Six ways open banking helps remittance

Remittances play a vital role in supporting global economies, but there are many challenges for providers including customer experience, competition, and fraud. Read on for six ways that open banking can enhance the remittance process, making it more efficient and secure.

Remittances are crucial for supporting tourism, investment, and expats sending money home. Global transaction values for remittances are expected to reach $6.5 trillion by 2028.

Remittance providers face challenges such as customer experience, competition, business complexity, fraud and compliance, and settlement issues.

Open banking can improve the remittance process by enhancing customer experience, reducing fraud, simplifying authentication, optimising mobile experience, and streamlining compliance.

If you work in accounting, you’re probably very familiar with the term remittance, as the broad definition means to send money. For consumers, the term ‘remittance' has come to be more specific to mean cross-border, peer-to-peer payments. Remittances can be made for any number of purposes including supporting family members, paying for services, and donating to causes.

Why are remittances so important?

With globalisation, cross-border money movement is an essential consumer service supporting tourism, investment and expats sending money home to family and friends. According to Juniper Research, global transaction value for money transfer and remittances are expected to reach $3.9tn in 2024, increasing to $6.5tn by 2028, with the US and India sending and receiving the most money, respectively.

Europe is seeing similar growth, with expected volumes of 21 billion by 2027 indicating significant opportunity for remittance service providers.

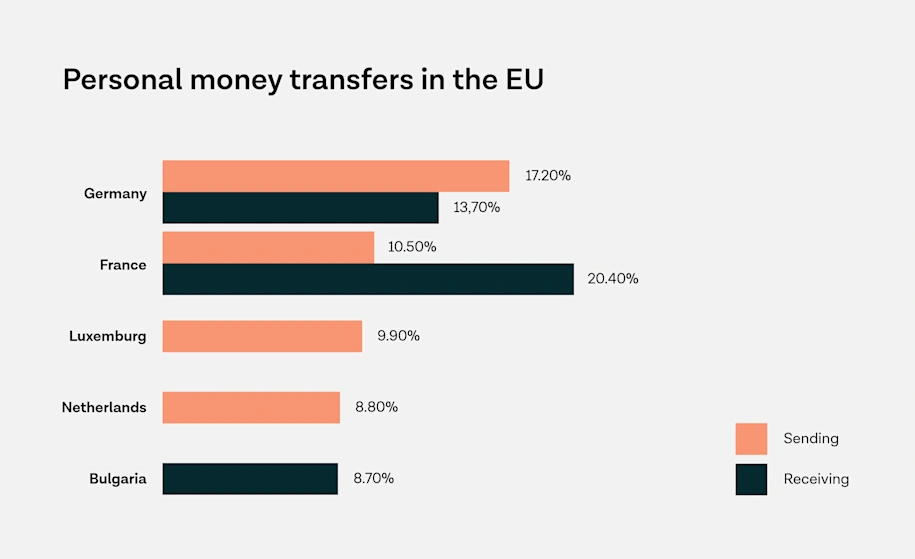

When it comes to country specific data, the largest remittance payment volumes in Europe are seen by Germany and France. The chart below gives a sample of some of the largest sending and receiving country volumes as a percentage of the total EU send and receive remittance payments.

Source: Biteffect

Five challenges remittance providers are facing today

Remittance providers are facing more challenges than ever before. Let's take a look at some of the key factors.

Customer experience

In a fiercely competitive market, capturing and keeping users loyal is top of mind for remittance providers. But meeting expectations is not so easy. Delivering best-in-class features, hassle-free processes, and instant experiences could be the difference between winning and losing in business. And with consumers now empowered to access a wide array of services through their smartphones with ease and simplicity, expectations will only continue to rise.

Competition

While demand for digital exchange services continues to grow, market competition is fierce, putting pressure on margins. And with more competition and market disruption, consumer expectations evolve, making instant transfers and low fees the new cost-of-entry to the remittance market.

Business complexity

The very nature of remittance is highly complex. For a money transfer business, managing variables between countries and markets is no easy feat, but may be crucial to business success. As well as the obvious currencies and pricing, there are also languages, market dynamics, payment methods, and regulations creating nuance from market to market that a remittance business needs to cope with. A one-size-fits-all approach can’t suit every user, and therein lies the challenge.

Fraud and compliance

Like all financial services, fraud and regulatory compliance are key concerns for remittance companies. As regulations vary from country to country, so does the volume and nature of fraud risk. With the risk of fines and unjustified chargebacks ever present, user verification processes are particularly important in remittance but can have a knock-on effect to the product experience. Unnecessary verification steps in the sign-up journey may cost you in conversion, labour, and ultimately affect your bottom line.

Settlement

Instant settlement usually comes at a premium and is not yet available everywhere. But consumers today expect payments to arrive instantly, at the lowest cost possible, with the greatest degree of transparency.

Six ways open banking can help remittance providers

Instant experiences with Pay by Bank

Traditional ways of topping up an account, such as a bank transfer or direct debit, can be cumbersome for the user. Traditional payment journeys often require manual steps for the user and, increasingly, with clunky authentication steps bolted on.

Pay by Bank, the account-to-account payment (A2A) method powered by open banking, offers a solution for both merchants and consumers, by unlocking access to Europe’s A2A payment infrastructure. Thanks to a pre-built UI and connectivity across Europe, with Tink, a bank payment journey can become seamless, easy and cost efficient for remittance providers to deploy and maintain.

For remittance providers, Pay by Bank offers a low-cost, low-fraud payment method with fast settlement that provides convenience and peace of mind.

For consumers, Pay by Bank offers a quick, secure and frictionless payment experience – reducing the amount of manual input.

Mitigate fraud with Risk Signals

However today, not all European markets have instant payment schemes, and even in some major markets, coverage is limited. In these cases, the nature of legacy systems means that a delay in settlement can increase fraud risk due to payments being cancelled before they settle, but after goods or services have been received.

Tink offers Risk Signals, a rules-based engine that unlocks instant payment experiences while reducing fraud risk, helping give merchants more security. With more peace of mind and payment certainty, merchants can choose to fund transfers right away, with confidence that payment will settle in a few days' time – allowing a more competitive, instant service. Risk Signals uses account, balance and transaction data to block risky payments based on the ability and likelihood of a user to pay.

Reduce friction with a seamless UX

Pay by Bank offers flexibility and customisation options which can help improve efficiency, process and payment conversion.

Tink’s software development kit (SDK) includes a customisable UI which blends seamlessly with a customer’s UX in any channel, letting remittance providers create their own self-branded payment option. Unlike incumbent payment methods, Tink allows for a fully white-label UX, including full ownership of the payment method, naming, branding and much more. Through the Tink console and our customisation APIs, remittance providers can ensure a seamless transition between the deposit step and the Tink flow.

Make verification easier with simplified authentication flows

Strong customer authentication is applied to payments as a way of adding an extra layer of security and reducing fraud risk. But with many digital journeys, including banks across Europe, two sets of authentication are required, increasing friction for end-users in a payment flow.

In markets where two authentication steps usually apply, Tink has built new logic that cuts the number of authentication steps for returning users, which can shorten payment journeys by a significant amount, while maintaining security.

Optimise UX with an app-to-app SDK

Mobile user journeys often contain too many steps in the authentication process, adding unnecessary interactions and causing friction for users. Existing experiences often require users to leave the original app in order to authenticate with a relevant banking provider. The process typically involves the opening of a web browser, which can slow things down due to longer loading times and waiting screens.

Tink’s optimised experience for mobile apps, offers a more seamless journey for end-users, allowing remittance providers to swiftly integrate payments across 19 European countries for a truly mobile experience.

Simplify compliance with verified payments and enhanced fraud prevention

Today, remittance providers, as financial services businesses, are subject to Anti-Money Laundering regulation and so need to verify customer’s personal information as part of their ‘Know Your Customer’ due diligence and show that they are taking all reasonable steps to prevent financial crime on an ongoing basis.

With open banking, remittance companies can move away from verifying customer accounts manually and move towards a more efficient account verification process, which can be performed through one simple flow.

With Tink’s verified payments service, remittance providers can combine payment and account verification data in one user journey to produce a report containing the user's bank verified account details. Plus, with Tink’s User Match feature, remittance providers can verify that the account holder name retrieved via Tink matches the name entered by the user to help mitigate unauthorised access.

–––

Open banking is a constantly evolving solution with several recent regulatory changes likely to have a positive impact on the remittances industry. Tink's Head of Industry & Wallets, Jan van Vonno, commented:

"Remittance will hugely benefit from the new Instant Payments Regulation, as well as the growing familiarity with A2A payments more generally.

“The latest regulatory changes will mean remittance providers can directly access central bank infrastructure and to potentially reach every Euro account in the world. In combination with open banking, these developments will make remittance accessible to more people in a secure and affordable way.”

The opportunity to build a digital and seamless proposition with an instant payments experience and reduced fraud is already here. If you’re curious about how your business can get ahead of the curve, reach out to our team.

–––

Sources:

DIGITAL MONEY TRANSFER & REMITTANCES Key Trends, Competitor Leaderboards & Market Forecasts 2022 -2027 (Juniper Research)

https://biteffect.net/who-is-the-leader-in-money-transfers-in-europe/

Case studies, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Visa Inc. does not make any warranty or representation as to the completeness or accuracy of the Information within this document, nor assume any liability or responsibility that may result from reliance on such Information. The Information contained herein is not intended as legal advice, and readers are encouraged to seek the advice of a competent legal professional where such advice is required.

All material contained in this document was obtained from publicly available sources, including websites, between the dates of 01/03/2024 and 12/08/2024. As such, Visa does not make any warranty or representation as to the completeness or accuracy of the information within this document, nor assume any liability or responsibility that may result from reliance on such information contained within this document.

More in Use cases

2025-06-18

2 min read

Video – How Snoop is unlocking smarter saving with variable recurring payments

With the launch of variable recurring payments (VRP), Snoop is introducing a smarter, more flexible way for people to build their savings – and making the most of Tink's open banking solutions in the process.

Read more

2024-12-17

7 min read

User experience: Wealthify empowers customers’ financial wellness with Pay by Bank

Tink partner Wealthify uses Pay by Bank for the optimal PFM, investment and saving experience, thanks to easy account top ups and secure account-to-account payments.

Read more

2022-06-30

4 min read

How Again is using transaction data to drive change

Using open banking to drive sustainable change: Swedish climate fintech Again is partnering with Tink to end greenwashing. Their app leverages transaction data to accelerate the climate transition by offering valuable user data to sustainable brands.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.