4 ways to reap the rewards of open banking

Over the past couple of years we’ve seen the first movers of open banking making their mark, setting up award-winning apps that are delighting users across Europe - but now it’s time for the rest of the industry to catch on. And the end goal here is not about meeting regulations and compliance with PSD2 - that was so 2019. It’s about increasing sales, increasing productivity and reducing risk. In other words: getting a return on your open banking investment.

The first movers have shown us the award-winning apps that can come from open banking technology - and how to get an ROI from them.

Each ROI strategy will depend on the problem you’re trying to solve, but there are 4 key areas we’re highlighting as ways to get value from open banking.

They are increasing share of wallet, streamlining onboarding, upping engagement and increasing self-service.

The strategy for getting value from open banking will largely depend on the problem a business is trying to solve. This could be acquiring more customers, getting new upsell opportunities, increasing conversion, having smoother onboarding, reducing risk or upping productivity - the options are almost endless.

But because open banking touches so many areas, measuring ROI can stretch across many departments in a bank or financial institution, making measurement more than a tick-box exercise.

To help reduce some of the complexity around ROI, here are four ways businesses can get a return from open banking - checking out those first movers who have taken the lead.

1. Increasing share of wallet

Expanding your relationship by increasing the services you can offer each customer is a surefire way of keeping their business, and getting value from open banking.

One way is allowing customers to challenge the rates or prices they pay for financial services, such as payment account charges, savings account interest, a loan or a mortgage rate. In just a few simple steps, you can find ways to increase sales opportunities and give the customer a better deal.

Using the data your customers have given you access to, you can analyse spending trends and get to know your customers better - making sure the offers you are presenting to them are on the money.

Swedish Bank SBAB teamed up with Tink in 2017 to launch Mortgage Match. It’s a service that uses aggregation technology to instantly collect a user’s mortgage information and compare it with a rate at SBAB, giving the bank the ability to make well-informed and competitive offers and convince more people to switch their mortgage. The result? Eight in ten customers are offered a better deal on their mortgage which they can take up in just a few clicks. The customer saves money and SBAB increases business.

SBAB's Mortgage Match app

2. Smoother onboarding

Onboarding can be a friction-filled process that puts people off from becoming a customer. But with an end-to-end digital experience you can create a smooth onboarding flow, and make sure your business is getting the right customers.

The benefits of smooth onboarding are vast. For a start, you end up with more would-be customers seeing the process through to completion without dropping out. Due diligence is improved, because you can fetch real-time data from customers’ bank accounts at the moment of onboarding. Debt and fraud can be reduced, because you can instantly verify the customer’s name, IBAN number, account balance and income, while back-office productivity is improved through automation. All big impacts on the bottom line.

One business that has taken advantage of a slick onboarding flow is Swedish savings and investment bank Avanza. It wanted to give its customers a better experience, and prevent people having to manually input account details to move their investments to an Avanza account - which was causing users to drop out.

So Avanza turned to Tink's aggregation technology to make this step easier. Now, customers authenticate themselves with their bank and their account information is automatically fetched and populated for them. The process became simpler and quicker, making conversion rates go up by 150%.

Avanza's streamlined flow

3. Upping engagement

Engaging people with their finances through your brand creates greater loyalty. And using technology to provide customers with personal and relevant insights into their finances, to help them manage their money better, can help you reap the rewards of open banking and reduce customer churn.

In the Netherlands, ABN AMRO launched Grip, which quickly became the #1 PFM app in the country - and is one of our most successful partnerships to date. Grip allows customers from Dutch banks to get an overview of their finances across multiple accounts, track their spending and budgets by category, and nudges users with alerts to stay on top of their finances. Grip’s customer base grew quickly, along with customer satisfaction - with 73% of users saying they would recommend the app months after it was released.

ABN AMRO's Grip app

4. Improving self-service

Giving your users the tools to take control of their finances, greatly reduces the pressure put on customer service functions, because people no longer need to get in touch with their bank to find out information about their transactions or fulfill small requests. Customers are more satisfied because they have everything they need to manage their finances at their fingertips, which can help reduce churn rates.

Major Nordic bank SEB developed its own app based on Tink’s platform, using data enrichment to categorise and display account transactions in a clear way for their customers. SEB's app is now the most popular channel for private customers in Sweden, with more than 200 million visits every year.

SEB's banking app

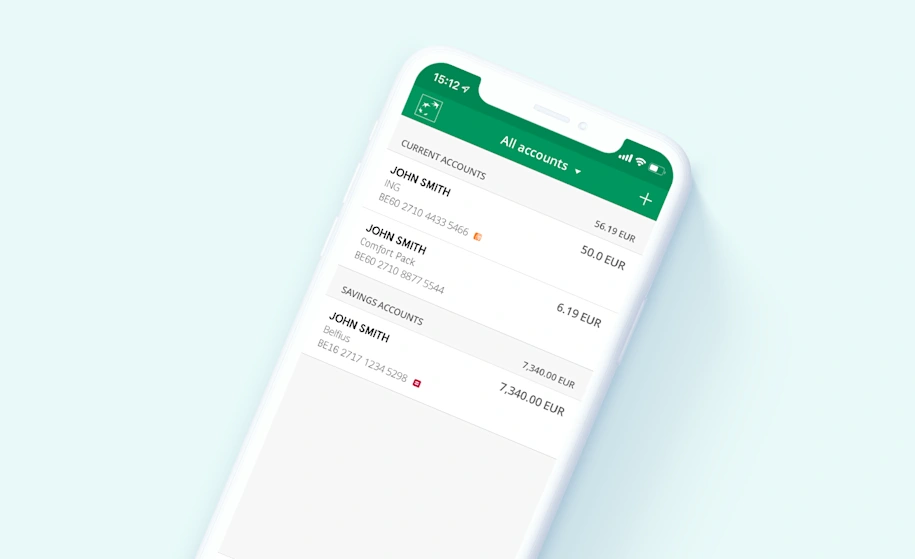

And as a first of its kind for Belgium, BNP Paribas Fortis added aggregation to its core banking app ‘Easy Banking’. Now, customers can view balances and transactions from multiple accounts in one place, with one of the aims being to increase customer retention by removing obstacles for those who manage money in several places.

BNP's Easy Banking app

To find out more about using open banking technology to build services that give you a real return on investment, check out our handy getting started page.

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.