28% of self-employed struggle to access financial services – here's how open banking can help

Twice as many self-employed people struggle to access the financial services they need versus the national average. Over a third of self-employed workers also believe that they’ve been negatively impacted and feel discriminated against when it comes to accessing financial services.

Self-employed customers are often overlooked and feel discriminated against when it comes to risk assessments.

Twice as many struggle to access financial services when compared to the national average.

Open banking can lead the way for a more tailored, data-driven approach to lending.

For years, there has been a significant disconnect between the self-employed and financial services. Many factors make this the case – from a perceived lack of financial stability to risk assessments not being flexible enough to truly understand their financial situation. To a lender, a stable income is preferred over an irregular one – even if the irregular income may actually be larger when cumulated than a stable one. This causes a great divide in loan origination, where more irregular ways of earning income (such as self-employment) are bypassed to the benefit of those on the payroll.

The self-employed vs financial services

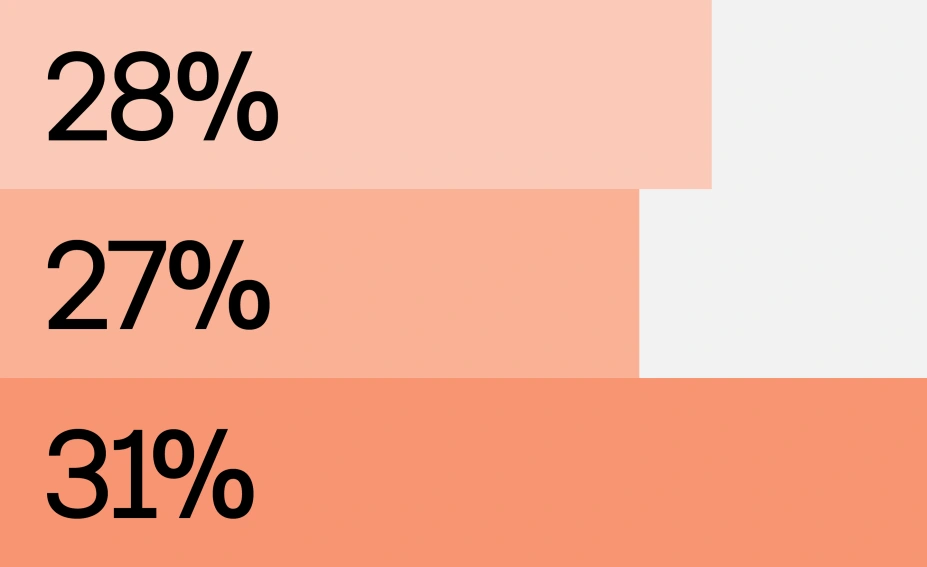

New consumer research from Tink has revealed that over a quarter (28%) of the UK’s self-employed struggle to access the financial services they require, leading many to believe the current system works against them due to their employment status. According to the survey of UK consumers, a staggering 27% of self-employed people feel they have been actively discriminated against whilst trying to access financial services. In addition, a third of the self-employed (33%) believe their employment status has been an obstacle to getting a mortgage, and 31% believe it has affected their ability to obtain credit.

As proof, more than 15% of self-employed people say they have been rejected while trying to secure a mortgage, which is twice as many as the national average (7%). Meanwhile, some self-employed people struggle to get accepted for core personal banking services such as current or savings accounts (16% vs 7% national average).

Providers can do more to help all types of consumers

In the UK alone, sole traders contribute a whopping 303 billion to the economy, highlighting the need for a more tailored, data-driven approach to financial support for the self-employed. Traditional credit checks and complex, paper-based processes can be time-consuming and end in higher abandonment or rejection rates, especially for those with a non-traditional income pattern, such as the self-employed.

With open banking, there’s a better way. With the consumer’s consent, financial services providers can access their transactional data to get a more rounded view of their income, spending behaviours, and creditworthiness. This approach is more inclusive, giving all consumers, such as the self-employed, a fairer shot at being able to access financial services.

How open banking can help unlock inclusive consumer lending

Highlighting an issue is one thing. Solving it is another. Tink has focused on solving this issue with open banking for years, with one example being Income Check. Knowing that having a true understanding of a consumer’s financial situation is paramount to assessing affordability and creditworthiness, we developed a product that delivers real-time income data directly from the consumer’s bank account – with their consent, of course. What’s more, Income Check’s aggregated account information makes it possible to check alternative sources of income such as freelancer or consultancy fees, benefits, pensions, etcetera. It gives the lender a more nuanced and complete view of the applicant’s income – for the benefit of both lender and borrower.

Another Tink product, Risk Insights, allows lenders to understand a customer’s finances in-depth and detect possible risk factors based on data insights. It goes without saying that this helps improve risk management, but another benefit is that it opens up your services to an otherwise overlooked and underserved segment – self-employed workers. Given that these workers make up a big chunk of the UK’s GDP, it seems natural that those who adapt to open-banking-powered, tailored risk assessments stand to win big in gaining new customers.

Want to know more about how you can harness the power of open banking to give all customers a better experience? We’re always happy to answer your questions, big or small – just get in touch.

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.