Let your customers get money to market faster

Upgrade your customer experience with real-time onboarding, instant deposits, and fast withdrawals. All backed by the strongest team and connectivity platform in open banking.

Let your customers get money to market faster

Upgrade your customer experience with real-time onboarding, instant deposits, and fast withdrawals. All backed by the strongest team and connectivity platform in open banking.

Build better investing experiences

Three-click onboarding flows

Slow, manual onboarding flows are a drag on adoption and prone to human error. Verify users and link their accounts in seconds, with data straight from the bank.

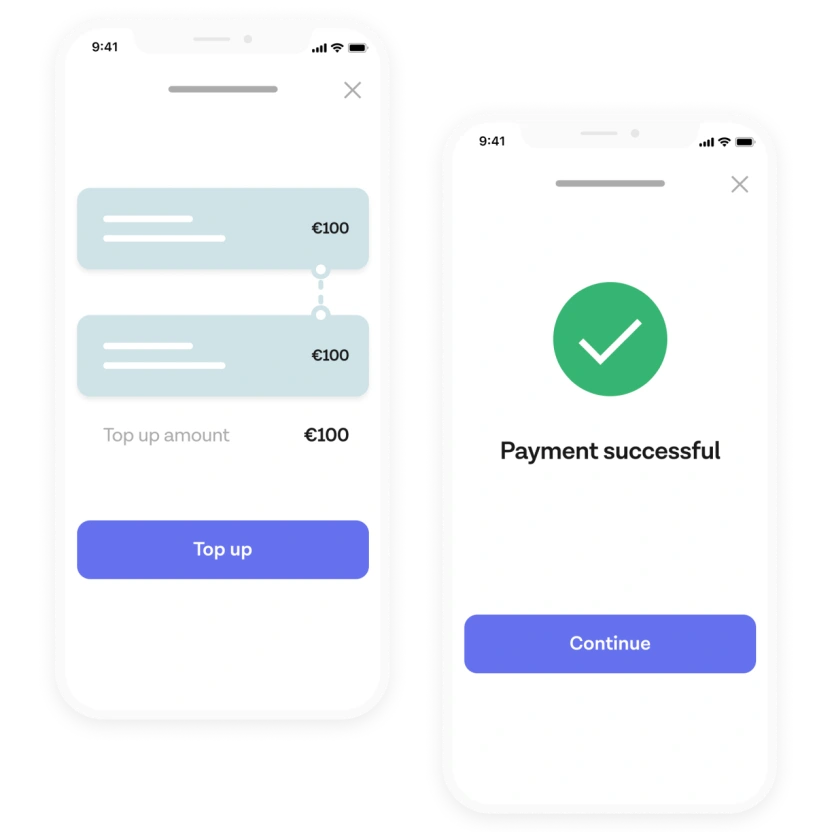

Instant, effortless deposits

Say goodbye to slow deposits with instant bank payments that settle in real time – no need to punch in card details, go through a clunky redirect, or make a manual transfer.

Fast cash-outs that delight

Level-up your service and boost loyalty with instant cash-outs, delighting users with withdrawals directly to their bank account on the fastest payment rails.

Solutions that will pay dividends for your customers

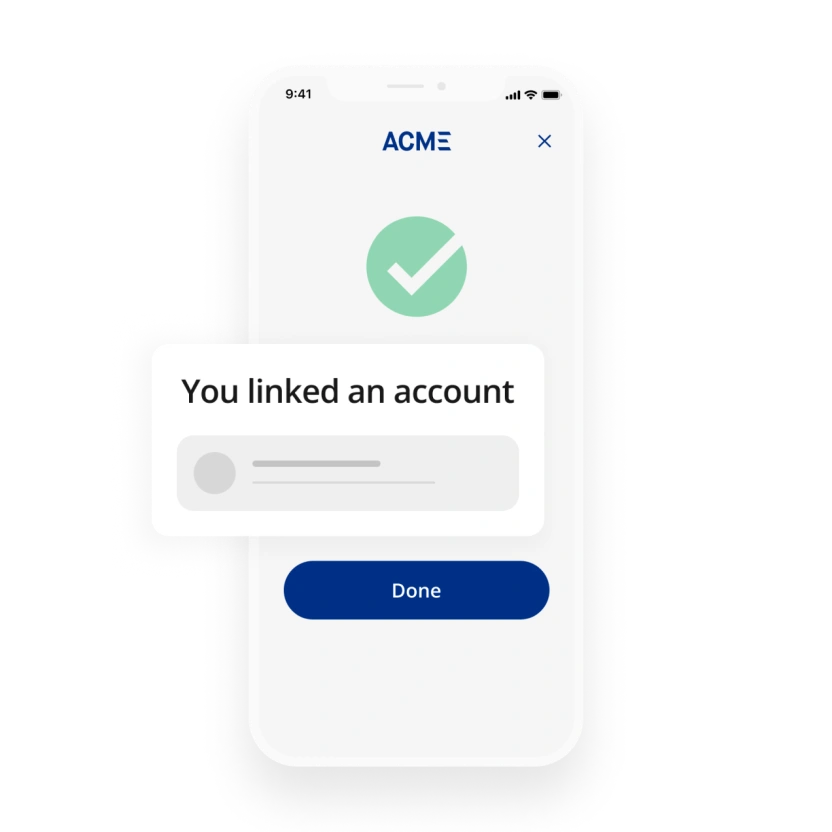

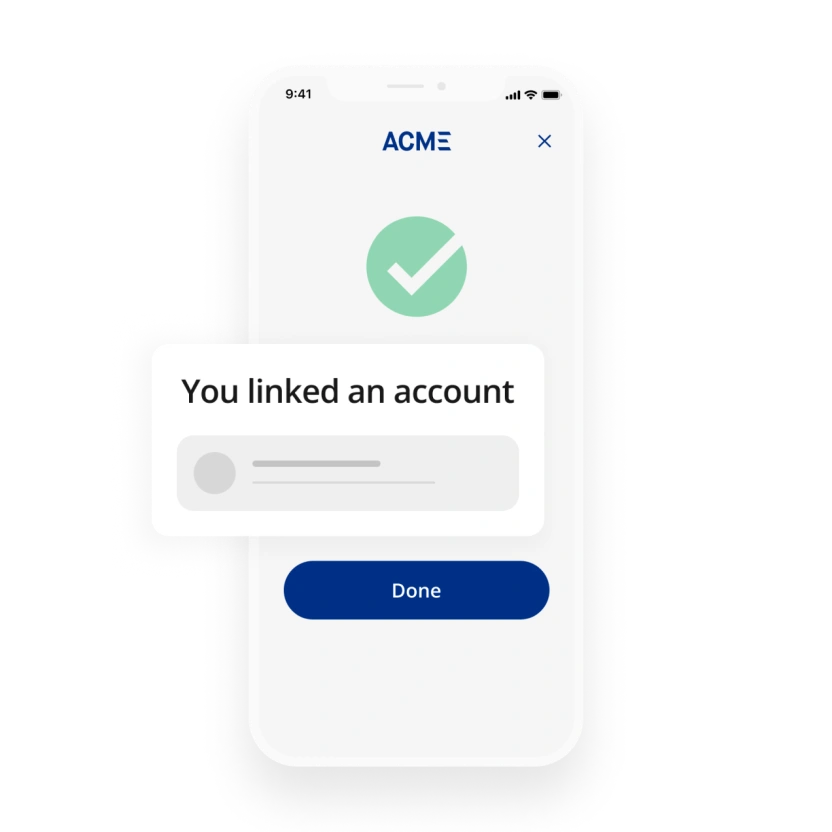

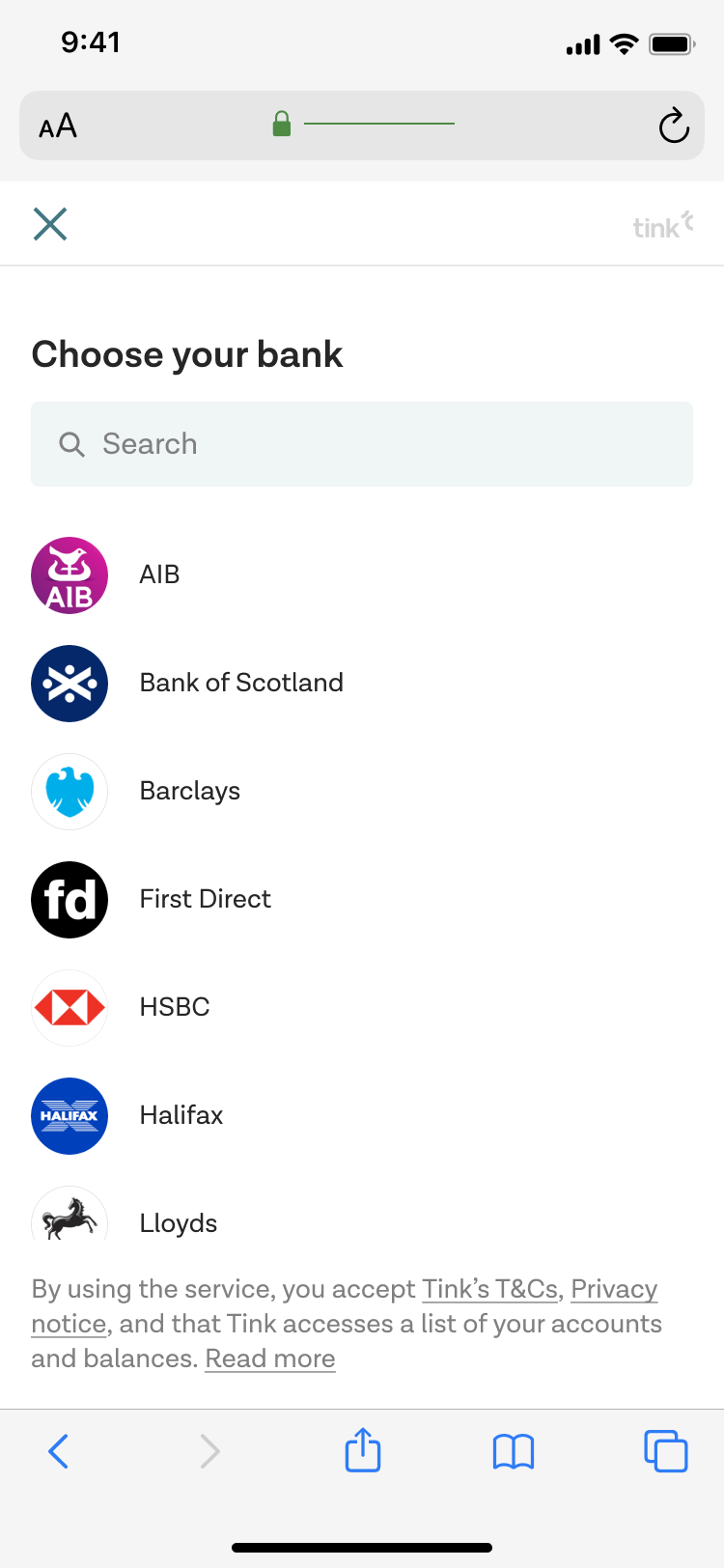

Streamlined onboarding

Maximise conversion with fast, mobile-first account and identity verification flows. With Tink you can verify account information in the payments journey itself, enabling real-time checks and minimising the number of steps.

“The quality of the end-user experience is key for us. Tink was the obvious choice to help make our product experience as simple and as user-friendly as possible.”

– Ylla von Malmborg, Product Manager at Billogram

Learn about customer onboarding

Streamlined onboarding

Maximise conversion with fast, mobile-first account and identity verification flows. With Tink you can verify account information in the payments journey itself, enabling real-time checks and minimising the number of steps.

“The quality of the end-user experience is key for us. Tink was the obvious choice to help make our product experience as simple and as user-friendly as possible.”

– Ylla von Malmborg, Product Manager at Billogram

Learn about customer onboarding

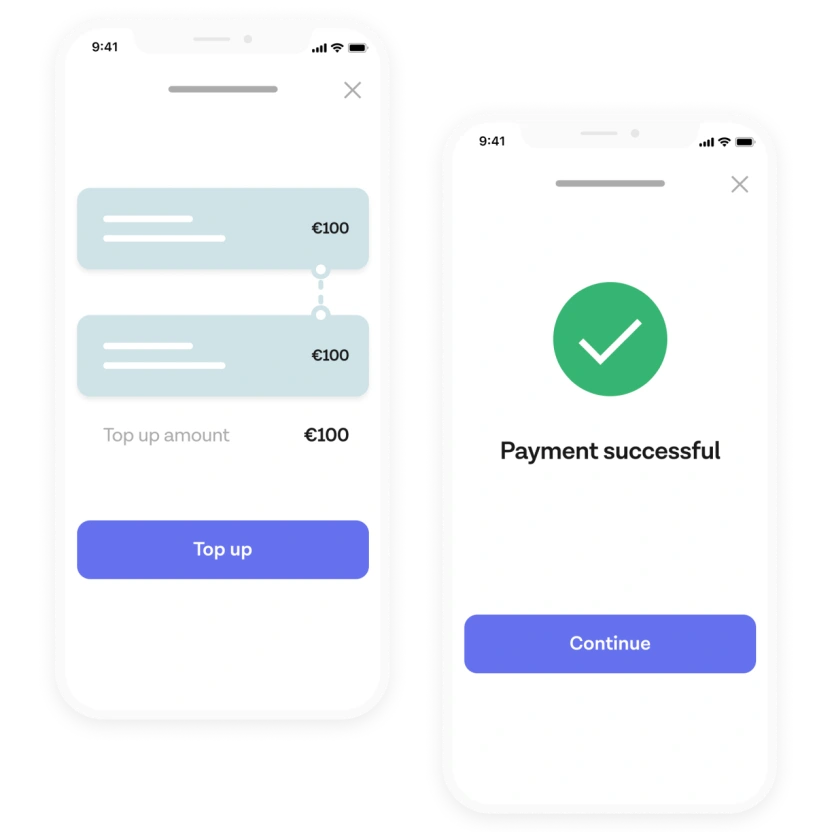

Fast, effortless pay-ins

Offer instant deposits with real-time payment confirmation and settlement – giving users immediate access to your service. Automated reconciliation lets you cut out manual back-office processes and bring unallocated payments to zero.

“Tink lets us add instant payments to our onboarding experience, enabling anyone to invest in crypto in less than 2 minutes.” – Jamie McNaught, co-founder and CEO at Solidi

Learn about Pay by Bank

Fast, effortless pay-ins

Offer instant deposits with real-time payment confirmation and settlement – giving users immediate access to your service. Automated reconciliation lets you cut out manual back-office processes and bring unallocated payments to zero.

“Tink lets us add instant payments to our onboarding experience, enabling anyone to invest in crypto in less than 2 minutes.” – Jamie McNaught, co-founder and CEO at Solidi

Learn about Pay by BankReal-time withdrawals

Give users the ability to withdraw funds and cash out instantly. Automate payouts from your Tink-managed settlement account via API, giving users immediate access to their money with no extra work.

Learn about withdrawals

Real-time withdrawals

Give users the ability to withdraw funds and cash out instantly. Automate payouts from your Tink-managed settlement account via API, giving users immediate access to their money with no extra work.

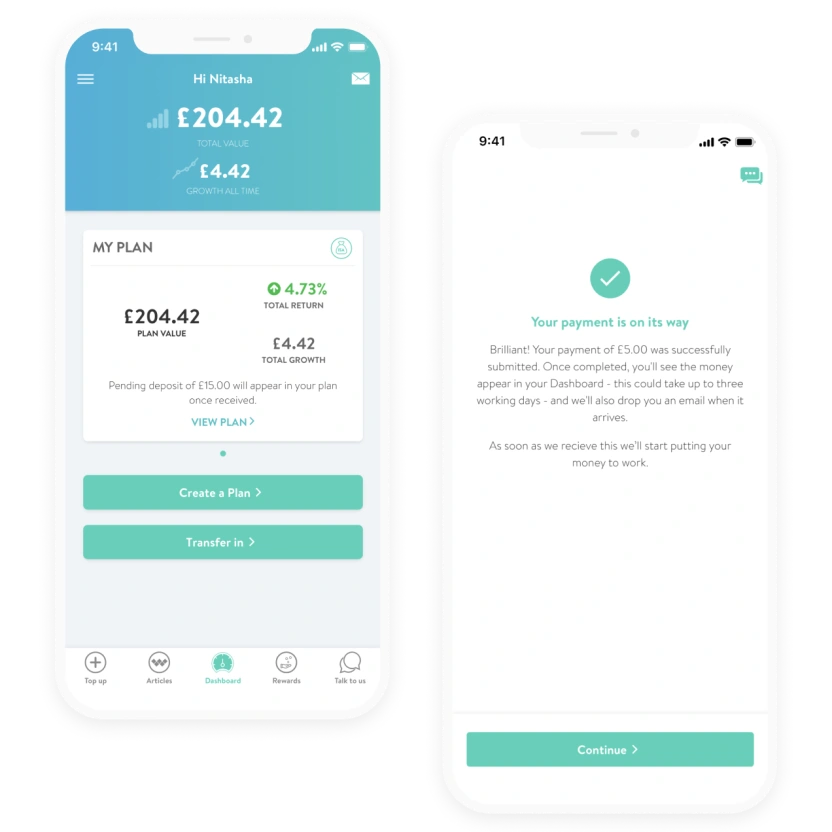

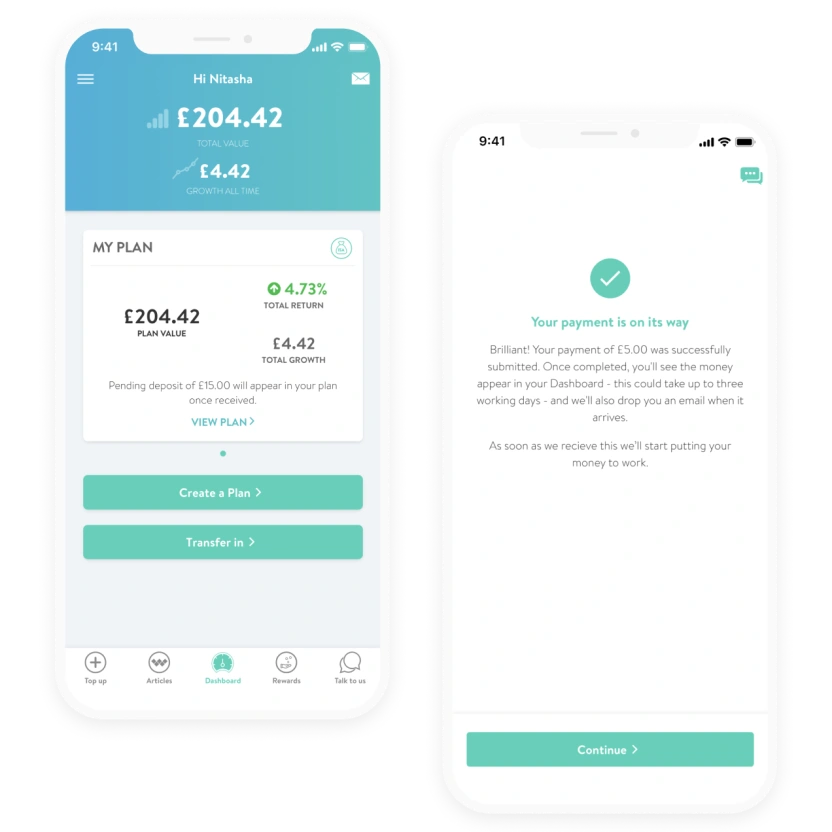

Learn about withdrawalsWealthify uses Tink to get money to market faster

Challenge

Simplifying investing through a frictionless user experience is a key part of Wealthify’s mission. They wanted an account top-up solution that would streamline their onboarding flow while keeping fees low.

Solution

Wealthify chose Tink to deliver a fully embedded payment experience powered by open banking – letting investors transfer funds and start investing in a few clicks.

Payments

Wealthify uses Tink to get money to market faster

Challenge

Simplifying investing through a frictionless user experience is a key part of Wealthify’s mission. They wanted an account top-up solution that would streamline their onboarding flow while keeping fees low.

Solution

Wealthify chose Tink to deliver a fully embedded payment experience powered by open banking – letting investors transfer funds and start investing in a few clicks.

Payments

For industry leaders

“Open banking lets us deliver seamless payment experiences that are quicker and more competitive than traditional card payments. The customer response has been brilliant, and our partnership with Tink means we can maintain our market-leading low fees.”

Simon Holland

Chief Product Officer at Wealthify

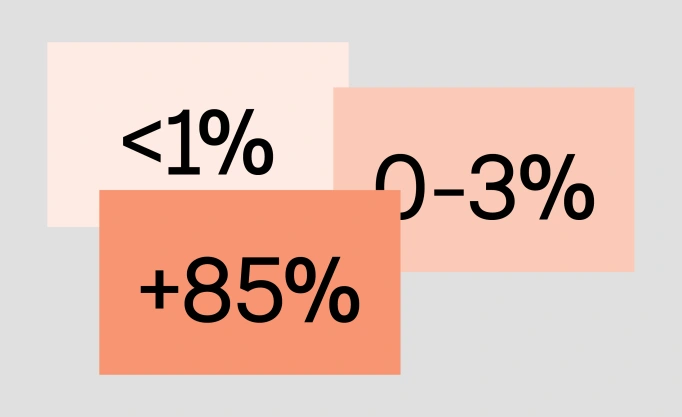

Compounding returns for you and your customers

Let customers sign up and start trading in under a minute with just a few clicks. No lengthy forms, no need to punch in card details, no wait time, and a user journey customisable to your brand.

1

https://link.tink.com/1.0/risk-insights/?client_id=7a294f1581c4f4c96ab1b237af7h6f1&redirect_uri=http://yourdomain.com/callback&market=SE&locale=sv_SE&external_reference=[YOUR REFERENCE]

Reap the rewards of open banking with Tink

Industry-leading success rates

Benefit from our 10+ years of experience in optimising success rates across Europe, enabling you to capture more revenue.

100% customisable

Own your user journey end-to-end with fully white-label flows that give you deeper customisation and design options.

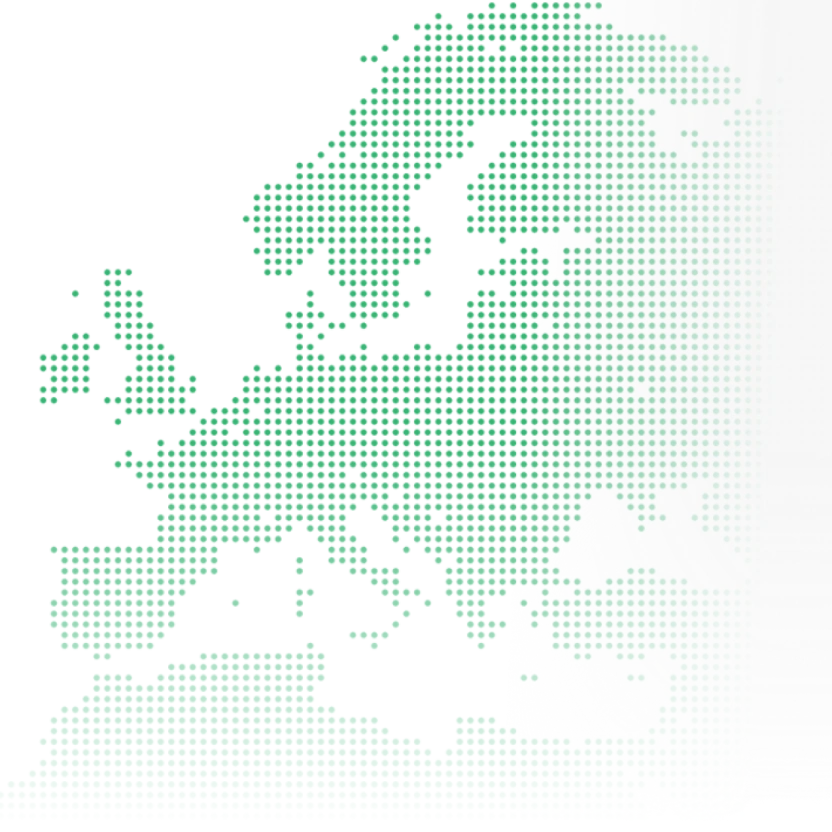

Broadest bank coverage

No market is off-limits with Europe-wide bank connections – all managed in-house by the industry’s largest connectivity team.

Reap the rewards of open banking with Tink

Industry-leading success rates

Benefit from our 10+ years of experience in optimising success rates across Europe, enabling you to capture more revenue.

100% customisable

Own your user journey end-to-end with fully white-label flows that give you deeper customisation and design options.

Broadest bank coverage

No market is off-limits with Europe-wide bank connections – all managed in-house by the industry’s largest connectivity team.

3,000+

Connections to all major banks across Europe

19

Markets

87%

AVG. end-to-end conversion rate

20%

average increase in onboarding conversion rate

Visa

part of the world’s most dependable payments network with a long-term commitment to open banking

Europe’s top financial executives have already bought in

We surveyed 380 financial executives across Europe about open banking payments

1 in 3

see top-ups or deposits as the ideal payments use case for open banking

7 in 10

view instant transfers as the top benefit of open banking

75%

have already invested in open banking or plan to in the next 12 months

Interesting reads

2022-10-27

8 min read

Investment platforms: what to look for in an open banking partner

Looking for the best open banking provider? Here is everything you need to consider before making a decision.

Read more

2022-11-23

5 min read

Instant refunds and withdrawals are here

Tink’s payments upgrade adds instant refunds and withdrawals, letting businesses across Europe issue payouts that settle in less than one second.

Read more

2022-11-01

8 min read

What’s a good Pay by Bank conversion rate?

Comparing Pay by Bank conversion rates across different payment methods can be tricky since most don’t use an end-to-end metric. See Tink’s own benchmarks and how we track performance in this conversion rate deep-dive.

Read more

Let’s workshop together!

Contact our team to learn more about what we can help you build – or create an account to get started right away.

Book a demo today!