Young people in the UK call for banks to help them go green

Tink's latest research finds that 18-34 year olds in the UK want more information on their carbon footprint, and place high expectations on banks to help them track and improve it. Many would even consider switching providers if that could help them go green. Read on to find out how the younger generation see the role of banks in measuring their environmental impact, and how open banking can help.

Tink’s latest research shows that 18-34 year olds in the UK want banks’ help to reduce their carbon footprint.

Many would even consider switching providers if this would help them achieve their sustainability goals.

With open banking, financial institutions now have the opportunity to meet the demand for greener financial tools.

Open banking technology has enabled banks and other financial institutions to get closer to their customers than ever before. With greater insight into spending habits, a better understanding of income patterns, the ability to check account ownership and verify identity – and much more.

But we’ve only scratched the surface of what open banking can help achieve: wherever data is needed, open banking technology can help. Of course, one of the greatest challenges facing us today is sustainability, and the onus is on all of us to reduce our carbon footprint. In this challenge, financial institutions have the opportunity to help consumers understand and improve their environmental impact.

We surveyed 2,000 UK consumers, asking them about the importance of cutting their carbon footprint, and how they think financial services providers should be stepping up to help them.

From the results, it’s clear that 18-34 year olds are on the lookout for financial tools that allow them to measure and minimise their environmental impact – tools that open banking could help provide.

Using open banking to meet consumer demand

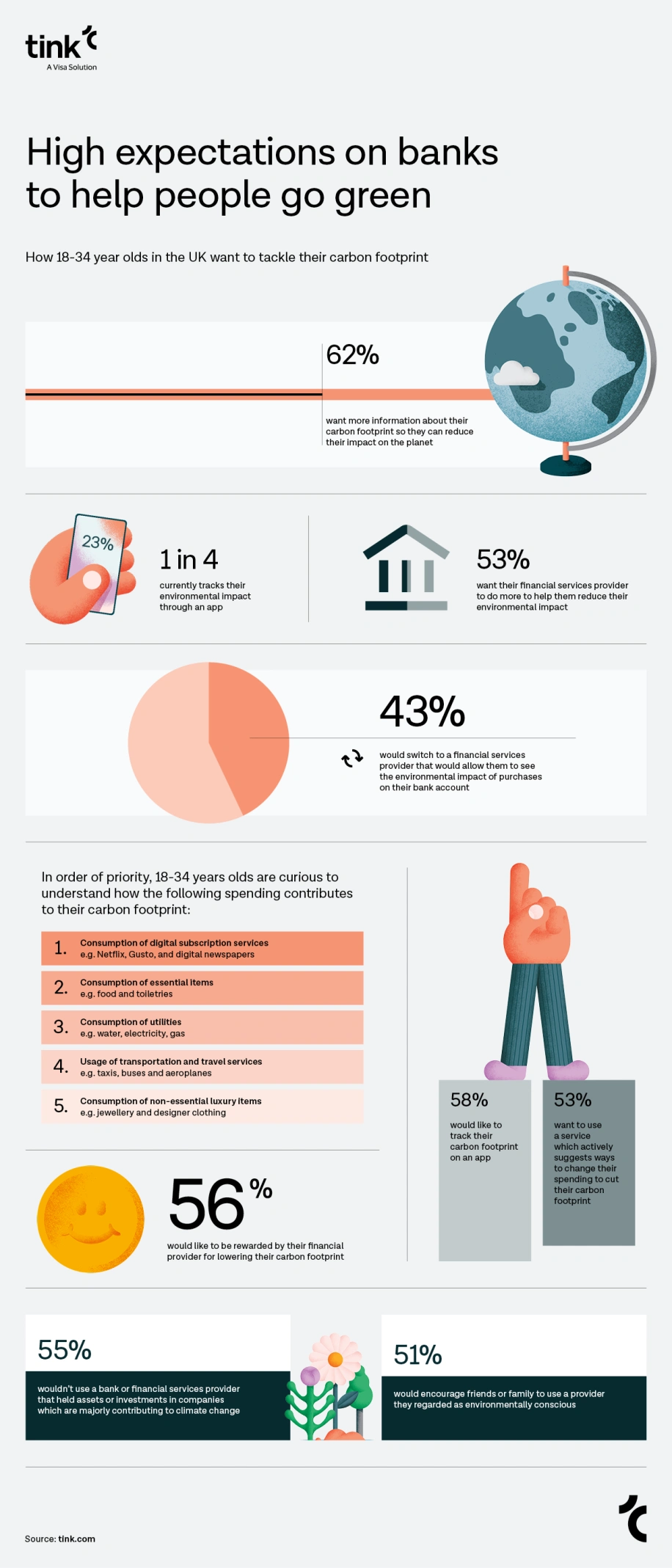

Among the surveyed 18-34 year olds, nearly two-thirds (62%) want more information about their carbon footprint so they can reduce their impact on the planet. With the urgency of the climate crisis becoming more evident every day, it’s no wonder young people are looking for ways to mitigate climate risks. Many are now realising that influencing where your money goes is one of the most effective ways to fight climate change.

More than half (53%) of the respondents want their financial services provider to do more to help them reduce their environmental impact. While almost a quarter (23%) are already using apps to track their impact on the environment, a further 58% would like to start making use of these types of services.

It’s interesting to note that over half (53%) want to use a service which actively suggests ways to change their spending to cut their carbon footprint, giving banks and other financial institutions the opportunity to meet consumer demand through their own mobile banking apps.

Going green with personal finance management tools (PFM)

Those surveyed weren’t only interested in tracking how their physical spending impacted the environment, like what they ate, wore, or how much they travelled. They also wanted to know how their spending on digital services affects their carbon footprint. In order of priority, here’s what they’re curious to better understand the environmental impact of:

Consumption of digital subscription services, like Netflix, Gusto, and digital newspapers

Consumption of essential items, for example food and toiletries

Consumption of utilities, such as water, electricity, gas

Usage of transportation and travel services, like taxis, buses and aeroplanes

Consumption of non-essential luxury items, such as jewellery and designer clothing

In essence, many 18-34 year olds feel they could benefit from a money management tool, or PFM, that helps them keep tabs on and minimise their carbon footprint. With Tink’s open banking technology, you can aggregate spending data and categorise it according to environmental impact – giving consumers the information they’re looking for.

Making sustainability rewarding

According to our respondents, going green shouldn’t necessarily be its own reward. 56% would like to be rewarded by their financial provider for lowering their carbon footprint. And consumers aren’t the only ones interested in reward and loyalty programmes. In our November 2021 report, Following the money, 65.9% of the surveyed financial executives ranked loyalty programmes as ‘very’ or ‘extremely important’ for their business.

Tink’s latest research shows that there’s an appetite from the younger generation for loyalty programmes that reward those who reduce their carbon footprint through spending.

Help customers go green – or lose them to competitors that do

The UK consumers we surveyed made it clear that the environment is high on their agenda. Nearly half (43%) would switch to a financial services provider that would allow them to see the environmental impact of purchases on their bank account.

Luckily, you won’t have to build the technology yourself to prevent customers from jumping ship: 49% would grant a bank or third-party provider access to their financial data to track their environmental impact. So, you could choose between building your own carbon-tracking tool or partnering with a trusted TPP – young consumers are ready to grant access to their financial data in order to track how their spending affects the environment.

But it’s not only the consumers’ own spending that matters – they look at how their financial providers choose to spend their assets too. 55% of respondents say they wouldn’t use a bank or financial services provider that held assets or investments in companies which are majorly contributing to climate change. So if you start encouraging consumers to go easy on the environment, it would be best to follow your own advice.

Improve user feedback and NPS with green open banking powered tools

Our survey results make it clear that those who provide environmental tools will be rewarded: 51% of respondents say they would encourage friends or family to use a provider they regarded as environmentally conscious.

Using open banking to meet consumer demand and provide environmental impact tracking tools isn’t good only for the environment or business revenue. Our research suggests that it has the power to significantly increase customer loyalty – meaning higher NPS (net promoter score) and more satisfied customers.

We’ve been at this open banking thing for a while. As part of powering the future of finance we’re also powering the fight against climate change. If you want to learn more about how we use our open banking technology to promote sustainability, check out these articles.

About the research:

Online research was conducted by Opinium on behalf of Tink between 4-8 February 2022, amongst 2,000 nationally representative UK adults.

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.