SMEs count the cost of Brits’ ‘Fear of Messing Up’ (FOMU) at checkout

Our latest research reveals that many UK consumers feel anxious about making mistakes when paying by manual bank transfer. This lack of confidence is driving abandoned transactions and undermining trust in the small businesses they buy from – while simple human errors continue to cause failed payments.

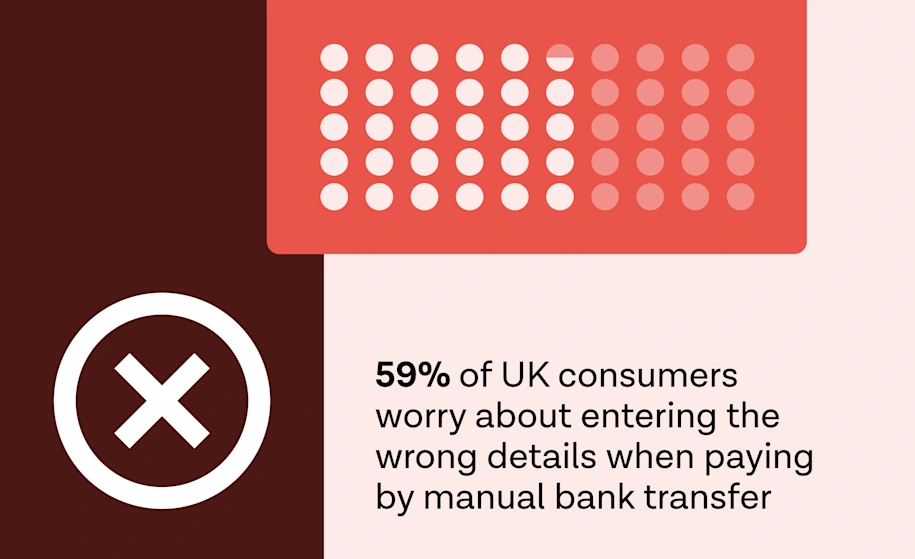

Tink's latest research reveals widespread payment anxiety around manual bank transfers, with six in 10 (59%) Brits worrying about entering the wrong details when paying this way.

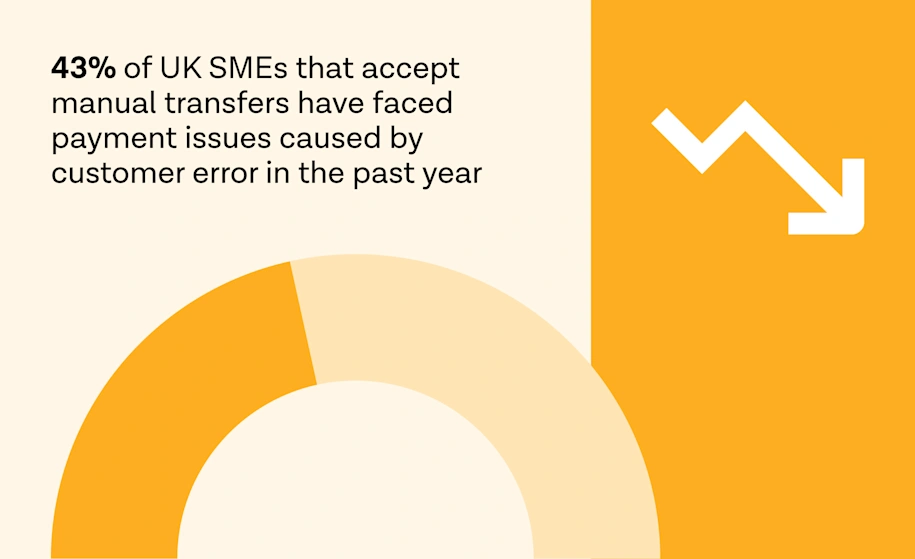

43% of UK SMEs that accept manual transfers have faced payment issues caused by customer error in the past year, adding extra costs and admin burden to their business, and businesses are waking up to the problem, with 27% now prioritising ‘low-risk’ payment methods.

Ian Morrin, Head of Payments at Tink, said: "The Cost of Messing Up (COMU) is something SMEs can no longer afford to ignore. Secure, recognised payment methods, including Pay by Bank, significantly reduce that risk, giving consumers confidence and merchants certainty at checkout.”

We refer to this consumer anxiety about some payment methods as the ‘Fear of Messing Up’ (FOMU). Meanwhile the ‘Cost of Messing Up’ (COMU) refers to the business impact of payment errors on sales, staff time and customer relationships.

Confidence issues stalling payments

Our research shows that just 11% of UK consumers surveyed feel totally confident when making payments in general, while six in 10 (59%) worry about entering the wrong details when paying by manual bank transfer. Their fears about manual bank transfers are justified: 43% of UK SMEs surveyed that accept manual transfers say they’ve faced payment issues caused by customer error in the past year.

FOMU impacts how people pay. More than a third (37%) of consumers surveyed say they would abandon a payment altogether rather than risk entering the wrong details – and 7% of consumers admit they’ve mistyped payment details, with funds failing to reach the right account.

For customers who have messed up a payment, the fallout can be both frustrating and time-consuming. Almost three in 10 (29%) had to contact their bank to trace missing funds, while 23% said the experience left them less confident about making future payments.

The COMU effect: payment errors cost SMEs time, money and trust

For SMEs, these customer errors create the Cost of Messing Up. Among those SMEs surveyed that have experienced payment issues, 38% lost valuable time tracking down missing funds, while over a quarter (28%) had to dedicate staff solely to resolving the problem.

Secure payments are key to restoring trust at checkout

Our research also highlights opportunity. More than three-quarters (78%) of consumers say they’re more likely to complete a payment if they can verify details before confirming. SMEs surveyed are taking note: 27% now prioritise a ‘low risk of human error’ when selecting payment methods.

Ian Morrin, Head of Payments at Tink, said: “During one of the busiest shopping periods of the year, relying on manual bank transfers means all the pressure is on customers to get every detail right. When they don’t, it’s the UK’s small businesses that pay the price in lost sales, wasted time and eroded trust.

Tink is part of Visa A2A which is bringing greater protections to Pay by Bank payments. This will effectively provide a similar level of protection typically associated with cards, giving consumers yet another safe and secure payment option.

Methodology:

SME research was conducted by Opinium on behalf of Tink between 23 May - 2 June amongst a sample of 500 UK SME decision makers.

Consumer research was conducted by Opinium on behalf of Tink between 23-27 May amongst a nationally representative sample of 2,000 UK adults.

Case studies, statistics, research and recommendations are provided “AS IS” and intended for informational purposes only and should not be relied upon for operational, marketing, legal, technical, tax, financial or other advice. Tink and Visa does not make any warranty or representation as to the completeness or accuracy of the Information within this document, nor assume any liability or responsibility that may result from reliance on such Information. The Information contained herein is not intended as legal advice, and readers are encouraged to seek the advice of a competent legal professional where such advice is required.

More in Tink news

2025-12-03

2 min read

Fidelity introduces Tink’s Pay by Bank for account top-ups

Tink and Fidelity International have partnered to enable account top-ups via Pay by Bank for Fidelity’s Personal Investing customers and advised clients on the Fidelity Adviser Solutions platform.

Read more

2025-10-30

2 min read

Coinbase and Tink partner to launch Pay by Bank crypto payments in Germany

Coinbase and Tink have partnered to launch Pay by Bank in Germany, enabling secure, fast crypto purchases directly from users’ bank accounts and expanding access to the cryptoeconomy with a seamless, mobile-first experience.

Read more

2025-10-20

2 min read

Splitwise expands Pay by Bank across France, Germany, and Austria with Tink

Splitwise is expanding its partnership with Tink to bring seamless Pay by Bank payments to users in France, Germany, and Austria, following a year of rapid growth of our partnership in the UK. This move enables millions more people to settle shared expenses instantly and securely within the Splitwise app, thanks to our open banking technology.

Read more

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.