Using Tink Link to easily connect end users to their banks

This is the fourth piece in our ‘Build with Tink’ series, where we go through the Tink platform. Now we’ll put the spotlight on Tink Link, a tool that simplifies end-user authentication so you can easily and safely connect to over 2,500 European banks.

Open banking opened the floodgates to financial data. But connecting your customers with their banks – with wildly varying authentication methods – can be a drain. Tink Link removes this complexity and provide seamless authentication (and consent) flows for customers of practically any bank, all with one line of code.

Open banking opens up a new generation of services, from personal banking apps to carbon footprint calculators. But to work, they all have a basic requirement: users need to pick their financial providers and consent to sharing their data with you.

To simplify this process, we built Tink Link, a software development kit (SDK) which compresses all bank authentication standards into one easy-to-install component.

Essentially, it lets you provide a secure and easy way for your customers to share their financial data – which you can then use to provide a great service. And since the connected banks cover the large majority of the population in the 13 markets where our platform is live, it means you can reach millions of customers instantly – as well as easily scale your business.

Plug-and-play end-user authentication

Tink Link is available through the Tink Console and takes just minutes to launch (for more details, check our getting started guide). This front-end tool essentially allows your service to start using our account aggregation technology, by instructing our API to retrieve data from your customers’ banks.

In other words, it lets Tink access and analyse your customer’s banking data with their consent.

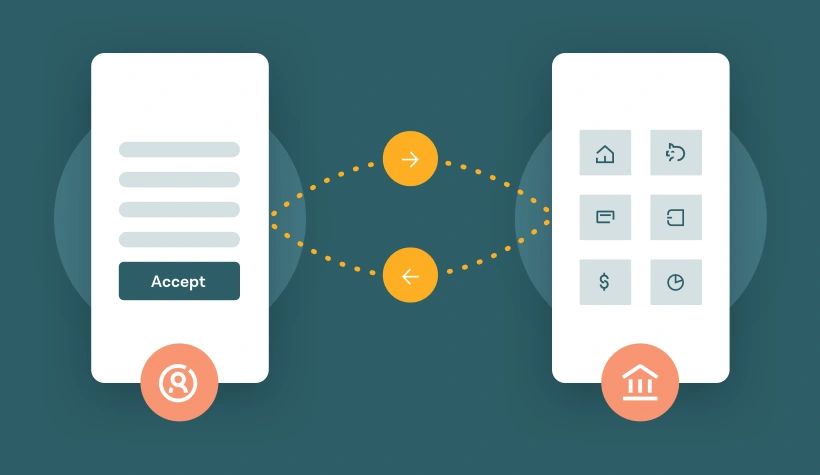

Once users pick their bank from a list of providers, they will either be led to complete the authentication in their bank’s app or website – or authenticate right within Tink Link when embedded flows are available (more on that below).

Example of a Tink Link flow – customers select their bank, authenticate and connect to their accounts through a Tink-powered service.

When a user has given full consent* and completed authentication, your service can start aggregating the data from their accounts (or initiate payments on their behalf).

Tink Link can either be the entry point to a service or the foundation of one. Our onboarding solution, for instance, uses Tink Link as a standalone service, so that online forms can be automatically filled in with a user's banking details.

What are the benefits?

Tink Link can be used by both regulated and unregulated institutions alike, and streamlines development to a minimum. By embedding one snippet of code, you’ll be able to connect your users with 2,500 banks across Europe – and to access the data you need for your use case.

A Tink Link code configures the market, language and data types of an authentication journey.

Even if you’re a regulated financial institution – and therefore allowed to build your own PSD2 API connections – Tink Link does the job of integrating with each separate bank so you don’t have to.

With Tink Link, you’ll always access the latest bank PSD2 APIs, or the backup connections we’ve built to ensure the continuity of your services (in case PSD2 APIs are temporarily down). We take care of updating and maintaining the API connections, so you can focus on your core business.

Lastly, the Tink platform’s coverage across Europe lets you expand quickly – and painlessly. Taking your services to a new market? You don't need to worry about figuring out what specific authentication methods local banks (and customers) are likely to use.

Strong Customer Authentication, sorted

What the Tink Link user journey will look like in any given case depends on your customer’s bank and market. But in either case, we provide a mobile-friendly interface that will guide the user through all the steps.

Under PSD2 regulation, European banks are required to provide Strong Customer Authentication (SCA); meaning users have to authenticate using two factors of identification. Tink Link naturally facilitates SCA compliance since it makes end users interact directly with their banks.

Overall, there are three categories under which all authentication journeys will fall:

Tink Link – an enabler of future use cases

As the open banking movement matures and new data-driven use cases appear, Tink Link will grow even more relevant. By outsourcing authentication formalities, you can fast-track your time to market – while ensuring that your users get to start using your service securely and quickly.

Tink Link allows you to build and launch powerful customer experiences without draining your development resources. It’s all taken care of automatically, with one line of code.

If you want to learn more about how you connect with Tink Link to build an aggregation service, see the previous article in ‘Build With Tink’.

*The data transfer from an AISP (in this case, Tink) to a TPP (third party provider) requires that the end user has granted explicit consent a) for the AISP to retrieve the data, b) for the AISP then to transport the data to the TPP, and c) for the TPP to use the data for specific services. Step b) and c) fall under GDPR regulation.

More in Product

2025-10-07

7 min read

Beyond instant: Building reliable Pay by Bank payments

As instant payments roll out across Europe, merchants still face challenges with reliability and settlement. Our Smart Routing and Risk Signals products provide a reliability layer for Pay by Bank, optimising payment routes and blocking likely-to-fail transactions.

Read more

2025-02-06

6 min read

Introducing User Match: Built-in name verification to make security fast and easy

Discover how the latest feature of our verification products, User Match, is improving security by verifying users' names when adding bank accounts, reducing fraud and enhancing account protection.

Read more

2025-01-15

1 min read

Guide – How to optimise verification with open banking

Download our new account verification guide to learn how to streamline your operations, reduce risk, and enhance customer experience with the help of open banking-powered solutions.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.