Go to checkout

Pay by Bank

Select bank

Authenticate

Payment processed

Payment blocked

Account Data

Verifies account holder information, checks the account status, identifies suspicious activity, and more.

Live balances

Verifies a user’s ability to pay with real-time balance information including their overdraft, credit lines, and pre-booked orders.

Transaction history

Assesses risk based on recent transactions, chargeback history, and previous non-settled payments.

Velocity checks

Prevents high-velocity attacks with configurable limits for the volume, number, and individual value of transactions.

Tink platform data

Leverage the strength of the Tink network with risk decisions informed by past payment attempts across other apps on the Tink platform

How Risk Signals can help you

Explore our different use cases to see how Tink supports your industry.

Payment platforms

Offer an instant payment confirmation on account-to-account transactions to your merchants with less settlement risk.

Explore the use caseEcommerce

Offer the ultimate checkout experience with instant bank payments – while keeping fraud and chargebacks to a minimum.

Explore the use caseiGaming

Level up the player experience by crediting accounts immediately, letting users onboard faster without the risk of non-settlement.

Explore the use caseWealth management

Stand out from the competition by cutting wait times down from days to seconds, ensuring a faster, better investor experience.

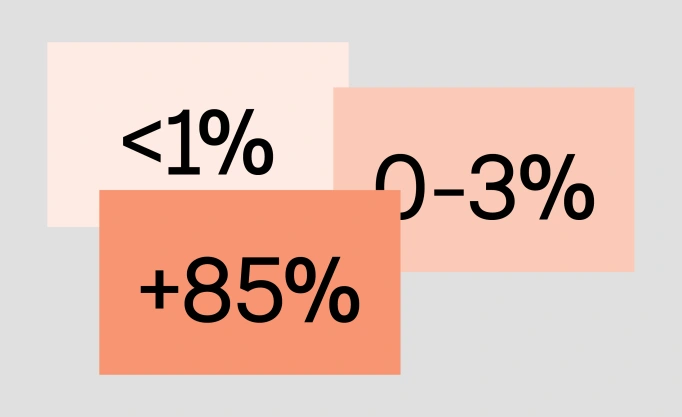

Explore account top-upsWe let the numbers do the talking

7

unique sets of risk checks designed for account-to-account payments

1000s

of possible criteria profiles to configure

1 week

average implementation time to date

For industry leaders

“We are delighted to bring Tink’s solutions to Revolut. Our partnership with Tink will enable Revolut to expand our open banking services across new markets in a fast and sustainable way.”

Ivan Chalov

Head of Retail at Revolut

“Our aim is to always innovate to meet consumer needs by providing a breadth of convenient, fast, and secure payment options. Partnering with Tink for open banking is the latest way we have evolved our technology to deliver on this goal.”

Edgar Verschuur

Head of Global Acquiring at Adyen

“By teaming up with Tink, we aim to give Lydia’s users the best possible experience and allow them to easily manage their financial daily lives within our app.”

Cyril Chiche

co-founder and CEO of Lydia

“We’re very pleased to partner with Tink, the leading player in account-to-account payments. Today we handle hundreds of millions of invoices annually for customers in the Nordics. Open banking lets us expand our offering to now also include simple, compliant, and user-friendly payment solutions integrated in our existing channels.”

Mattias Norén

Head of Strategy at PostNord Strålfors

Get started with Tink

Contact our team to learn more about what we can help you build – or create an account to get started right away.