Easy bill payments simply make sense

Discover how open banking can help you to transform user experiences and deliver more value to your clients.

Easy bill payments simply make sense

Discover how open banking can help you to transform user experiences and deliver more value to your clients.

Switch on smarter billing with Tink

Seamless payment

There’s a new standard for UX optimisation: Create fast, seamless journeys that make it easy for users to pay.

In any channel

On paper, on desktop or mobile, Pay by Bank makes bill payments fast and trouble-free, no matter the delivery method.

Optimised costs

Save costs and deliver more value, with a fully integrated payment journey that reduces manual processes and helps improve conversion.

Pain-free payments

Nobody likes paying bills. But making it easy and quick to pay can turn a user pain point into a fast, frictionless experience, that delights your clients and their customers.

And when a bill is easier to pay, it’s more likely to get paid.

Pain-free payments

Nobody likes paying bills. But making it easy and quick to pay can turn a user pain point into a fast, frictionless experience, that delights your clients and their customers.

And when a bill is easier to pay, it’s more likely to get paid.

Deliver more value to your clients

Your customers have a lot to deal with. From unpaid bills and customer churn, to the mounting cost of failed payments, managing processes manually can take its toll on numbers and cost organisations dearly.

Help your clients get more from their payments. Pay by Bank puts payment into a digital flow right at the users fingertips, reducing lateness, streamlining data and improving collection rates.

Deliver more value to your clients

Your customers have a lot to deal with. From unpaid bills and customer churn, to the mounting cost of failed payments, managing processes manually can take its toll on numbers and cost organisations dearly.

Help your clients get more from their payments. Pay by Bank puts payment into a digital flow right at the users fingertips, reducing lateness, streamlining data and improving collection rates.

How Tink enables smarter billing

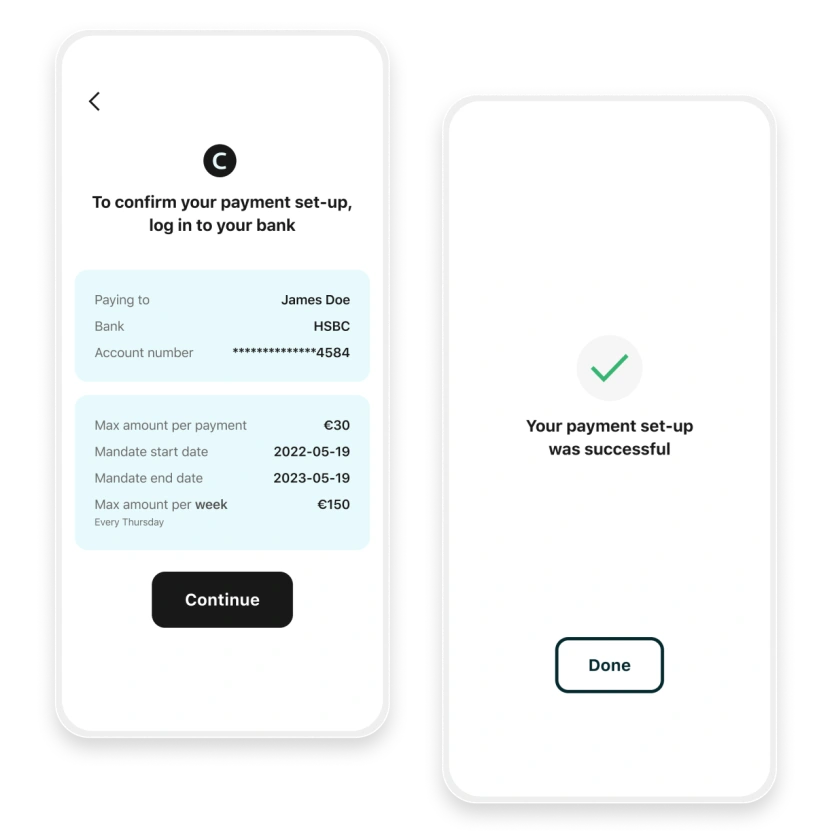

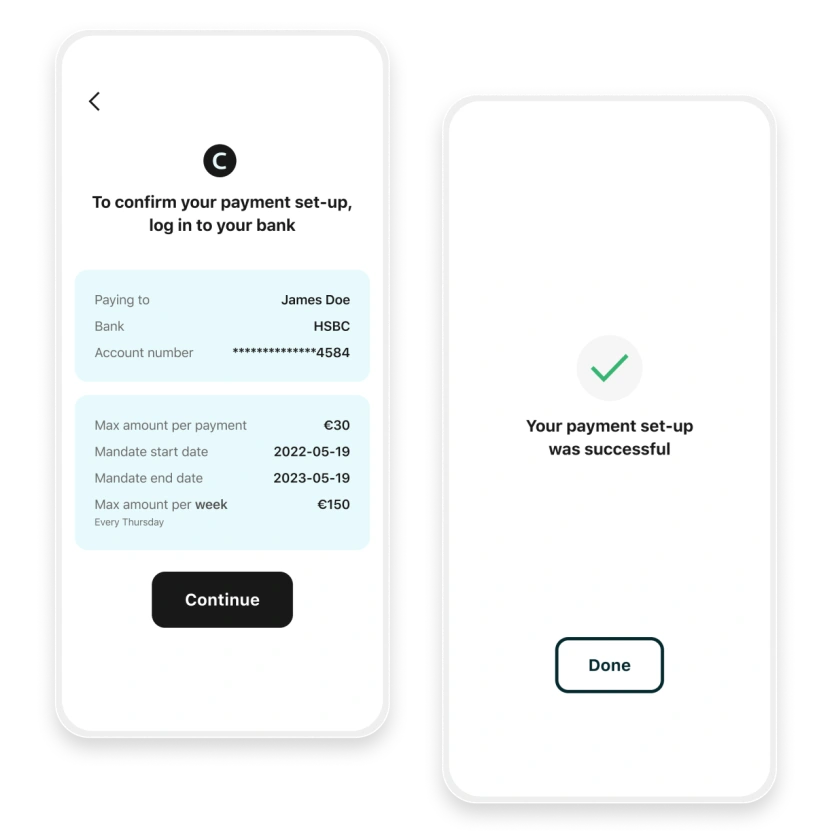

Flexible recurring payments

Automated mandate set-up with built in verification powered by VRP means a smooth experience, fewer errors, reduced fraud and higher conversion.

Processes powered by deeper data

Use real-time balance data to maximise your collection rate, billing customers when they have funds available - avoiding failed payments and minimising churn.

Instant account linking

Collect account information and set up direct debits instantly, either through simple sign-up flows or a one-time payment.

Why Tink

-80%

Est. reduction in payment-related costs

87%

AVG. end-to-end conversion rate

3M

Unique users paying an invoice via Tink each month

€540M

Total value of invoices paid via Tink each month

Let's build together

Contact our team to learn more about what we can help you build - or create an account to get started right away.

Contact us