Why connecting to open banking APIs is not as simple as it seems

Connecting to an open banking API seems pretty straightforward. Once you have a connection, everything should run smoothly, right? Well, it isn’t as simple as that. Making the connection is just one step in a complex process. You also want to maintain the connections – and make sure they work well.

Open banking connectivity allows services to safely access financial data from banks (with customer consent).

Connecting to open banking APIs is just one step in a complex process.

Maintaining quality connections requires dedicated work and significant investments.

Businesses should consider these complexities when deciding to build the connections in-house or partner with a provider.

You have a great idea to use banking data to allow people to track their carbon footprint or to manage their finances and you want to dive into open banking. That means it’s crucial to choose between investing in building connections in-house or partnering with an open banking provider.

But first, the big question is, what do we mean when we talk about open banking connectivity? This connectivity is what allows third party providers (TPPs) to connect to a bank or financial institution through an open banking API. Simply put, it is building connections to safely access financial data from banks – with the customer’s permission, of course.

While creating connections is the goal, it is just one part of the process. There are other challenges associated with building connectivity across multiple banks and multiple countries. Let’s take a look at just a few of them.

Open banking standards and testing

Under PSD2, banking institutions are required to grant TPPs access to collect account data and initiate payments. However, banks aren't required to follow strict guidelines for how this is done.

The result of this is that there are three main API standards in Europe– STET PSD2 API framework, UK Open Banking Standard, and Berlin Group’s NextGenPSD2 XS2A Framework Standard. Each API standard has different specifications or requirements for its region.

Not only that, these vary from bank to bank as well. For example, there are differences in payment flows, fields, and identity verification. What this means is that all the data needs to be standardised in order to aggregate and integrate it with existing solutions or new solutions will need to be built.

Once the connections have been made, it’s time to test them to ensure that they are stable and working. This means testing the connections with real credentials – opening up accounts in every bank in the market – and providing feedback about the end-user experience.

Monitoring connections – daily upkeep and the future

Now that the connections have been tested and everything is working, there’s nothing left to do and the data is going to roll in, right?

Not exactly.

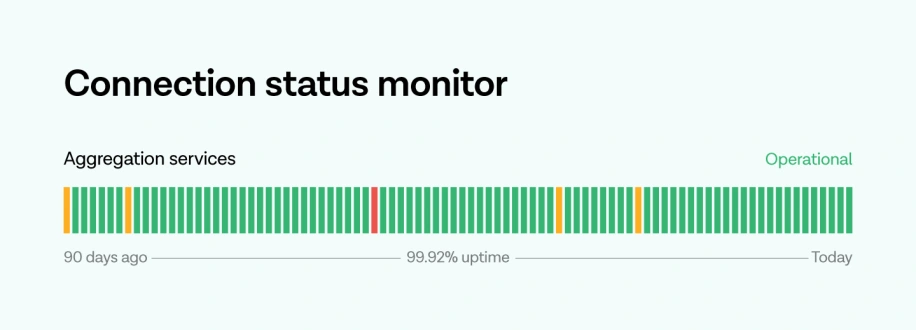

It’s important to make certain that the connections work on a daily basis. All connections need to be monitored continuously for downtime, upgrades, and improvements. It is also important to maintain an open dialogue with banks and financial institutions in order to stay on top of upcoming changes.

Keeping a solution operational while undergoing proper testing and maintaining daily routines is not an easy task. This is an aspect of building connections in-house that is often overlooked.

The advantages of partnering

Building API connections is a far more difficult challenge than merely developing APIs, especially if the goal is to connect with multiple banks and in multiple markets.

There is a significant and ongoing workload, requiring large investments in time, technology and staff. This does not make sense for most businesses, which is why many of them decide to partner with a provider that takes care of the connections, with dedicated resources to continuously test, monitor and improve them. This gives them more time to focus on the core business and customers.

To ensure you have good open banking connectivity, you need to have a partner you can trust. And partnering with open banking platforms such as Tink means more than just having good connections. It also means having people, from research analysts to coders, who are on top of the latest developments in the ever-changing world of open banking. They are there to do all the heavy lifting so businesses can focus on taking care of their customers.

Want to know more about the complexities of open banking connectivity and get a deeper understanding of how Tink is tackling some of technical challenges?

Check out our open banking connectivity guide for more details.

More in Open banking

2025-11-20

3 min read

Tink powers the UK’s first cVRP transaction with Visa A2A

In partnership with Visa, Kroo Bank, and Utilita, we’ve just helped demonstrate the UK’s first commercial variable recurring payment (cVRP) using the Visa A2A solution – and it’s a big step forward for how people make regular payments.

Read more

2025-06-09

11 min read

The case for “Pay by Bank” as a global term

Thomas Gmelch argues that "Pay by Bank" should be adopted as a standard term for open banking-powered account-to-account payments to reduce confusion, build trust, and boost adoption across the industry.

Read more

2025-06-02

3 min read

Tink joins Visa A2A – what it means for Pay by Bank and VRP

Visa A2A brings an enhanced framework to Pay by Bank and variable recurring payments (VRP) in the UK, and Tink is excited to be one of the first members of this new solution.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.