Kivra: an easy way to pay bills

Kivra is Sweden’s digital mailbox, which helps people easily handle their mail, sign documents, and pay bills. Here’s how they streamlined operations and improved the user experience with a simpler payment solution.

Payments

Kivra: an easy way to pay bills

Kivra is Sweden’s digital mailbox, which helps people easily handle their mail, sign documents, and pay bills. Here’s how they streamlined operations and improved the user experience with a simpler payment solution.

Payments

Kivra’s payment solution

83%+ success rate

Kivra's improved payments flow delivers a 83% end-to-end success rate on average, rising to 86% for returning users.

<45 secs

With payment initiation, customers just connect with their banks and can complete payments in seconds – with a few clicks.

3m+ payments per month

Kivra currently serves 4 million users – a large chunk of the Swedish population – and processes millions of payments monthly.

For industry leaders

“Partnering with Tink was an important step in our ambition to improve the user experience, leveraging PSD2 to develop a simpler payment solution. Using Tink as a provider for our new payment service became a natural choice as we explored the market.”

Vesna Lindkvist

CTO at Kivra

Reducing operational costs and customer friction

Kivra settles millions of invoices monthly, making payments a key part of their offering. Users would authorise their payments through Kivra, but this resulted in a heavy operational burden with the collection and distribution of funds. It also caused friction for users, as payments could take days to complete.

Kivra wanted to streamline operations and UX without compromising on cost or accessibility – users should be able to pay directly from their account, without needing to leave the Kivra app or incur extra fees.

Reducing operational costs and customer friction

Kivra settles millions of invoices monthly, making payments a key part of their offering. Users would authorise their payments through Kivra, but this resulted in a heavy operational burden with the collection and distribution of funds. It also caused friction for users, as payments could take days to complete.

Kivra wanted to streamline operations and UX without compromising on cost or accessibility – users should be able to pay directly from their account, without needing to leave the Kivra app or incur extra fees.

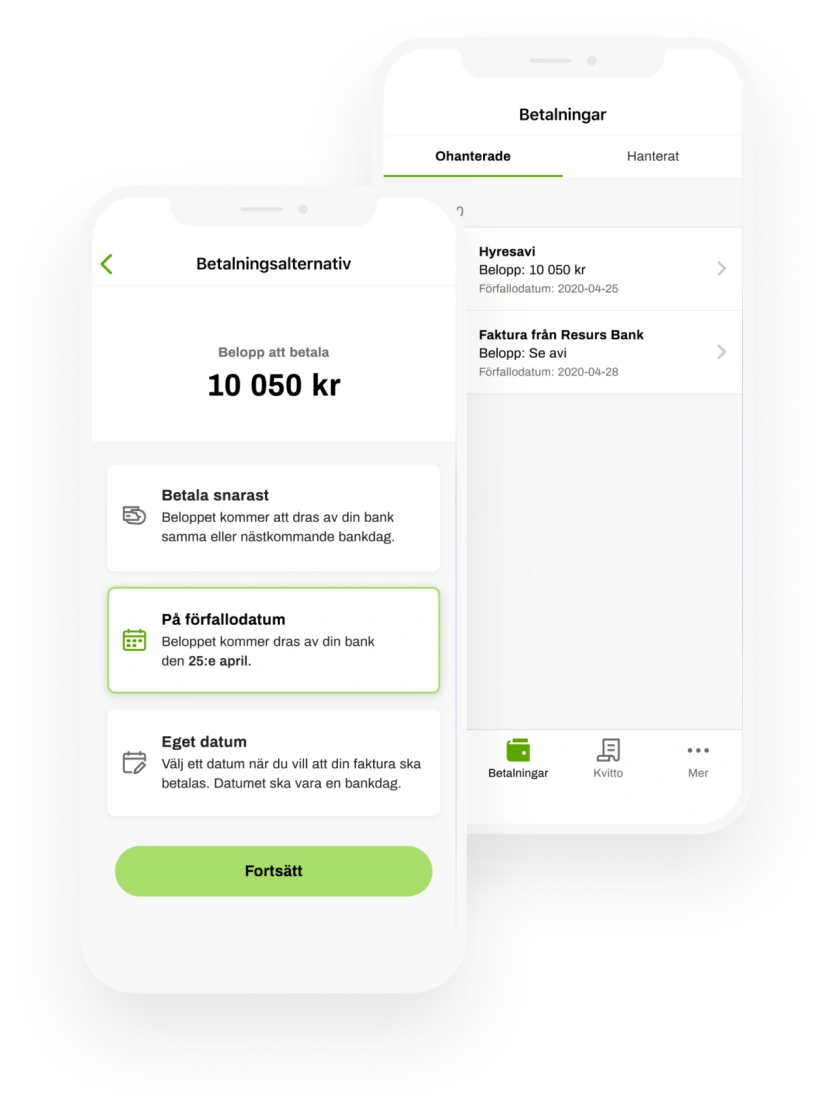

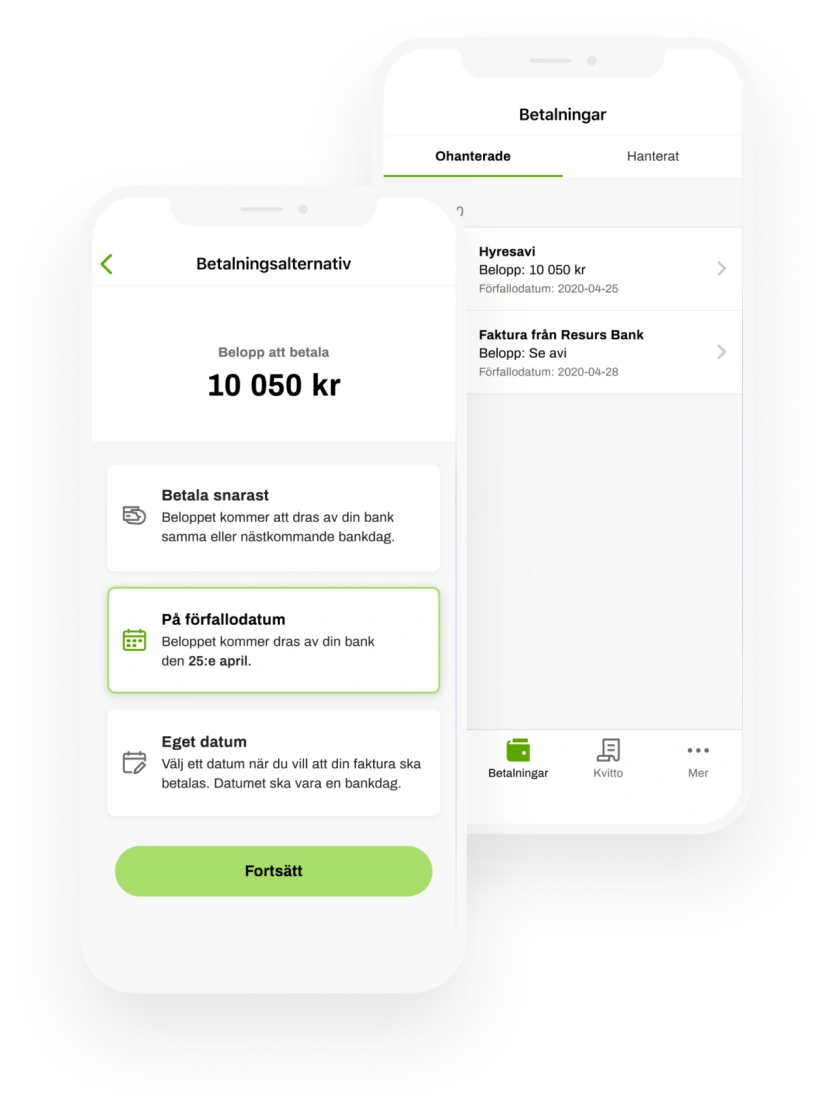

A simpler way to pay, all within the app

When looking for a cost-effective, friction-free way to enable payments, Kivra found Tink. Building on PSD2, Tink’s Payment Initiation brings direct bank payments into existing digital journeys.

In three months, Kivra launched a new payment flow in-app, letting users settle invoices with just a few clicks. Now, users pay directly to the merchant or service provider, without Kivra needing to touch the money in between.

How does it work? Kivra’s customers simply:

Click to pay directly on the digital invoice

Select the bank account they want to pay from

Approve the payment

A simpler way to pay, all within the app

When looking for a cost-effective, friction-free way to enable payments, Kivra found Tink. Building on PSD2, Tink’s Payment Initiation brings direct bank payments into existing digital journeys.

In three months, Kivra launched a new payment flow in-app, letting users settle invoices with just a few clicks. Now, users pay directly to the merchant or service provider, without Kivra needing to touch the money in between.

How does it work? Kivra’s customers simply:

Click to pay directly on the digital invoice

Select the bank account they want to pay from

Approve the payment

High conversion, high volume

The new solution helped Kivra significantly reduce their compliance requirements, since the payments are initiated using Tink’s PISP license. Less hassle for both Kivra and their users, with more invoices getting paid on time.

Just a few months after launching the new flow, Kivra’s results have been quite impressive. Payment volumes are up and user drop-off is down.

High conversion, high volume

The new solution helped Kivra significantly reduce their compliance requirements, since the payments are initiated using Tink’s PISP license. Less hassle for both Kivra and their users, with more invoices getting paid on time.

Just a few months after launching the new flow, Kivra’s results have been quite impressive. Payment volumes are up and user drop-off is down.

Billy Telidis, Product Manager, Payments Core, TinkDesigning and implementing a product that will be used by half of the Swedish population is quite the challenge. We worked closely with the Kivra team to provide a world class product and the best possible payment experience for Kivra users.

The level of commitment and daily collaboration by both teams exceeded expectations and ultimately enabled a successful implementation with rapid user adoption. Still, we gathered a lot of feedback from users with the goal to further improve the payment initiation flow and worked together to make the user journey even more simple and efficient.I am thrilled for the future of this partnership and all of the exciting features and improvements that we are preparing together with Kivra.

Billy Telidis, Product Manager, Payments Core, TinkDesigning and implementing a product that will be used by half of the Swedish population is quite the challenge. We worked closely with the Kivra team to provide a world class product and the best possible payment experience for Kivra users.

The level of commitment and daily collaboration by both teams exceeded expectations and ultimately enabled a successful implementation with rapid user adoption. Still, we gathered a lot of feedback from users with the goal to further improve the payment initiation flow and worked together to make the user journey even more simple and efficient.I am thrilled for the future of this partnership and all of the exciting features and improvements that we are preparing together with Kivra.

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.