Brits’ ‘fear of fraud’ cost UK SMEs £6.15bn in the last financial year

Our latest research and economic analysis with Cebr reveals that a lack of consumer trust in manual bank transfers is fuelling £6.15 billion in lost sales yearly across the UK economy. The study surveyed 2,000 UK consumers and 500 SME leaders to understand how this payment method is driving a ‘fear of fraud’ – a risk validated by the UK Finance 2025 Fraud Report*, which recorded that £450 million was lost to Authorised Push Payment (APP) fraud in 2024.

New economic analysis from Tink and Cebr reveals that a lack of consumer trust in manual bank transfers is fuelling £6.15bn in lost sales yearly across the UK economy.

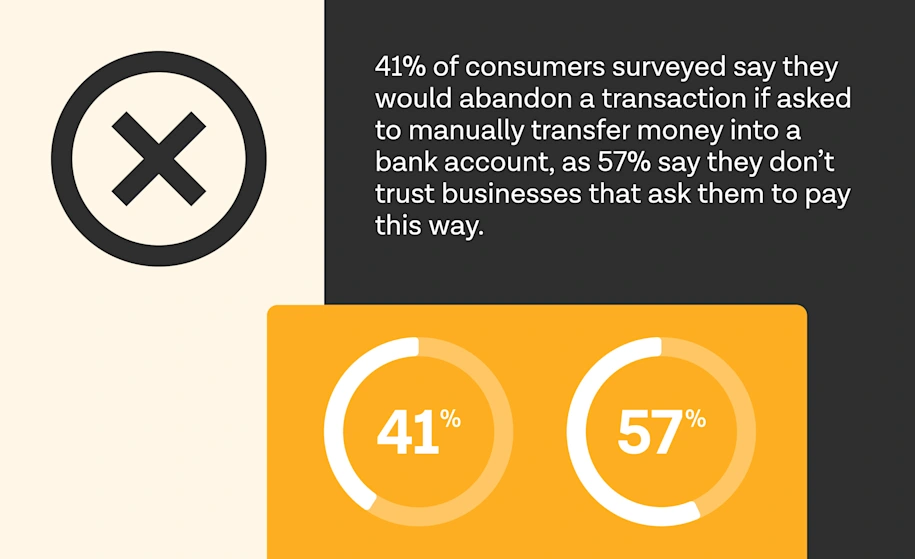

41% of consumers surveyed say they would abandon a transaction if asked to manually transfer money into a personal bank account, as 57% say they don’t trust businesses that ask them to pay this way.

Secure payment options can help restore trust, reduce abandonment, and protect revenue, as 66% of consumers say they don’t trust businesses that don’t use a recognised third-party payment provider.

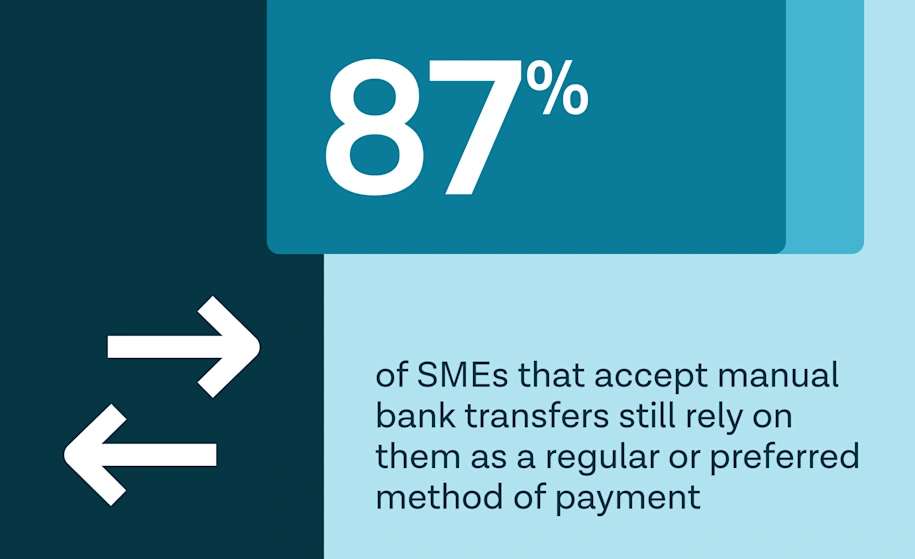

Tink’s new findings show that 87% of SMEs that accept manual bank transfers still rely on them as a regular or preferred method of payment. These transfers remain common for things such as paying an up-front deposit for a building service, or for a medical appointment.

Manual bank transfers are fuelling fraud fears – and driving customers away

This erosion of trust is translating directly into lost sales. UK SMEs, which make up 99.9% of the UK’s business population**, are particularly exposed. When asked to send money via manual bank transfer into a personal bank account, 41% of consumers surveyed say they would abandon the transaction altogether.

According to the research, this is because nearly three in five (57%) consumers say they don’t trust businesses that request this method. In fact, 67% worry about being scammed into paying funds directly into a fraudster’s account when sending a manual bank transfer. 86% also feel uneasy when the bank account name doesn’t match the business they’re sending money to - a small detail that can destroy trust at checkout.

This trust gap is costing more than short-term sales. The analysis also estimates a potential indirect annual cost of £31.6 billion to SME’s relying on payment via manual bank transfer in lost customer loyalty, as consumers say they’re unlikely to return to businesses that ask for payment via manual bank transfer.

Payment trust matters and consumers are voting with their wallets

When it comes to making a purchase, payment options matter. Four in five consumers (81%) say the methods available at checkout influence whether they choose to purchase from a business.

Trust is also a major factor. Two in three (66%) respondents say they don’t trust businesses that don’t work with a recognised third-party payment provider.

Beyond trust, choice also matters. 84% of consumers say they’re concerned when a business doesn’t offer multiple payment options - signalling that flexibility, security and transparency are now baseline expectations.

Pay by Bank offers a secure, trusted alternative for businesses

Ian Morrin, Head of Payments at Tink, said: “Manual bank transfers are often no longer fit for purpose and are holding the UK economy back. Whether it’s covering medical bills or making an upfront payment for a high-ticket item like a new car, consumers are uncomfortable being asked to send money without the reassurance of a trusted payment provider.

“These methods can create friction, fuel fraud fears, and ultimately erode customer trust. In today’s landscape, where trust and choice are non-negotiable at checkout, businesses can’t afford to rely on outdated payment methods that cost them both sales and loyalty.

Tink is part of Visa A2A which is bringing greater protections to Pay by Bank payments. This will effectively provide a similar level of protection typically associated with cards, giving consumers yet another safe and secure payment option.

Methodology:

SME research was conducted by Opinium on behalf of Tink between 23 May and 2 June 2025 amongst a sample of 500 UK SME decision makers.

Consumer research was conducted by Opinium on behalf of Tink between 23 and 27 May 2025 amongst a nationally representative sample of 2,000 UK adults.

Economic modelling was provided by Cebr (Centre for Economics and Business Research).

Cebr estimated the direct and indirect costs of fraud-related transaction abandonment based on survey responses from UK businesses and consumers. Direct costs of the ‘fear of fraud’ reflect lost revenue at the point of payment and throughout the customer journey, as consumers are likely to avoid transactions with businesses that primarily use bank transfers. Indirect costs capture future revenue losses from reduced customer loyalty and missed repeat business opportunities.

To estimate direct costs, Cebr utilised responses from an Opinium survey enquiring on the value of abandoned sales due to payment-related issues. These figures were calculated as a share of each business's turnover and scaled up to the wider business population using official turnover data. Survey responses were also weighted using publicly available business demography statistics to ensure a nationally representative view.

For indirect costs, Cebr analysed consumer responses from a separate Opinium survey on the frequency, value, and likelihood of repeat purchases for transactions they had abandoned. These were used to estimate lost future revenue per business, which was then extrapolated using official UK population data and aligned with the business-level findings.

Case studies, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Tink and Visa does not make any warranty or representation as to the completeness or accuracy of the Information within this document, nor assume any liability or responsibility that may result from reliance on such Information. The Information contained herein is not intended as legal advice, and readers are encouraged to seek the advice of a competent legal professional where such advice is required.

* https://www.ukfinance.org.uk/system/files/2025-05/UK%20Finance%20Annual%20Fraud%20report%202025.pdf

More in Tink news

2025-12-10

4 min read

SMEs count the cost of Brits’ ‘Fear of Messing Up’ (FOMU) at checkout

Our latest research reveals that many UK consumers feel anxious about making mistakes when paying by manual bank transfer. This lack of confidence is driving abandoned transactions and undermining trust in the small businesses they buy from – while simple human errors continue to cause failed payments.

Read more

2025-12-03

2 min read

Fidelity introduces Tink’s Pay by Bank for account top-ups

Tink and Fidelity International have partnered to enable account top-ups via Pay by Bank for Fidelity’s Personal Investing customers and advised clients on the Fidelity Adviser Solutions platform.

Read more

2025-10-30

2 min read

Coinbase and Tink partner to launch Pay by Bank crypto payments in Germany

Coinbase and Tink have partnered to launch Pay by Bank in Germany, enabling secure, fast crypto purchases directly from users’ bank accounts and expanding access to the cryptoeconomy with a seamless, mobile-first experience.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.