Level up your affordability assessments

Upgrade your application process and build a solid customer portfolio via optimised affordability assessment. Leverage enriched data to verify customer financial data instantly. Avoid delays and elevate your customer experience.

Some industries we serve:

Retail banks & consumer finance

Challenger banks & online lenders

Property rental services, car leasing & gaming

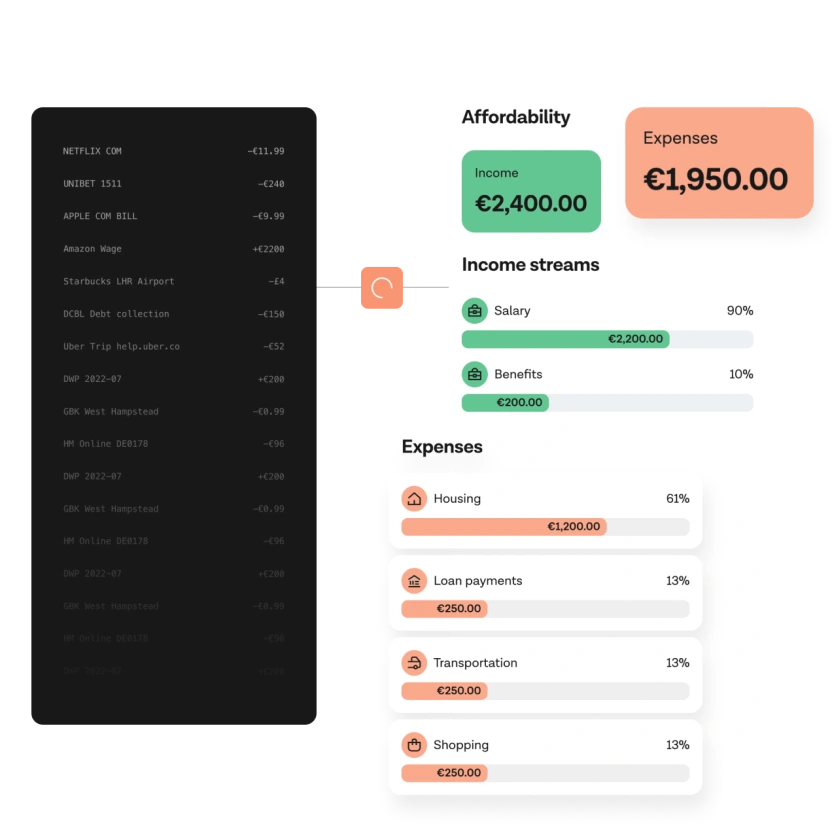

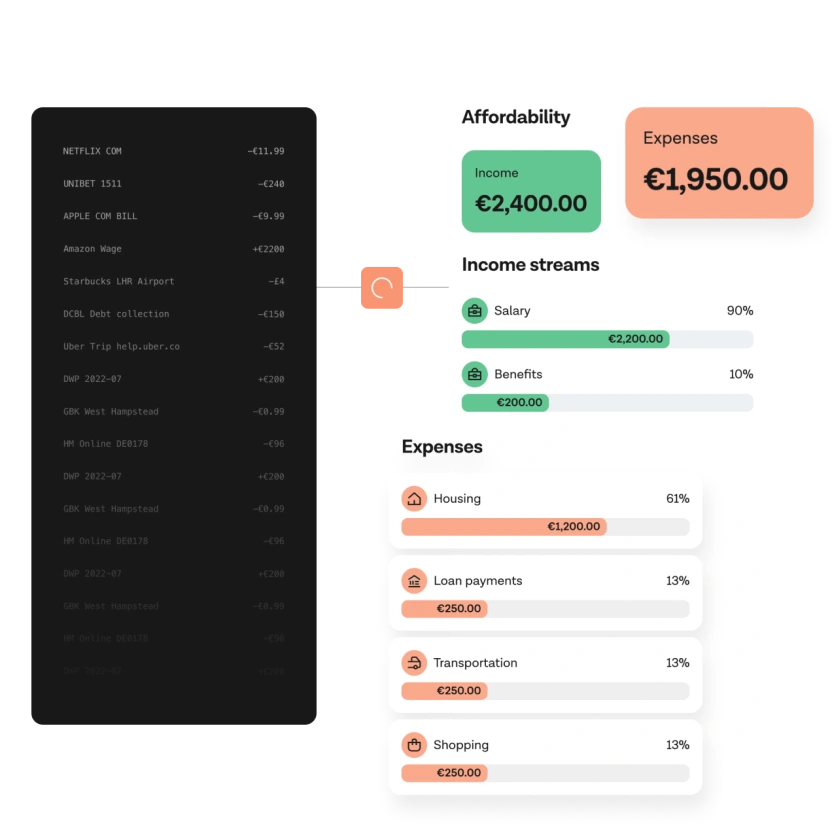

Assess and validate regular expenses to comply with regulations

Document actual regular expenses to cater to new regulatory creditworthiness guidelines accelerated by EBA and local authorities.

Learn more about Expense Check

Assess and validate regular expenses to comply with regulations

Document actual regular expenses to cater to new regulatory creditworthiness guidelines accelerated by EBA and local authorities.

Learn more about Expense Check

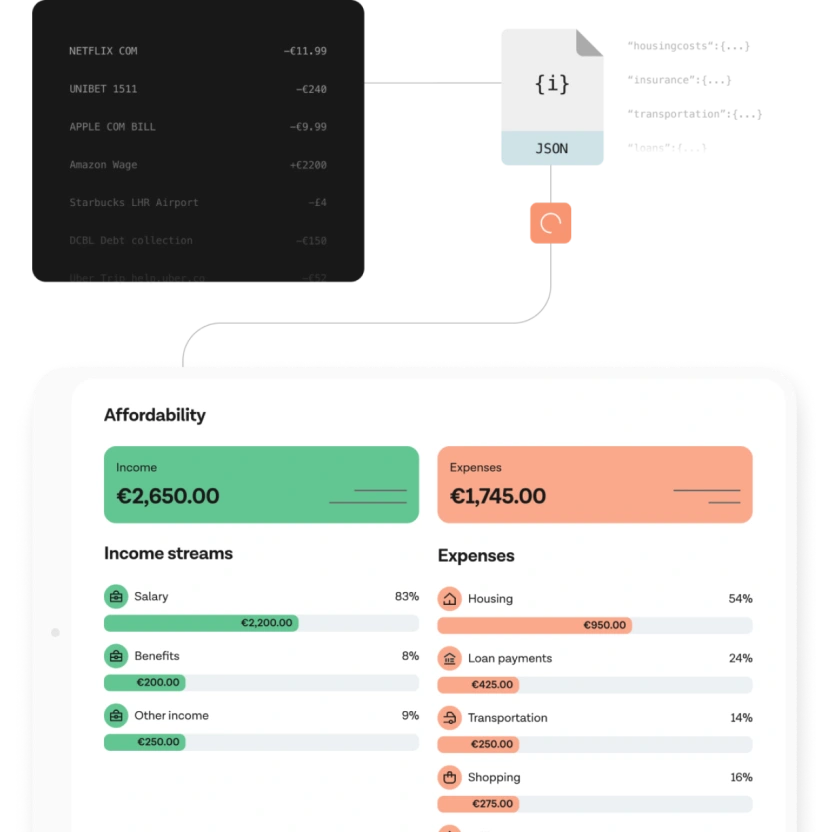

Analyse affordability with a granular set of data

Get a granular set of relevant transactions to feed into your affordability assessment. Improve your underwriting process while providing a more inclusive application experience.

Analyse affordability with a granular set of data

Get a granular set of relevant transactions to feed into your affordability assessment. Improve your underwriting process while providing a more inclusive application experience.

Onboard credit customers within minutes (instead of days)

Offer a seamless application process with pre-filled application forms and verified transaction data. Reduce friction and drop-offs due to manual input and paperwork from applicants.

Onboard credit customers within minutes (instead of days)

Offer a seamless application process with pre-filled application forms and verified transaction data. Reduce friction and drop-offs due to manual input and paperwork from applicants.

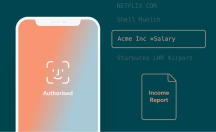

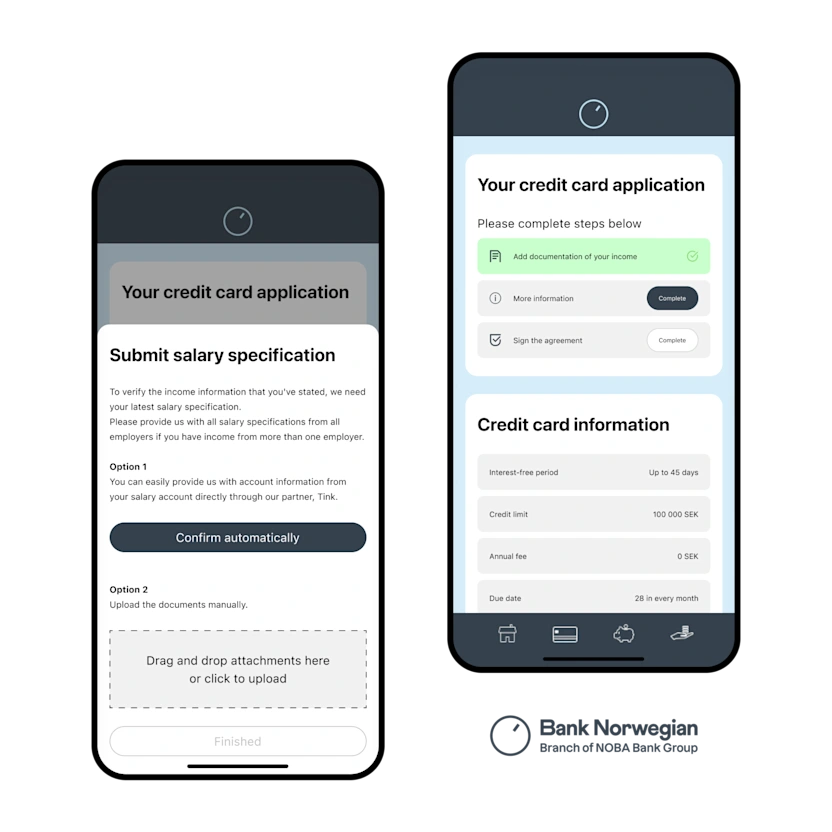

Bank Norwegian: automated and simplified

Challenge

As they expanded internationally, Bank Norwegian wanted to provide faster, simpler user journeys to their customers. They noticed that loan applications were one of the highest points of friction.

Solution

Tink’s Income Check lets applicants validate their earnings instantly and securely. Once the applicants choose the loan specifications to apply for, they simply click to verify, choose their bank account, and authenticate.

Income Check

Bank Norwegian: automated and simplified

Challenge

As they expanded internationally, Bank Norwegian wanted to provide faster, simpler user journeys to their customers. They noticed that loan applications were one of the highest points of friction.

Solution

Tink’s Income Check lets applicants validate their earnings instantly and securely. Once the applicants choose the loan specifications to apply for, they simply click to verify, choose their bank account, and authenticate.

Income Check

For industry leaders

“Responsible lending is all about granting the correct credit to the private individual that has the means to service the loan without compromising on other expenses. Tools such as those Tink provides for Bank Norwegian is an enabler of data that supports our philosophy as a provider of a pure digital customer journey.”

Peer Timo Andersen-Ulven

CRO at Bank Norwegian

Increase customer satisfaction and reduce fraud risk

Leverage Tink’s data enrichment solutions to enable users to apply for your services seamlessly and assess their affordability instantly.

Faster time to money

GF Money reduced application processing time from 2 hours to less than 10 minutes.

Decrease fraud

Tink’s Income Check, combined with Strong Customer Authentication (SCA) helps drop First and third/party fraud by up to 70% when compared to payslips.

Increase customer satisfaction

Substantial increase in end-user satisfaction for customers applying Tink’s affordability assessment solutions to their loan application process.

Open banking unlocks inclusive consumer lending

Elevate affordability assessments with enriched data. Streamline the loan application process to the benefit of both lenders and consumers through more granularity and inclusive lending.

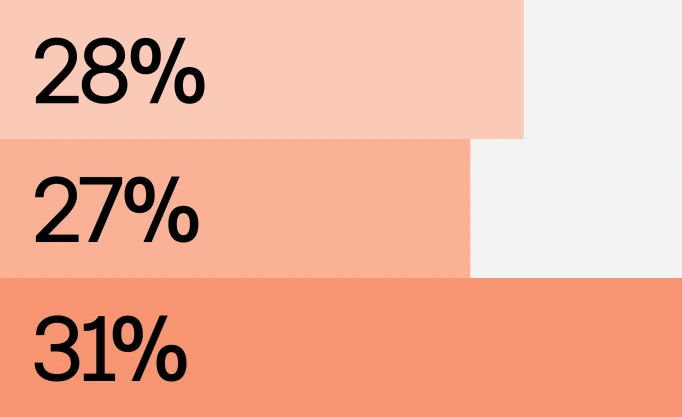

Read the report53%

Assess earnings correctly - 53% of UK lenders said in our latest survey that documents showing proof of income were most important when making decisions. Accurate assessments are much easier to achieve with Tink.

41%

Understand spending habits - according to top UK lenders, high friction in the application process often arises from monthly expense evaluation, with 41% of respondents saying that this was where they saw the highest applicant drop-off.

88%

Get to grips with new regulations - When we asked UK lenders if they are experiencing stricter regulations on affordability assessments, 88%said that they are either seeing this now or expect it in the next year.

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.