The evolution of the revolution – from open banking to open data economies

It’s time to move on from talking about open banking: get ready for open data economies – the next frontier for digital services. Tink’s latest report, ‘From open banking to open data economies’, explains how businesses can get a head start on the open banking evolution while lighting up the road ahead for customers as well as peers.

Open banking is evolving and expanding into open finance

Open finance is powering embedded finance and readying the market for open data economies

Our latest research report covers the entire open banking journey – from its inception, introduction, and adoption, and shows you how to prepare for the next frontier for digital financial services

Since 2012, Tink has been a driving force in the open banking revolution. Enabling thousands of banks and payment providers to connect with customers, powering billions of transactions each month. That’s why it may sound strange when we say that we want to stop talking about open banking. After all, it’s our thing, right?

It’s true that our mission is to power the future of finance, and open banking is an important step along the way. But open banking itself is not the goal – it’s a means to an end. The goal is meeting customer expectations while unlocking the potential of digital financial services.

From open finance to open data economies

Tink’s research makes it clear that while open banking is still far from global market adoption, it's already moved beyond what it was a few years ago. Instead, open finance has emerged as the natural continuation of open banking. Open finance is an important stepping stone on the road towards embedded finance, open insurance, and open data economies.

The key difference between them is that while open finance operates strictly within the financial services industry, open data economies have the potential to move across all industries: from payments and banking to technology and transportation – and much more.

Open finance market maturity

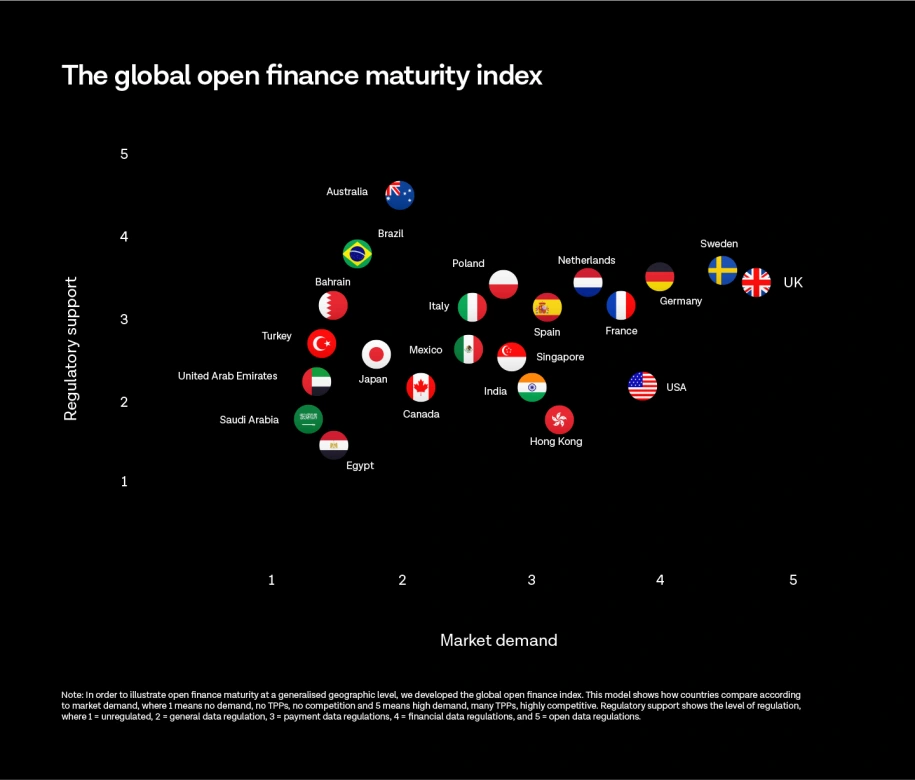

According to our research, the market is ripe and ready to evolve and move beyond open banking. In Europe, Sweden and the UK are leading the pack, thanks to well-developed regulatory support and a tech-savvy population.

But Europe as a continent isn’t the clear winner: countries such as the US, India, and Hong Kong are ahead of many European countries because of market demand.

Unlocking data access across industries

As we’re moving into open finance, embedded finance is often highlighted as the ultimate application of open banking technology. A perfect example of how fintech journeys can significantly enhance customer experience.

Convenience is key to creating superior user experiences. That’s why embedded finance is so highly anticipated. What better financial service for consumers than one that operates flawlessly in the background, completely invisible?

It’s this kind of ‘under-the-hood’ thinking that we believe will power the future of finance. But before we can move onto perfecting embedded finance and preparing for open data economies, we need to level the playing field around access to data.

Access to financial data unlocks countless opportunities and has the potential to change the role that financial institutions play in our lives – from a provider of financial services to an enabler of all industries. And with the experience of implementing open banking, financial institutions are well-positioned to lead other markets in the journey towards open data economies.

Want to know more? Download the full report below to find out how open finance and open data economies are set to transform the financial services industry – and how to prepare. You can also discussing the subject.

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.