, the need for clear standards has never been more urgent. As open banking continues to scale, frameworks like the EU’s Instant Payments Regulation (IPR) are pushing the industry towards safer, faster, and more transparent transactions. But regulation alone isn’t enough. Standardisation in naming also plays a role in building trust. When consumers understand exactly what a payment method is and how it works, adoption follows.

At Tink, we’re not only building the infrastructure behind these experiences. We’re also working with regulators and partners to create the conditions where open banking can thrive – and that includes making the language around it simpler and more consistent.

Just think about how “PIN” became a household term. Most people don’t even know it stands for Personal Identification Number - they just know it’s how they pay. Same with ATM, IBAN, or even branded names like PayPal or Apple Pay. These terms have become second nature, even across borders.

Now compare that with “Pay by Bank”, a modern, open banking-powered way to pay directly from your bank account. It’s simple, secure, and increasingly available. But the terminology around it? A complete mess.

Too many terms, too much confusion – what’s the difference between Pay by Bank and... everything else?

Consumers in Germany are used to seeing different names for what is essentially the same experience – paying directly from their bank account. But the naming isn’t just varied. It’s confusing.

Some of these names are well-known brands, like Sofortüberweisung or giropay, while others are generic terms, like Echtzeitüberweisung or Direktüberweisung. Some refer to specific providers or payment methods, others to payment rails or speeds. But to most users – and even many merchants – the differences aren’t always clear.

Let’s unpack some of the most common terms we hear in the market – and how they compare to what we mean when we say Pay by Bank.

What’s the difference between Pay by Bank and Sofortüberweisung?

Sofortüberweisung, one of the earliest Pay by Bank options in Germany, allowed users to pay directly from their bank account using their online banking login. After acquiring Sofort in 2014, Klarna continued to offer Sofortüberweisung alongside its own Klarna Pay Now product. As of 31 March 2025, Klarna has fully discontinued the Sofortüberweisung brand, meaning merchants now need to switch to Klarna Pay Now or integrate other Pay by Bank options.

This shift is a good reminder of why a clear, brand-neutral term like Pay by Bank is valuable — it helps future-proof the payment experience as individual brands and platforms change or phase out.

Is Echtzeitüberweisung the same as Pay by Bank?

Not exactly. Echtzeitüberweisung refers to a specific infrastructure: SEPA Instant Credit Transfer, where funds are sent and received within seconds.

Pay by Bank may use this rail behind the scenes, but it describes the checkout experience, not necessarily the settlement speed. So, while some Pay by Bank flows are built on Echtzeitüberweisung, others still rely on standard SEPA.

Is giropay a type of Pay by Bank?

Giropay was a branded Pay by Bank method offered by German banks, allowing users to pay online using their regular online banking credentials. It worked similarly to systems like iDEAL in the Netherlands or MyBank in Europe. It was officially discontinued in December 2024.

While giropay was a key example of Pay by Bank in Germany, its phase-out only reinforces the need for a clear, universal term that can outlast individual brands. That’s where “Pay by Bank” comes in.

What’s the difference between Pay by Bank and Direktüberweisung?

In many ways, Direktüberweisung and Pay by Bank describe the same kind of payment experience – paying directly from a bank account. The term Direktüberweisung simply means "direct transfer" and is often used interchangeably to describe bank-initiated payments made online.

But here’s the issue: Direktüberweisung isn’t clearly defined. It’s a generic term, not tied to any one flow, user experience, or technology. It might refer to a manual transfer, a branded service like Sofort, or a modern open banking flow – which makes it hard to scale or standardize.

That’s why we believe “Pay by Bank” is the better choice going forward. It’s clearer, more descriptive, brand-agnostic, and already gaining international traction. As open banking adoption grows and merchants look for consistency across markets, Pay by Bank offers the clarity and simplicity that both consumers and businesses need.

Is Online-Überweisung the same as Pay by Bank?

Online-Überweisung just means “online bank transfer”. It could mean logging into your bank to pay a bill manually or using a payment provider at checkout.

Pay by Bank narrows that down to a more specific, streamlined experience – paying during checkout, with a few clicks, directly from your bank account, and without needing to enter an IBAN or reference number.

What is Schnelle Bankzahlung and how does it compare to Pay by Bank?

Schnelle Bankzahlung literally means “fast bank payment.” It’s sometimes used in marketing copy but isn’t tied to any formal product. It might describe Sofort, giropay, or even a fast SEPA transfer.

Pay by Bank offers a clearer definition. It’s a payment method, not just a description – one where the user pays from their bank account, digitally and securely, within the merchant's checkout flow.

Why "Pay by Bank" should be the standard

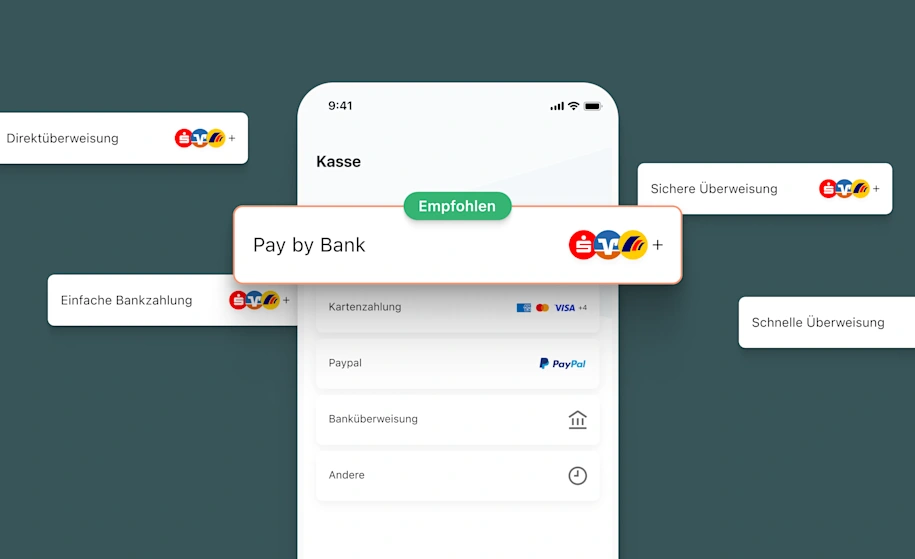

Adopting a unified term like Pay by Bank could significantly reduce the confusion surrounding open banking payments for both businesses and consumers. Tink has been around since the early days of open banking, so we’ve seen first-hand the confusion that both businesses and consumers have faced. So here are five reasons why I think Pay by Bank should become the gold standard:

No clear winner: Current usage is so fragmented that no single term has emerged as the definitive choice. This presents an opportunity to introduce a new, standardised term without rocking the boat too much.

International recognition: "Pay by Bank" is increasingly becoming an international concept. As cross-border transactions become more commonplace, having a universally recognised term will facilitate smoother transactions and potentially speed up the adoption of Pay by Bank globally. Even the big research companies, such as Gartner, Juniper, and Forrester are using the term.

It follows a familiar pattern: Just as terms like “Contactless”, “Cashback”, and “Wallet” have entered daily language across Europe, “Pay by Bank” is intuitive and easy to adopt.

It reflects the shift to open banking: "Pay by Bank" aligns with modern open banking innovations, such as those introduced by the EU’s second Payment Services Directive (PSD2). It represents a shift away from proprietary systems towards more open and global interoperable solutions.

It’s brand-agnostic and scalable: Unlike branded (and regional) terms such as Sofortüberweisung, Paydirekt, and Giropay, "Pay by Bank" is brand agnostic. Nobody owns it, so everybody owns it. Taking a non-branded approach can help bring a broader acceptance and trust among consumers.

It’s not one-size-fits-all, and that’s the point

To be clear, this is not about forcing a one-size-fits-all approach. Some merchants might find that “Direktüberweisung” resonates better with their customers. That is completely fine. In fact, some of our own customers have chosen to use other labels because it felt more aligned with their local audience.

But the strength of “Pay by Bank” lies in its flexibility. It is a white-label term for a white-label experience. Anyone can use it, and it works across use cases. The more we converge around a shared language, the easier it becomes to educate consumers, unify payment experiences, and build trust at scale.

Of course, as a company with account-to-account payment solutions in 20 countries and growing, we like to lead with “Pay by Bank” from a global point of view. As for the buttons that go into the box at checkout, we encourage merchants to use whatever phrasing works best for their customers, even if it’s not those exact words.

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

2024-11-19

12 min read

From authentication to authorisation: Navigating the changes with eIDAS 2.0

Discover how the eIDAS 2.0 regulation is set to transform digital identity and payment processes across the EU, promising seamless authentication, enhanced security, and a future where forgotten passwords and cumbersome paperwork are a thing of the past.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.