The key to picking an open banking payments partner: bank coverage

If you’re looking for an open banking provider to enable fast, seamless bank payments, you’ll need one that connects to a wide range of banks. This sounds like a no-brainer, but when all providers claim the broadest coverage it can be hard to determine what’s genuine and what’s hot air. So let’s uncover what really matters when it comes to comparing providers’ coverage, and the right questions to ask.

One of the most important criteria when picking an open banking payments partner is bank connectivity – the amount and quality of a provider’s connections to banks.

A lot of providers are misleading with their coverage figures, with ‘markets covered’ giving a false impression

Partnering with a proven open banking payments provider should be top priority, as scaling is complex and demands experience

As open banking payments have become more sought-after, the number of providers to choose from has risen too. Clearly, you’ll want to consider a range of factors to make sure you get the solution you’re looking for: product capabilities, user experience, ease of implementation, uptime, price, and so on. Arguably one of the most important factors of all is bank connectivity – the amount and quality of a provider’s connections to banks.

More bank connections means your service can reach more customers, but that’s only part of it. Those connections are worth little if they’re not well-functioning and reliable. To deliver the highest possible conversion rate – because that’s what matters in the end – an open banking provider needs to have strong coverage in the markets relevant to your business, but also the experience and resources to continually maintain and optimise them. Open banking is still an emerging industry, after all, and ensuring a seamless user experience requires deep connectivity expertise built up over years.

What ‘coverage’ really means

Comparing coverage between providers can be hard since they don’t all define it in the same way. Some may claim ‘21 markets covered’ yet the percentage of banks they’re connected to in a given market may be well below 100%. What’s more, not all bank connections are created equal, so it’s important to understand the type and quality of connections on offer. And finally, having a connection to a bank means little if it’s not properly maintained or tested, or isn’t reliable enough to support any real volume.

Ask for percentages

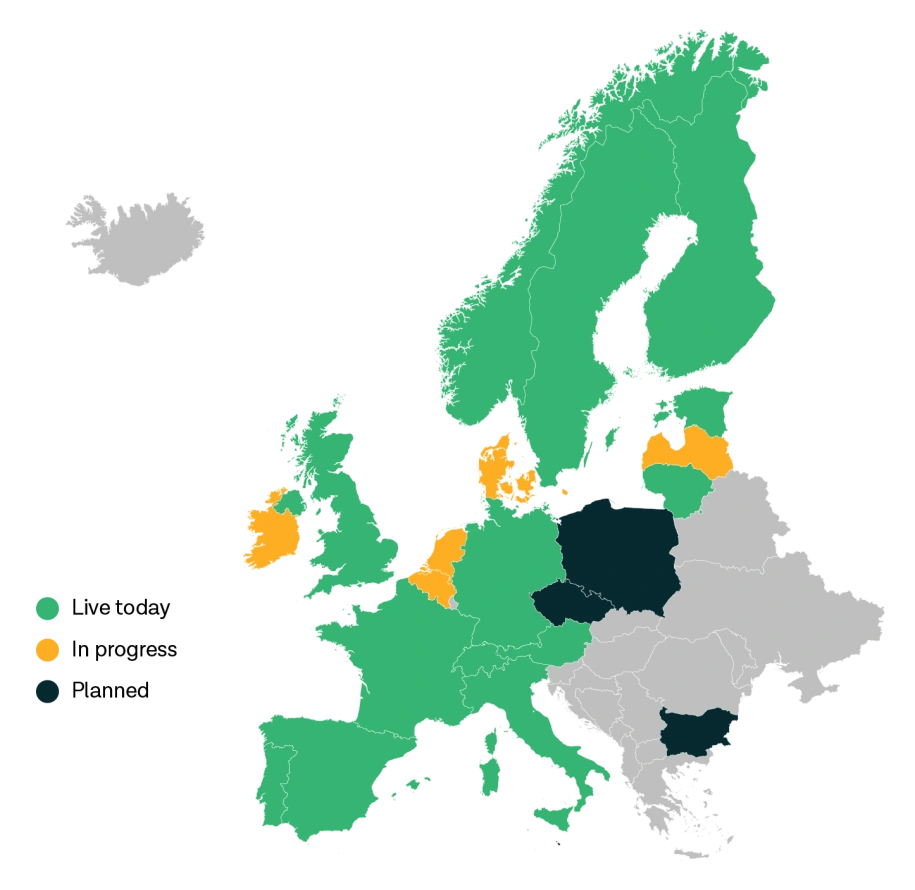

To understand real coverage, it’s best to talk in terms of the percentage of major banks or the banked population covered in a given market. At the time of writing, Tink covers 90%+ of banks in 13 European countries, rising to 95%+ in major markets like the UK, France, and Germany. We consider a market to be ‘live’ when at least 95% of the banked population is covered.

Tink payments bank coverage as of August 2022.

Source: https://docs.tink.com/market-capabilities/payments

Some providers also invest more heavily in growing their coverage than others. That’s why it’s critical to ask about their plans to increase coverage in the months to come. At Tink our teams are constantly working on unlocking new markets – earlier this year we launched payments in 5 countries (the Netherlands, Norway, Estonia, Finland, and Lithuania) – and strengthening our coverage in existing markets. As Ivan Chalov, Head of Retail at Revolut put it recently: ‘Our partnership with Tink will enable Revolut to expand our open banking services across new markets in a fast and sustainable way.’

Questions to ask your provider:

What percentage of banks do you cover in market X, Y, and Z?

What percentage of the banked population does this translate to?

What are you doing to increase your coverage in the next 6 to 12 months?

Connectivity, uptime, and conversion

The strength of a provider’s connectivity should be judged on uptime and, ultimately, conversion rates. Claiming full coverage across Europe is easy on paper – delivering seamless user experiences with real traffic at scale is harder.

Bank connectivity is one of many factors that influence open banking conversion rates, but it’s an important one (we cover the others in detail in our UX guide). If a connection is unstable or goes down for any reason, your conversion rate will suffer. That’s why our teams at Tink work obsessively to optimise our back-end connectivity infrastructure, on top of A/B testing and tweaking the front-end user experience.

One way we do this in some markets is by building and maintaining multiple types of bank connections – using both PSD2 APIs and reverse engineering. In an ideal world, the PSD2 APIs maintained by banks would be 100% reliable, 24/7, and provide the same functionality and experience as the bank’s own customer interface. This simply isn’t the case yet, despite recent major improvements and stronger enforcement of regulation (Tink actively collaborates with industry authorities in this regard). In the meantime, Tink’s stance is simply to use the best connection available for the purpose, with an emphasis on compliance and security. For the vast majority of banks in most of our markets, this means using PSD2 APIs – but not always.

Building multiple connections of different types to the same bank gives us the ability to use the best-performing connection, and provides a fallback option if and when a bank’s API goes down. This serves to maximise uptime for our customers, and ensures that bank outages or technical errors affect conversion rates as little as possible.

Questions to ask your provider:

What percentage of your API connections do you own and maintain in-house?

Do you maintain other connection types as a fallback option?

What’s your conversion rate per country?

Platforms versus aggregators

Another important consideration is to what extent an open banking provider builds and maintains their connections in-house, as opposed to aggregating other providers’ connections. Aggregators may offer comparable coverage on the surface, but they’re dependent on external services and have less control over the quality and reliability of their connections. This can mean higher fees (since the provider passes their costs onto you), an increased risk of technical issues outside your control, and slower response times. 100% of Tink’s API connections are built and operated internally, meaning we have full visibility and control over our coverage.

Questions to ask your provider:

What percentage of your connections are managed externally?

What’s the procedure if any of these external connections become unreliable?

Why scale matters

When you compare coverage you shouldn’t only consider the breadth of a provider’s bank connections, but the quality of each connection too. The reliability of an API connection can vary greatly depending on how heavily it’s tested and used. Which is why you should ensure your provider invests the time and resources necessary to properly test their connections.

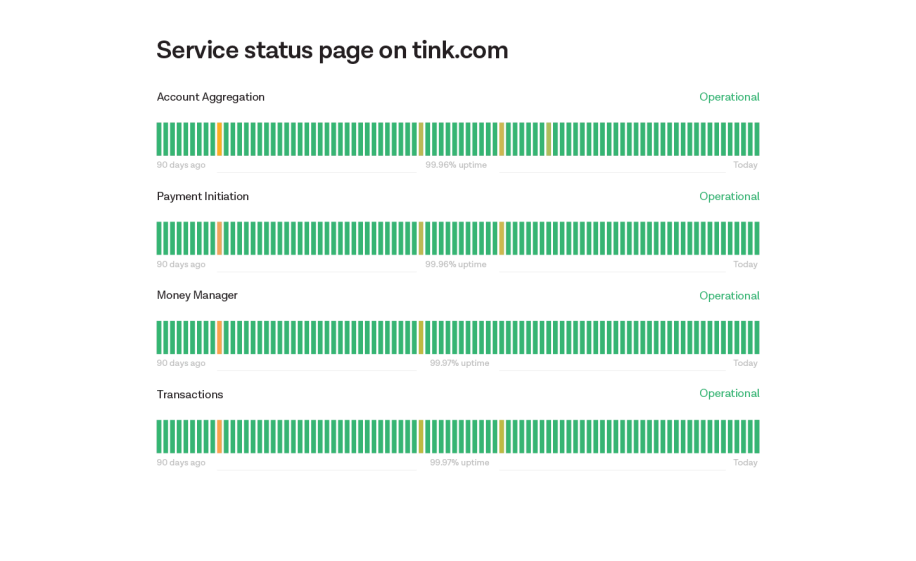

To be totally confident in the reliability of an API connection you need real-world traffic, and lots of it. Only by continuously processing a high volume of API requests can you uncover the otherwise hidden errors that can cause payments to fail. And ideally this volume is driven by a wide variety of customers with different use cases, since this helps in teasing out kinks and edge cases. Tink handles over 1 billion monthly API calls across both account information and payment initiation services, with 99.9%+ uptime. You can check the current and historical status of our APIs here.

Source: status.tink.com, 18 August 2022

Questions to ask your provider:

How much volume do you process in market X, Y, and Z?

How do you test and maintain your bank connections?

What’s your uptime?

Find a partner who’s been there, done that

Open banking has matured at different speeds across Europe, which makes experience and know-how key in choosing the right provider. While banks in the UK and Nordics are furthest ahead, every market has its own nuances, ranging from regulatory and technical requirements to consumer behaviour.

It’s only through months (if not years) of testing, debugging, and optimising at scale that it’s possible to find the edge cases and errors that would otherwise cause failures. These edge cases are never described clearly in bank API documentation. Providers that have rigorously tested their connections across Europe with real volume and across many different use cases naturally have a head start in terms of conversion and user experience. At Tink we spend a lot of time working directly with banks to improve their APIs, monitoring and reporting on API statuses in each market and, as a member of key industry associations, we actively lobby both EU and UK regulators on behalf of our customers.

Tink is one of the first movers in open banking with connections to over 3,500 banks and payment providers across Europe and over 2 billion transactions processed every month. We constantly test and optimise our connections and user journeys on a country-by-country basis, and have teams dedicated to doing exactly this for all 18 markets in which we have a presence (we’ve summarised some of our UX learnings in this guide). In short, we’ve done this before, and our dedication to becoming the leading open banking platform worldwide means we’ll continue to expand and deepen our coverage for the long term.

To learn more about open banking connectivity and why there’s more to it than meets the eye, check out our in-depth connectivity guide.

Tink’s guide to open banking connectivity

Uncover the hidden complexities and day-to-day operations involved in testing and maintaining open banking connections.

Get the guideMore in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.