Meet Merchant Information: providing bank customers with elevated transaction visibility

Today we’re introducing Merchant Information, a new solution that helps consumers easily recognise their banking transactions. As part of our Consumer Engagement offering, Merchant Information helps banks display clear and detailed transaction information in real time. That means happier bank customers – and fewer transaction enquiries, by improving the customer experience.

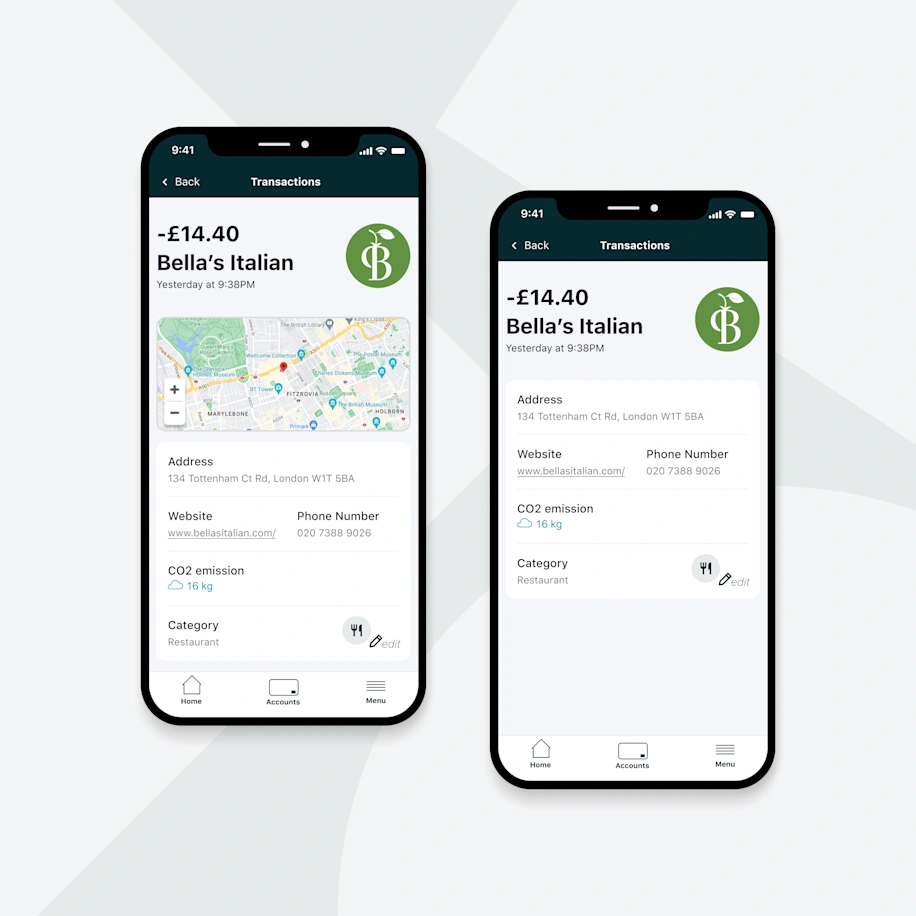

Tink has launched a new solution that cleans and enriches banking app transactions with the merchant name, logo, location and contact information.

Merchant Information will be available first in the UK, France, Belgium and the Nordics with a full European rollout expected to be complete by spring 2025.

Consumers can easily recognise their transactions, and banks will see fewer transaction enquiries as a result.

Consumers have come to expect detailed information to help them identify their purchases at a glance. Tink’s research shows that 45% of adults in the UK already want their bank to show them more details about their individual payments, such as logo, location and retailer name. With Merchant Information, banks can provide consumers with more understanding and clarity over their transactions.

Turning confusion into clarity

For those moments of panic spent scrolling through bank transactions to identify a purchase, lack of detail is often the culprit.

Merchant Information is designed to solve just this, offering better and more detailed transaction history. Our new solution transforms messy raw data into enriched transaction feeds – providing clear brand names, logos, locations, and merchant contact details so that consumers can then identify their transactions and better manage their finances.

For banks, Merchant Information reduces the need for consumers to contact their bank to enquire about transactions they don't recognise. This means cost savings from reduced call centre enquiries and transaction chargebacks. Tink's analysis indicates that large issuers can save as much as €22m annually by providing greater clarity to their customers.

Why Tink’s Merchant Information?

Tink’s Merchant Information works by leveraging Visa’s global data network of 130m+ merchants in 200+ markets as well as other third-party data sources for even more scaled coverage. The results? The ability to meet rising consumer demand for a more accurate overview of transactions in a visually appealing way.

Merchant Information includes a series of benefits for consumers and banks:

Reduce cardholder enquiries: the information simplifies transaction reconciliation, reducing transaction enquiry call volumes

Fraud prevention: greater ability to deter friendly fraud and improve fraud models through granular transaction information

A better digital user interface: the structured and clear transaction data drives in-app engagement and helps consumers to better understand and manage their finances

Increase customer loyalty: clearer information on customer spend enables greater personalisation of services to drive customer engagement

Tink’s Merchant Information will be paired with complementary data enrichment capabilities including categorisation and recurring transaction prediction. CO2 emissions enrichment can also be added giving banks the ability to provide consumers with a 360° understanding of spend. This can help grow digital relationships between banks and their customers – leading to increased share of wallet and loyalty.

The solution will be available in seven European markets in 2024 with a full European roll out to follow by spring 2025.

Jack Spiers, Banking & Lending Director at Tink,commented: “By providing a clear and understandable way of presenting bank account transactions, Tink’s new Merchant Information solution is a win-win for all parties. Consumers can easily recognise their transactions, reducing the need to contact their bank for additional information or to request a refund. While for banks, this opens up large potential cost savings, through fewer enquiries.

“Banks and merchants are increasingly interconnected in their digital transformation journeys. Tapping into Visa’s extensive merchant data network, we can enhance the customer experience to give consumers the 360 degree understanding of their spend they deserve.”

Interested in learning more about our new Merchant Information solution and how it can help move your digital services ahead of the curve? Get in touch.

–––

Consumer research was conducted by Censuswide on behalf of Tink in May 2024 amongst a nationally representative sample of 2,010 consumers aged 16+ in the UK. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.

More in Tink news

2025-12-10

4 min read

SMEs count the cost of Brits’ ‘Fear of Messing Up’ (FOMU) at checkout

Our latest research reveals that many UK consumers feel anxious about making mistakes when paying by manual bank transfer. This lack of confidence is driving abandoned transactions and undermining trust in the small businesses they buy from – while simple human errors continue to cause failed payments.

Read more

2025-12-03

2 min read

Fidelity introduces Tink’s Pay by Bank for account top-ups

Tink and Fidelity International have partnered to enable account top-ups via Pay by Bank for Fidelity’s Personal Investing customers and advised clients on the Fidelity Adviser Solutions platform.

Read more

2025-10-30

2 min read

Coinbase and Tink partner to launch Pay by Bank crypto payments in Germany

Coinbase and Tink have partnered to launch Pay by Bank in Germany, enabling secure, fast crypto purchases directly from users’ bank accounts and expanding access to the cryptoeconomy with a seamless, mobile-first experience.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.