Gain efficiency

and engaged customers

Tap into a treasure trove of data to offer better digital experiences and increase efficiency. Open banking brings a lot of new possibilities, helping banks quickly deliver sleek digital solutions to attract and engage customers – while also simplifying operations.

Benefits at every step of the customer journey

Attract new customers

Offer digital banking experiences that consumers are looking for, and make it easy for them to become your customers.

Engage and empower

Consumers want to feel in control, and expect digital experiences that are easily accessible and highly personalised. Tink’s Finance Management products are designed to create unique and engaging user experiences, at scale.

Improve lending and reduce risk

Using open banking can help banks make better-informed decisions based on real-time data and speed up digital applications, improving the customer experience and streamlining processes by removing friction and paperwork.

Results that make a difference

<10 minutes

GF Money reduced underwriting decisions to less than 10 minutes – when it used to take them 2 hours.

Partnering for impact

Tink's personal finance management and data enrichment technology can easily plug in with third-party providers, to enrich transaction data beyond attributes and actions and deliver innovative and engaging solutions within the digital banking app

Partnering for impact

Tink's personal finance management and data enrichment technology can easily plug in with third-party providers, to enrich transaction data beyond attributes and actions and deliver innovative and engaging solutions within the digital banking app

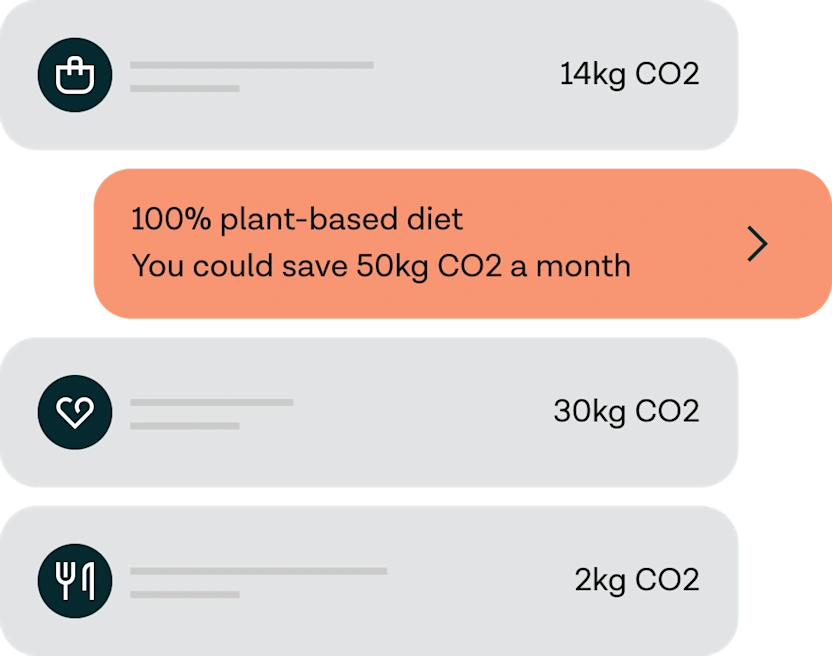

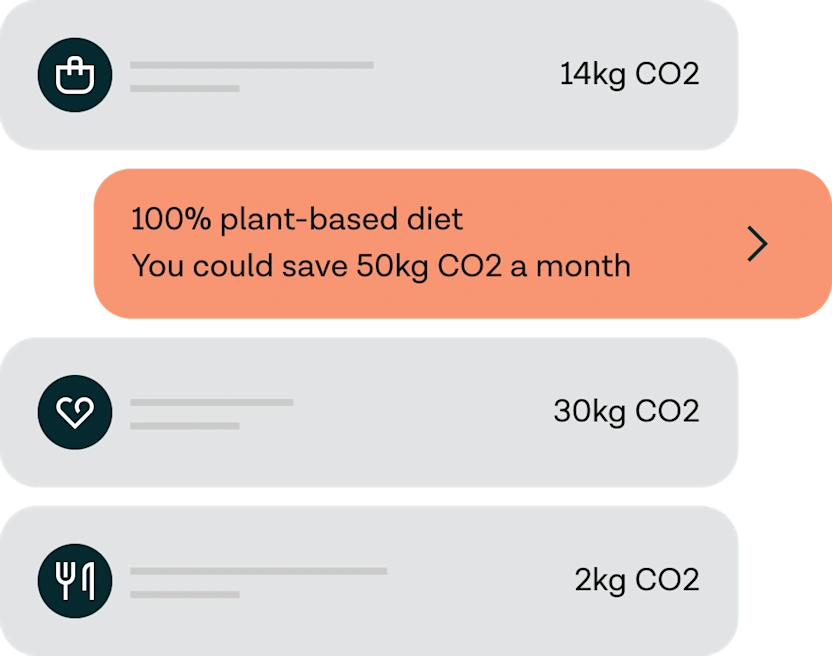

Sustainability: enabling users to track and reduce their carbon footprint

By integrating with providers of carbon footprint insights and Tink's PFM and data enrichment technology, banks can offer customers insights on their carbon footprint based on daily transactions and offer nudges to help reduce their climate impact directly in their mobile banking app.

Sustainability: enabling users to track and reduce their carbon footprint

By integrating with providers of carbon footprint insights and Tink's PFM and data enrichment technology, banks can offer customers insights on their carbon footprint based on daily transactions and offer nudges to help reduce their climate impact directly in their mobile banking app.

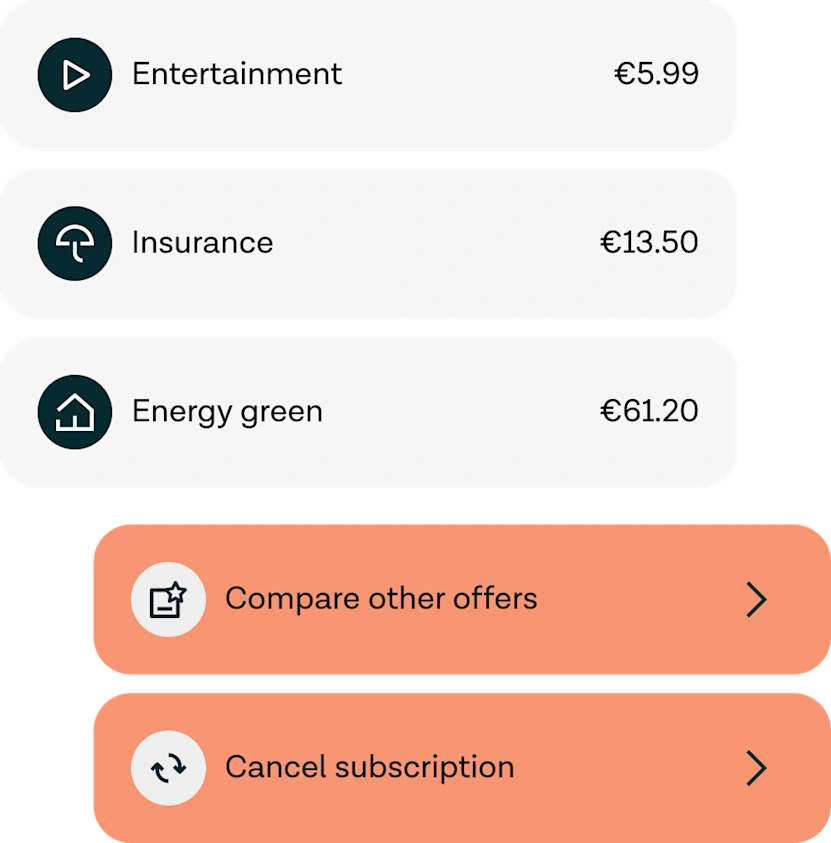

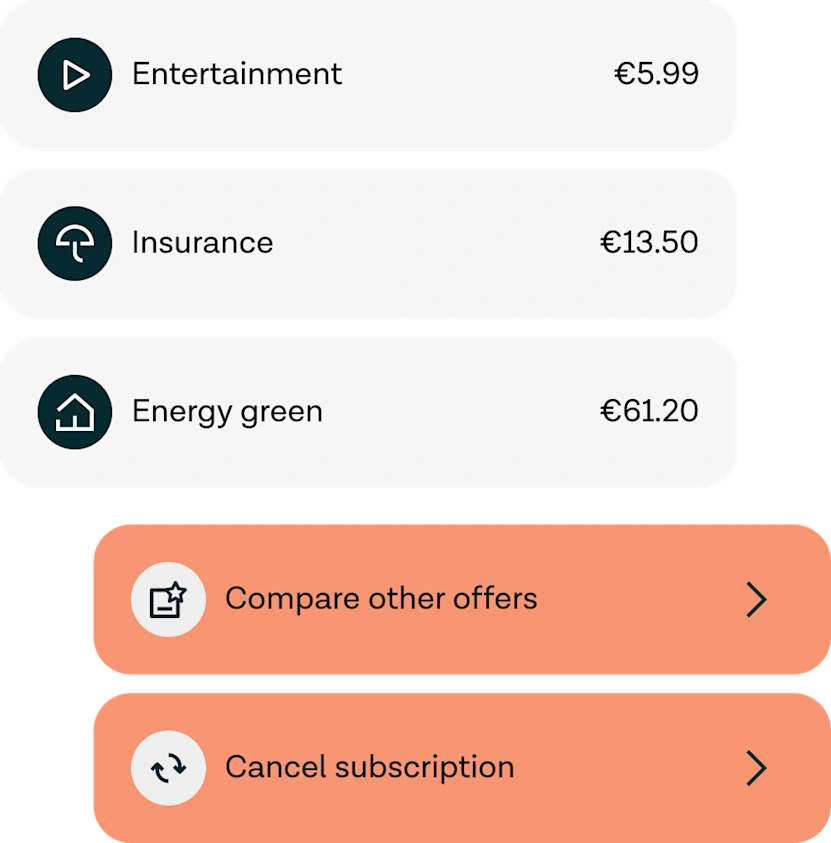

Contract management: beyond banking with embedded subscription management

By integrating with players providing subscription switching or canceling and Tink's pattern recognition technology, banks and fintechs can enable customers to view their subscriptions, compare with other offers in the market, and cancel their contracts directly in the digital banking app.

Contract management: beyond banking with embedded subscription management

By integrating with players providing subscription switching or canceling and Tink's pattern recognition technology, banks and fintechs can enable customers to view their subscriptions, compare with other offers in the market, and cancel their contracts directly in the digital banking app.

Are you interested in partnering with us and helping power the future of banking together?

Partner with us

Are you interested in partnering with us and helping power the future of banking together?

Partner with usReady-to-go products to solve different needs

Account Check

Confirm account ownership with real-time data straight from a user’s bank account, creating a quick and simple payment setup process.

Transactions

Get real-time transaction data - straight from banks, and delivered in a standardised format.

Money Manager

Build smart, intuitive personal finance management applications that give your customers tools and personalised insights to better manage their money.

Payments

Increase engagement and conversion by giving your customers a fully embedded payments experience – at a fraction of the cost.

Income Check

Optimise credit decisions and understand your customers’ true financial capacity by instantly verifying income using real-time data.

Risk Insights

Start assessing creditworthiness with real time, up-to-date and verified data giving unique insights into spending behaviours.

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.