Unlock fast, seamless invoice payments

Increase conversion and simplify operations with low-cost, digital-first payments.

Some industries we serve:

Billing and invoicing platforms

Lending and credit management

Telecom

Utilities

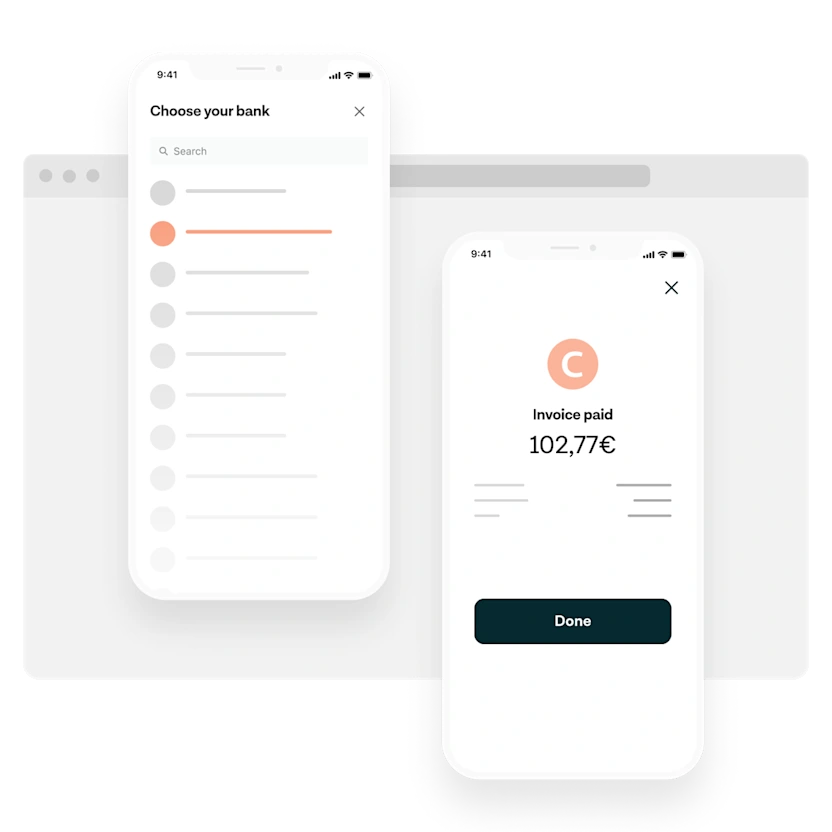

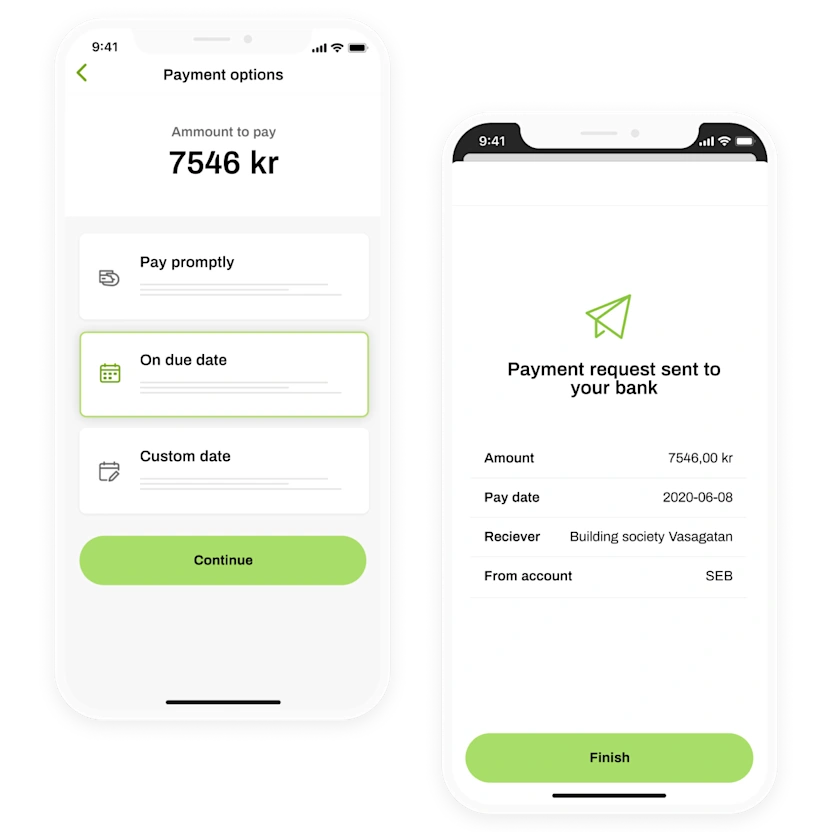

Make paying an invoice painless with fast, embedded payments

Let customers pay directly from their bank account in real-time, in just a few taps, and authenticate via fingerprint or Face ID: no manual entry, no clunky redirects. Our flows are optimised for mobile and desktop and customisable to your brand.

‘We’re very pleased to partner with Tink, the leading player in open banking and A2A payments. Today we handle hundreds of millions of invoices annually for our Nordic customers. With open banking, we can now also offer our customers a simple, compliant, and user-friendly payment solution that’s integrated with our existing channels.’ – Mattias Norén, Head of Strategy and Business Development, PostNord Strålfors.

Learn about our partnership

Make paying an invoice painless with fast, embedded payments

Let customers pay directly from their bank account in real-time, in just a few taps, and authenticate via fingerprint or Face ID: no manual entry, no clunky redirects. Our flows are optimised for mobile and desktop and customisable to your brand.

‘We’re very pleased to partner with Tink, the leading player in open banking and A2A payments. Today we handle hundreds of millions of invoices annually for our Nordic customers. With open banking, we can now also offer our customers a simple, compliant, and user-friendly payment solution that’s integrated with our existing channels.’ – Mattias Norén, Head of Strategy and Business Development, PostNord Strålfors.

Learn about our partnership

Protect your revenue

Open banking means no intermediaries, reduced fraud, and no unnecessary fees. Tink customers save up to 80% on payment-related costs versus other online payment methods.

No interchange fees

Reduced fraud, zero chargebacks

Fixed fee per transaction

Protect your revenue

Open banking means no intermediaries, reduced fraud, and no unnecessary fees. Tink customers save up to 80% on payment-related costs versus other online payment methods.

No interchange fees

Reduced fraud, zero chargebacks

Fixed fee per transaction

Save time by streamlining your payment operations

Accept payments from anyone with a bank account through one solution. It’s easy to implement on any channel – in-app, online, email or QR code – and you can track payments, download reports, and automate reconciliation in the Tink Console.

‘By partnering with Tink we can improve the customer experience for our billers across Europe and easily scale to new markets while keeping payment-related costs down.’ – Marko Kling, VP of Solution Architecture at Serrala

Learn about invoice settlement

Save time by streamlining your payment operations

Accept payments from anyone with a bank account through one solution. It’s easy to implement on any channel – in-app, online, email or QR code – and you can track payments, download reports, and automate reconciliation in the Tink Console.

‘By partnering with Tink we can improve the customer experience for our billers across Europe and easily scale to new markets while keeping payment-related costs down.’ – Marko Kling, VP of Solution Architecture at Serrala

Learn about invoice settlementKivra uses Tink to process over 5 million invoices every month

Challenge

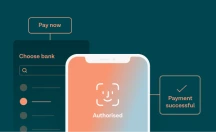

Kivra wanted to streamline its operations and the user experience without compromising on cost – users should be able to pay directly from their account, without needing to leave the Kivra app or incur extra fees.

Solution

When looking for a cost-effective, friction-free way to enable payments, Kivra found Tink. In three months, Kivra launched a new payment flow in-app, letting users settle invoices with just a few clicks. Now, users pay directly to the merchant or service provider, without Kivra needing to touch the money in between.

Built using

Payments

Kivra uses Tink to process over 5 million invoices every month

Challenge

Kivra wanted to streamline its operations and the user experience without compromising on cost – users should be able to pay directly from their account, without needing to leave the Kivra app or incur extra fees.

Solution

When looking for a cost-effective, friction-free way to enable payments, Kivra found Tink. In three months, Kivra launched a new payment flow in-app, letting users settle invoices with just a few clicks. Now, users pay directly to the merchant or service provider, without Kivra needing to touch the money in between.

Built using

Payments

For industry leaders

“Partnering with Tink was an important step in our ambition to improve the user experience, leveraging PSD2 to develop a simpler payment solution. Using Tink as a provider for our new payment service became a natural choice as we explored the market.”

Vesna Lindkvist

CTO at Kivra

Simple, low-cost payments for focusing on your business

Save time and resources while increasing your collection rate with easy-to-integrate bank payments.

Boost conversion

Let customers pay in a few clicks and authenticate via fingerprint or Face ID – no need to fill out lengthy forms or switch to their bank’s app or website.

Customise the experience

Prefill invoice and account details to make paying even easier, and let customers pay multiple invoices in one go or schedule payments for a future date.

Add payments anywhere

Give customers the ability to pay on any channel by tapping a button or scanning a QR code, with minimal integration work required.

Keep costs down

Accept low-cost bank payments with reduced fraud, zero chargebacks, no interchange fees, and less complexity.

How open banking is changing invoice and bill payments

We surveyed 380 financial executives across Europe

Read the report1 in 3

see invoice payments as the #1 use case for open banking

3 in 4

view low-cost payments as the top benefit of open banking

75%

have already invested in open banking or plan to in the next 12 months

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.